The highlights from Tuesday’s SONAR reports. For more information on SONAR — the fastest freight-forecasting platform in the industry — or to request a demo, click here. Also, be sure to check out the latest SONAR update, TRAC — the freshest spot rate data in the industry.

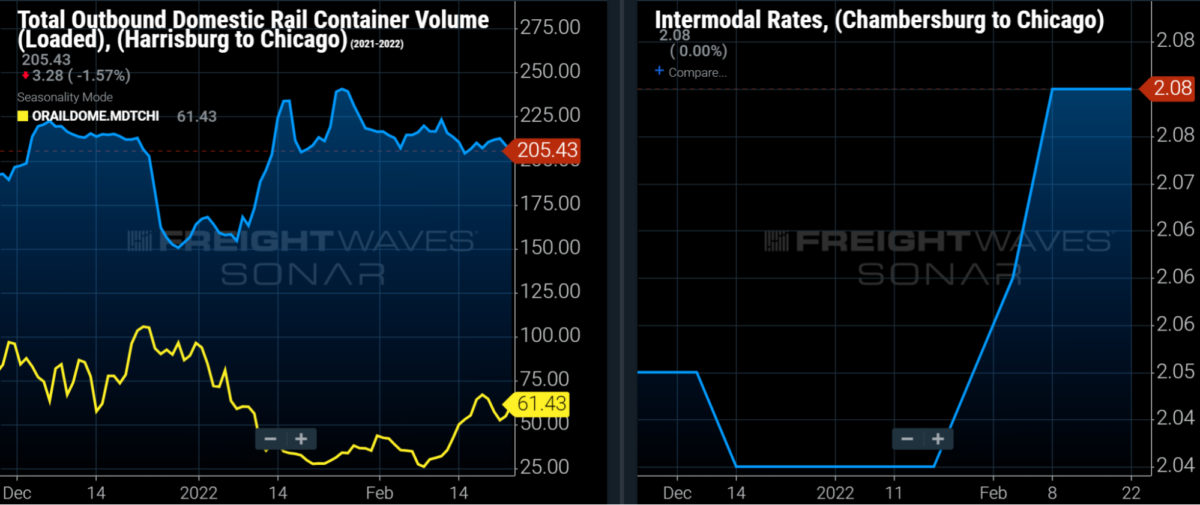

Lane to watch: Harrisburg (Pa.) to Chicago

Overview: Excess intermodal capacity in the lane has caused a 35% spread between intermodal and dry van spot rates.

Highlights:

- The average daily volume of 53-foot containers moving via rail intermodal declined 14% m/m to 205 units/day. Meanwhile, the volume of empty domestic intermodal containers increased from 36/day one month ago to 61/day in the past week, highlighting excess intermodal capacity in the lane.

- Domestic intermodal spot rates to move 53’ containers door-to-door are $2.08/mile, including fuel. That is 35% below the latest dry van spot rate shown in the SONAR Market Dashboard app.

- The current dry van tender rejection rate in the lane is 21.1%, down from 25% in mid-January.

What does this mean for you?

Brokers: The rising volume of empty domestic containers being repositioned in the lane means it may be possible for you to broker an intermodal load to minimize purchased transportation costs. When brokering highway loads, staying firm on your rates may lead to slight expansion in your margins since the average rate that brokers are paying for on-demand van capacity has declined slightly (~$0.08/mile) since the third week of February.

Carriers: The excess intermodal capacity in the lane suggests that dry van shipments are likely to be time-sensitive, so be sure to get compensated accordingly. Chicago is a solid destination for dry van carriers given that the Chicago van outbound tender rejection rate of 19.44% is 111 basis points (bps) below the national rejection rate and given Chicago’s status as a headhaul market.

Shippers: The wide spread between intermodal and dry van spot rates suggests that shippers with less time-sensitive shipments may want to consider rail intermodal. Shippers with more time-sensitive shipments may want to push their lead times out beyond the 3-day average for Harrisburg outbound dry van loads.

