Ocean container rates remain exceptionally high but may have finally hit their ceiling. Spot rates have not only stopped rising, they’ve pulled back by single digits. Is this a new plateau or the start of a longer-term reversal as liner alliances bring more capacity back online?

The share of idle container-ship tonnage is declining. The number of box ships being chartered by carriers is increasing. Charter rates are on the rise. All of this implies there will be more slots available for containers, a headwind for freight rates.

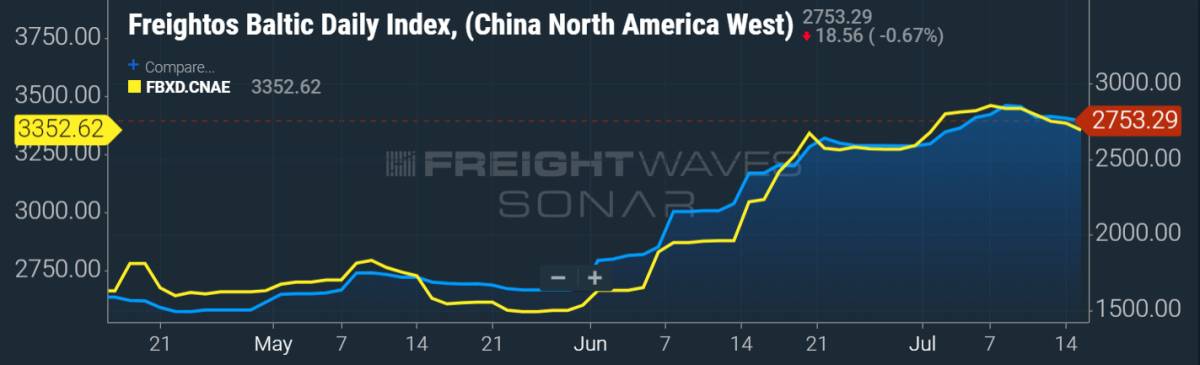

Spot rates halt their ascent

“As carriers restore capacity, ocean rates dipped slightly,” said Freightos Chief Marketing Officer Eytan Buchman in the company’s weekly report.

The Freightos Baltic Daily Index tracks the price to ship a forty-foot equivalent unit (FEU) container in various trades. Rates peaked on July 8 on the China-West Coast route (SONAR: FBXD.CNAW) and on July 7 on the China-East Coast route (SONAR: FBXD.CNAE). China-West Coast rates hit a high of $2,855 per FEU before falling 4% to $2,753 per FEU on Wednesday — still more than 65% above rates in the past two years.

Demand in flux

“Volumes and capacity are still not at equilibrium, keeping rates up, with reports of some carriers even requesting premiums on top of these rates to prevent rolled shipments,” noted Buchman.

The COVID-19 crisis could push importers to bring even more cargo in quickly, he continued. “As infections rates, closures and restrictions grow in the U.S., these extreme freight rates may point to the urgency importers are feeling to ship as soon as possible, as the pandemic has made it impossible to know how long consumers will still be buying.”

On one hand, this could lead to more orders in the coming weeks. On the other hand, importer urgency could have already brought orders forward, implying demand weakness ahead.

U.K.-based consultancy MSI warned in a new report: “There is some need for caution, since the recent rebound in volumes is potentially being driven by one-off inventory restocking dynamics. There are signs that the U.S. economic recovery in particular is slowing,” it said. This raises the question of “how durable current volume rebounds will prove.”

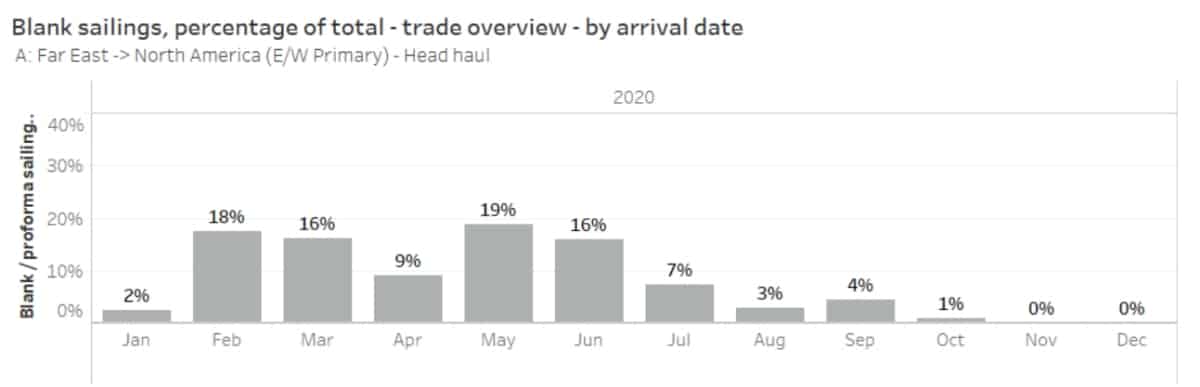

Blank-sailing data

Demand could be either positive or negative for rates. Given COVID-19, demand is a wildcard. Supply appears more one-sided, in favor of rates declining. An unprecedented amount of capacity was artificially removed from service by carriers to support rates in the wake of coronavirus-stricken demand declines. That capacity is now returning.

Carriers “blanked” (canceled) sailings to calibrate supply to demand. According to the data updated on Thursday from eeSea.com, carriers blanked 14.7% of their sailings from Asia to North America arriving in the second quarter, but have only blanked 4.7% of third-quarter arrivals.

