This week’s FreightWaves Supply Chain Pricing Power Index: 35 (Shippers)

Last week’s FreightWaves Supply Chain Pricing Power Index: 35 (Shippers)

Three-month FreightWaves Supply Chain Pricing Power Index Outlook: 35 (Shippers)

The FreightWaves Supply Chain Pricing Power Index uses the analytics and data in FreightWaves SONAR to analyze the market and estimate the negotiating power for rates between shippers and carriers.

This week’s Pricing Power Index is based on the following indicators:

Volume levels holding up better in July than in previous years

July’s seasonal lull in volumes isn’t as pronounced as it has been in previous years. In fact, tender volumes since the beginning of the month have been remarkably stable. The growth in tender volumes as a whole is healthy as higher import levels have helped boost demand while domestic manufacturing has shown much more tepid growth, but for freight market participants it likely isn’t being felt to the same degree as there is simply too much capacity in the market.

To learn more about FreightWaves SONAR, click here.

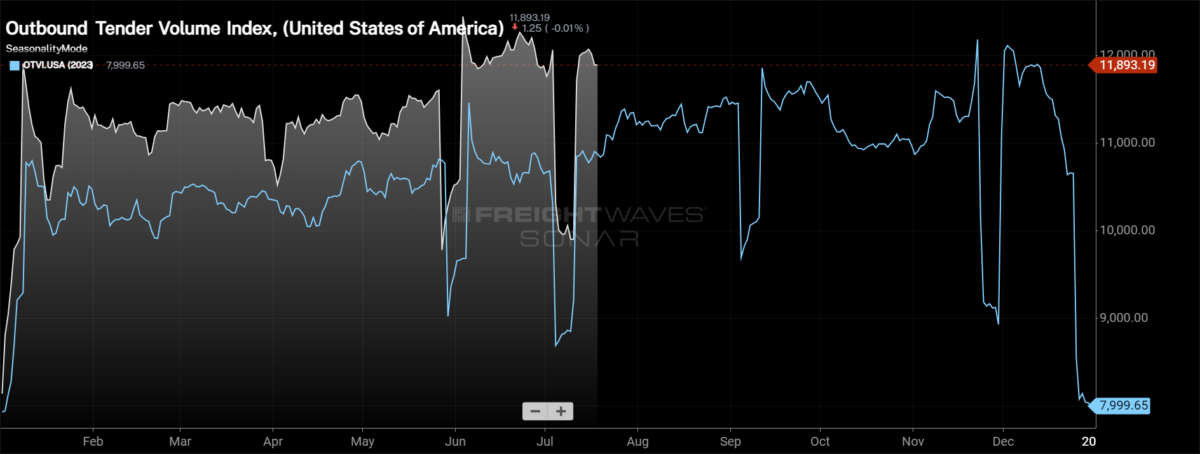

The Outbound Tender Volume Index , a measure of national freight demand that tracks shippers’ requests for trucking capacity, is 1.48% higher week over week as Fourth of July holiday impacts are largely in the rearview. Since the beginning of July, tender volumes are 1.1% higher, and if a trend similar to what happened in 2023 occurs, volumes will exit July well above where they entered the month.

To learn more about FreightWaves SONAR, click here.

