The highlights from Wednesday’s SONAR reports. For more information on SONAR — the fastest freight-forecasting platform in the industry — or to request a demo, click here. Also, be sure to check out the latest SONAR update, TRAC — the freshest spot rate data in the industry.

Lanes to watch

By Zach Strickland, director, Freight Market Intelligence

CHICAGO to ELIZABETH (New Jersey)

Overview: Dry van spot rates decline as long-haul carriers become more willing to head to Elizabeth.

Highlights

- The dry van spot rate in the lane is $3.91/mile with $4.16/mile and $3.68/mile representing rates in the 67th and 33rd percentiles, respectively, as shown in the SONAR Market Dashboard application. Last week, the holiday pushed rates above $4.30/mile. Those spot rates include fuel surcharges.

- Dry van carriers are rejecting 18.3% of loads in the lane, compared to a 14.5% dry van tender rejection rate for all dry van long-haul inbound Elizabeth loads.

- The intermodal spot rate is $3.37/mile, including fuel surcharges, which places intermodal 14% below the most recent spot rate shown in SONAR Market Dashboard.

What does this mean for you?

Brokers: Use SONAR Market Dashboard to view the rates that brokers are paying for capacity on similar loads and look to keep your buy rates below the $3.91 average for dry van loads in the same lane. When negotiating with carriers, stress that it will be easy to get reloaded in Elizabeth.

Carriers: Elizabeth has an outbound tender rejection rate of 16.52%, which indicates the market is tight despite that tender rejection rate being 266 basis points below the national dry van tender rejection rate. The Elizabeth Van Headhaul Index of 53 suggests that Elizabeth is an attractive destination for carriers since, in that market, outbound van demand far exceeds inbound van demand.

Shippers: In light of the 14% spread between dry van and intermodal spot rates, shippers moving less time-sensitive loads may want to consider rail intermodal. Recent anecdotes indicate that the worst may be over for the railway congestion issues.

PHOENIX to CHICAGO

Overview: Capacity is likely to get tighter in the days ahead as rejections rise 281 bps week-over-week and the Headhaul Index climbs 33% w/w.

Highlights

- Phoenix outbound tender volumes are down 22% w/w, but that is primarily because of the Thanksgiving holiday.

- The Headhaul Index in Phoenix is up 33% w/w, signaling that capacity is likely to tighten in the days ahead.

- Phoenix outbound tender rejections are up 281 bps w/w, signaling that capacity is likely already tightening from the growing volume imbalance.

What does this mean for you?

Brokers: With outbound tender rejections up 281 bps w/w, if outbound volumes (down 22% w/w) surge higher in the days ahead, then you are likely to see significant upward pressure on rates if outbound rejections move higher. West coast import volumes are likely to remain elevated through the end of the year, so be sure to make your team aware that your Phoenix lanes could be tightening further in the coming days.

Carriers: Phoenix pricing power is likely to shift even further into your favor, so stay firm on your rates. The large surge of over 33% in the Headhaul Index, along with a 281 bps increase in outbound tender rejections, is signaling that capacity is likely to tighten significantly in the days ahead.

Shippers: Your shipper cohorts in Phoenix are currently averaging 2.8 days in tender lead times (down slightly from 2.9 days). If the Headhaul Index continues to increase alongside outbound tender rejections, it would be wise to push your lead times to between 3.5 and 4 days to ensure that you are able to continue sourcing capacity adequately if the Phoenix market continues to tighten.

ATLANTA to HARRISBURG (Pennsylvania)

Overview: Atlanta rejection rates move higher; contrary to national trend.

Highlights

- Atlanta’s outbound tender rejection rate has climbed slightly heading out of the holiday break, contrary to national trend.

- Rejection rates to Harrisburg also increased and continue to be among the highest of the large lanes out of Atlanta, hitting 24% on Monday.

- Harrisburg’s outbound rejection rate has been flat over the past month, hovering right around 21%.

What does this mean for you?

Brokers: Expect relatively flat rates in this lane, though some upward pressure may be present from a week-over-week perspective. National capacity is showing signs of easing at the moment as some demand side pressure wanes. This lane is not seeing the same conditions.

Carriers: Expect consistent volume in this lane with some slight tightening over last week. There has been little change in Harrisburg’s conditions over the past month, but loads moving less than 250 miles continue to grow and long haul volumes decline. That being said, loads moving into the Northeast continue to bring premiums.

Shippers: Expect slightly lower compliance this week. Keep lead times as high as possible in lanes like this one moving into the Northeast. It is becoming increasingly difficult for carriers to reposition out of the Northeast. Even as national capacity is easing, carriers will have some resistance to moving in this direction.

