The highlights from Monday’s SONAR reports. For more information on SONAR — the fastest freight-forecasting platform in the industry — or to request a demo, click here. Also, be sure to check out the latest SONAR update, TRAC — the freshest spot rate data in the industry.

Lanes to watch

By Zach Strickland, director, Freight Market Intelligence

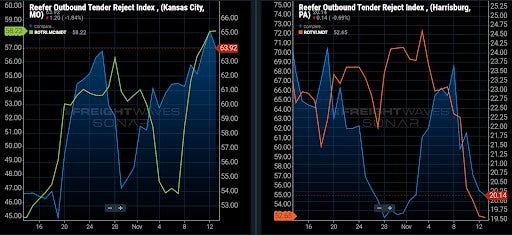

KANSAS CITY (Missouri) to HARRISBURG (Pennsylvania)

Overview: Reefer market conditions soften in Harrisburg, pushing reefer rejection rates up to 58.22% on the MCI–MDT lane.

Highlights:

- Reefer rejection rates increase from 46.64% to 58.22% over the past 6 days on the MCI – MDT lane, which is just below Kansas City’s market average of 63.92%.

- Harrisburg’s reefer freight volumes decline to 52.65 index points as the demand for reefer equipment falls, pulling reefer rejection rates down to 20.14%.

- Harrisburg shippers have increased reefer tender lead times to 4.63 days, indicating that shippers are still feeling pressure on capacity from the market.

What does this mean for you?

Brokers: Capacity has tightened on the MCI–MDT lane as market conditions in Harrisburg soften, allowing carriers to increase their rates for deliveries into that market. Brokers should search the spot market for reefer loads that run across the MCI–MDT lane, and increase your bids since carriers will increase their spot rates for on-demand capacity. SONAR’s Market Dashboard shows reefer carrier rates around $4800.00 all-in to the truck, indicating that brokers should bid around $5650.00 for a 15% margin on the load.

Carriers: Reefer carriers with excess capacity in the Kansas City market should search the spot market for reefer loads that deliver into Harrisburg. Capacity has tightened on this lane, pushing rejection rates back up to 58.22% as the volatility in rates increase on the lane. Reefer carriers are receiving rates between $4.49 – $4.75 all-in rpm on this lane, but your outbound rates from the Harrisburg market have declined.

Shippers: Harrisburg shippers need to keep downward pressure on carrier rates as market conditions soften. Reefer rejection rates are still over 20%, giving carriers the strength in rate negotiations, but the market is oversupplied with capacity and rejection rates are trending downward. Keep tender lead times extended, and secure capacity as early as possible.

STOCKTON (California) to LOS ANGELES

Overview: Stockton rejection rates hit multi-month high.

Highlights

- Stockton’s outbound rejection rate bounced off a floor of around 11.5% on November 7 and are currently hitting a multi-month high around 15%.

- Rejection rates to Los Angeles have moved similarly, which is surprising considering the backhaul nature of this lane.

- Los Angeles’ outbound rejection rate has been relatively stable over the past few weeks, hovering around 16%.

What does this mean for you?

Brokers: Expect slight upward pressure on spot rates in this lane this week. This is still a favorable direction for carriers to move, but all the capacity is being pulled into southern California.

Carriers: Check the spot market for loads moving in this lane. This is basically free repositioning money if the pickup and delivery are efficient. Los Angeles brings some of the highest rates in the country and is showing no signs of demand side easing.

Shippers: Keep lead times elevated in this lane to increase your compliance. You will not be able to take capacity for granted even in the most unbalanced markets, thanks to the rate disparity between northern and southern California freight. That gap is narrowing slowly and rate increases may be a good near-term strategy if your compliance is below market levels.

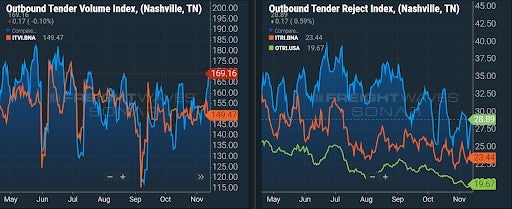

NASHVILLE to ELIZABETH (New Jersey)

Overview: Rejections likely to increase further as outbound volumes surge w/w.

Highlights

- Nashville outbound tender volumes are up 11% w/w, signaling that demand for outbound capacity is picking up.

- The Headhaul Index in Nashville is up 21% w/w, and likely to increase, further turning Nashville into a Headhaul market, where it is likely to remain through all of peak season.

- Nashville outbound tender rejections are relatively flat w/w, signaling that the increase in outbound volumes has not yet caused a significant tightening in capacity.

What does this mean for you?

