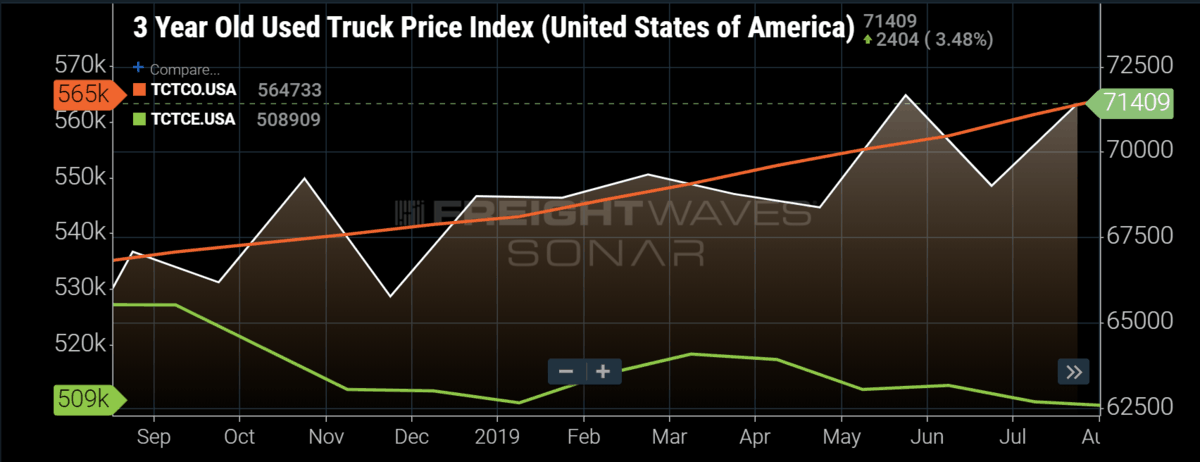

Chart of the Week: Tractor Count – 1-6 unit fleets, 1000+ unit fleets, Used Truck Prices – 3 year old (SONAR: TCTCO.USA, TCTCE.USA, UT3.USA)

According to the Federal Motor Carrier Association (FMCSA) data, carriers who operate smaller fleet sizes of one to six trucks continue to add power to their operation, with tractor counts growing 5% since last September. Over the same time, fleets who operate more than 1,000 units have decreased tractor count size by almost 3.5%. A byproduct of the sell-off has been continued increase in used truck prices for 3-year-old class 8 trucks, even as the freight market has softened from a year-over-year perspective.

The trend is somewhat unexpected as this year has been marred with increasing instances of trucking company failures due to lower volumes and an oversupplied market. Only recently in August, was there a sustained level of increased volumes, but the increasing tractor counts for smaller fleets have been steadily rising all year. Some of this is explainable in the way the smaller carrier has the least amount of visibility to the broader market due to dealing with only a few shippers at a time, but that is not the entire story.

FreightWaves Chief Insight Officer Dean Croke says, “Digitization and e-commerce has made it easier for smaller carriers to penetrate the market by giving them visibility via technology like mobile load board apps and increasing volumes of regional freight movements compared to longer haul over-the-road freight that is more difficult to manage and maintain utilization levels.”

Along with load boards like DAT and Truckstop.com, many larger brokers like CH Robinson and XPO offer apps that make it very simple for drivers to identify freight demand on their phone without having an existing relationship with a shipper. Freight that travels less than 250 miles is easier to manage in a small fleet as round trips can be completed in a day, reducing the need for large networks.

Many larger companies outside of Amazon such as The Home Depot have invested millions of dollars in their supply chain to make travel time from warehouse to end user shorter for faster online order completion. The demand for faster order fulfillment on just about all consumer goods has been expanding rapidly, which is changing the way freight is hauled.

The Shrinking Mid-haul

An upcoming release of a version of FreightWaves’ Outbound Tender Volume Index (OTVI) that divides the index into length of haul buckets, illustrates that volumes of loads travelling less than 100 miles (COTVI) are increasing much faster than other mileage bands over the past year. Interestingly, long-haul freight that travels over 800 miles is fighting for second place with loads travelling between 100 and 250 miles, leaving the 250 to 800-mile loads behind.

The result of a booming 2018 freight market has left an impression on many operators on the revenue potential of trucking. Owner operators and small fleet owners are taking advantage of last year’s profits by expanding their fleets by purchasing some of the more recent model year equipment while the large carriers are selling.

Record numbers of class 8 orders in 2018 lead to a slew of new truck deliveries in 2019. With large carriers replacing older equipment as well as contracting their fleets, it would seem to be a good time to purchase as the market turns bearish. This is truer for the four and five-year-old models whose prices have moderated since peaking in May, growing 3.8% and 2.7% respectively YoY. Three-year model prices have grown a much more robust 14.2% over the past twelve months.

It will be interesting to see if the trend of small fleet growth continues into 2020. Freight volumes have picked up, but more locally than long distance. Less-than-truckload (LTL) carriers specialize in local freight movements due to having a large portion of their fleet dedicated to local pickup and delivery runs. They will also benefit greatly from the shrinking load distances as they are more price competitive in that range.