The highlights from Thursday’s SONAR reports. For more information on SONAR — the fastest freight-forecasting platform in the industry — or to request a demo, click here. Also, be sure to check out the latest SONAR update, TRAC — the freshest spot rate data in the industry.

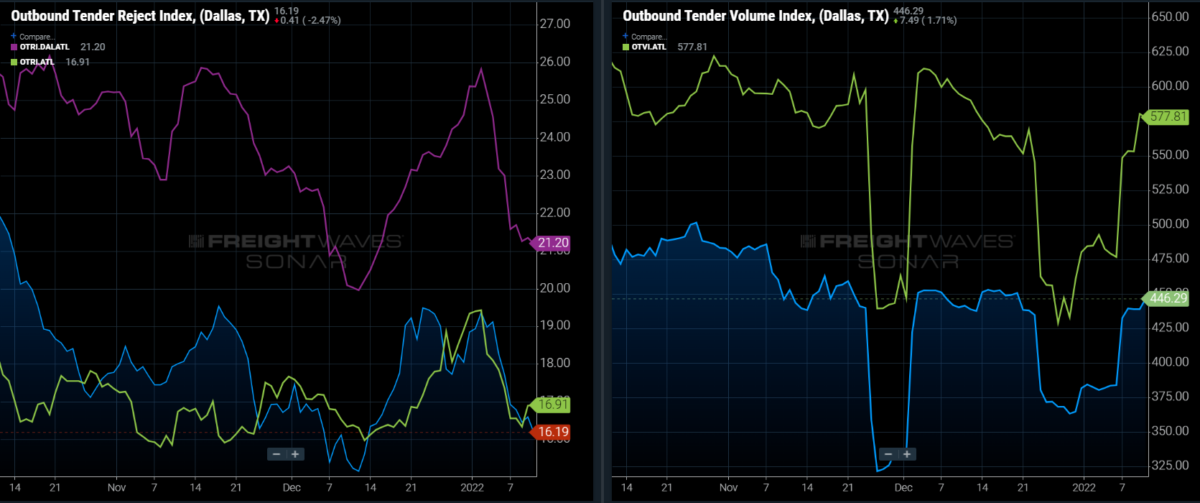

Lane to watch: Dallas to Atlanta

Overview: Dallas’ outbound demand keeps pressure on capacity.

Highlights:

- Dallas ‘ outbound rejection rate has dropped over 3 percentage points over the past week to 16.19%. Tender volumes continued to climb back to December levels.

- Rejection rates to Atlanta have declined from nearly 26% to 21% since January 2 with spot rates falling from $2.80 per mile on January 7 to $2.75 currently.

- Atlanta’s outbound rejection rate has dropped back to pre-Christmas values of around 16%. Tender volumes have already recovered to levels comparable to late October and mid-December.

What does this mean for you?

Brokers: Expect rates to be flat to slightly higher over the next week in this lane. Increasing demand will keep pressure on capacity and most of the w/w easing is due to drivers moving back into position after the holiday.

Carriers: Expect consistent demand in this lane as well as in the origin and destination markets. Spot activity will be lower than at the start of the month, but appears to be stabilizing for the moment.

Shippers: Expect the persistent demand to keep capacity from loosening significantly. Spot rates will be down compared to last week, but will not fall as they normally do this time of the year.