Watch: Shipper Update

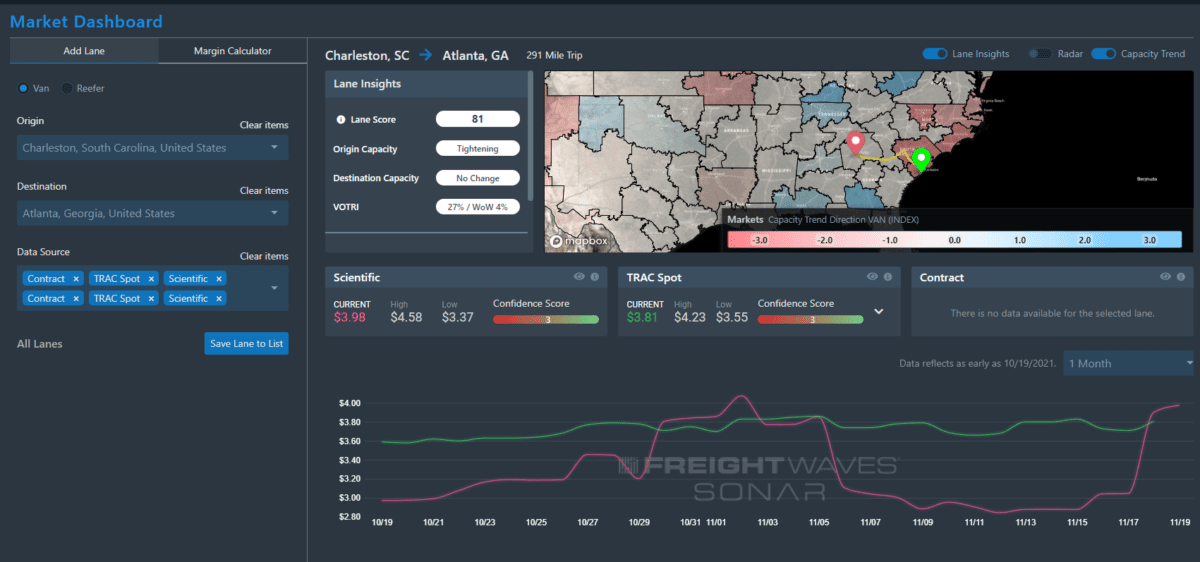

Focus on … Charleston to Atlanta lane

By Richard Daigle, SONAR account executive

The Charleston to Atlanta lane has been volatile and most recently, has significantly tightened.

TRAC Market Dashboard shows spot rates the majority of spot rates for dry van ranging from $4.23 to $3.55, inclusive of fuel.

The underlying market conditions have tightened significantly over the past few days, putting a lot of upward pressure on these rates.

The Lane Score is currently 81, signalling that capacity is tight. Tender rejections are at 27% on this lane, and that is up 4% week over week.

Expect spot rates to trend towards the higher end of the range shown in the TRAC Dashboard below.

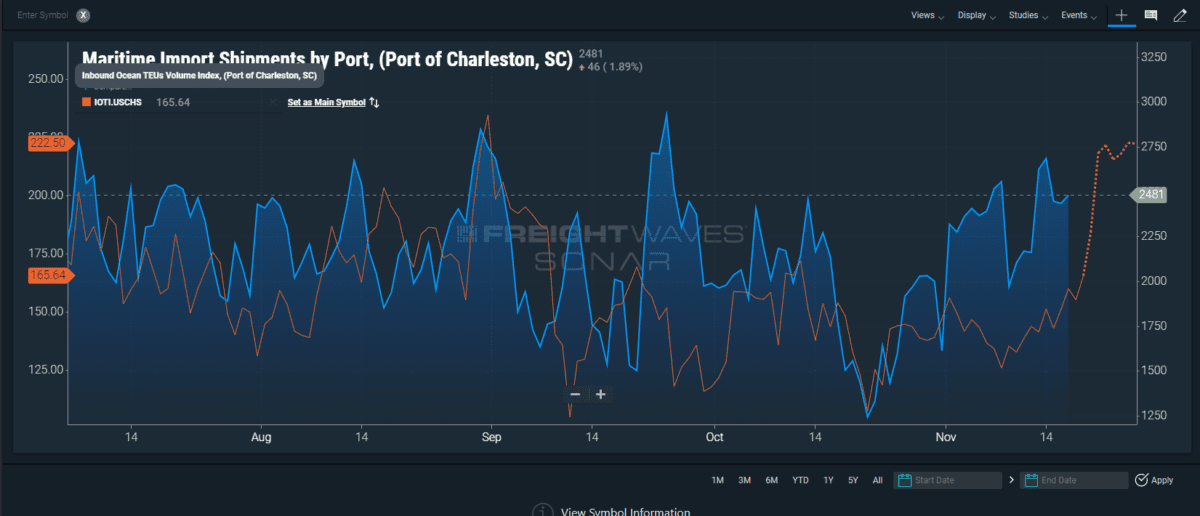

Looking forward, we see that there is a significant amount of import volume scheduled for the port of Charleston over the next month or so.

Look for capacity to remain tight as import fueled demand remains high.

Watch: Carrier Update

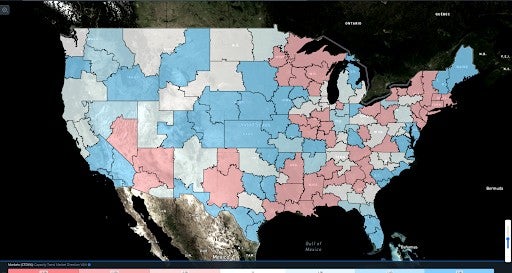

Capacity trend market direction van: 4-week map

By Zach Strickland

The Capacity Trend Market Direction map shows many areas in the eastern half of the country are showing some movement towards tightening.

This is being counterbalanced by a near equal number of markets showing capacity is easing, the most notable of which is the nation’s largest market of Ontario.

The capacity trend direction score is derived from a mix of tender data variables that measure load balance and rejection rates for each market.

The 4-week direction index is the most sensitive to capacity changes and is measured on a scale of -3 (fastest tightening) to 3 (fastest loosening).

Nearly all of the loosening markets show values of 3 while most of the tightening markets are -2, indicating easing is occurring at a faster pace than tightening throughout the U.S.

Elaine

[ JOIN US ] I get paid more than $30 to $87 per hour for working online. I heard about this job 3 months ago and after joining this I have earned easily $10k from this without having online working skills . Simply give it a shot on the accompanying site…

copy and open this site .…………>> http://Www.NETCASH1.Com