The highlights from Friday’s SONAR reports. For more information on SONAR — the fastest freight-forecasting platform in the industry — or to request a demo, click here. Also, be sure to check out the latest SONAR update, TRAC — the freshest spot rate data in the industry.

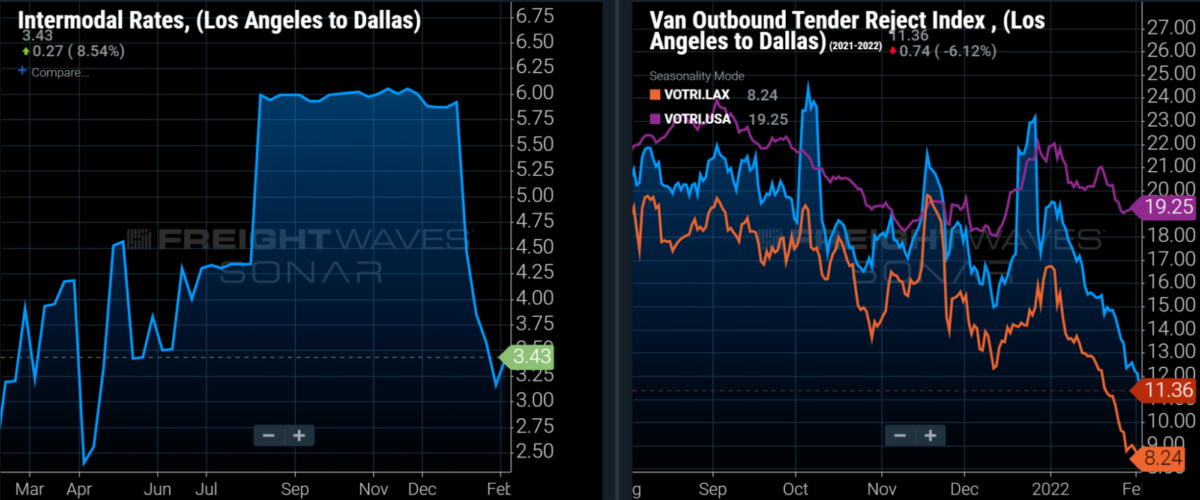

Lane to watch: Los Angeles to Dallas

Overview: Door-to-door intermodal spot rates are only 5% below dry van spot rates.

Highlights:

- In the past week, the intermodal spot rate to move 53-foot containers door-to-door increased 8.5% to $3.43/mile, including fuel. That was the first increase in that data series following a sharp decline during the previous weeks.

- SONAR Market Dashboard shows a dry van spot rate in the lane of $3.61/mile, including fuel, down from $4.01/mile at the beginning of the year.

- Dry van carriers are rejecting 11.4% of tenders in the lane, which is in between the LA outbound van tender rejection rate (8.2%) and the Dallas inbound tender rejection rate (16.3%).

What does this mean for you?

Brokers: Lower your bids in the lane to reflect the sharp decline in rates that other brokers are paying for capacity. When negotiating with carriers, cite Dallas’ Van Headhaul Index of 79, which suggests that it should be easy for dry van carriers to get reloaded in Dallas because outbound freight demand greatly exceeds inbound freight demand.

Carriers: Road conditions in Dallas should be clear long before carriers near their destination, so carriers should not be too worried about Thursday’s winter storm in Dallas. What might concern carriers more is that the Dallas market is not as tight as most freight markets currently; its van outbound tender rejection rate is 13.6% compared to 19.3% for the U.S. as a whole.

Shippers: The 5% spread between intermodal and dry van spot rates is likely not enough to warrant spot shippers using rail intermodal. When sourcing dry van capacity, keep lead times extended past the 2.7-day average lead time for inbound Dallas loads. Some carriers may be reluctant to head to a freight market that is not as tight as most.

