The highlights from Monday’s SONAR reports. For more information on SONAR — the fastest freight-forecasting platform in the industry — or to request a demo, click here. Also, be sure to check out the latest SONAR update, TRAC — the freshest spot rate data in the industry.

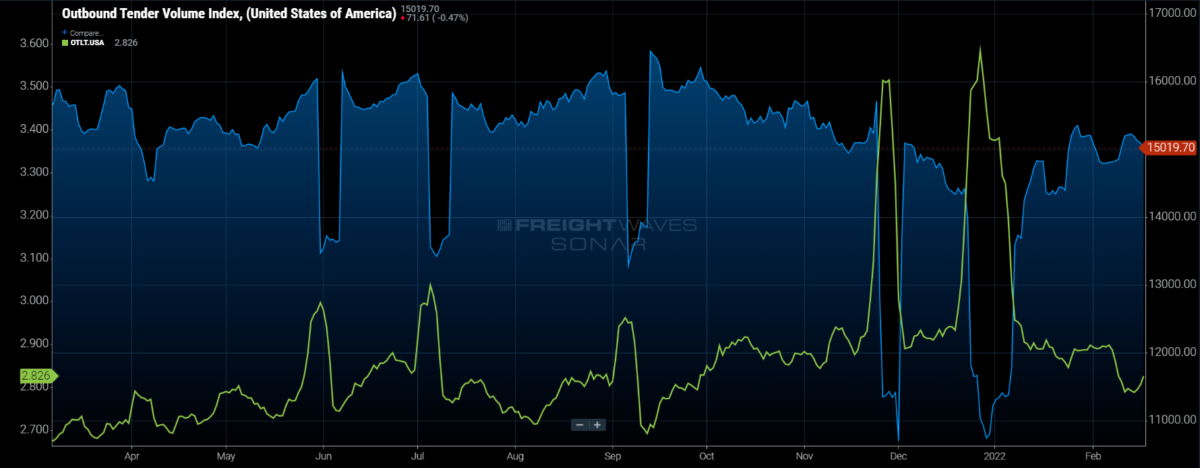

Shipping demand remained strong last week; the national Outbound Tender Volume Index remained above 15,000 and kept in line with the recent upward trend. Tender lead times dipped, however, indicating some increasing sense of urgency or a lack of concern around obtaining capacity.

There was some recovery in demand in the Midwest as the region was able to have a week without significant weather disruption, at least until the end.

There is little evidence of a slowdown in freight flow with spring quickly approaching. Compliance rates have improved over the past few weeks but are still at levels that will keep spot rates elevated.

Shippers should not lower their guard even with some of these marginal improvements in the market. Keep lead times elevated and stay in contact with your carriers because the market is prone to rapid changes this time of the year due to weather or demand surges.

Be aware of a potential weather disruption late this week in the upper Midwest and Northeast.

