The highlights from Monday’s SONAR reports. For more information on SONAR — the fastest freight-forecasting platform in the industry — or to request a demo, click here. Also, be sure to check out the latest SONAR update, TRAC — the freshest spot rate data in the industry.

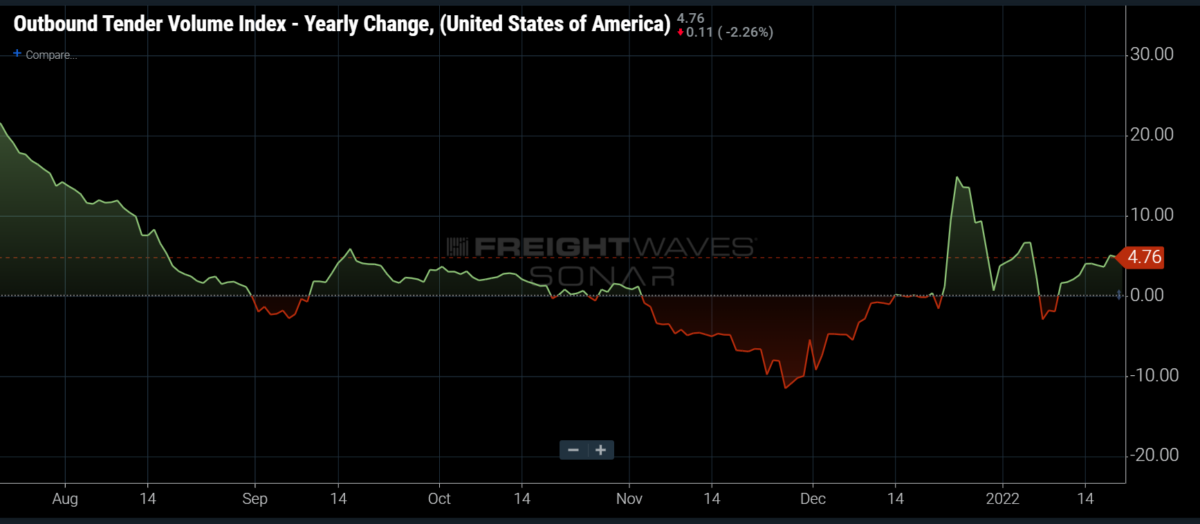

Truckload demand continues to outperform 2021 levels as the national Outbound Tender Volume Index (OTVI) averaged over 4% higher from a year-over-year (y/y) perspective last week.

Capacity is still a long way from being able to cover this level of transportation demand, so any annual increase will only extend or exacerbate the inflationary pricing environment.

The fact that January has had annual growth could be a result of shippers having been burned in 2021 by letting their feet off the gas too much as consumer demand accelerated unseasonably. This could mean shippers will be more prepared for the spring and less likely to see a surge.

Of course it could also mean shippers have found a new low end as transportation capacity is so uncertain.

Regardless, shippers will need to continue to expect tight conditions through the rest of the month, and be prepared for little relief before spring.

