The highlights from Friday’s SONAR reports are below. For more information on SONAR — the fastest freight-forecasting platform in the industry — or to request a demo, click here. Also, be sure to check out the latest SONAR update, TRAC — the freshest spot rate data in the industry.

Market Watch for Oct. 21:

Milwaukee

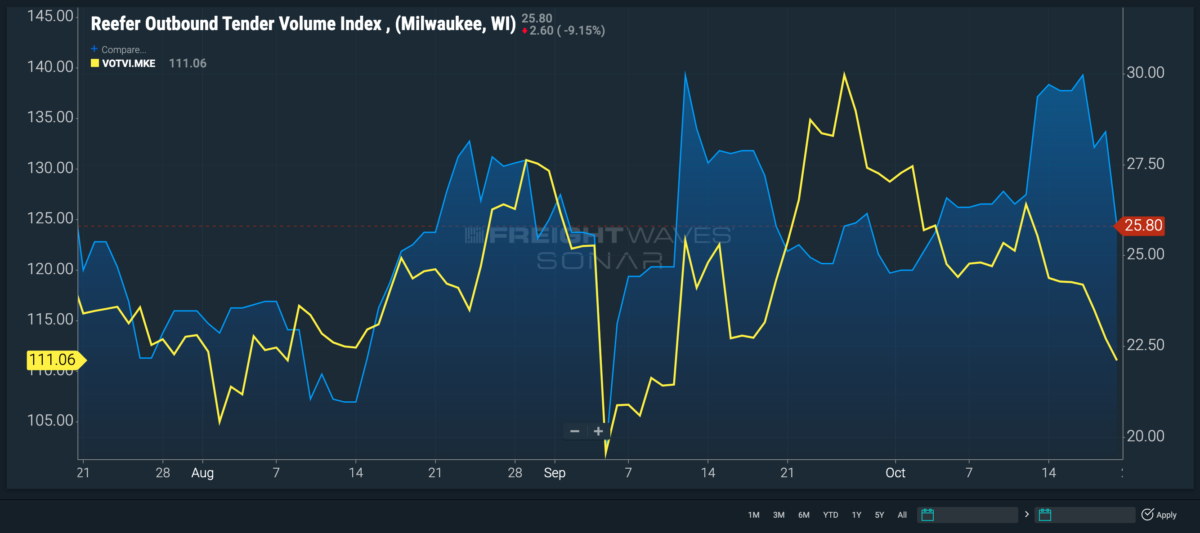

Outbound demand in Milwaukee dropped for the fifth time in the last month to the lowest levels since April, with most of the decline coming from a plunge in reefer volumes.

The Outbound Tender Volume Index for Milwaukee edged down another 6.5 points Friday and is down 10% since Oct. 12. Most of the downward trend is attributed to outbound reefer volumes taking a nosedive this week, but dry van volumes have been trending down steadily in the second half of October.

The Reefer Outbound Tender Volume Index fell 2.5 points Friday and is down 14% since Monday, but inbound reefer capacity is trending up after taking a fall last week. Inbound reefer volumes dropped 23.2% from Oct. 4 to 14, but the Reefer Inbound Volume Index pushed upward 2 points, or 10.5%, since Sunday.

The Reefer Outbound Tender Reject Index fell 150 bps since Monday as the increased amount of inbound capacity is accepting more contracted freight in order to secure loads during the decline in volumes.

Dry van volumes, on the other hand, began a downward trend at the end of September. The Van Outbound Tender Volume Index dropped 7.5 points since the start of the week and is down 14.8% since Oct. 2. Meanwhile, inbound dry van volumes have been, for the most part, inactive this month and remain at the same level they were on Oct. 2. The consistent flow of inbound capacity while outbound demand steadily trickled down caused rejection rates to plummet, falling 368 bps to 2.8% — their lowest since April 2020.

