The highlights from Thursday’s SONAR reports are below. For more information on SONAR — the fastest freight-forecasting platform in the industry — or to request a demo, click here. Also, be sure to check out the latest SONAR update, TRAC — the freshest spot rate data in the industry.

Market Watch for Oct. 27:

Charlotte, North Carolina

Outbound demand is continuing a slow recovery in the second half of October since hitting its lowest levels since February 2021.

Tender volumes leaving Charlotte, North Carolina, dropped by 17.5% from Sept. 29 to Oct. 11 and have since been crawling slowly upward. Since Oct. 11 the Outbound Tender Volume Index is up 14 points, or 7.5%, to 202.4.

Inbound freight levels, on the other hand, remain well above outbound volume in the Southeastern backhaul market. Inbound volumes dropped 10% from Oct. 8 to 13, but the Inbound Tender Volume Index is up more than 15 points, or 6.7%, since then.

The upward movement in both directional flows of volumes is pushing rejection rates up dramatically. The Outbound Tender Reject Index in Charlotte is up 400 bps since Oct. 20 as inbound capacity is increasing and carriers are searching the spot market for better rates to book on the way out.

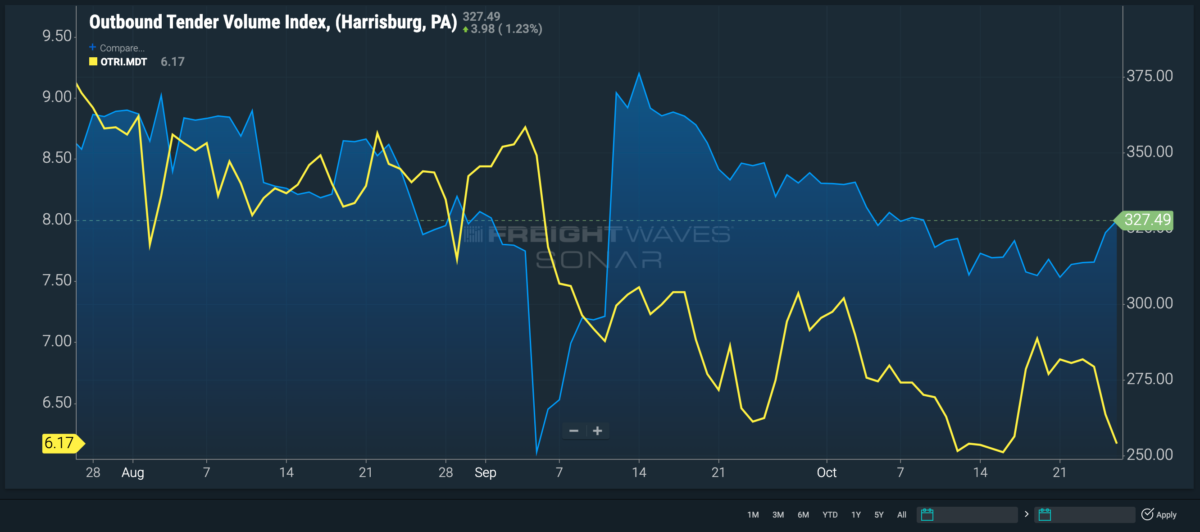

Harrisburg, Pennsylvania

Outbound demand is continuing its upward trend that started last Friday after dipping to its lowest level since May 2020.

Tender volumes leaving Harrisburg, Pennsylvania, fell 9% from Oct. 3 to 13 and were experiencing an increasing amount of volatility in the week that followed. It wasn’t until last Friday that the Outbound Tender Volume Index started to recover and is now up almost 19 points, or 6%, since then.

Neighboring market Allentown, Pennsylvania, started an increase on Saturday but has flatlined this week. The Outbound Tender Volume Index in Allentown saw a 15-point rise, or 6.4%, from Saturday to Monday, but plateaued and is now pointed in a slight downward trajectory.

Outbound volumes may still be trending upward in Harrisburg, but rejection rates are taking a nosedive. The Outbound Tender Reject Index was floating between 6.7% and 7% leading into this week but is down 63 basis points since Monday to 6.1%. The drop in rejections while volumes are still increasing points to carrier sentiment to comply with their contracted freight.

Back in Allentown, rejection rates are following a similar trend. Outbound volume has been stagnant for the last couple of days — and still is — and rejection rates are dropping. Outbound demand flatlined on Monday, and that was when the Outbound Tender Reject Index in Allentown began to really fall. The index is currently down 70 bps to 5.5% as carriers are accepting their contracted freight to secure loads.