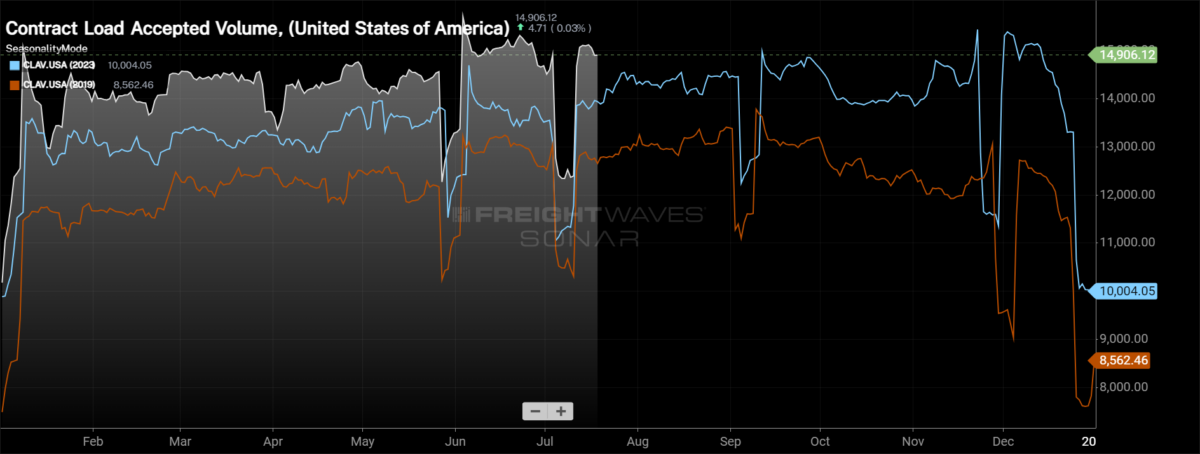

Contract Load Accepted Volume is an index that measures accepted load volumes moving under contracted agreements. In short, it is similar to OTVI but without the rejected tenders. Looking at accepted tender volumes, we see an increase of 1.59% w/w. CLAV is up over 7% from where it was this time last year, though comps become more challenging in the back half of the month.

Bank of America’s most recent card spending report for the week ending July 13, signaled a fairly dramatic slowdown in spending year over year. Total card spending was down 1.6% y/y, and excluding autos it was down 3%. Durable goods, like furniture, remain under pressure with spending down 8.5%, according to BofA. Additionally, online retail suffered its first decline in quite some time, down 4.4% y/y. This drop is likely short-lived as Amazon’s Prime Day event Tuesday and Wednesday set a record with $14.2 billion in sales in two days, up more than 11% y/y, according to Adobe Analytics.

To learn more about FreightWaves SONAR, click here.

With freight volumes rising at the national level, most of the freight markets in the country experienced rising volumes as well. Of the 135 freight markets across the country, 80 experienced volume growth over the past week, though many of the largest markets saw volume declines w/w.

In the major Southern California market of Ontario, tender volumes dropped 3.84% over the past week, the most significant weekly decline, outside of holiday-affected weeks, since the beginning of May. The decline in the market is driven entirely by a 5% drop in dry van volumes, while reefer volumes out of the market have increased by over 5% in the past week.

To learn more about FreightWaves SONAR, click here.