Atlanta

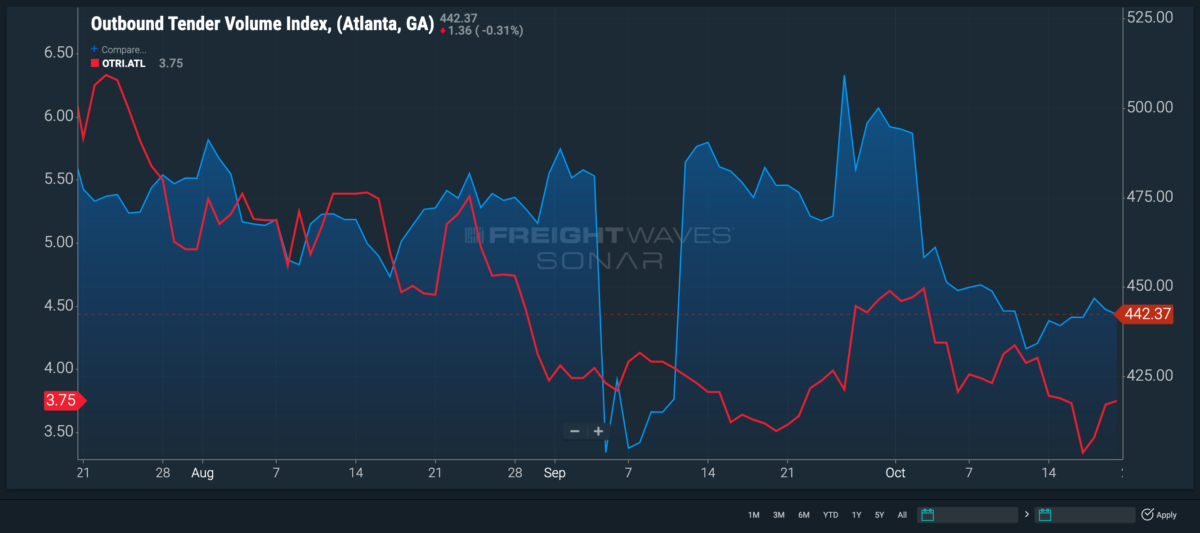

Volumes moving out of Atlanta have yet to make any sort of recovery since taking a steep drop at the start of October.

The Outbound Tender Volume Index for Atlanta fell 35 points on Oct. 2 and is down another 16 points since then — a 10.2% decrease overall for the month. This consistent decline in volumes has allowed room for Ontario, California, to catch back up to Atlanta by gaining its lost outbound tender market share. Atlanta claimed the throne on Sept. 25, but as volumes in Southern California have been trending up this month, Ontario’s outbound market share is up to 3.813%, right behind Atlanta with 3.857%.

Inbound freight volumes are trending up this week, though, rising 3.5% since Monday. The increase in inbound capacity while outbound volume continues to slump moved the Outbound Tender Reject Index up 40 bps to 3.7% as carriers entering Atlanta are searching the spot market for opportunities.

NTI as a point of reference

The National Truckload Index is a daily look at how spot rates in specific lanes hold up in comparison to the national average, giving carriers and brokers an idea of which lanes to gravitate toward or avoid.

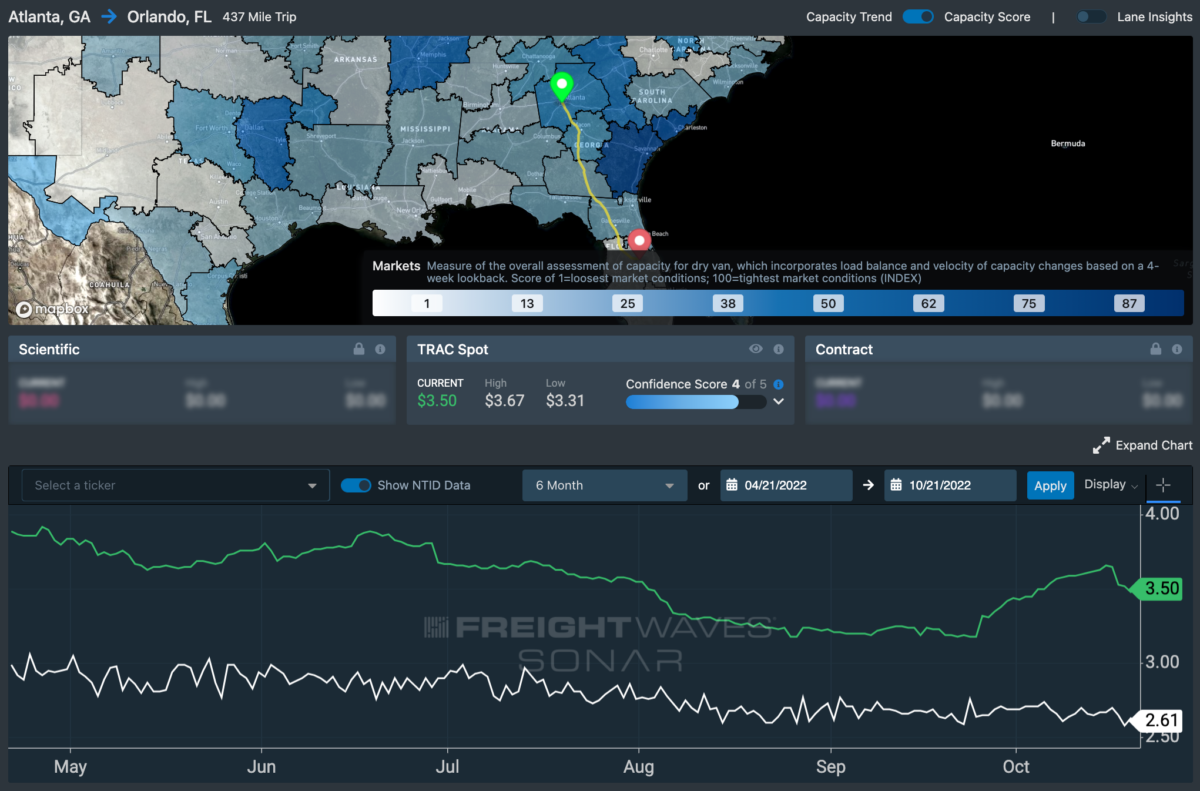

Lane to watch: Atlanta to Orlando, Florida

Spot market rates from Atlanta to Orlando are down 3 cents since Monday but are still 89 cents above the national average at $3.50 a mile.

Volumes out of central Florida are up 6.2% since Sunday and rejection rates ticked up 55 bps to 2.3% in the same time period. The increase in volumes and rejections provides a good chance of booking a load coming out, but a return rate drops significantly to $1.35 a mile to counter the elevated rate going into Florida.