Watch: How Shippers Can Leverage Easing Capacity

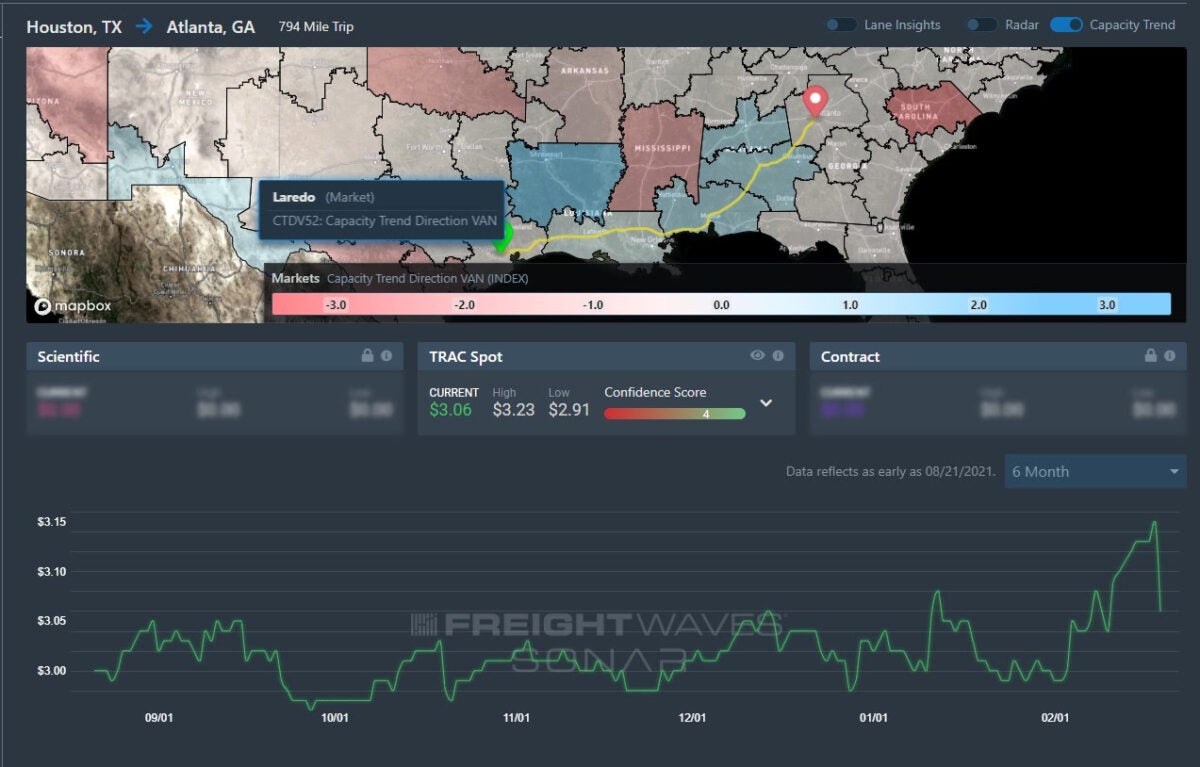

Lane to watch: Houston to Atlanta

Overview: Spot rates decrease 3% amid rising outbound tender rejections.

Highlights:

- FreightWaves TRAC spot rates saw a notable decrease from Q1 highs of $3.15 per mile to $3.06 per mile, a decrease of around 3%.

- Outbound tender rejections rose in the Houston market from 12.05% on February 10 to 15.21% on February 20, while volume rates continue to hover around 310 to 330 basis points (bps).

- Outbound tender rejections fell in Atlanta to 6-month lows of 13.33%, an indication of greater capacity entering the market.

What does this mean for you?

Brokers: Recent rate volatility from Houston to Atlanta indicates a loosening of capacity in both markets. Continue to develop detailed routing guides as you focus on pushing down rates. The lowered tender rejection rate in Atlanta might indicate a softening for outbound rates. Focus on increasing margins going inbound to Atlanta.

Carriers: Rate volatility continues to impact both the Atlanta and Houston markets. With the recent drop in spot rates relative to a slight increase in outbound tender rejections, continue to focus on tender compliance first, then evaluate if ad hoc spot market opportunities become available.

Shippers: The downward trend in Atlanta outbound rates might present a challenge from the Houston market. While outbound spot rates have fallen, the record low tender rejection rate in Atlanta may add to continued spot market volatility. Focus on increasing outbound tender lead times to increase savings.

