The highlights from Tuesday’s SONAR reports are below. For more information on SONAR — the fastest freight-forecasting platform in the industry — or to request a demo, click here. Also, be sure to check out the latest SONAR update, TRAC — the freshest spot rate data in the industry.

Market Watch for Oct. 4:

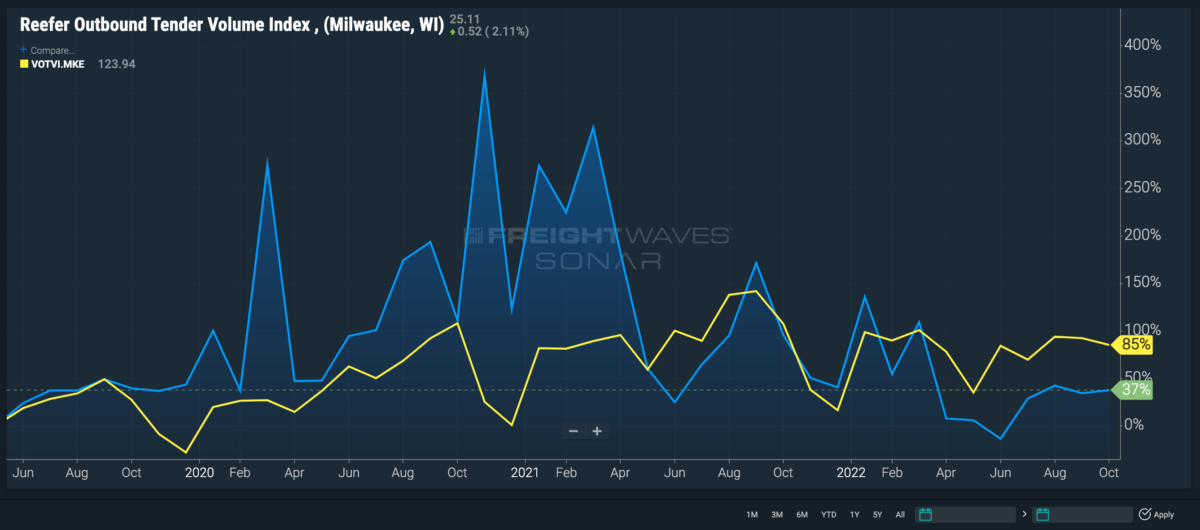

Milwaukee

Outbound volumes from Milwaukee are down to their lowest levels since May.

Reefer volumes from Milwaukee were in high demand during the first two years of the pandemic — everybody may have needed a little something from Brew City during that time — and have been the primary driving force behind the Midwestern market’s decline in volume.

Since February, outbound reefer demand is down 59%, while dry van volumes are only down 2.7% in the same time frame.

In the last week outbound reefer volumes are down 14.2%, plunging the Outbound Tender Volume Index in Milwaukee down 26 points, or 12.1%.

Last week when the volume drop began, rejection rates climbed 125 basis points (bps) to 6.3%, as carriers were likely searching for opportunities in the spot market. This week, however, rejections are down just over 50 bps, indicating that carriers are settling back into their contracts.

