This week’s FreightWaves Supply Chain Pricing Power Index: 35 (Shippers)

Last week’s FreightWaves Supply Chain Pricing Power Index: 35 (Shippers)

Three-month FreightWaves Supply Chain Pricing Power Index Outlook: 40 (Shippers)

The FreightWaves Supply Chain Pricing Power Index uses the analytics and data in FreightWaves SONAR to analyze the market and estimate the negotiating power for rates between shippers and carriers.

This week’s Pricing Power Index is based on the following indicators:

Volume yet to react for peak season

The start of November is traditionally a softer period for freight demand ahead of the retail peak season that tends to start gaining momentum around the middle of the month. This year, with the Thanksgiving holiday being the latest possible day it can be, volumes haven’t found any positive momentum as the middle of the month is just days away.

To learn more about FreightWaves SONAR, click here.

The Outbound Tender Volume Index (OTVI), a measure of national freight demand that tracks shippers’ requests for trucking capacity, continued to decline over the past week, falling by 2.19%. For the first time since late September, OTVI has turned negative, down 0.13% year over year.

Long-haul volumes, loads moving 800 miles or more, have yet to turn on as the intermodal market has been a pressure relief valve for the imports that have been coming into the country. Loaded domestic intermodal volumes are up over 6% compared to this time last year, whereas long-haul trucking volumes are down 3.2%. As intermodal’s value proposition weakens due to increased time sensitivity, long-haul truckload volumes will find some positive momentum, following a seasonal pattern.

To learn more about FreightWaves SONAR, click here.

Contract Load Accepted Volume (CLAV) is an index that measures accepted load volumes moving under contracted agreements. In short, it is similar to OTVI but without the rejected tenders. Looking at accepted tender volumes, the decline was larger than the decline in OTVI thanks to an increase in rejection rates, falling by 3% over the past week. With the fairly sizable decrease in CLAV w/w, accepted tender volumes are now down 2.92% y/y.

Spending growth remains tepid, according to the most recent Bank of America card spending report. Total card spending per household was up 0.9% y/y for the week ending Nov. 2. Autos continued to provide a boost to spending; retail spending excluding autos was down 0.5% y/y in the week. Online electronics and gas spending remain large drags on overall spending, falling 7.2% and 10.1% y/y, respectively, though gas spending is being driven largely by lower prices as opposed to significant changes in demand.

To learn more about FreightWaves SONAR, click here.

With the decline in freight demand overall, the majority of freight markets experienced lower volumes week over week. Of the 135 freight markets tracked within FreightWaves SONAR, just 50 had higher volumes compared to last week.

The Ontario, California, freight market, the largest in the country by outbound volume, saw some growth in volumes over the past week, rising 0.4%.

Houston also experienced some uptick in tender volumes over the past week, rising 3.9%. The other major Texas freight market, Dallas, experienced a fairly sizable decline in volumes, falling by 2.27% w/w.

To learn more about FreightWaves SONAR, click here.

By mode: The dry van market continues to be the primary source of volume weakness as dry van volumes continue to creep lower. The Van Outbound Tender Volume Index fell by 2.72% over the past week. With the weakness to start November, dry van tender volumes are down 1.26% y/y.

The reefer market continues to show signs of life, though seasonality is likely playing a large part in the growth in volumes over the past week. The Reefer Outbound Tender Volume Index increased by 1.22%, recovering from a slowdown to start the month. Even with the increase this week, reefer volumes are still lower year over year, currently down 2.69%.

Rejection rates break above 6%

While volumes aren’t showing signs of life, at least yet, the capacity side of the market is starting to percolate. For the first time outside of the Fourth of July holiday, tender rejection rates have eclipsed 6%, which, while it doesn’t create a significant increase in operational challenges, does signal that this peak season is ripe for disruption for the first time in more than two years.

To learn more about FreightWaves SONAR, click here.

Over the past week, the Outbound Tender Reject Index (OTRI), a measure of relative capacity, increased by 79 basis points to 6.01%, eclipsing the 6% level for only the second time since August 2022. At present, the OTRI is 257 bps higher than it was this time last year and 93 bps higher than it was in 2019. While the market this year is different from 2019’s, the upward movement is a positive sign for carriers heading into 2025, though it may take some time for the market to shift in a sustainable way.

To learn more about FreightWaves SONAR, click here.

The map above shows the Outbound Tender Reject Index — Weekly Change for the 135 markets across the country. Markets shaded in blue and white are those where tender rejection rates have increased over the past week, whereas those in red have seen rejection rates decline. The bolder the color, the more significant the change.

Of the 135 markets, 97 reported higher rejection rates over the past week.

Tender rejection rates in Southern California have moved higher over the past week, which is a positive sign for the overall market as these markets tend to be the heartbeat of the U.S. freight economy. Tender rejection rates in Ontario increased by 107 bps to 4.96%.

The Chicago freight market also experienced a significant increase over the past week, rising 169 bps w/w to 7.86%. The current rejection rate in Chicago is at the highest level since mid-April 2022.

To learn more about FreightWaves SONAR, click here.

By mode: Dry van rejection rates have finally crept above 5% with the rise over the past week, making it the final equipment type to reach that threshold. The Van Outbound Tender Reject Index increased by 50 bps over the past week to 5.15%. Van rejection rates are 222 bps higher than they were this time last year, an indication that the market has indeed gotten tighter but is still relatively loose, historically speaking.