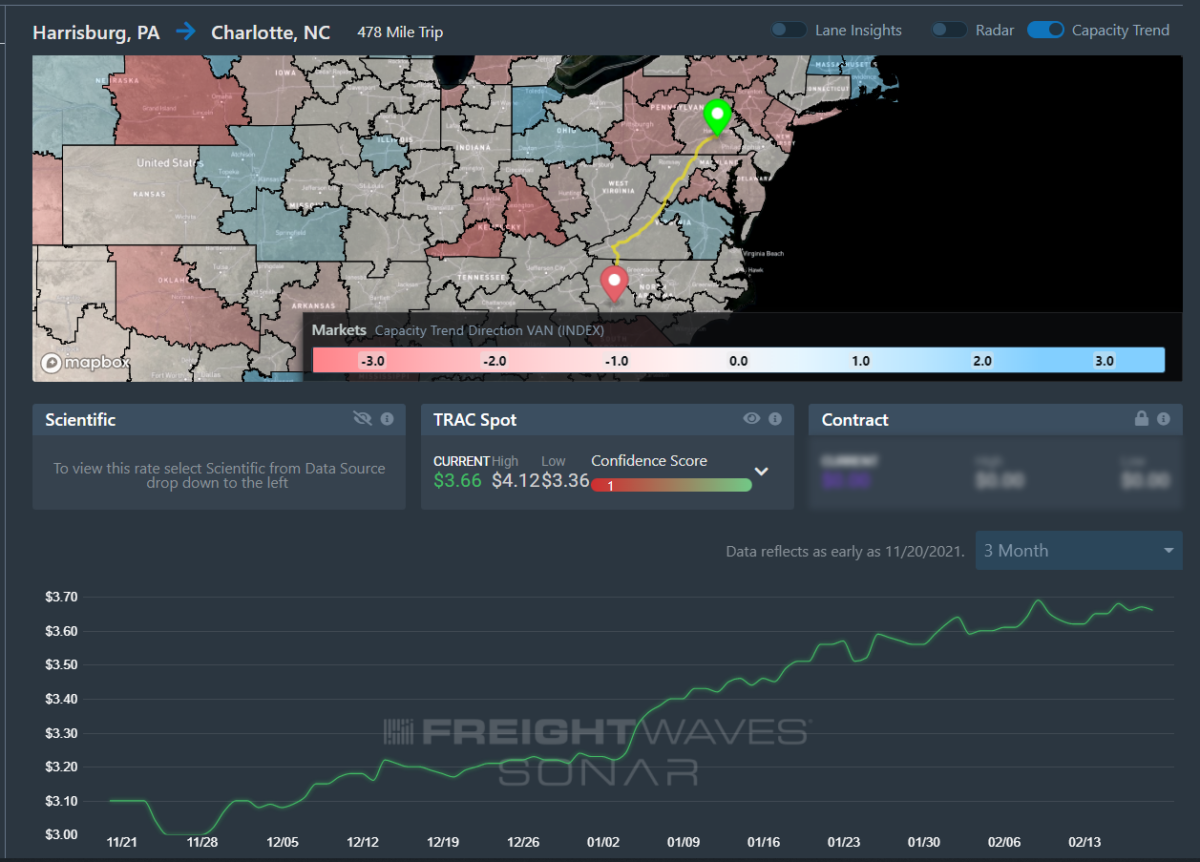

Lane to watch: Harrisburg (Pa.) to Charlotte (N.C.)

Overview: Harrisburg rejection rates are back on the rise.

Highlights:

- FreightWaves TRAC spot rates from Harrisburg to Charlotte continue to trend higher but with a wide range. One-third of the rates are between $3.36 and $4.12 per mile.

- Harrisburg’s outbound tender rejection rate has been trending higher since early December, rising from 19% to 24%.

- Charlotte’s outbound rejection rate has been trending lower since the start of the year, falling from 27.5% to 18.5%.

What does this mean for you?

Brokers: Continue to prioritize outbound Northeastern loads, even in the more favorable lanes moving south. Spot rates should be flat to slightly higher this week in this lane with Charlotte continuing to be a well-supplied destination that is not as favorable to carriers.

Carriers: Divert more capacity to the spot market in this lane. Contract rates may be more difficult to increase and maintain in the long run and spot rates are very lucrative, even for loads moving south.

Shippers: Watch for continuing disruption in capacity out of the Northeast. Carriers are still prioritizing other regions of the U.S. as outbound demand is growing disproportionately in the main outbound centers. Look for regional carriers to supplement where the national carriers may be falling short.

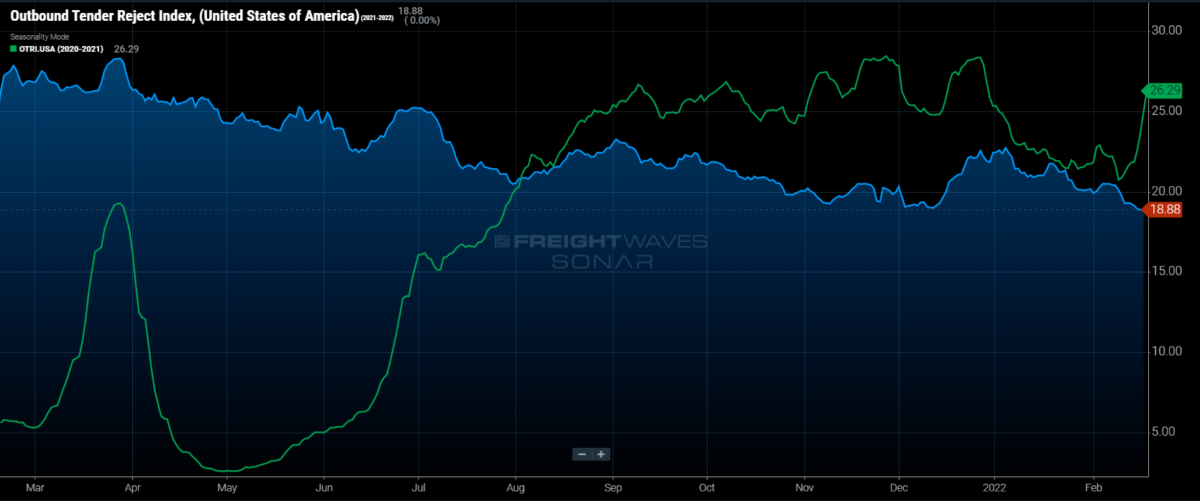

National rejection rates continued to slide below 19% last week, hitting their lowest point in two months. This improvement is incremental in the near-term, but does suggest capacity conditions are improving in the long run.