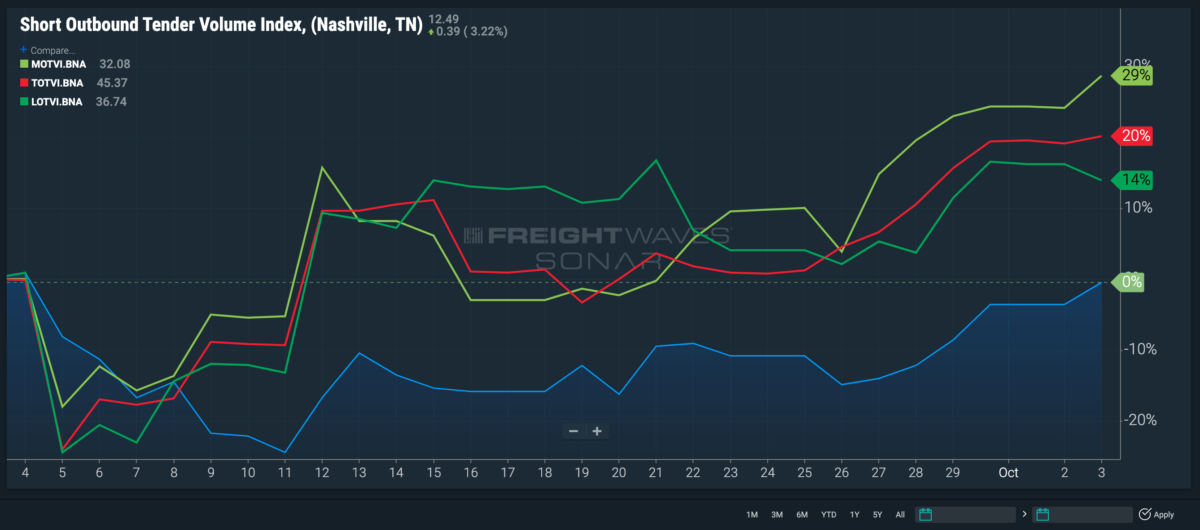

Nashville, Tennessee

As the fourth quarter of the year kicks off, truckload volume has softened across the board.

“Rates seem to have remained relatively flat the last few weeks based on what we have been seeing, and volume is definitely decreasing all across the country,” said Lucas Doyle, carrier team lead at Business to Business Logistics.

Nashville is one of the few markets that is showing positive signs leading into this quarter.

“We are certainly seeing quite a few tenders outbound from Nashville,” said Alex Riemersma, truckload pricing manager at Ally Logistics. “Our rates leaving Nashville have gone consistently down for the past few months, but this is hardly unique to that individual outbound location.”

In the last week the Outbound Tender Volume Index for Music City moved up almost 19 points, or 16.2%, to 132.7 — its highest value since May. The significant increase has caused outbound demand to exceed inbound capacity for the first time since June, soaring the Headhaul Index up 118% into the positive to 3.9.

The majority of the loads leaving Nashville in the last month are mid-length of haul, delivering to other markets in the Southeast region.

Once outbound volume started to increase, rejection rates grew 300 bps in the last week to 7.4% and remained stable for the past few days, indicating that capacity is handling the increased amounts of volume.

NTI as a point of reference

The National Truckload Index is a daily look at how spot rates in specific lanes hold up in comparison to the national average, giving carriers and brokers an idea of which lanes to gravitate toward or avoid.

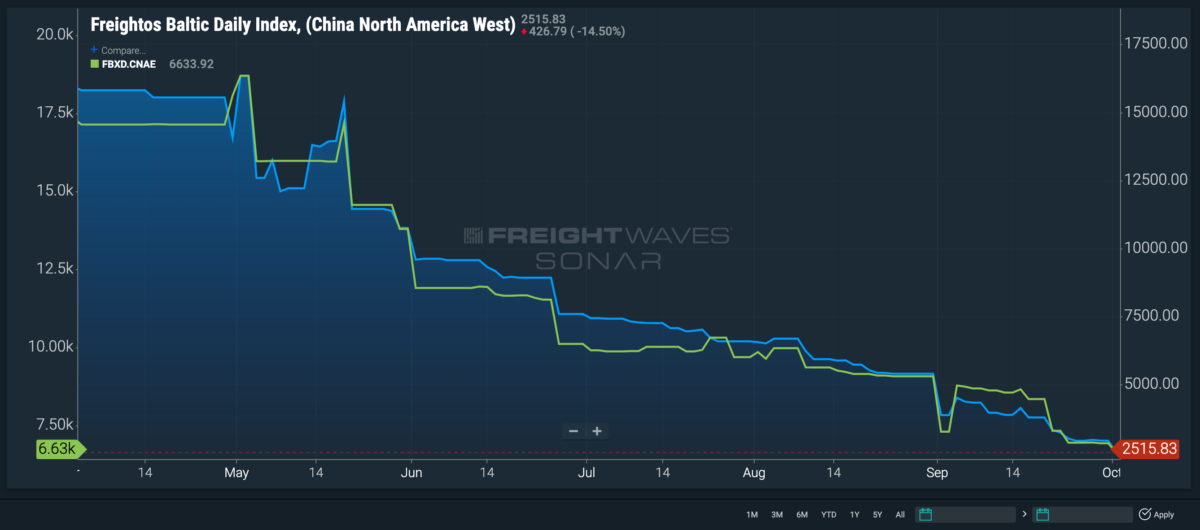

Maritime rates from China to the U.S.

Spot rates from China to both coasts of the U.S. continue to fall into the fourth quarter.

Booking volumes from China to the United States are down 28.9% in the past month alone. From Sept. 30, ocean spot rates from China to the West Coast ports of America are down $293 to $2,515, and spot rates to the East Coast dropped even lower, falling $429 to $6,633 in the same period. Both spot rates were north of $15,000 in the middle of May.

This marks the eighth price drop in shipments to the East Coast and the ninth to the West Coast in the past two months.