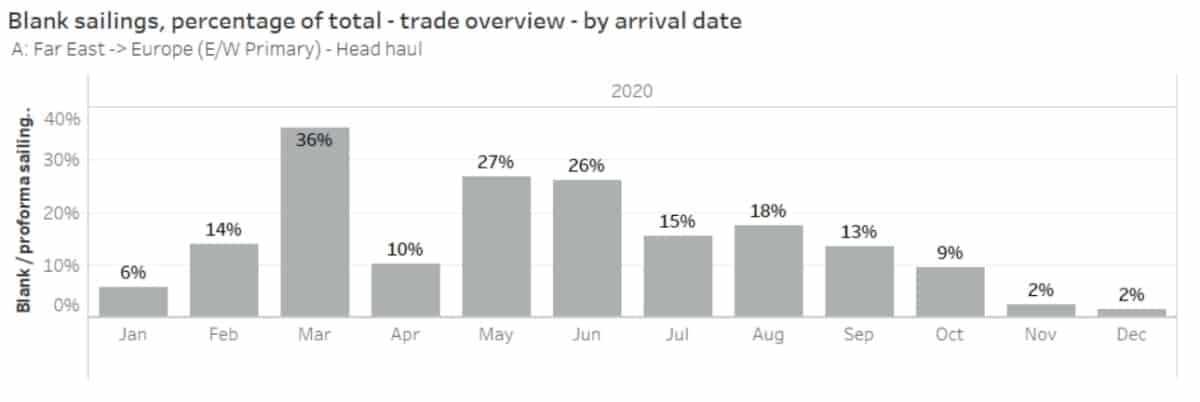

The data also shows that carriers are much more optimistic about North American consumer demand than European demand. In the second quarter, 21% of Asia-Europe sailings were blanked, with 15.3% blanked in the third.

This implies that carriers are as pessimistic about European imports in the current quarter as they were about U.S. imports in the previous quarter.

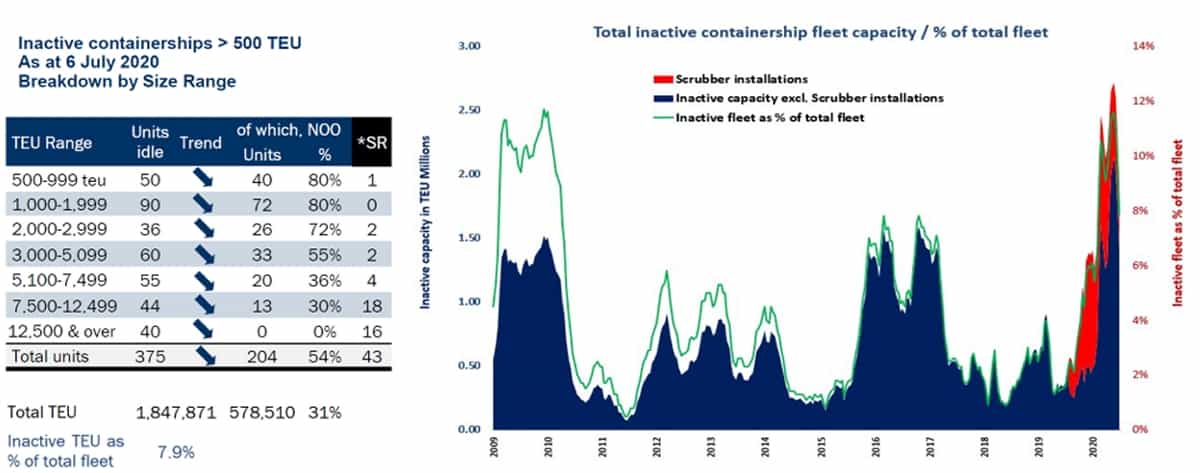

Inactive fleet on the decline

The fewer blank sailings, the fewer ships are idled. Data on idled ships tracked by Alphaliner is pointing to a major change.

Alphaliner reported that the inactive container-ship fleet fell to 1,847,871 twenty-foot equivalent units (TEUs) as of July 6, down 20% from the previous count in late June.

“The inactive fleet capacity level has dropped below the 2-million-TEU mark for the first time since mid-February, indicating improving market conditions,” said Alphaliner.

Charter rates rebounding

Carrier fleets are composed of owned tonnage and chartered vessels. This mix provides the flexibility to manage costs. Carriers renew fewer expiring charter contracts in weak markets. This increases the number of ships available for hire and decreases charter rates.

Those charter rates plunged in the wake of the coronavirus. Now, they’re coming back.

According to MSI, “Recent weeks have been encouraging, at least for mid-size and larger benchmarks, as a chartering spree has greatly reduced the number of spot units and placed upward pressure on time-charter earnings.”

Charter rates for 8,500-TEU ships are up to $18,000 per day from a low of $11,000 per day. “The specific driver was chartering by MSC [Mediterranean Shipping Co.], which fixed essentially the entire market in the space of a week,” reported MSI.

Will carrier willpower break down?

Ocean carriers have been surprisingly adept at averting a price war during the pandemic — so much so that the word “profiteering” has been voiced.

But the real test of carrier willpower will come when vessel supply returns to the market. In other words, now.

More services, fewer blanked sailings and more chartered-in ships equate to more container slots that need to be filled. If carriers don’t maintain price discipline, a mid-single-digit drop in spot rates could snowball into something more substantial.

As Simon Sundboell, founder of eeSea.com, previously told FreightWaves, “Now that things are starting to open back up, it’ll be interesting to see how well carriers manage not just the shutdown but the reopening. It’s way too early to claim that carriers have gotten the upper hand in the perpetual supply/demand-balance game.” Click for more FreightWaves/American Shipper articles by Greg Miller

MORE ON BLANK SAILINGS: For an in-depth Q&A on blank sailings with Sea-Intelligence CEO Alan Murphy, see story here. For extensive data on blank sailings from eeSea.com, see story here. For a comparison of second- and third-quarter blank sailings to U.S. ports, see story here.