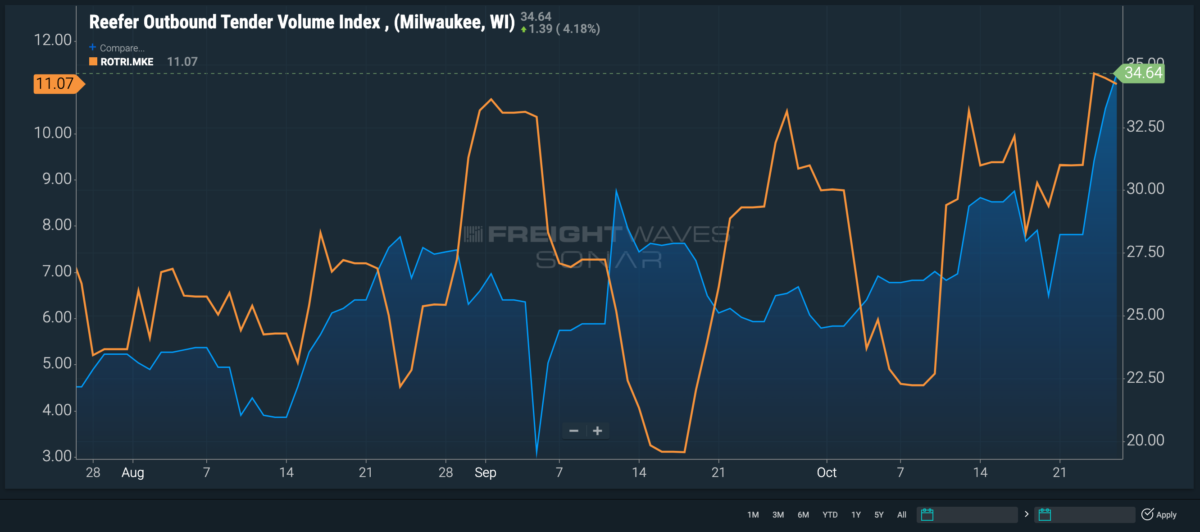

Milwaukee

Outbound demand from Milwaukee is swinging upward after dipping to its lowest levels since June 2020.

Overall outbound tender volumes in Milwaukee are up 10.7% since Monday and most of the increase is credited to a rise in reefer volumes. The Reefer Outbound Tender Volume Index is up nearly 6.5 points, or 22.7%, since Sunday. Meanwhile, van volumes are only up 6% since Monday.

An initial decrease in volume earlier this month plunged rejection rates below 4%, but on Oct. 18 they began to trend upward and the recent increase in outbound volumes has boosted them even further. The Outbound Tender Reject Index is up 116 bps since Oct. 18 to 5%. The boom in reefer volume surged reefer rejection rates in particular. They are up to 11% this week — their highest since May — which will put upward pressure on spot rates leaving the market.

“Carrier capacity within Milwaukee tightens significantly in Q4 as shippers demand a larger share of capacity to support higher seasonal volumes,” said Alex Riemersma, a pricing analyst at Ally Logistics. “If this is the case, rates outbound from Wisconsin will be going up while rates coming into Milwaukee should be going down.”

NTI as a point of reference

The National Truckload Index is a daily look at how spot rates in specific lanes hold up in comparison to the national average, giving carriers and brokers an idea of which lanes to gravitate toward or avoid.

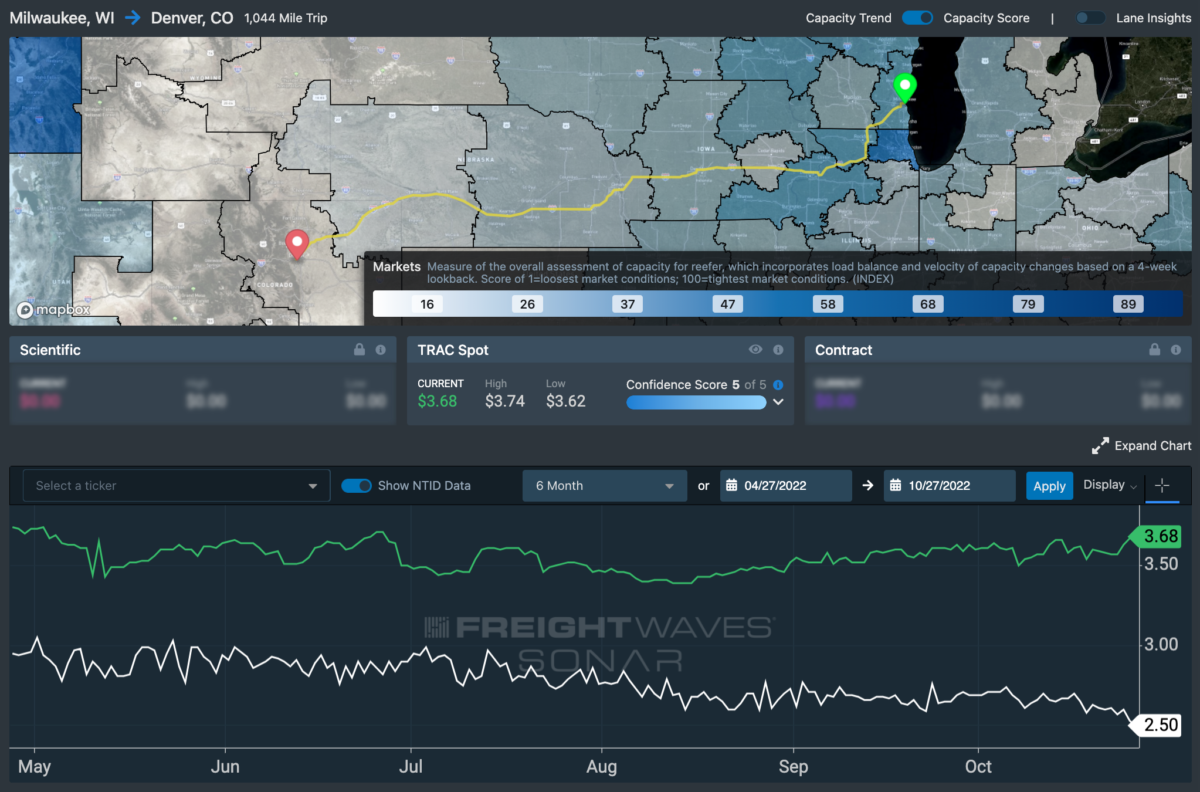

Lane to watch: Milwaukee to Denver (reefer)

The dry van spot rates in this lane were looked at Wednesday, so let’s take a look at the reefer spot rates.

Spot market reefer rates from Milwaukee to Denver are up 5 cents — with a confidence score of 5 — since Monday to $3.68 a mile. The rise in spot rates is in correlation with the rise in volumes and rejections and as rejection rates continue to rise out of Milwaukee, these rates will only increase further.

Once in Denver, both volume and rejections are trending up this week as well, providing a good chance of booking a load coming out.