Watch: Shipper Update

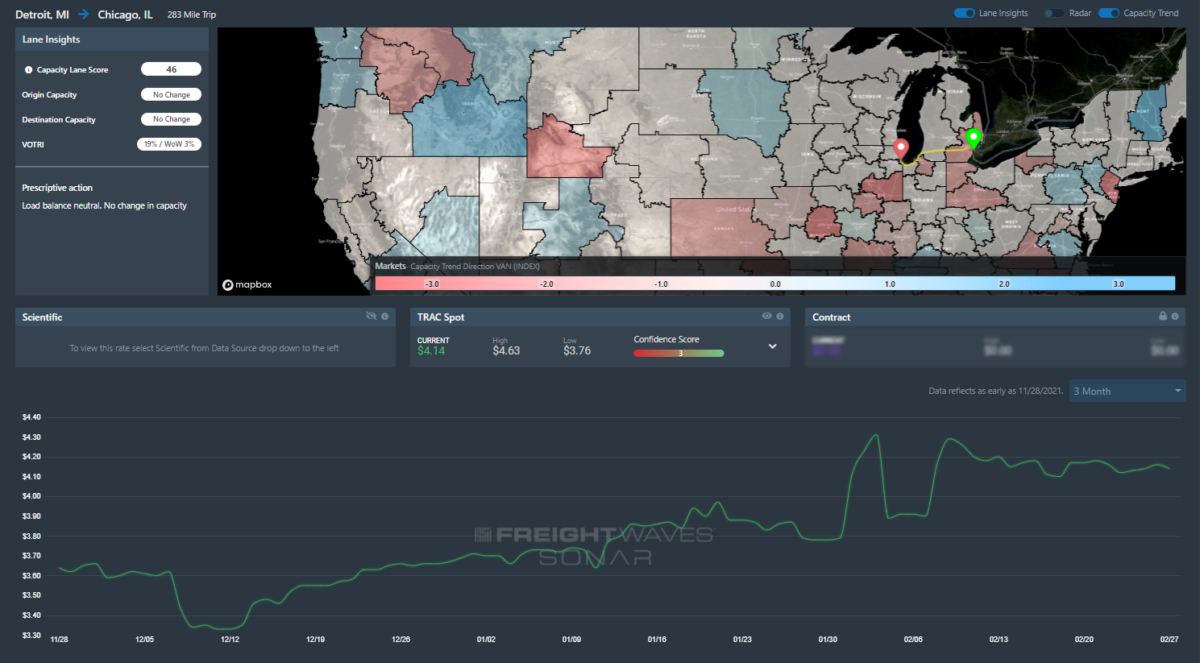

Lane to watch: Detroit to Chicago

Overview: Detroit rejection rates spike back near 20%.

Highlights:

- FreightWaves TRAC spot rates have increased 9% to $4.14 per mile since the end of January with little change over the past two weeks.

- Detroit’s outbound tender rejection rate has increased 6.5 percentage points to 19.2% over the past week with lane-specific rejection rates to Chicago remaining above the market average.

- Chicago’s outbound rejection rate has fallen slightly over the past week, but has remained in a narrow band hovering around 21% since the start of the year.

What does this mean for you?

Brokers: Make loads moving out of Detroit a higher priority this week. This is still an oversupplied market with rates near the bottom of its mileage band in this lane, but the large uptick in rejections could be a sign of carrier aversion.

Carriers: Expect increasing activity in this lane compared to last week due to contract waterfalls. Spot loads are moving for around $800-$900 all-inclusive, which is more than enough to justify some deadhead from nearby areas.

Shippers: Double check with your carriers on all loads scheduled to pick up this week out of Detroit. Spot market minimums can be much higher than contract, so do not take capacity in these low mileage lanes for granted.

