Shippers move LTL freight to full truckload

The ongoing freight recession is having a multimodal spillover effect as shippers look for creative ways to save costs. Excess supply of trucking capacity remains the 18-wheeled elephant in the room, to such an extent that we see instances in which LTL is losing share to full truckload due to lower costs. Typically full truckload can compete with rail and intermodal when rates are lower, but recent Q1 earnings commentary from LTL executives highlights an additional angle when looking at ways trucking companies are trying to backfill volumes as competition from other carriers pushes down rates.

Old Dominion President and CEO Kevin “Marty” Freeman said on the company’s earnings call that “the truckload market, in particular, has been incredibly weak. And I think there has been some spillover of volumes that have gone into that industry just given the overall weakness there and players that are willing to move freight, take some maybe large, heavy-weighted LTL shipments for cost or less than their cost to operate just to kind of keep the trucks rolling.”

LTL provider Saia also highlighted opportunistic shippers taking advantage of low truckload rates. Douglas Col, executive vice president and CFO of Saia, said on the earnings call, “But I do think the customer is taking advantage of this longer — lower-for-longer — environment and figuring out ways to consolidate and move more things to truckload before they break it down to an individual pallet and move it.”

TFI International gives Daseke home office a $12M haircut

Canadian transport and logistics provider TFI International on its Q1 earnings call provided an update to its plan to eventually spin off Daseke through some cost restructuring. Daseke has a fleet of around 4,500 tractors and 11,000 flatbed and specialized trailers and is the largest flatbed provider in North America. Part of Daseke’s size comes from its being a combination of multiple business units, with their performances being mixed.

Alain Bedard, president and CEO of TFI International, said on the call, “Daseke, like I said earlier, I mean, the eight, nine business units there, they operate really well. There’s maybe one or two that are subpar, OK, that we’re going to have to work on. The head office of Daseke was the cancer, was — those guys were costing a fortune, and the results were not there. So, we did some cleanup over there.” Clean up they did, with Bedard reducing Daseke’s head office salaries by $12 million.

Bedard, while impressed with some of Daseke’s business units, believes the head office was impeding improvement. He adds, “We got one or two operating companies that are running under 90 OR, OK? But you got one or two guys are running closer to 100 OR, right? But I would say that ’23 average, OK, you think about 93, 94 OR on average, right? So that’s the starting point, OK? So, when we take over, then the head office was the big culprit that was dragging the OR, OK, up or down, I mean, in the worst direction, OK?”

Market update: U.S. Bank Freight Payment Index shows continued trucking contraction

On Tuesday, freight audit and payments provider U.S. Bank released its Q1 Freight Payment Index data, which saw a continued contraction in truck freight. Compared to Q1 2023, freight spending fell 27.9% year over year and was also down 16.8% quarter over quarter. Shipment volumes also saw declines, contracting 7.8% from Q4 ’23 and down 21.6% y/y. In addition to nationwide declines, all regions with the exception of the Southwest saw significant declines in shipments and spendings. The Southwest saw an 8.9% uptick in volumes from Q4 2023, but spending fell 16.5% during that same period. The hardest-hit region was the Northeast, which saw spending and volumes fall 34.8% and 33.9% y/y, respectively.

Bobby Holland, director of freight business analytics at U.S. Bank, said in the report, “While there was hope for a freight market turnaround to start the year, our data shows that the challenges continued. Nationally, this was the eighth straight quarter of year-over-year volume decreases and the fifth straight with a drop in spending.”

Impacts of freight rate cuts caused disproportionate drops in spending compared to volumes. The report adds, “While the freight volumes for motor carriers contracted, the spend for those loads fell disproportionately more than volumes, which suggests downward pressure on rates during the quarter. Specifically, while shipments fell 7.8% from the final quarter of 2023, spend on those loads was down 16.8%. And while shipments decreased 21.6% from a year ago, the U.S. Bank National Spend Index had a more significant drop of 27.9%.”

FreightWaves SONAR spotlight: Reefer madness: Carriers try to stabilize van contract rate declines

Summary: As Q1 earnings season continues, a recurring theme among trucking management and executives is resistance to contracted rate cuts. J.B. Hunt and Knight-Swift were the first carriers to mention surprise at how competitive Q1 bid season was. J.B. Hunt highlighted on its earnings call reducing volumes with less flexible shippers and embracing more volumes from rate-friendlier ones, while Knight-Swift shifted more capacity into the spot market and accepted losses on certain contracted lanes due to cuts. Heartland Express spoke on refusing to lower contracted rates and not relying on brokered freight. Marten Transport went a step further, noting on its earnings press release, “We have not agreed to rate reductions since last August.”

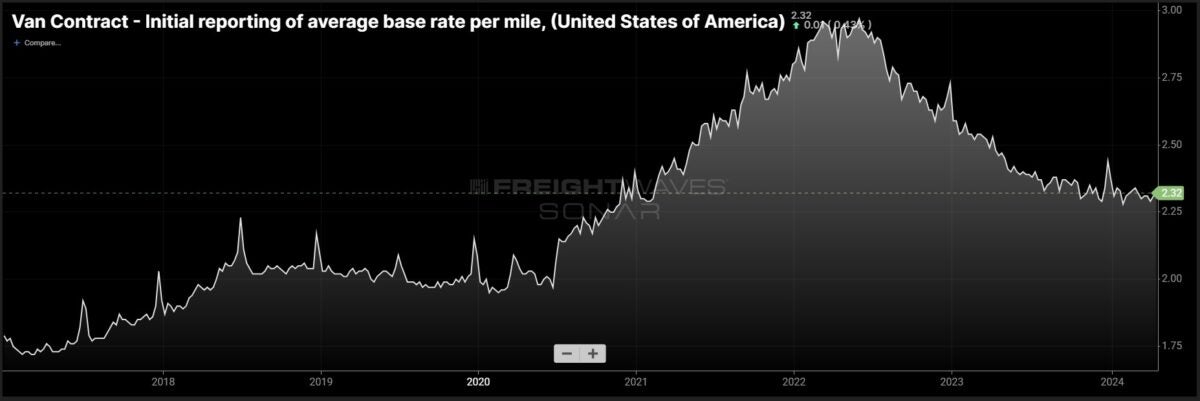

For trucking observers, while earnings remarks may sound muted, the signaling is louder that contract rates are close to a market bottom, and those shippers who continue to push for concessions will risk degraded service when the market improves. Contract rate data appears to support the argument that carriers have reached a contract rate pricing bottom. Based on data from the FreightWaves Van Contract Initial reporting of average base rate per mile (VCRPM1), Q1 2023 mostly hovered between $2.28 and $2.33 per mile, following an end-of-year spike, which can be observed in previous years.

Initial contracted rate data is useful to determine market trends, and carriers’ higher costs from equipment, wages and insurance appear to be a contributing factor to the new elevated pricing bottom. Looking ahead, spot market rate movements will be a leading indicator of whether Q2 and Q3 RFPs will see carriers regain the pricing momentum. This will remain a challenge to adequately predict due to the current market conditions being driven by excess truckload capacity and not truckload demand.

The Routing Guide: Links from around the web

Supreme Court: Drivers hauling baked goods are in transportation, not baking (FreightWaves)

DRIVE Act speeds up while speed limiter proposal slows down? (Land Line)

Werner Enterprises says end of downcycle getting closer (FreightWaves)

ACT: Trucking sector upturn likely within ‘a couple of months’ (DC Velocity)

US carriers illegally hiring Mexican drivers to haul loads, sources say (FreightWaves)

92-year-old Texas trucking company files for bankruptcy liquidation (FreightWaves)