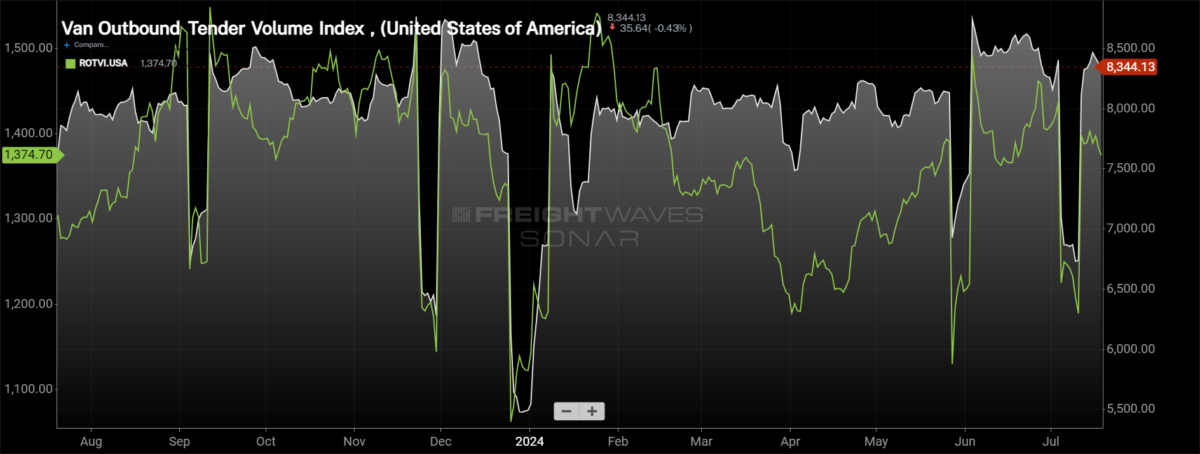

By mode: The dry van market is slowly bouncing back from the slowdown at the end of June. Over the past week, the Van Outbound Tender Volume Index increased by 2.85%, outpacing the growth of the overall market. Van volumes are over 9% higher than they were this time last year, but again, too much truckload capacity is masking this growth from even some of the largest transportation companies.

The reefer market came under pressure this week, despite fairly strong growth in one of the largest markets in the country. The Reefer Outbound Tender Volume Index fell by 1.65% over the past week and is down 2.7% since the beginning of July. Even with the decline, reefer volumes are still over 5% higher than they were this time last year.

Rejection rate decline stalling

Capacity is continuing to exit the market, and the largest fleets in the country have been reducing tractor counts. Just this week, J.B. Hunt reported its second-quarter earnings, and it reduced its dedicated fleet by 2.6% y/y, its independent contractor tractor count in its Truckload segment by 8% y/y and its Intermodal segment (or drayage) tractor count by 5%. As earnings season carries on, it will be interesting to see if this trend continues across the rest of the transportation providers.

To learn more about FreightWaves SONAR, click here.

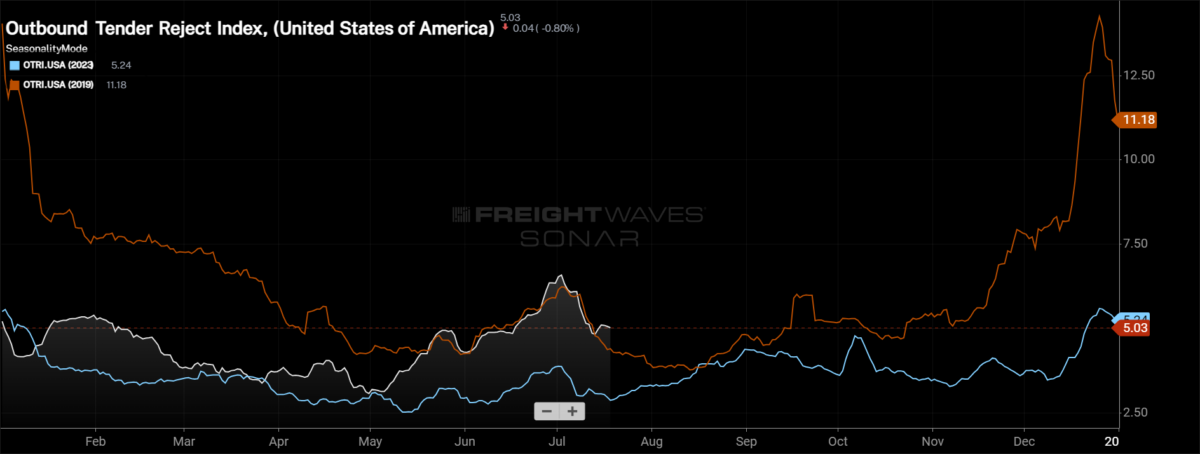

Over the past week, the Outbound Tender Reject Index, which measures relative capacity in the market, was fairly stable, dropping just 10 basis points to 5.09%, as OTRI is starting to stabilize around 5%. The post-Fourth of July holiday decline in rejection rates has slowed compared to how it did in 2019, a sign that from a capacity perspective, the market is becoming much more balanced.