Watch: Shipper Update

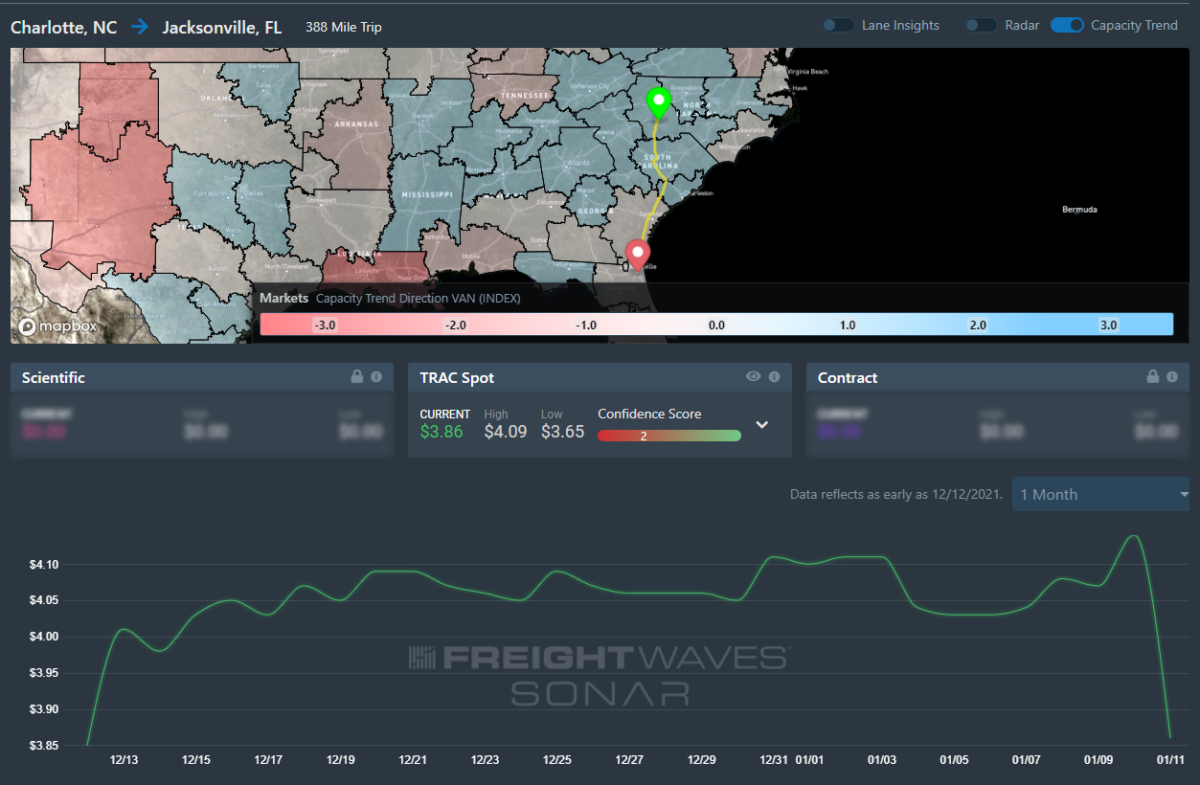

Lane to watch: Charlotte (N.C.) to Jacksonville (Fla.)

Overview: Rejection rates are down significantly from the beginning of the month in both markets.

Highlights:

- Charlotte’s outbound rejection rates have plummeted since the beginning of the year. Rejection rates in the market are at 18% after hitting 27% at the beginning of the year.

- Spot rates from Charlotte to Jacksonville have dropped 28 cents per mile over the last few days.

- Jacksonville outbound tender rejection rates followed Charlotte, plummeting so far in January(currently, rejection rates are at 23%).

What does this mean for you?

Brokers: Spot rates have plummeted in this market. Adjust your rates downward to ensure you can get the lanes covered. Expect lower rates to be consistent for the next few days.

Carriers: Volumes are up in Charlotte, but down in Jacksonville. Once a truck is in the Charlotte market getting out for a good rate shouldn’t be an issue.

Shippers: Volumes are up, rejections are down. It’s a good time to push any loads you have in this area into the market now. Rates will likely not hold this low for long.