Brokers: Nashville tender rejections are relatively flat w/w, but are currently over 10% higher than the national average. With outbound volumes increasing 11% w/w, pushing the Headhaul Index up 21% w/w, it is likely that there is significant upward pressure on rates, so capacity is also likely to get tighter in the coming days. Nashville is likely to maintain consistent demand for outbound volumes, so be sure to account for the upward pressure on spot rates when pricing new opportunities and prioritizing coverage on your existing loads.

Carriers: Stay firm on your rates because there is significant upward pressure coming from both a decrease in supply and increase in demand w/w. Outbound tender rejections have already increased over 5% w/w, and with the Headhaul Index increasing 21% w/w, pricing power is likely to shift even further in your favor for outbound Nashville lanes. Keep an eye on outbound tender rejections. If they continue to rise, you can likely push your rates higher alongside them.

Shippers: Your shipper cohorts are currently average 2.8 days in tender lead times, and remain largely the same w/w. With outbound tender rejections on the rise alongside both outbound volumes and the Headhaul Index, you will likely need to push tender lead times well over 3 days to protect your company from at least some of the upward pressure being put on rates and causing a tightening of capacity.

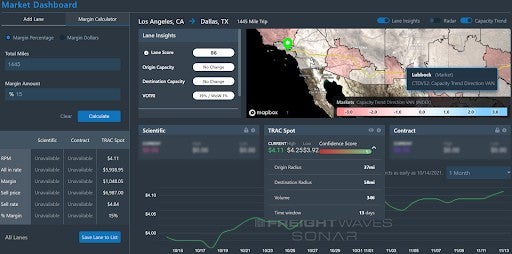

TRAC Market Dashboard: Los Angeles to Dallas

How high do brokers have to bid in a tight lane?

In light of the congestion at and near the ports of Los Angeles and Long Beach and congestion in the intermodal networks, it won’t surprise any brokers or shippers to see that spot rates are high from L.A. to Dallas. TRAC’s Market Dashboard adds value by quantifying that.

Here are some quick insights from Market Dashboard in the lane:

- The estimate for today’s spot rate in the lane is $4.11/mile, including fuel surcharges.

- The estimate for spot rates that will land in the 67th and 33rd percentile are $4.25/mile and $3.92, respectively.

- Spot rates in the lane are up ~3% in the past month from just under $4/mile and at the highest level in the past month.

- The estimated rates are calculated using data from 346 loads in the past 13 days with a radius at origin and destination no further than 37 miles and 58 miles (a relatively small radius), respectively.

- Dry van carriers are rejecting 19% of tendered loads in the lane, up 1% week-over-week.

- There has been little change to capacity levels at both the origin and destination markets in the past week (which is why they are shown as neutral on the dashboard map).

Watch: Shipper Update

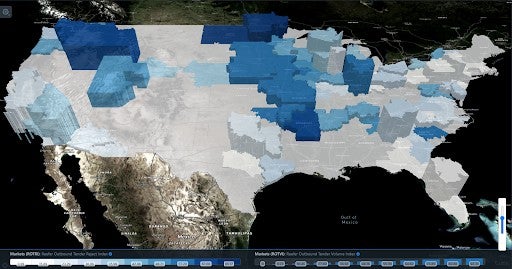

Focus on … Reefer Outbound Tender indices

By Zach Strickland

The national average of reefer outbound tender rejection rates has climbed to 38.43% over the past week as freight volumes declined to 2164.54 index points.

Reefer rejection rates should continue a steady climb through the Thanksgiving holiday as demand for reefer equipment tightens, allowing carriers to push spot rates upward for on-demand capacity.

Shippers in the Fargo, Pendleton, Twin Falls and Little Rock markets are struggling with rejection rates over 65%, and over 60% in the Kansas City, Joplin, Cedar Rapids, Columbia, Sioux Falls, Fayetteville, Tulsa, Omaha, Indianapolis and Jefferson City markets.

Carriers will find the most opportunities for reefer freight in the Twin Falls, Ontario, Joliet, Atlanta, Indianapolis, Allentown, Fresno, Lakeland, Fort Worth, Green Bay, Pendleton and Salt Lake City markets, which are the largest reefer markets by volume in the nation.

Watch: Carrier Update

Market Update Webinar this Wednesday

FreightWaves’ monthly Market Update webinar is our most popular monthly segment designed to provide data around the latest events affecting the freight markets today. Based on real-time intelligence, we will be exploring current economic factors and freight trends to help you and your company plan for the future.

Presented in partnership with CarrierDirect, this webinar will feature insights from FreightWaves’ Director of Freight Market Intelligence, Zach Strickland, and Lead Economist, Anthony Smith, who will also be prepared to answer your questions during the live audience Q&A.

Topics for November include:

• Employment momentum

• Shift in trends

• Warehouse capacity

• Inventory challenges

Join us Wednesday for this important update to hear about the current state of the industry and how you can prepare for the future based on the latest data available.