This aligns with the transportation capacity reading in the most recent Logistics Managers’ Index, which came in at 50, indicating there was no change in capacity in June. The LMI is a diffusion index, meaning any number above 50 is expansionary and anything below 50 is contraction. The 50 reading for transportation capacity in June was the first time since March 2022 that the index wasn’t in expansionary territory. Additionally, transportation capacity was below transportation prices for the second consecutive month, which, according to the LMI, if it continues would be a signal that the freight recession is coming to an end.

To learn more about FreightWaves SONAR, click here.

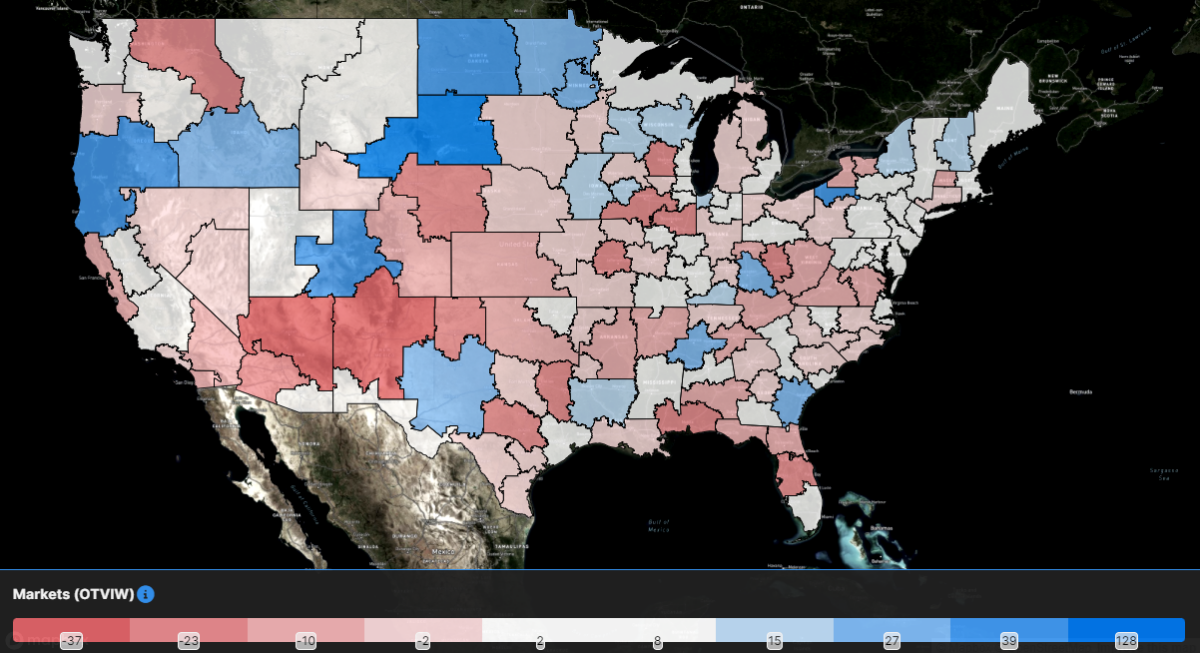

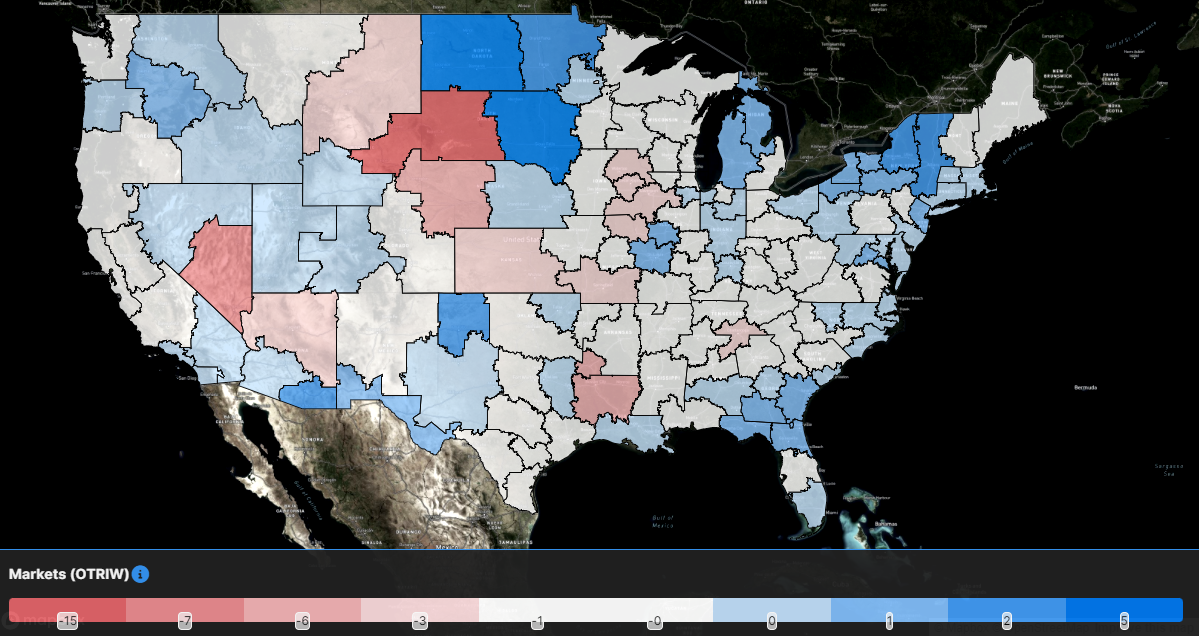

The map above shows the Outbound Tender Reject Index — Weekly Change for the 135 markets across the country. Markets shaded in blue are those where tender rejection rates have increased over the past week, while those in red have seen rejection rates decline. The bolder the color, the larger the change in rejection rates.

Of the 135 markets, only 65 reported higher rejection rates over the past week, up from 40 last week as transportation network fluidity has largely recovered from the holiday as well as Hurricane Beryl.

Many of the largest markets in the country experienced a slight uptick in rejection rates over the past week, but none of the increases were extremely meaningful. In the Southern California markets of Los Angeles and Ontario, rejection rates increased by 48 basis points w/w to 6.7% as rejection rates remain above the national average. In Dallas, rejection rates increased by just 18 bps w/w, but as in Southern California, rejection rates are above the national average at 5.95%.

To learn more about FreightWaves SONAR, click here.

