Volumes are scorching and are running up 20% year-over-year (y/y). Large asset-based carriers have begun to rapidly reject contracted freight. This is putting upward pressure on spot rates. Independence Day typically marks the beginning of the mid-summer slow down. If volumes continue flowing like this post-Fourth of July, and tender rejections remain elevated, there is potential for a significant capacity squeeze in the third quarter.

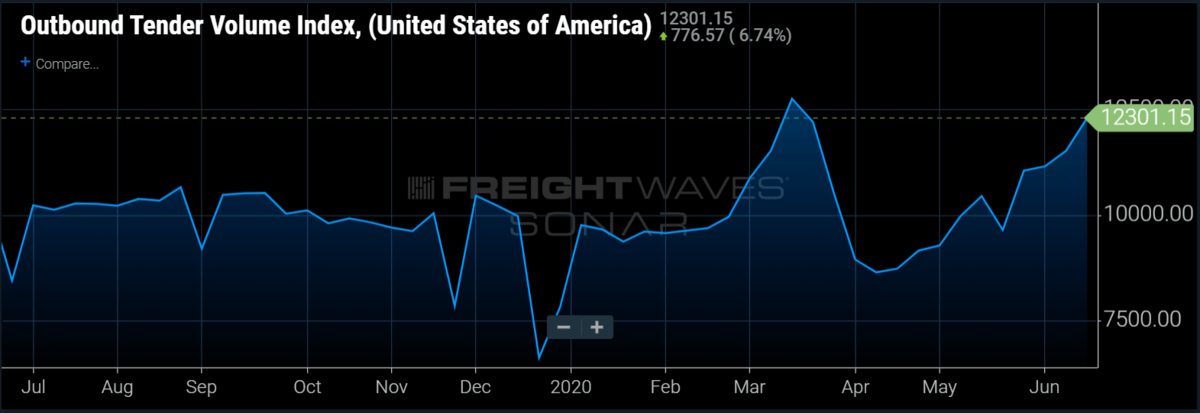

Outbound tender volumes continued to spike in many regions around the country this week. The Outbound Tender Volume Index (OTVI) is now above 12,000 for only the second time in its three-year history (with the first coming just three months ago during the March panic-induced buying spree).

The current volume of freight flowing in the U.S. is significant – besides the March 2020 demand spike, there has not been freight demand like this in recent history. 2018 was considered a banner year for freight volume and OTVI currently sits more than 8% above the 2018 high point. The index is only 3% off the all-time high that was set on March 23rd.

There is typically a surge in volumes leading up to Independence Day as shippers try to clear as much inventory as possible before the close of the second quarter. After a lost April and a depressed May, demand has accelerated off of the trough and many shippers could find themselves scrambling to push out freight to keep up with demand. The mid-summer slowdown historically drags on throughout July and August before picking back up at the beginning of autumn. If 2020 is to follow those historical patterns, seasonality would imply that this extremely high volume level will only last a few more days. That being said, 2020 has followed very few historical patterns, and there is uncertainty about where demand will be in the third quarter (particularly with the strong resurgence in COVID-19 cases in many states) but it does not appear to be slowing at all at this time.

On the positive side, all 15 of the major freight markets FreightWaves tracks were positive on a week-over-week basis. This ratio has been consistently high in recent weeks but 100% up weeks are rare. The markets with the largest gains this week in OTVI.USA were Cleveland (29.74%), Laredo, Texas (23.62%) and Memphis (20.82%).

Tender rejections continue to soar with volumes

Carriers began rejecting loads at a much higher rate this week than at any time since the panic buying spree in March. The Outbound Tender Rejection Index (OTRI) jumped more than 400 basis points (bps) over the past week, which is one of the largest one-week jumps in its three-year history. OTRI currently sits at 12.3%, which is the highest non-holiday value excluding March since the tight summer of 2018.

While capacity had been stubbornly resistant to high volumes for some time, in the past few weeks this has changed. Volumes have been elevated since Memorial Day, but carriers are really just now starting to reject freight en masse.

Much like volumes, tender rejections tend to trend higher in the week(s) leading up to a national holiday. However, this spike is unusual seasonally and unlike those leading up to the Fourth of July in the past few years. In other words, it is possible that the rise in rejections stems from opportunistic carriers in a time of freight abundance and not simple seasonality. Typically, double-digit tender rejections lead to upward pressure on rates.

For more information on the FreightWaves Freight Intel Group, please contact Kevin Hill at khill@freightwaves.com, Seth Holm at sholm@freightwaves.com or Andrew Cox at acox@freightwaves.com.

Check out the newest episode of the Freight Intel Group’s podcast here.