Contract compliance has come at a high cost, however, with contract rates increasing 25% over the past year according to FreightWaves invoice data, which indicates we are still a long way from supply meeting demand.

This past week was the anniversary of the winter storms that crippled Texas and sent shockwaves through the freight market, pushing rejection rates back to record levels. Fortunately there was nothing like that last week.

Though February tends to be a slower month, demand and relatively low inventory levels will keep pressure on capacity for a while; however, slow improvement appears to be the trend. We will be constantly on the outlook for any changes to this pattern into March as spring tends to increase shippers’ sense of urgency.

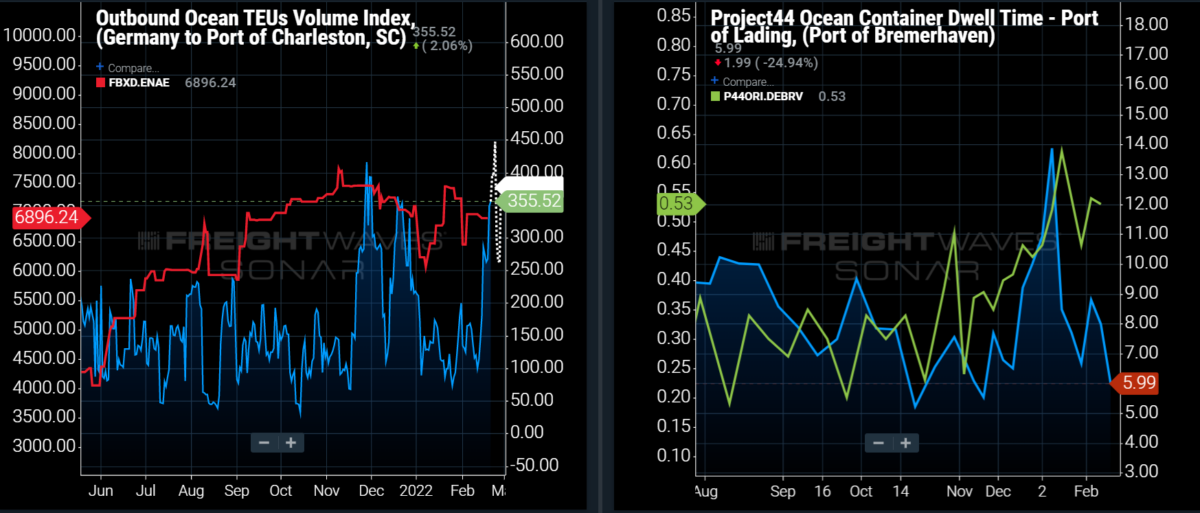

Ocean lane to watch: Bremerhaven (Germany) to Charleston (S.C.)

Overview: The recent surge in outbound container volumes is causing capacity to tighten, putting upward pressure on spot rates.

Highlights:

- Outbound twenty-foot equivalent unit (TEU) volumes from Bremerhaven to Charleston are up 263% week-over-week (w/w), as well as 211% month-over-month (m/m).

- Ocean container dwell times in Bremerhaven (as a Port of Lading) were at record highs (14 days) a month ago, but have decreased to 6 days as of last week.

- For containers transshipping at the Port of Bremerhaven, 53% are being rolled from their intended vessel schedule to the next available vessel schedule, an indication that capacity has tightened significantly.

What does this mean for you?

Brokers: If you are currently moving ocean container freight from Germany to the Port of Charleston, you need to prioritize this lane and book space as far out as possible. Currently, 53% of container volumes transshipping in Bremerhaven are being rolled to the next available vessel, indicating that capacity is likely tightening as volumes surge 263% w/w and 211% m/m. This is putting significant upward pressure on spot rates for this lane.

Carriers: The pricing power on this lane is shifting further in your favor with the recent surge of TEU volumes on a w/w and m/m basis to the Port of Charleston. For the next 7 days, TEU volumes are expected to move even higher and put even more upward pressure on spot rates. This would be a good opportunity to increase your spot rates for at least the next week to two weeks on this lane.

Shippers: It would be wise to try and shift your booking lead times out by 7 to 14 days further than you normally place bookings on this lane. With the recent increases in ocean containers being rolled when transshipping via Bremerhaven, the risk of your containers rolling when using Bremerhaven as a Port of Lading is increasing as well. With capacity tightening and volumes surging, you are highly likely to see spot rates move higher.

japege7054

Start making cash right now… Get more time with your family by doing jobs that only require for you to have a computer and an internet access and you can have that at your home. Start bringing up to $8012 a month. I’ve started this job and I’ve never been happier and now I am sharing it with you, so you can try it too. You can check it out here.

==>=>) https://www.fuljobz.com