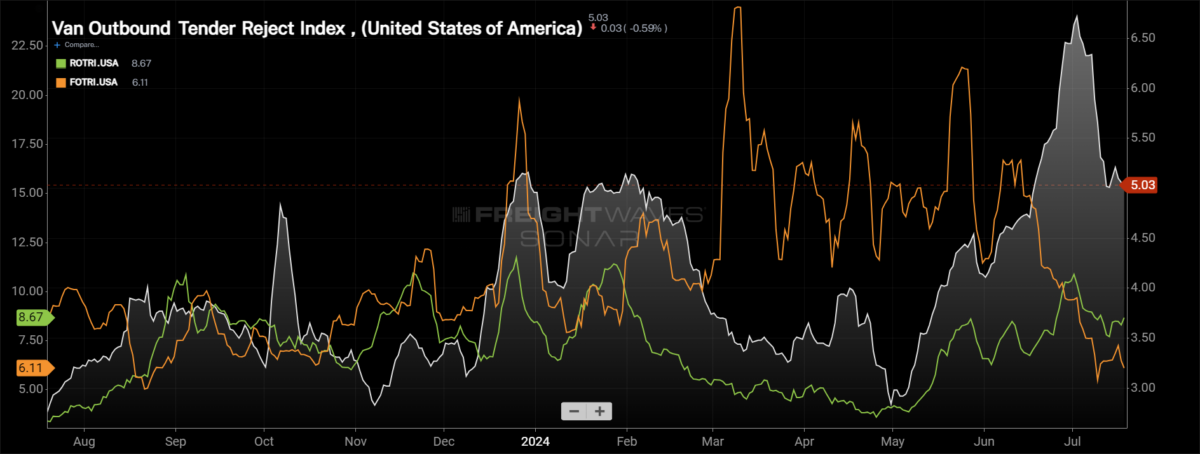

By mode: Capacity in the dry van market remains the loosest of the equipment types, which isn’t a surprise given the size of the market relative to the others. Over the past week, the Van Outbound Tender Reject Index decreased 24 bps to 5.03%.

Reefer rejection rates have started to flatten out after declining in the early stages of July. Over the past week, the Reefer Outbound Tender Reject Index has increased by 29 bps to 8.67%, which is higher than it reached around the Memorial Day holiday.

June’s housing start data was better than it had been the previous two months but still hasn’t been strong enough to help boost flatbed rejection rates. Over the past week, the Flatbed Outbound Tender Reject Index fell by 36 bps to 6.11%, one of the lowest levels in over a year. The positive sign for flatbed and housing is the possibility for an interest rate cut in September. While it wouldn’t be an immediate shot in the arm, it could create some optimism in the space.

Spot rates holding above pre-Fourth of July levels

Spot rates have retreated from the recent holiday highs, but even so they have stabilized higher than they were throughout the second quarter. One of the more interesting tidbits that came out of J.B. Hunt’s earnings release was that even though volume in the Integrated Capacity Solution segment (or the company’s freight brokerage) was significantly challenged, revenue per load was positive y/y in Q2.

To learn more about FreightWaves SONAR, click here.

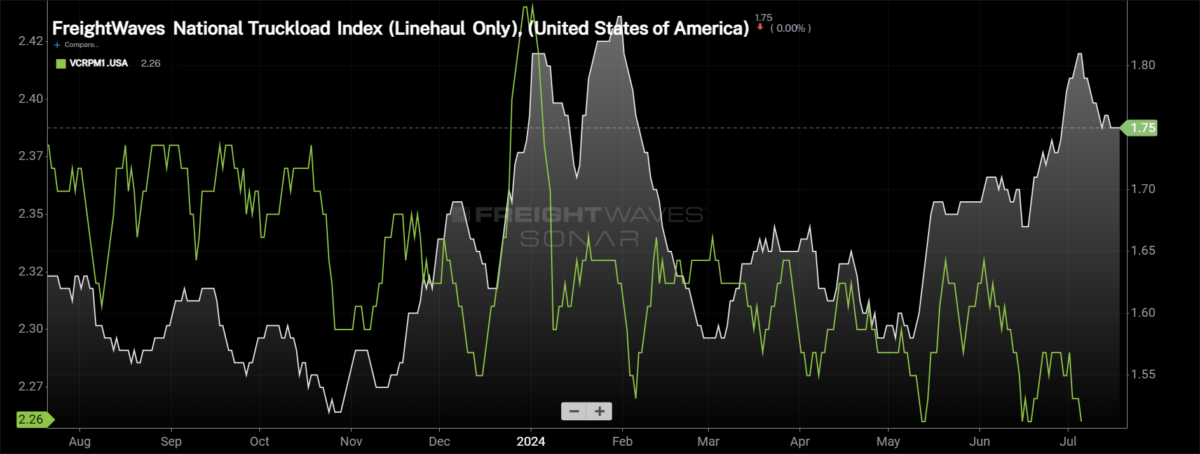

This week, the National Truckload Index — which includes fuel surcharge and various accessorials — fell 1 cent per mile to $2.35 but is 7 cents per mile higher than it was a month ago. Linehaul rate declines matched the decline in the NTI, as the linehaul variant of the NTI (NTIL) — which excludes fuel surcharges and other accessorials — fell by 1 cent per mile w/w to $1.75, up 6 cents per mile from where it was this time last month and 11 cents per mile higher than it was this time in 2023.

