Schneider raised margin targets for its truckload and intermodal segments and issued full-year 2022 guidance ahead of expectations Thursday. The company reported adjusted earnings per share of 76 cents for the fourth quarter, 11 cents better than the consensus estimate and 73% higher year-over-year.

The longer-term operating margin target for the company’s TL segment was raised to a range of 12% to 16% (up from 11% to 13%). The top end of the intermodal margin range was raised 200 basis points and now stands at 10% to 14%.

Schneider (NYSE: SNDR) issued full-year 2022 adjusted EPS guidance of $2.35 to $2.55 compared to the consensus estimate of $2.34 at the time of the print. Full-year 2021 adjusted EPS was $2.29, well ahead of its initial guidance of $1.45 to $1.60 issued a year ago. The 2021 result included 9 cents per share from gains on its equity investments, whereas the 2022 outlook excludes any such benefit.

“As we look ahead, we anticipate that the supply and demand conditions experienced in 2021 will extend well into 2022,” Mark Rourke, CEO and president, stated in a press release. “We anticipate continued excess demand conditions with gradual supply chain improvement as the year progresses.”

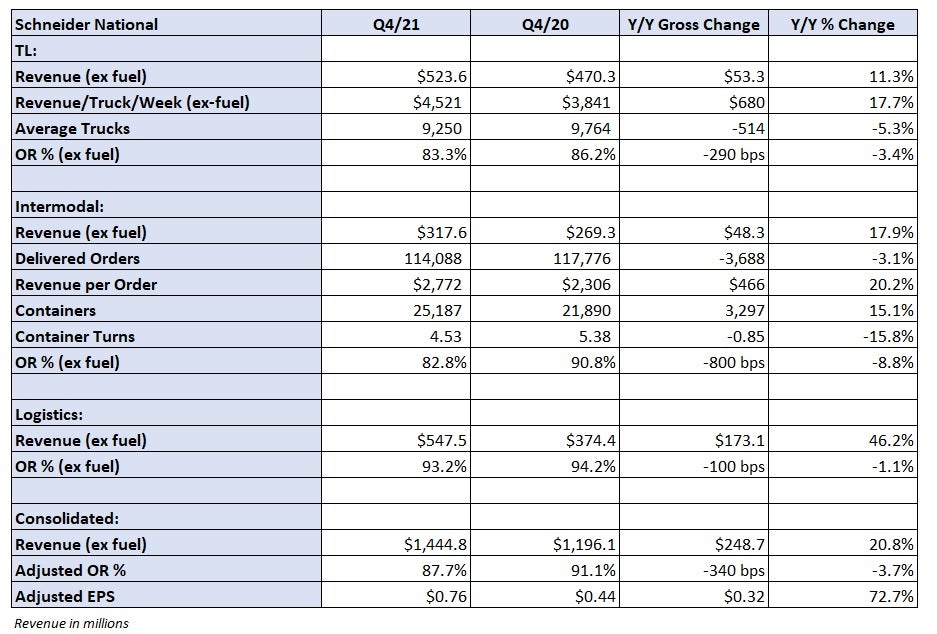

Truckload revenue, excluding fuel, increased 11% year-over-year to $524 million. Revenue per truck per week was up 18% while the average fleet count was down 5%. Revenue in the dedicated segment was 26% higher as the unit onboarded new accounts. Dedicated revenue growth was driven by a 12% increase in truck count and a 13% increase in revenue per truck per week.

Fewer miles driven due to supply chain congestion and higher driver sourcing costs were headwinds in the quarter. However, the TL unit reported an 83.3% adjusted operating ratio, 290 bps better year-over-year.

The company didn’t provide specifics on pricing guidance for 2022 but the current supply-demand dynamics are expected to hold.

“We’re carrying a lot of price momentum into the year, contractually,” Rourke told analysts on a call. “We have incredible support from our customers on the inflationary cost pressures that they are feeling across their supply chain and certainly as a provider to them that we are feeling. I would consider the market constructive and supportive.”

Intermodal loads were down 3% year-over-year in the quarter but revenue per load was up 20%. The container fleet was 15% bigger at more than 25,000 boxes, but average turns were lower by a similar percentage due to delays unloading equipment at customer facilities. Schneider grew its box fleet by 1,600 units in the third quarter and 1,300 units in the fourth quarter.

The jump in revenue per load drove margins higher. The division reported an 82.8% operating ratio, 800 bps better year-over-year.

Schneider recently announced a new rail partnership with Union Pacific (NYSE: UNP). Schneider will use Union Pacific exclusively for intermodal transport in the West, providing the only asset-based Union Pacific-CSX (NASDAQ: CSX) rail connection, starting in 2023.

Schneider will continue to honor its intermodal contract with BNSF (NYSE: BRK.B), which runs through 2022.

“We have felt that we have been underrepresented in our growth profile in the West,” Rourke said. “This strategic shift for us is really unlocking what we think is a great transcontinental connection point to unlock the growth potential that we think we have in front of us.”

Schneider’s goal is to double the intermodal business by 2030.

Logistics revenue jumped 46% year-over-year to $548 million. Brokerage loads grew by 23% with higher revenue per load presumably accounting for the rest of the revenue increase. The OR was 93.2% in the quarter, 100 bps better year-over-year. The brokerage platform now has more than 50,000 approved carriers.

Schneider ended the year with $270 million in debt, a year-over-year reduction of 12%. Its cash balance was down 38% year-over-year to $245 million. The company deployed a large amount of cash acquiring dedicated carrier Midwest Logistics Systems in a $263 million deal (6x earnings before interest, taxes, depreciation and amortization) at the end of 2021.

The transaction onboarded a fleet of 900 tractors (1,000 drivers), which generate roughly $200 million in revenue throughout the central U.S. annually. The purchase multiple implies the fleet operates at a high-80% OR. The deal was immediately accretive to earnings.

The FREIGHTWAVES TOP 500 For-Hire Carriers list includes Schneider (No. 7).

Click for more FreightWaves articles by Todd Maiden.

- Economics 101: Driver pay will keep moving higher

- Old Dominion eyes operating ratio in the 60s

- Lack of transportation capacity swells inventories, survey finds