As 2023 draws to a close, the oft-predicted recession is still nowhere in sight and the S&P 500 index is flirting with a new all-time high. It was a strong year for ocean shipping stocks: They performed even better than the broader market.

FreightWaves ranked 2023 shipping stock performance based on the change in the adjusted closing price (adjusted for dividends) on Wednesday versus the adjusted closing price on Dec. 30, 2022.

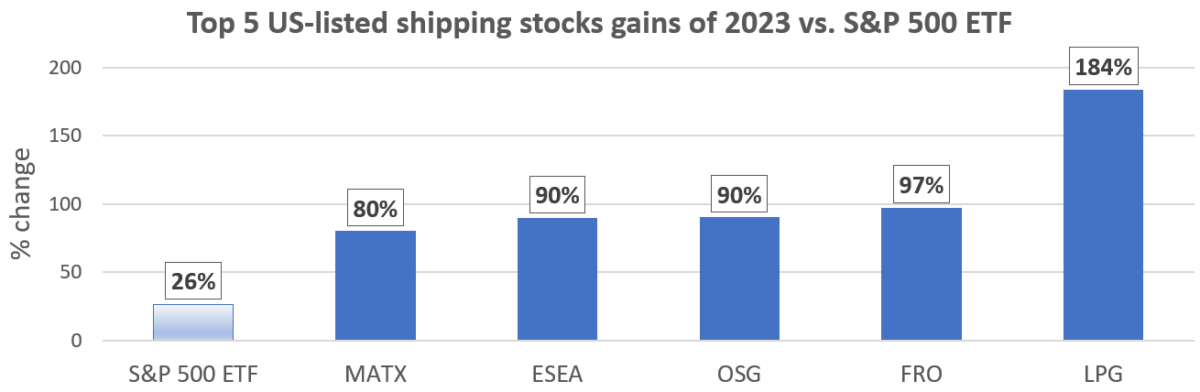

To put results in context, U.S.-listed shipping stock performance was compared to the SPDR exchange-traded fund (ETF) that tracks the S&P 500 index (NYSE: SPY).

The final tally shows some surprises at the top.

Top 5 shipping stock gains of 2023

No. 1 — Dorian LPG (NYSE: LPG). The winner, by a long shot, is Connecticut-based Dorian LPG. Its adjusted share price surged 184% this year. That’s more than seven times the gain of the S&P 500 ETF.

No one would have predicted Dorian taking the crown at the beginning of 2023. Dorian transports liquefied petroleum gas — propane and butane — in very large gas carriers (VLGCs). Sentiment on the VLGC sector was weak as this year began, given the high number of newbuildings due for delivery.

Strong demand ultimately trumped market headwinds from newbuildings. Panama Canal disruptions lengthened VLGC voyages, giving further support to spot rates. On Dec. 22, Dorian’s share price hit its highest level since the company went public in 2014.

No. 2 — Frontline (NYSE: FRO). Shares of tanker giant Frontline doubled this year, rising 97%.

The company, founded by shipping tycoon John Fredriksen, is currently taking delivery of 24 very large crude carriers (VLCCs; tankers that carry 2 million barrels of oil) purchased from Euronav (NYSE: EURN) for $2.35 billion.

As a result of this transaction, which will boost fleet capacity by 58%, Frontline “will completely dwarf all publicly listed tanker competition,” said Pareto Securities analyst Eirik Haavaldsen in October.

No. 3 — Overseas Shipholding Group (NYSE: OSG). OSG spun off its foreign-flag tankers into International Seaways (NYSE: INSW) after emerging from bankruptcy in 2014, leaving OSG with its Jones Act tankers and barges. (Jones Act vessels serve legally protected U.S. coastwise trades.)

OSG is not a high-profile name in shipping equity circles. It has a small market cap ($383 million, compared to Frontline’s $4.46 billion) and limited analyst coverage. Yet its shares quietly rose 90% this year, more than any other U.S.-listed crude or products tanker company save Frontline.

No. 4 — Euroseas (NASDAQ: ESEA). Founded by Greece’s Aristides Pittas, Euroseas is a small player that had previously operated a mixed fleet of dry bulk ships and container vessels. Pittas split the fleet in 2018, hiving off the bulkers into Eurodry (NASDAQ: EDRY) and turning Euroseas into a pure-play container-ship lessor.

Lease rates held up surprisingly well this year despite a tidal wave of newbuilding deliveries. Euroseas’ adjusted share price rose 90%.

No. 5 — Matson (NYSE: MATX). Stocks of almost all container shipping lines have been under heavy pressure this year as incremental capacity from newbuilding deliveries outweighs transport demand. The worst performer among larger U.S.-listed shipping names across all vessel segments is Israeli liner company Zim (NYSE: ZIM). Zim’s adjusted share price is down 19% in 2023.

And then there’s Matson, whose share price is up 80%. Matson’s stock hit a new 52-week high on Dec. 22. With the exception of March-April 2022, at the peak of the supply chain crisis, Matson’s share price has never been higher.