The reefer rejection rate continues to show that the reefer market has battled out of its own freight recession experienced earlier this year. The Reefer Outbound Tender Reject Index increased by 426 bps over the past week to 17.68%. Reefer rejection rates are almost double what they were this time last year, up 885 bps y/y.

If the Federal Open Market Committee continues to cut the target range for the federal funds rate, it will present increased opportunities for flatbed operators as capital investments increase. The Flatbed Outbound Tender Reject Index continues to inch higher, rising 56 bps over the past week to 11.59%. Compared with this time last year, flatbed rejection rates are 222 bps higher.

Spot rates have 1 of the best weeks of the year

It took some time for spot rates to react to rejection rates moving higher, but some positive momentum has been found in recent weeks. Spot rates have been moving higher since early October and are now less than 10 cents per mile under the year-to-date highs established in January. With the recent upward movement, a higher baseline for spot rates is set ahead of the holidays, leading to the potential for even momentum to be captured during the final six weeks of 2024.

To learn more about FreightWaves SONAR, click here.

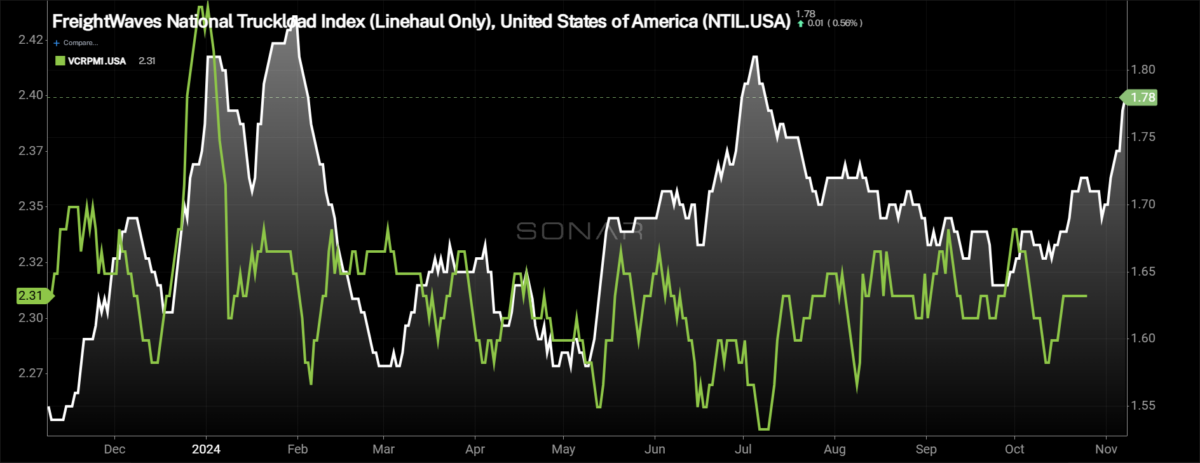

This week, the National Truckload Index — which includes fuel surcharge and various accessorials — saw one of its most significant single-week increases, rising 9 cents per mile after last week’s 3-cent-per-mile decrease, now up to $2.34. With the increase, the NTI is now widening the gap with last year’s figure, now 11 cents per mile higher y/y. The linehaul variant of the NTI (NTIL) — which excludes fuel surcharges and other accessorials — increased slightly less than the NTI. That is an indication that fuel prices did help create some boost to all-in spot rates, but it was marginal at best. The NTIL rose by 8 cents per mile to $1.78. The NTIL is 23 cents per mile higher than it was this time last year, a sign of how impactful the decline in diesel fuel prices, which are down 18.5% y/y, have been on all-in spot rates. If there is a rapid shift in fuel prices moving higher, that could create a significant shock to all-in spot rates as the underlying rate is up 14.8% y/y.

Initially reported dry van contract rates, which exclude fuel, have remained fairly stable the past couple of months, as shippers have become more understanding over the past year that pricing could shift significantly. Over the past week, the initially reported dry van contract rate was unchanged at $2.31. Initially reported dry van contract rates are 2 cents per mile lower than they were this time last year. The Logistics Managers’ Index future outlook for transportation prices reached 81 in October, a signal that a fairly large shift in transportation prices is likely next year as any reading over 50 signals expansion.

To learn more about FreightWaves SONAR, click here.

The chart above shows the spread between the NTIL and dry van contract rates is trending back to pre-pandemic levels. The spread remains wide, but with the recent positive momentum in spot rates and flattening of contract rates, the spread is starting to narrow. Over the past week, the spread between contract and spot rates narrowed by 4 cents per mile and is 22 cents narrower than it was this time last year.

To learn more about FreightWaves TRAC, click here.

The FreightWaves Trusted Rate Assessment Consortium spot rate from Los Angeles to Dallas continues to trend higher, but not without some volatility along the way. The TRAC rate from Los Angeles to Dallas increased by 4 cents per mile to $2.64. Spot rates along this lane are 14 cents per mile above the contract at present.

To learn more about FreightWaves TRAC, click here.

From Chicago to Atlanta, spot rates have been rising since early October, but the past week presented a challenge. The TRAC rate for this lane fell by 5 cents per mile over the past week to $2.67. Spot rates are 10 cents per mile below the contract rate, but that spread is as narrow as it has been all year.