Schneider National noted some green shoots across the modes it serves and said truckload demand has returned to normal seasonal patterns.

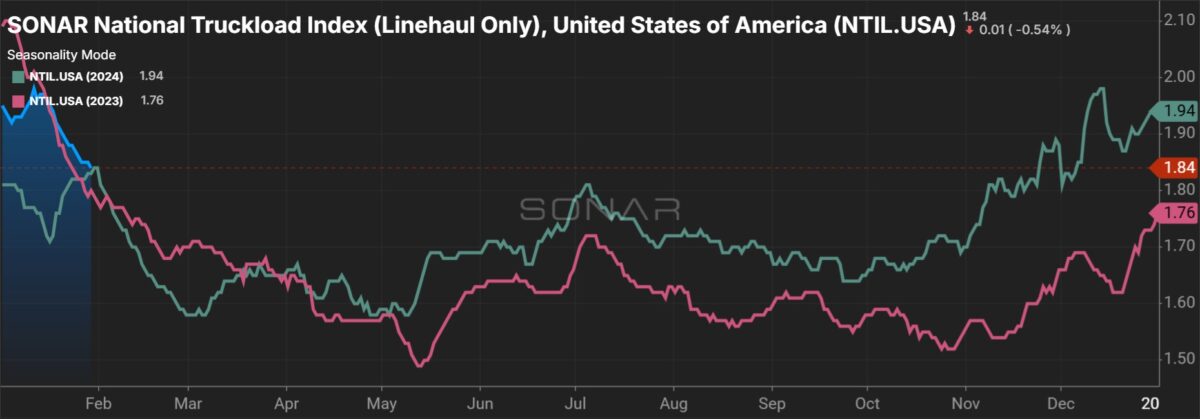

The Green Bay, Wisconsin-based multimodal transportation provider said Thursday it started seeing spot rates exceed contract rates (typically the requisite precursor to a positive inflection in contract rates) around last Thanksgiving, with the trend accelerating from that point into 2025. Schneider’s customers have been, “more receptive to rate restoration,” as “the freight market is continuing its path to recovery,” President and CEO Mark Rourke told analysts on a quarterly call.

He said seasonal strength in retail-related shipments was partially offset by prolonged auto production shutdowns in the fourth quarter. The company benefitted from “unseasonal strength” in intermodal volumes in the quarter and in January.

Schneider (NYSE: SNDR) reported adjusted earnings per share of 20 cents for the fourth quarter, which was in line with the consensus estimate and 4 cents higher year over year. The number included a 3-cent drag from insurance reserve adjustments tied to three prior accident claims. The result excluded nonrecurring costs from prior acquisitions, including the Dec. 2 purchase of dedicated carrier Cowan Systems.

Schneider issued full-year 2025 adjusted EPS guidance of 90 cents to $1.20, which at the midpoint was approximately 5% below the $1.10 consensus estimate at the time of the print.

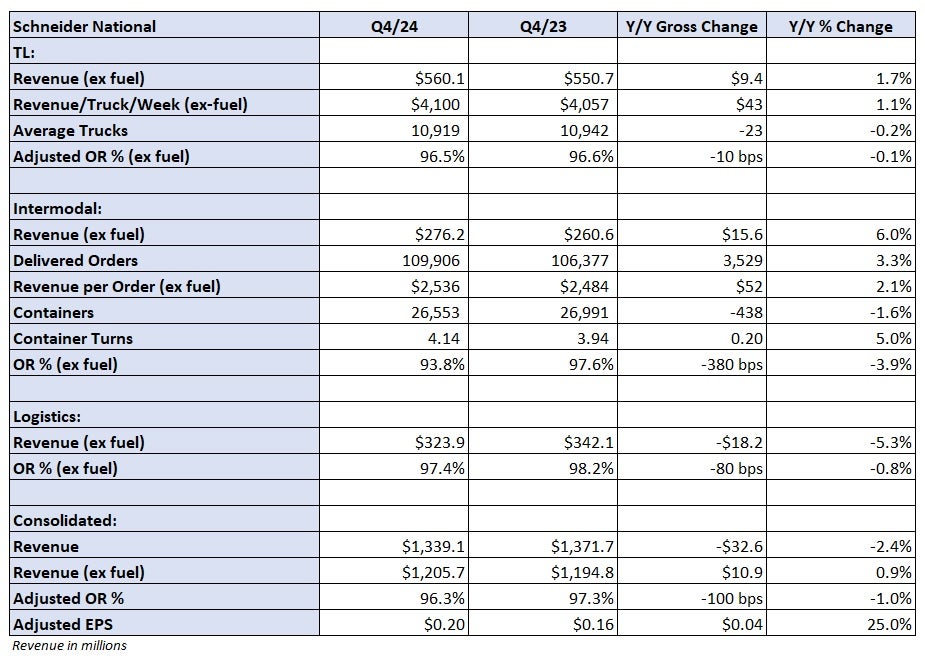

The TL segment reported a 1.7% y/y increase in revenue (excluding fuel surcharges) to $560 million. Average trucks in service were off 0.2% y/y while revenue per truck per week increased 1.1% y/y (3.2% higher sequentially). The dedicated fleet saw a 1% increase in revenue per truck per week with the network (one-way) segment seeing only a slight increase. (The tractor count in one-way was cut 13% y/y, the result of a utilization improvement initiative.)

The period included a one-month contribution from Cowan, which operates 1,900 trucks and 7,600 trailers.

The TL unit reported a 96.5% adjusted operating ratio (inverse of operating margin), 10 basis points better y/y. Most of the insurance adjustment hit the TL unit, likely resulting in a more than 100-bp drag in the quarter.

The Cowan acquisition was accretive to earnings in the period.

Schneider’s full-year guidance assumes improving revenue per truck per week in dedicated as it tightens truck-to-driver ratios across recently acquired fleets. That will allow the company to allocate more equipment to new startup accounts. The dedicated unit is also expected to benefit from organic growth within existing customer accounts.

The Cowan fleet is forecast to see administrative cost synergies of $20 million to $30 million annually (after one full year of ownership), with benefits starting to be realized in the first half of the year.

The network fleet is forecast to return to profitability in the back half of the year due to improved pricing, cost cutting and better asset utilization.

Intermodal revenue increased 6% y/y to $277 million as loads were 3.3% higher and revenue per load was up 2.1%. The unit recorded a 93.8% OR, 380 bps better y/y.

Scheider’s forecast includes growth in intermodal volumes and pricing this year. Revenue per load was up nearly 3% from the third to the fourth quarter. Intermodal pricing is expected to increase as TL rates move higher this year but with less intensity, which is the norm.

Schneider currently has 10% of its intermodal containers stacked and out of service. It said it could handle up to 30% more volume without additional investments in the fleet. Loads per container, or box turns, improved 5% y/y in the fourth quarter.

Management downplayed the impact tariffs could have on its cross-border intermodal business as most of what it moves from Mexico into the U.S. is unlikely to ever be manufactured domestically.

Logistics revenue fell 5.3% y/y to $324 million. The unit reported a 97.4% OR, which was 80 bps better y/y.

The company expects the logistics business to continue to be profitable this year. However, it did lower the long-term operating margin target range for the unit to 3-5% from 5-7%. A lower mix of power-only brokerage given the addition of Cowan’s traditional 3PL operations was cited as the reason for the change.

Long-term margin targets for TL (12-16%) and intermodal (10-14%) were reiterated.

Shares of SNDR were up 0.6% at 1:47 p.m. EST on Thursday, compared to the S&P 500, which was up 0.5%.