“Unicorns do exist — just look at Matson,” said Stifel analyst Ben Nolan in October.

Matson’s market cap of $3.85 billion is more than triple the market cap of Zim, despite the fact that Zim’s fleet capacity is nine times higher. Matson operates in protected Jones Act trades, as well as in the China-West Coast international trade, where it offers expedited service that competes with air cargo.

Restrictions on both the Panama and Suez canal routes are making Matson’s niche China-West Coast service even more attractive.

Tanker stocks

FreightWaves also analyzed 2023 shipping stock performance by vessel sector, calculating average sector performance on a market-cap-weighted basis.

Sentiment on tanker stocks was ebullient at the beginning of 2023. There was even talk of a new “super cycle.” But only a few tanker stocks lived up to those very lofty expectations. Share performance of owners of product tankers — vessels that carry gasoline, diesel, jet fuel and other refined products — has been particularly disappointing.

Beyond Frontline and OSG, the biggest tanker share-price gains were posted by Teekay Tankers (NYSE: TNK), up 73%, and Nordic American Tankers (NYSE: NAT), up 61%. Both companies own Suezmax tankers (with capacity of 1 million barrels), a vessel category benefiting from reroutings due to the Russia-Ukraine war.

This year’s smallest tanker-stock gains were posted by product-carrier owners Scorpio Tankers (NYSE: STNG), whose adjusted share price rose 17%, and Ardmore Tankers (NYSE: ASC), with a gain of just 7%.

Tanker shares overall rose 48% on a market-cap-weighted basis, almost double the S&P 500 ETF. However, Frontline heavily skewed this average. Excluding Frontline, the remaining tanker owners’ shares rose 33% — not much higher than the broader market.

Container-ship lessor stocks

Companies that lease container vessels to shipping lines continued to report hefty profits this year despite the end of the supply chain crisis and the normalization of freight rates.

These shipowners locked in most of their fleets on multi-year charters at the peak of the COVID-era boom. That shielded this year’s returns from downside. Furthermore, liner companies have surprised analysts and brokers by continuing to book new charters at lease rates higher than pre-COVID levels, despite newbuilding deliveries.

Euroseas’ stock rose the most, but it has the smallest market cap in this group, at just $223 million.

Greece’s Danaos Corporation (NYSE: DAC) is the largest U.S.-listed player in this segment, with a market cap of $1.44 billion. Its share price rose 47% this year, close to double the gain of the S&P 500 ETF.

Greece’s Costamare (NYSE: CMRE) had the smallest gain, at 19%. This company also owns a large dry bulk fleet, and its share performance was likely lowered by exposure to that segment.

U.S.-listed container-ship lessors’ average stock gain was 37% in 2023, outpacing the broader market.

Dry bulk stocks

The dry bulk sector is more exposed to the Chinese economy than any other shipping segment.

China’s post-COVID recovery was much weaker than predicted. The country’s property sector — a major driver of steel production and thus iron ore and coal imports — continued to deteriorate. Central government stimulus via infrastructure spending — a major driver of dry bulk rates after the global financial crisis — has been absent.

Spot rates for Capesizes (larger bulkers with capacity of around 180,000 deadweight tons or DWT), unexpectedly surged in the fourth quarter of this year. But in general, 2023 bulker rates have been disappointing.

According to Jefferies, spot rates for Capesizes averaged $16,500 per day from Jan. 1 through Thursday, up only 2% versus the same period last year. Rate for Panamaxes (65,000-90,000 DWT) averaged 11,000 per day, down 43% year on year. Rates for Supramaxes (45,000-60,000 DWT) averaged $11,300 per day, down 49% year on year.

Rhode Island-based Pangaea Logistics (NASDAQ: PANL), an owner of midsize bulkers, is the best-performing U.S.-listed dry bulk stock of 2023, up 68% through Wednesday. Pangaea’s stock reached its highest level since 2014 on Thursday.

Greece’s Seanergy (NYSE: SHIP), which has a fleet of 17 Capesizes, came in second, up 56%. Its stock hit a new 52-week high on Wednesday. (Seanergy’s share price has also been buoyed by stock purchases by shipping magnate George Economou, who has emerged as an activist investor in recent months.)

The year’s worst performer among larger U.S.-listed bulker owners is Greece’s Diana Shipping (NYSE: DSX). Its adjusted closing price fell 14% in 2023.

Overall, U.S.-listed dry bulk stocks rose an average of 19% this year, underperforming the S&P ETF gain of 26%.

Click for more articles by Greg Miller

Related articles:

- Tide turning against ‘hyper-dilutive’ shipping stock sales

- How have shipping shares performed versus broader stock market?

- Corporate governance in shipping: Who’s been naughty or nice?

- Container shipping stocks outperform despite market gloom

- Controversy swirls over shipping stocks that sink as rates rise

- Hello, goodbye: Shipping’s latest entries and exits on Wall Street

- Five years on Wall Street: Shipping’s exits, arrivals, whales and minnows

- Shipping’s Wall Street saga: Rags to riches to rags to occasional riches