For many, cost savings from transportation have already been felt, and the key in contract negotiations is turning to service. Over the past year, the initially reported dry van contract rate (VCRPM1.USA), which excludes fuel surcharges and accessorials, has fallen by 10 cents per mile to $2.26. But since November, VCRPM1 has been within a 9-cent-per-mile range, excluding the holidays, signaling that while many are still looking for aggressive rate reductions, the overall market has stabilized.

To learn more about FreightWaves SONAR, click here.

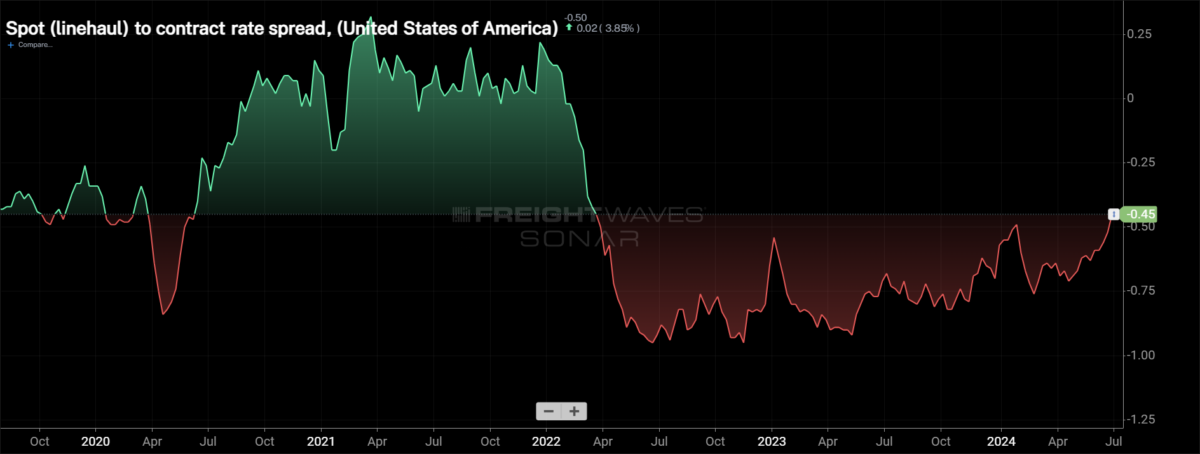

The chart above shows the spread between the NTIL and dry van contract rates is trending back to pre-pandemic levels as the higher spot rates around the Fourth of July have created the narrowest spread since April 2022. Linehaul spot rates are now just 45 cents per mile below contract rates. The spread has narrowed by 19 cents per mile over the past year. As capacity continues to exit the market and if spot rates are able to stabilize at the higher levels, the spread will continue to narrow to levels that present carriers with some level of optionality in the market.

To learn more about FreightWaves TRAC, click here.

The FreightWaves Trusted Rate Assessment Consortium spot rate from Los Angeles to Dallas continues to retreat from the Fourth of July holiday peak, though the decline is starting to flatline. The TRAC rate from Los Angeles to Dallas decreased by 1 cent per mile to $2.28, just 25 cents below contract rates along this lane.

To learn more about FreightWaves TRAC, click here.

J.B. Hunt highlighted in its earning report as well as its call with analysts that challenges to its East Coast intermodal volumes derive from competitive pricing with truckload markets. The TRAC rate from Atlanta to Chicago currently sits at $2.03 per mile, down 3 cents over the past week and 35 cents per mile below contract rates. For the early parts of the second quarter, truckload spot rates and intermodal spot rates were fairly close, making intermodal less attractive. In the back half of the quarter and in the early stages of the third quarter, intermodal providers have dropped spot rates in order to make intermodal competitive to truckload in an effort to capture any excess volume from the truckload market.