Watch: Carrier Update

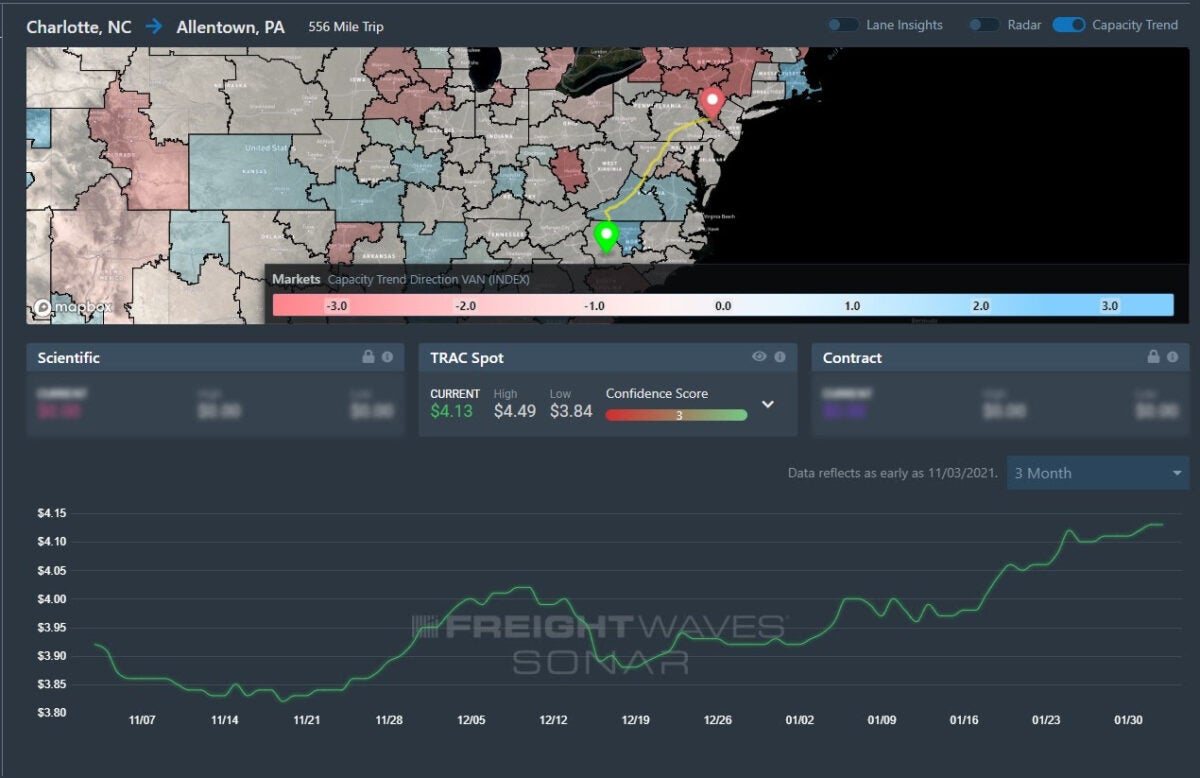

Lane to watch: Charlotte (N.C.) to Allentown (Pa.)

Overview: Outbound tender rejections decline as spot rates continue to rise.

Highlights:

- Spot rates from Charlotte to Allentown increased 5% – from $3.93 per mile on Jan. 1, to $4.13 per mile now.

- Charlotte outbound tender rejections remain volatile. They are currently at 17.03%, compared to a seasonal high of 27% at the beginning of 2022.

- Outbound tender rejections from Allentown currently stand at 21.72%, indicating continued disruption from winter weather events and a lack of capacity.

What does this mean for you?

Brokers: Volatility in the Charlotte market can present an opportunity to increase margins as tender rejection volumes trend downward but spot rates remain high. Recent weather systems have caused capacity disruptions moving into the Northeast. Continue to develop a routing guide of carriers for this lane to seize the opportunity for extra awards once the weather improves.

Carriers: Charlotte outbound tender rejections currently are oscillating 10% but appear to be trending downward as outbound tender volumes have fluctuated – they stood at 158.04 bps during the holiday and are currently 236.01 bps. The volume levels appear to be impacting rejection rates, so focus on service amid weather disruptions and seize the opportunity for greater rates if ad hoc options are available due to seasonally high spot rates.

Shippers: Declining outbound tender rejections represent an opportunity to hammer on service and tender level compliance. Because of the repeated winter weather systems that are affecting the Northeast, increase tender lead times to avoid higher rejection rates and possible increased costs if your load goes to the spot market.