Watch: Carrier Update

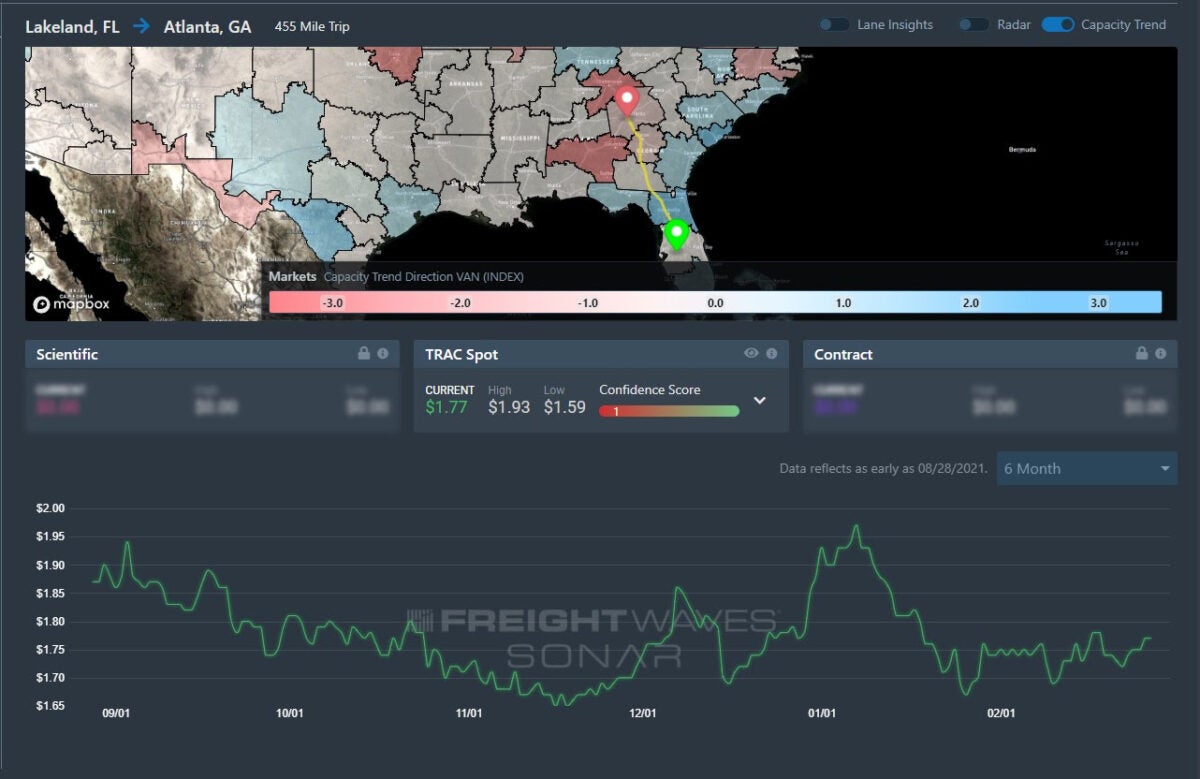

Lane to watch: Lakeland (Fla.) to Atlanta

Overview: Spot rates stabilize amid tender volume and rejection volatility.

Highlights:

- FreightWaves TRAC spot rates continue to hover around $1.75 per mile since Feb. 1, indicating greater capacity in the market to meet demand.

- Outbound tender volumes from the Lakeland market remain volatile but averaged between 225 to 240 bps for most of February, compared to a quarterly high of 280 bps near the middle of January.

- Outbound tender rejections from Lakeland to Atlanta remain high at 20.63% but are lower than six-month averages of around 24% to 28% during the last half of 2021.

What does this mean for you?

Brokers: Focus on developing an internal routing guide while spot rates remain stable, because there is an opportunity for greater margins if volatility returns. Expect greater rate movement in the coming weeks as shippers will be gearing up for the beginning of the produce season in April. Florida should experience greater seasonal volatility as the calendar gets closer to spring, but continue to keep an eye on recent international developments as some large brokerages rely on outsourced labor and disruptions in Ukraine have impacted operations’ teams abilities to book and manage loads.

Carriers: Florida is a major driver domicile location and the flattening of rates will create less opportunity to negotiate for higher rates. Higher outbound tender rejections can present an opportunity if extra capacity is available, allowing the ability to undercut a broker while still yielding greater than contracted rates. Expect greater volatility in the coming weeks as the produce season begins in earnest.

Shippers: Outbound tender volumes remain volatile but the lower rejection rates from Lakeland to Atlanta should provide some relief on rates. Rejection rates of 20% remain high but the plateau in spot rates presents an opportunity to push down on rates and encourage greater competition between carriers and brokers for loads returning back into the Southeast. Continue to keep outbound tender lead times high for the best shot at transportation cost savings.

