The container shipping boom refuses to end on its predicted schedule. Maersk previously guided for a sharp slowdown starting in July. That didn’t happen. Now it sees a gradual pullback toward the end of the year.

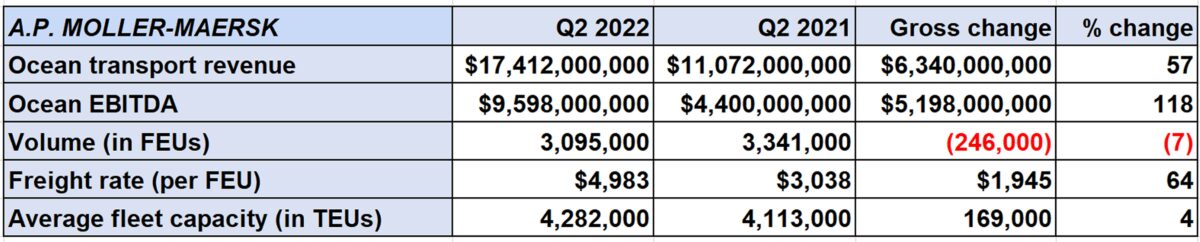

On Tuesday, the world’s second-largest container liner operator pre-reported an all-time high $10.3 billion in earnings before interest, taxes, depreciation and amortization for Q2 2022. During a conference call on Wednesday, Maersk CEO Soren Skou said that Q3 2022 will be “equally good,” i.e., around $10 billion.

Maersk has pushed back expectations for a “normalization” of its ocean business until Q4 2022. Even then, it doesn’t see a collapse. Its new guidance calls for full-year EBITDA of $37 billion, implying Q4 2022 EBITDA of around $7 billion. If so, Q4 2022 would be the fourth- or fifth-best quarter in the company’s history.

What has kept the container boom going longer than expected? Maersk executives cited three causes: ongoing supply chain congestion, continued U.S. import demand strength and higher long-term contract pricing.

‘No quick resolution’ to congestion

According to Maersk CFO Patrick Jany, “Q2 saw a continuation of global congestion, with several disruptions offsetting the weakening demand and lower economic outlook and [supporting a] still very high level of freight rates. Although spot rates softened, they remain high in absolute terms.

“While the demand outlook is certainly down, various disruptions preempted a wider erosion of freight rates, which led to an overall market development that was very similar to that of the first quarter, with both higher rates and lower [year-on-year] volumes.”

Skou said he has been frequently confronted with questions from investors on the development of global congestion. He explained, “Congestion really ramped up last year on the U.S. West Coast as import volumes jumped at the same time labor supply dropped due to COVID. We had expected congestion to ease by the middle of this year.

“The situation on the ground is that while congestion has eased a bit on the West Coast, congestion has spread to the East Coast and to Europe.

“Containers are just not moving off the terminals fast enough. On the West Coast, we have a massive problem getting rail cars. Yesterday, we had 8,500 containers in our L.A. terminal waiting for rail cars. That is three or four times the average from a few years ago.

“Across the West Coast, East Coast and Europe, we see issues with customers not picking up containers because of full inventories. This picture means that a quick resolution of the global supply chain issue is increasingly unlikely.”

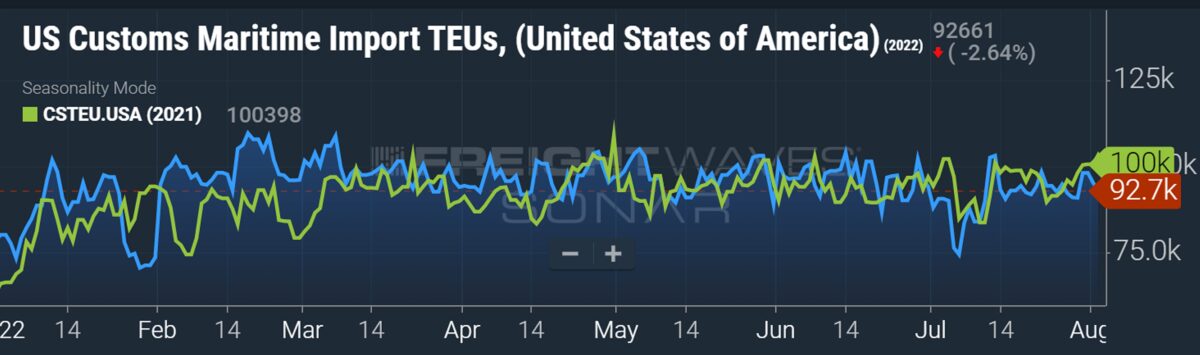

US imports remain at ‘very high levels’