Watch: Shipper Update

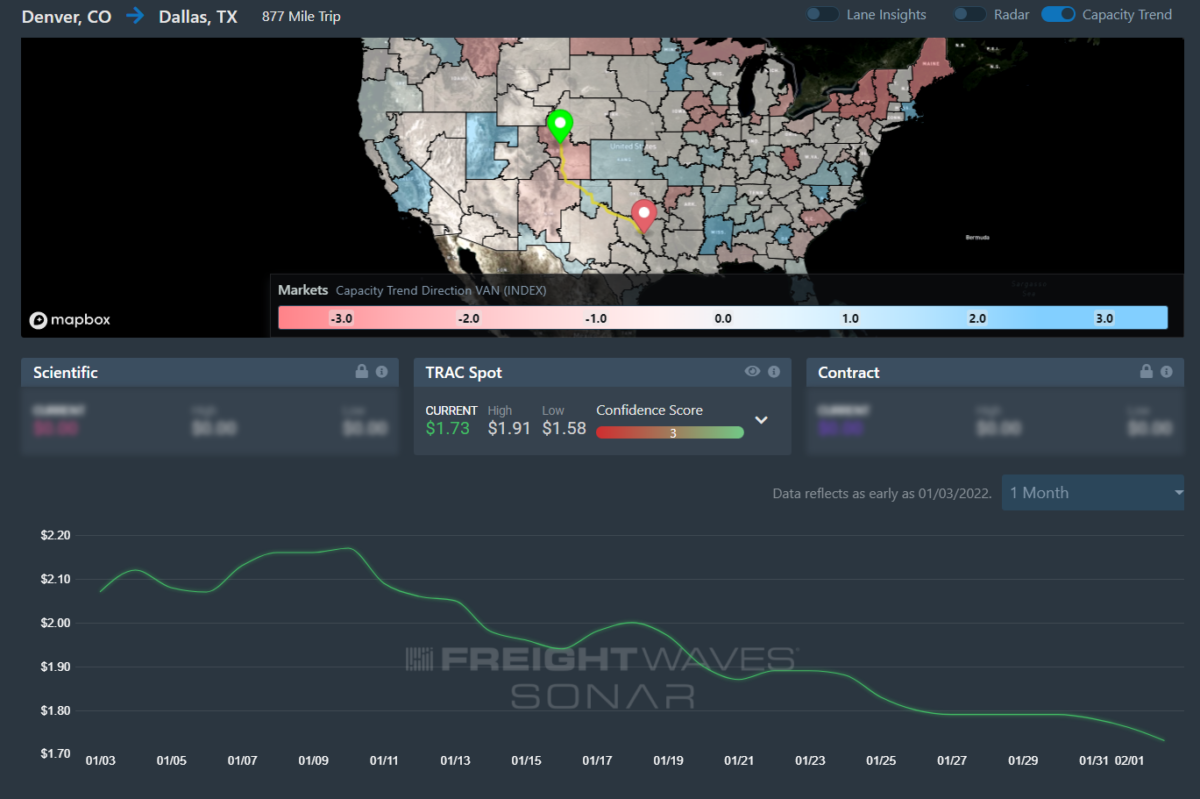

Lane to watch: Denver to Dallas

Overview: Capacity is likely to tighten as the Headhaul Index surges 43% w/w.

Highlights:

- Denver outbound tender volumes are up 7% w/w, signaling that demand for capacity is increasing and will likely put upward pressure on spot rates.

- The Headhaul Index in Denver is up 47% w/w, signaling that capacity is likely to tighten as Denver becomes increasingly imbalanced between outbound and inbound volumes.

- Denver outbound tender rejections are up 193 bps w/w, signaling that capacity has likely already been tightening over the past week.

What does this mean for you?

Brokers: Outbound tender rejections in Denver are up 193 bps w/w, and that trend is likely to continue as outbound volumes rose 7% w/w in addition to a 47% increase in the Headhaul Index. With a growing imbalance between inbound and outbound volumes, expect capacity to get tighter and put greater upward pressure on spot rates.

Carriers: The pricing power is very likely to shift further in your favor on outbound Denver lanes. With the Headhaul Index in Denver surging over 47% w/w (in addition to a 7% increase w/w in outbound volumes), Denver market conditions are signaling that there will be significant upward pressure on spot rates in the coming days.

Shippers: Your shipper cohorts in Denver have tender lead times at 3.2 days, so it would appear that they have already been experiencing tightening conditions. While these lead times may be above the national average, historically shippers have pushed lead times to between 3.5 and 4 days whenever market conditions are deteriorating. It would be wise to go ahead and set them in that range to help offset tightening conditions.