Amanda

I get paid over $190 per hour working from home with 2 kids at home. I never thought I’d be able to do it but my best friend earns over 10k a month doing this and she convinced me to try. The potential with this is endless. Here’s what I’ve been doing..

Copy HERE ===))> 𝐡𝐭𝐭𝐩𝐬://𝐰𝐰𝐰.𝐰𝐨𝐫𝐤𝐬𝐟𝐮𝐥.𝐜𝐨𝐦

Jullia

𝑰 𝒂𝒎 𝒎𝒂𝒌𝒊𝒏𝒈 $150 𝒆𝒗𝒆𝒓𝒚 𝒉𝒐𝒖𝒓 𝒃𝒚 𝒘𝒐𝒓𝒌𝒊𝒏𝒈 𝒐𝒏 𝒕𝒉𝒆 𝒘𝒆𝒃 𝒂𝒕 𝒉𝒐𝒎𝒆. 𝑨 𝒎𝒐𝒏𝒕𝒉 𝒂𝒈𝒐 𝑰 𝒉𝒂𝒗𝒆 𝒈𝒐𝒕𝒕𝒆𝒏 $19723 𝒇𝒓𝒐𝒎 𝒕𝒉𝒊𝒔 𝒂𝒄𝒕𝒊𝒗𝒊𝒕𝒚. 𝑻𝒉𝒊𝒔 𝒂𝒄𝒕𝒊𝒗𝒊𝒕𝒚 𝒊𝒔 𝒆𝒙𝒄𝒆𝒑𝒕𝒊𝒐𝒏𝒂𝒍𝒍𝒚 𝒂𝒔𝒕𝒐𝒖𝒏𝒅𝒊𝒏𝒈 𝒂𝒏𝒅 𝒊𝒕𝒔 𝒏𝒐𝒓𝒎𝒂𝒍 𝒊𝒏𝒄𝒐𝒎𝒆 𝒇𝒐𝒓 𝒎𝒆 𝒊𝒔 𝒔𝒖𝒑𝒆𝒓𝒊𝒐𝒓 𝒕𝒐 𝒂𝒏𝒚𝒕𝒉𝒊𝒏𝒈 𝒎𝒚 𝒑𝒂𝒔𝒕 𝒐𝒇𝒇𝒊𝒄𝒆 𝒘𝒐𝒓𝒌. 𝑻𝒉𝒊𝒔 𝒂𝒄𝒕𝒊𝒗𝒊𝒕𝒚 𝒊𝒔 𝒇𝒐𝒓 𝒂𝒍𝒍 𝒂𝒏𝒅 𝒆𝒗𝒆𝒓𝒚𝒐𝒏𝒆 𝒄𝒂𝒏 𝒘𝒊𝒕𝒉𝒐𝒖𝒕 𝒎𝒖𝒄𝒉 𝒐𝒇 𝒂 𝒔𝒕𝒓𝒆𝒕𝒄𝒉 𝒋𝒐𝒊𝒏 𝒕𝒉𝒊𝒔 𝒄𝒐𝒓𝒓𝒆𝒄𝒕 𝒏𝒐𝒘 𝒃𝒚 𝒖𝒕𝒊𝒍𝒊𝒛𝒆 𝒕𝒉𝒊𝒔 𝒍𝒊𝒏𝒌. 𝑪𝒐𝒑𝒚 𝑯𝒆𝒓𝒆……===))> 𝒉𝒕𝒕𝒑𝒔://𝒘𝒘𝒘.𝒇𝒖𝒍𝒋𝒐𝒃𝒛.𝒄𝒐𝒎

Sandra Canada

== [ JOIN US ]

I get paid more than $145 to $395 per HOUR for working online. I heard about this job 3 months ago and after joining this I have earned easily $23k from this without having online working skills . Simply give it a shot on the accompanying site…

copy and open this site .…………>> 𝗪𝘄𝘄.𝗡𝗘𝗧𝗖𝗔𝗦𝗛𝟭.𝗖𝗼𝗺