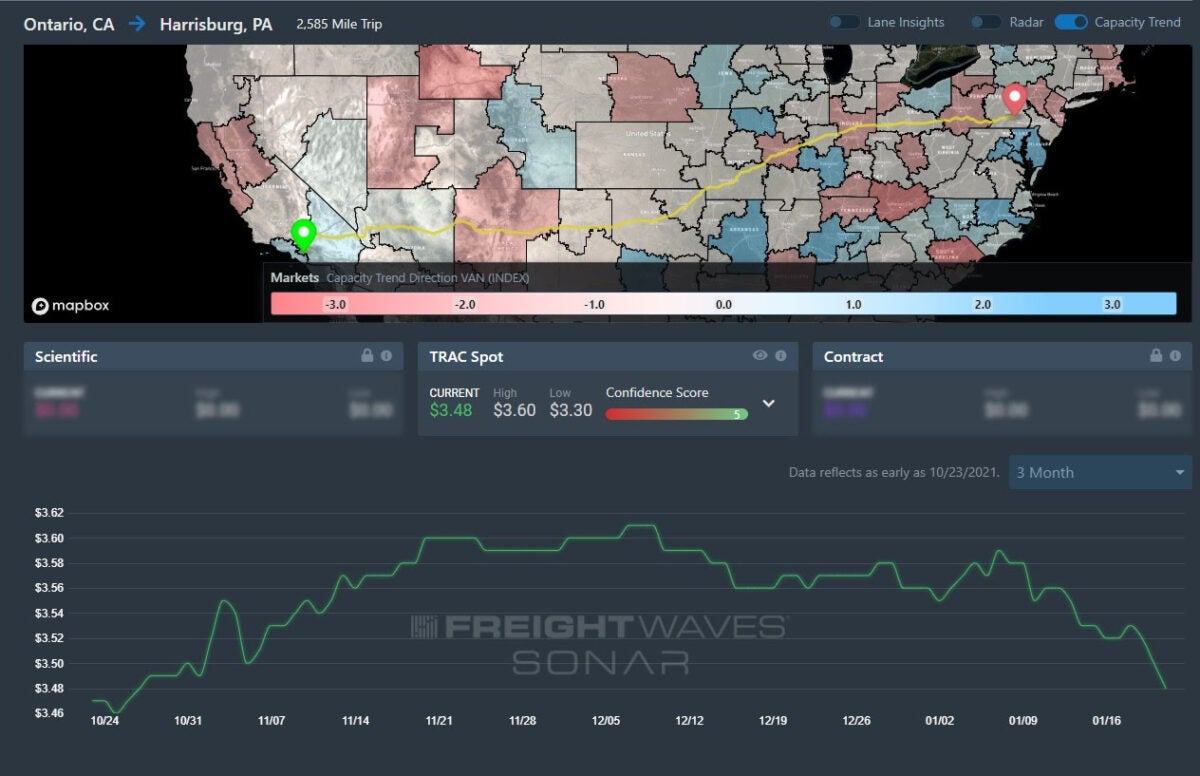

Lane to watch: Ontario (Calif.) to Harrisburg (Pa.)

Overview: Spot rates decline amid downward slide in tender rejections. Capacity continues to enter southern California.

Highlights:

- FreightWaves TRAC spot rates declined 12 cents (or 3%) to $3.48 per mile compared to $3.60 per mile at the beginning of December.

- Ontario to Harrisburg tender rejections declined 21% from their Christmas holiday highs of 24.5% to 19.17%.

- Ontario’s outbound tender rejections have declined 29% since the beginning of January, from 18.25% to 12.74%. This indicates that capacity pressures are easing.

What does this mean for you?

Brokers: The Ontario market appears to be loosening, giving an opportunity for greater margins if contracted lanes are priced appropriately. The steady decline in spot rates indicates a decline in carrier buying power. Brokers with extensive routing guides can take advantage of loosening rates to push down prices.

Carriers: With tender rejections declining in the Ontario market, expect greater attention to service and tender acceptance levels from shippers and brokers. Capacity remains tight and the backlog of ships waiting to offload at the ports of LA and Long Beach means this may represent a lull in activity until the port situation resolves.

Shippers: Expect to push for lower rates and higher tender acceptance as capacity enters the market. While carriers may still lack capacity for some lanes, there is an opportunity for cost savings if brokers are taking this opportunity to undercut each other to gain market share.