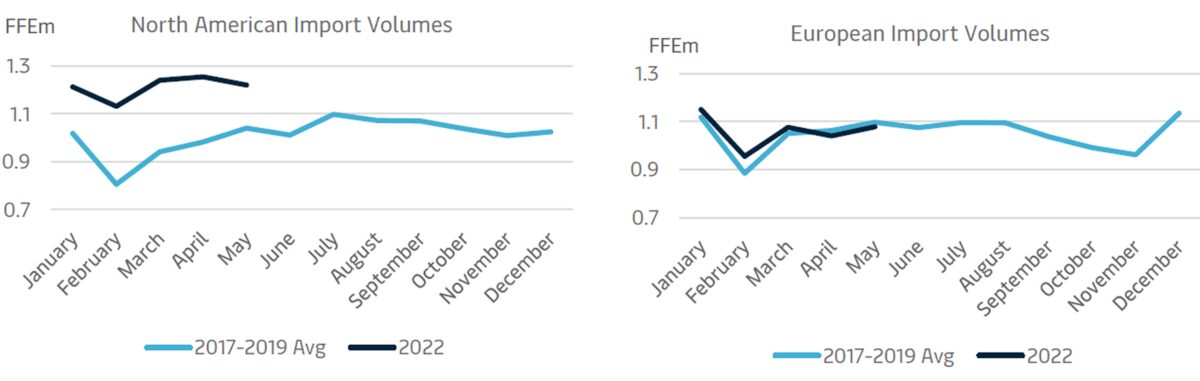

“Import volumes into the U.S. remain at very high levels,” said Skou. In contrast, he noted, imports to Europe are back to pre-pandemic levels.

An analyst asked Skou why U.S. imports have remained strong despite U.S. retailers reporting excess inventories and slowing demand for some products.

He responded: “Some of the [excess] inventory, particularly in the U.S., is the ‘wrong’ inventory. So, our customers are complaining that they have the wrong inventory and they still have to import the ‘right’ inventory.

“There are also certain product categories, especially in durable goods, where pretty much everybody has bought [what they needed]. Everybody has bought a new couch, a new set of lounge furniture, a new TV screen — all the things we spent our money on during the pandemic.

“You cannot go on buying things like another TV screen. But there is still actually very strong demand for faster-moving stuff, especially in lifestyle and retail goods.”

“With inflation being rampant in the U.S., people are able to afford less than they were a few months ago. At some point, that should have an effect on U.S. imports,” said Skou.

According to Jany, “Fundamentally, we cannot escape the macroeconomic environment, which is clearly headed toward lower growth, higher inflation and lower consumer confidence. So, there will be reduced demand at one point in time.”

Skou added, “The only caveat is that {U.S.] savings is also very, very high. Many wise people have said that we should always be careful not to count out the U.S. consumer.”

Maersk contract rates exceed expectations

Yet another reason why the container shipping boom is lasting longer than some expected: long-term freight contract coverage. Spot rates get more attention and spot rates are falling. But contract rates are up sharply year on year.

Contract rates have been even higher than Maersk previously thought, one of the key reasons why it just hiked full-year guidance.

“The conclusion of our 2022 contracting season was very strong,” said Skou. Maersk now expects 2022 contract rates to be $1,900 per forty-foot equivalent unit higher than 2021 contract rates. That’s $500 more per FEU than it predicted just three months ago. “That reflects much better performance, compared to our expectations, in the latter part of Q2 and over the summer,” said Skou.

Maersk now has 71% of its long-haul business on contracts, mostly with beneficial cargo owners as opposed to freight forwarders.

The company’s average freight rate, including both contract and spot, came in at $4,983 per FEU in Q2 2022, up 64% year on year and up 9% from the first quarter. It was the highest quarterly average rate ever reported by Maersk — and the current quarter looks like more of the same.

Click for more articles by Greg Miller

Related articles:

- Record container ship traffic jam as backlog continues to build

- Container shipping boom continues: Hapag-Lloyd hikes outlook (again)

- Win streak continues: Container lines just posted more record results

- US containerized imports keep record pace in June, start strong in July

- Container shipping jackpot continues: CMA CGM profits soar

- Blockbuster container shipping results collide with sinking sentiment