The highlights from Thursday’s SONAR reports are below. For more information on SONAR — the fastest freight-forecasting platform in the industry — or to request a demo, click here. Also, be sure to check out the latest SONAR update, TRAC — the freshest spot rate data in the industry.

Market watch

Salt Lake City

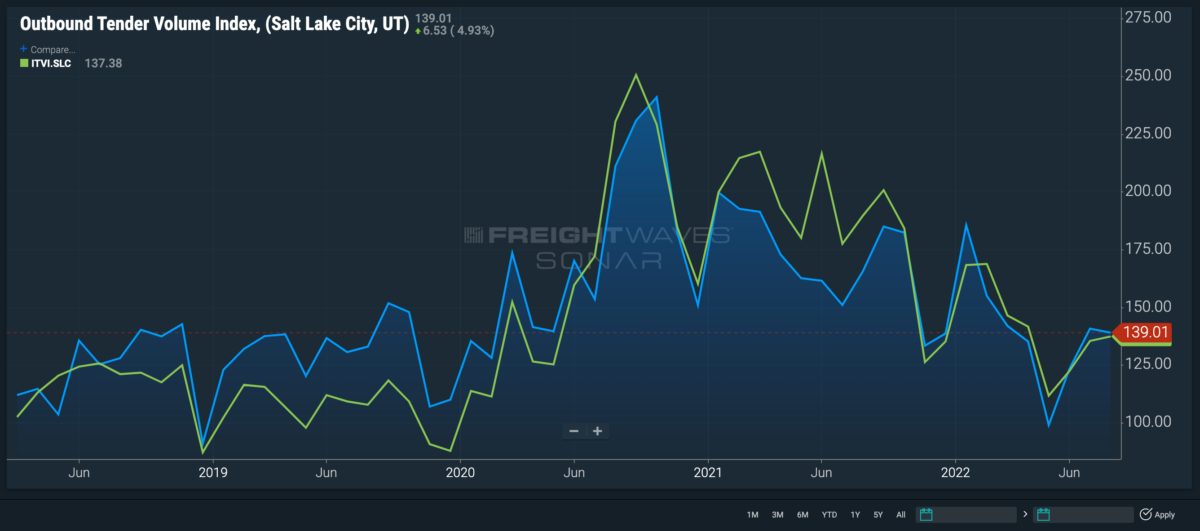

The decline in national volumes that began at the start of 2022 hit the Salt Lake City market hard in the first half of the year, but outbound tendered volumes are beginning to make a comeback.

In 2019, Salt Lake City was a firm headhaul market, but during the pandemic that changed. Inbound freight volumes started to exceed the amount of outbound volumes, and with very few exceptions that is the way it has remained.

However, outbound freight jumped 11.8% in the last week of August to surpass the level of inbound volumes by 1.3%. Inbound volume levels also grew 7.4% in the same time frame, but the increased levels of outbound volumes pushed Salt Lake’s Headhaul Index up 124.8% into the positive to 1.62.

Carriers are quick to accept contracted freight out of Salt Lake City as the Outbound Tender Reject Index dropped by 120 basis points in the past week to 2%.

Denver

Outbound volumes from Denver dropped consistently through August, and now one day into September have essentially fallen off of a cliff.

The Outbound Tender Volume Index for Denver fell 26.5% in August, a 14.5% decrease week over week. Inbound tender volumes, on the other hand, remain elevated relative to outbound volumes, falling only 4.3% in the past week.

The discrepancy between the two flows of volume has plunged Denver’s headhaul score downward 163% to minus-30.4 — its lowest score since March.

Despite outbound volumes declining rapidly, carriers are still trying to put upward pressure on spot rates as the rejection rate is up more than 100 bps since the start of the week to an even 5% — just below the national average of 5.5%.

NTI as a point of reference

The National Truckload Index is a daily look at how spot rates in specific lanes hold up in comparison to the national average, giving carriers and brokers an idea of which lanes to gravitate toward or avoid.

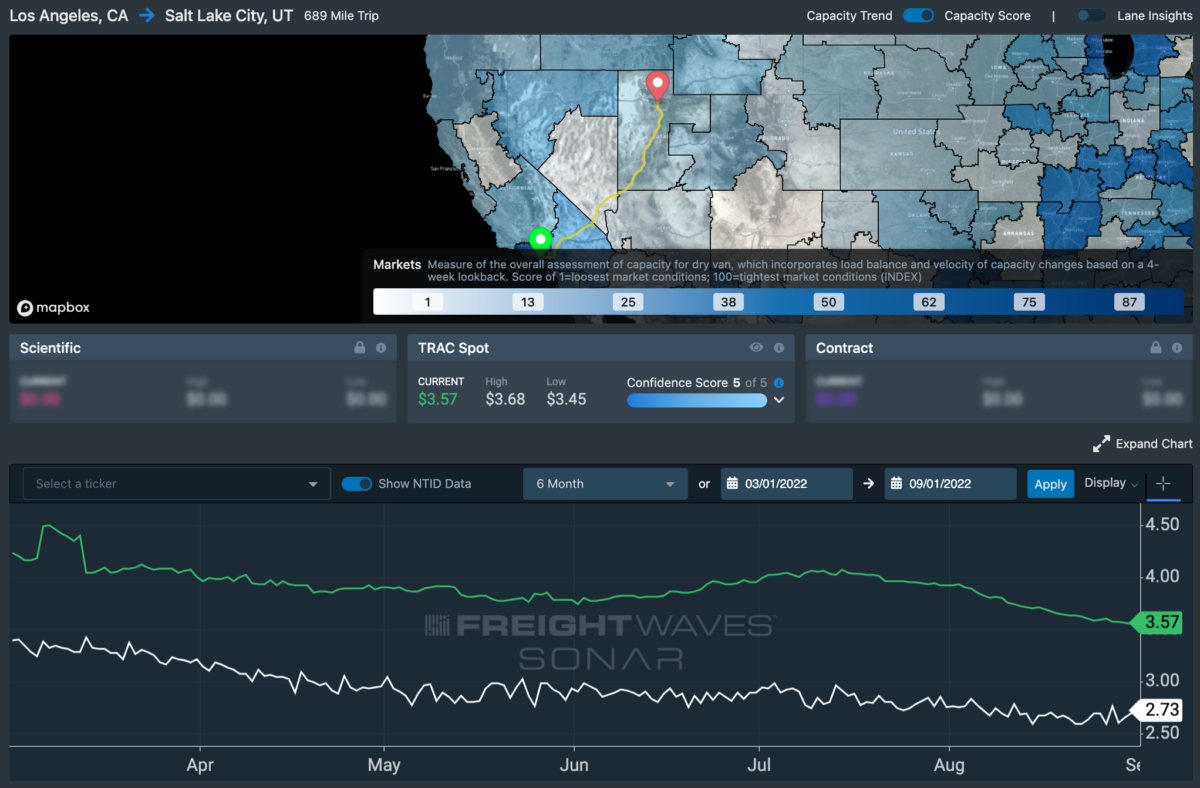

Lane to watch: Los Angeles to Salt Lake City

Spot rates in this lane may be down 36 cents from Aug. 1 but remain 84 cents above the national average. This lane is given a confidence score of 5, providing little to no volatility in what is being paid. With the increase in outbound volume coming out of Salt Lake City, carriers have a very probable chance of booking a load coming out.

A return rate is now paying $1.39 a mile, significantly less than the rate going in, but return rates are higher now than this time last year. In addition, rejection rates from Salt Lake back to LA are ticking up, which will start to put upward pressure on the return rates in favor of the carriers.