Watch: Carrier Update

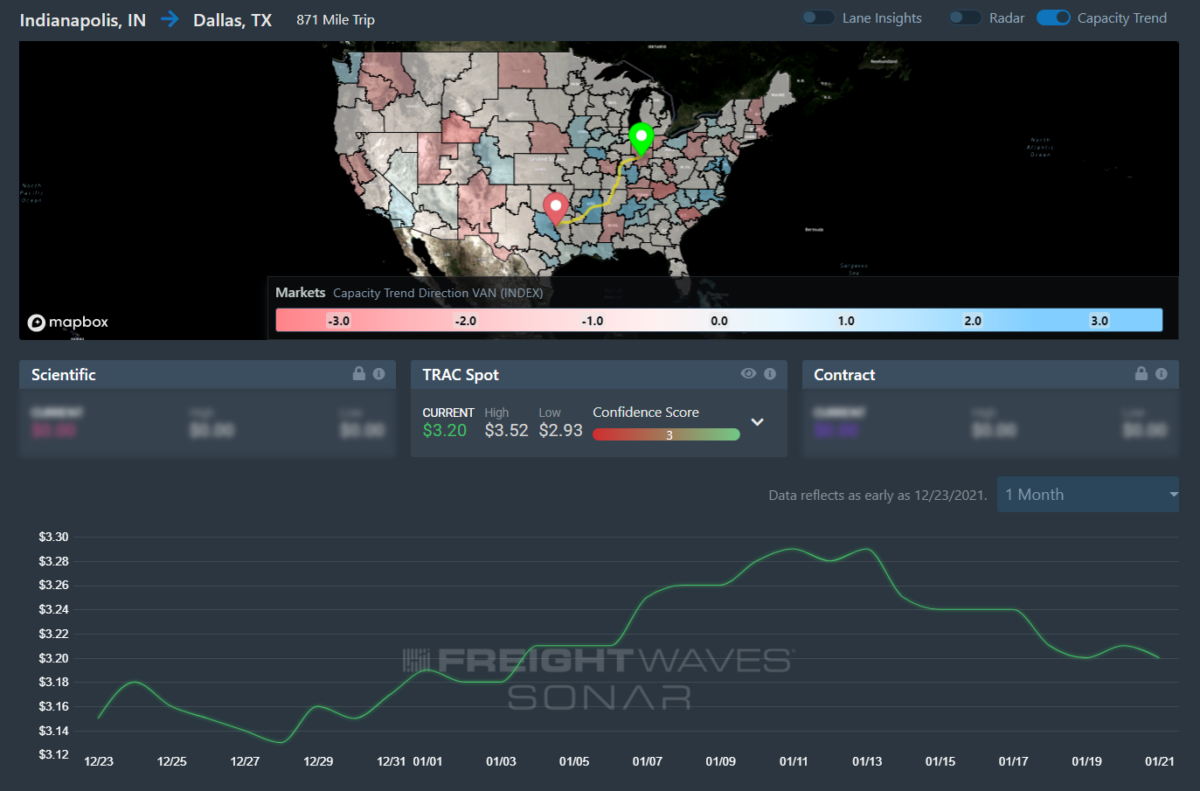

Lane to watch: Indianapolis to Dallas

Overview: Capacity is likely to tighten further as the Headhaul Index increases over 20% w/w.

Highlights:

- Indianapolis outbound tender volumes are up 5% w/w, signaling that demand for outbound capacity has increased over the last week.

- The Headhaul Index in Indianapolis is up 20% w/w, signaling capacity is likely to tighten from the growing imbalance between outbound and inbound volumes.

- Indianapolis outbound tender rejections are up 195 basis points (bps) w/w but are likely to move higher as a result of the large w/w increase in the Headhaul Index.

What does this mean for you?

Brokers: Take notice of the 20% increase in the Headhaul Index w/w, as well as the 195 bps increase in outbound tender rejections w/w. Even though outbound volumes are up 5% w/w, inbound volumes have actually dropped at a faster pace; thus, causing the major increase in the Headhaul Index w/w. With fewer trucks headed into the Indianapolis market, if outbound volumes level off, or reverse and head higher, capacity will likely tighten rapidly and put significant upward pressure on spot rates.

Carriers: Stay firm on your rates out of Indianapolis. The increase of over 20% in the Headhaul Index w/w, coupled with the 195 bps increase in outbound tender rejections, is likely to cause greater upward pressure on spot rates. Outbound volumes are up 5% w/w, and we expect them to increase further for at least the next week to two weeks. Keep a close eye on outbound tender rejections, and if they rise higher in the coming days, adjust your pricing higher to capitalize on tightening conditions.

Shippers: Your shipper cohorts in Indianapolis have increased tender lead times to 2.9 days on average. This is a strong increase w/w, and is a key signal that shippers are feeling capacity tighten. Historically, shippers have lead times between 3.5 and 4 days during periods of extremely tight capacity, so it would be wise to go ahead and adjust your lead times to prepare for capacity to tighten further.

Watch: Shipper Update

Lane to watch: Allentown (Pa.) to Indianapolis

Overview: The increase in Allentown’s rejection rate has moderated.

Highlights:

- Allentown’s outbound rejection rate increased from 19% to 24% before easing slightly to just under 23%.

- Lane-specific rejection rates to Indianapolis have moved similarly but at a much higher level, keeping pressure on spot rates. Spot rates have increased 18 cents per mile to $2.95 over the past two weeks according to FreightWaves TRAC.

- Indianapolis’ outbound rejection rates have been trending higher since the start of the year, moving above the national average.

What does this mean for you?

Brokers: Expect continued upward pressure on rates, but with some deceleration. A tightening Indianapolis market and favorable direction should help mitigate any future increase, which is bound to reverse course.

Carriers: Now is the time to target customers in the Northeast as capacity continues to be tighter than normal in this region. This lane will have more activity than normal, so look to the spot market if you are inbound and in need of a load to exit the area.

Shippers: Expect compliance issues if your contract rates are too far below the current spot rate that is nearing $3 per mile. Be prepared to pay for service if something needs to ship with urgency.