Watch: #WithSONAR

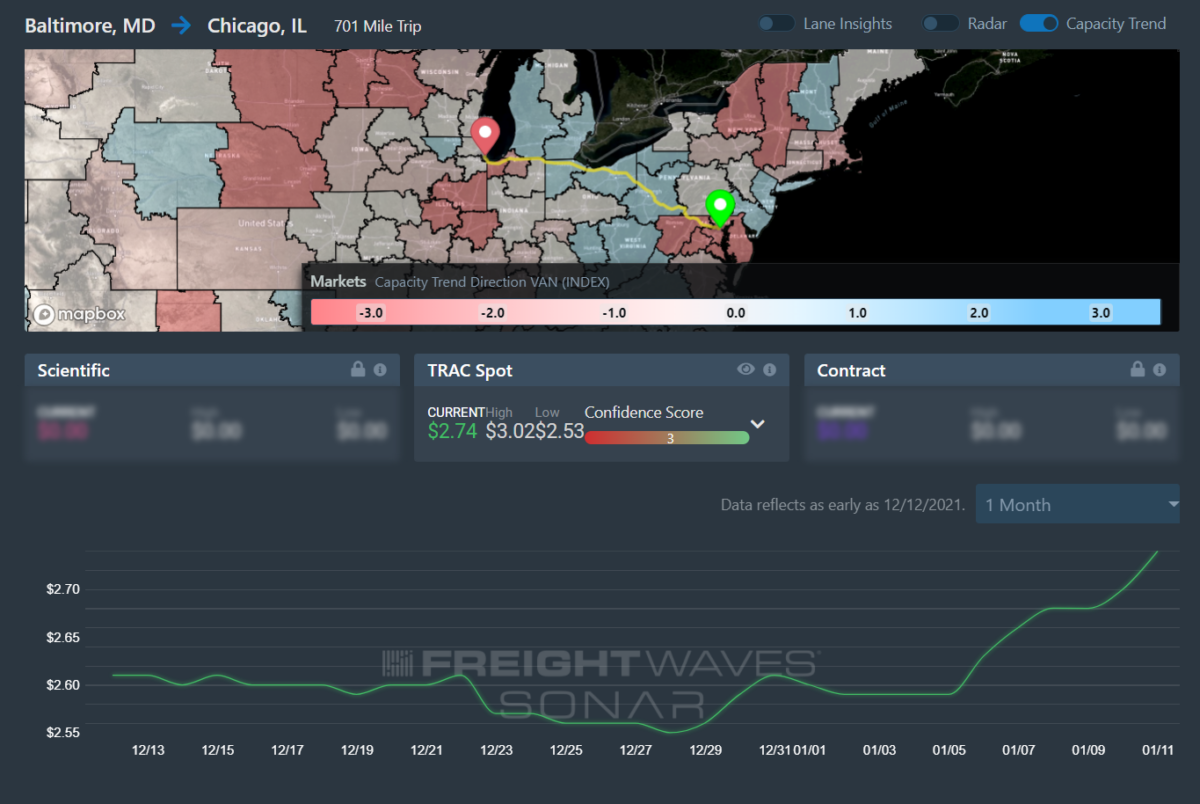

Lane to watch: Baltimore to Chicago

Overview: Spot rates are increasing; capacity is expected to get even tighter as outbound rejections rise 6.9% w/w.

What does this mean for you?

Brokers: The 10% w/w increase in the Headhaul Index is signaling that capacity is likely to get even tighter in the days ahead. With rejections already up 6.9% w/w, it is reasonable to expect that the Baltimore market will likely remain tight for at least the next month. Expect spot rates to continue increasing as a result.

Carriers: Stay firm on your rates coming out of Baltimore. With a 10% w/w increase in the Headhaul Index, and rejections already up 6.9% w/w, pricing power is likely to shift even further into your favor. FreightWaves TRAC spot rates are already showing a one-month high, and rates are expected to trend even higher in the days to come.

Shippers: Your shipper cohorts in the Baltimore market have outbound tender lead times averaging 2.3 days, but with outbound volumes on the rise, shippers will need to set these lead times closer to 3.5 to 4 days if possible. This will help ensure your carriers/brokers have adequate lead time to secure capacity while conditions tighten in the days ahead.

Highlights:

- Baltimore outbound tender volumes are up 45% w/w, signaling that demand for outbound capacity has increased significantly from last week.

- The Headhaul Index in Baltimore is up 10% w/w, signaling that there is a growing imbalance between inbound and outbound volumes.

- Baltimore outbound tender rejections are up 6.9% w/w, signaling that capacity has likely tightened w/w.

peyaxi

I get paid over $87 per hour working from home with 2 kids at home. I never thought I’d be able to do it but my best friend earns over 10k a month doing this and she convinced me to try. The potential with this is endless.

Here’s what I’ve been doing…► 𝗪𝘄𝘄.𝗝𝗼𝗯𝘀𝟳𝟬.𝗰𝗼𝗺

Susan Voigt

𝘾𝙝𝙖𝙣𝙜𝙚 𝙔𝙤𝙪𝙧 𝙇𝙞𝙛𝙚 𝙍𝙞𝙜𝙝𝙩 𝙉𝙤𝙬! 𝙒𝙤𝙧𝙠 𝙁𝙧𝙤𝙢 𝘾𝙤𝙢𝙛𝙤𝙧𝙩 𝙊𝙛 𝙔𝙤𝙪𝙧 𝙃𝙤𝙢𝙚 𝘼𝙣𝙙 𝙍𝙚𝙘𝙚𝙞𝙫𝙚 𝙔𝙤𝙪𝙧 𝙁𝙞𝙧𝙨𝙩 𝙋𝙖𝙮𝙘𝙝𝙚𝙘𝙠 𝙒𝙞𝙩𝙝𝙞𝙣 𝘼 𝙒𝙚𝙚𝙠. 𝙉𝙤 𝙀𝙭𝙥𝙚𝙧𝙞𝙚𝙣𝙘𝙚 𝙉𝙚𝙚𝙙𝙚𝙙, 𝙉𝙤 𝘽𝙤𝙨𝙨 𝙊𝙫𝙚𝙧 𝙔𝙤𝙪𝙧 𝙎𝙝𝙤𝙪𝙡𝙙𝙚𝙧. vcs… 𝙎𝙖𝙮 𝙂𝙤𝙤𝙙𝙗𝙮𝙚 𝙏𝙤 𝙔𝙤𝙪𝙧 𝙊𝙡𝙙 𝙅𝙤𝙗! 𝙇𝙞𝙢𝙞𝙩𝙚𝙙 𝙉𝙪𝙢𝙗𝙚𝙧 𝙊𝙛 𝙎𝙥𝙤𝙩𝙨 𝙊𝙥𝙚𝙣…

𝙁𝙞𝙣𝙙 𝙤𝙪𝙩 𝙝𝙤𝙬 𝙃𝙀𝙍𝙀…..> http://Www.NETCASH1.Com

Bernadette

I’ve made $84,000 so far this year working online and I’m a full time student. I’m using an online business opportunity I heard about and I’ve made such great money. It’s really user friendly and I’m just so happy that I found out about it. The potential with this is endless

Here’s what I do……………….. 𝐖𝐰𝐰.𝐒𝐞𝐥𝐟𝟐𝟓.𝐜𝐨𝐦