The highlights from Tuesday’s SONAR reports are below. For more information on SONAR — the fastest freight-forecasting platform in the industry — or to request a demo, click here. Also, be sure to check out the latest SONAR update, TRAC — the freshest spot rate data in the industry.

Market Watch for Oct. 18:

Seattle

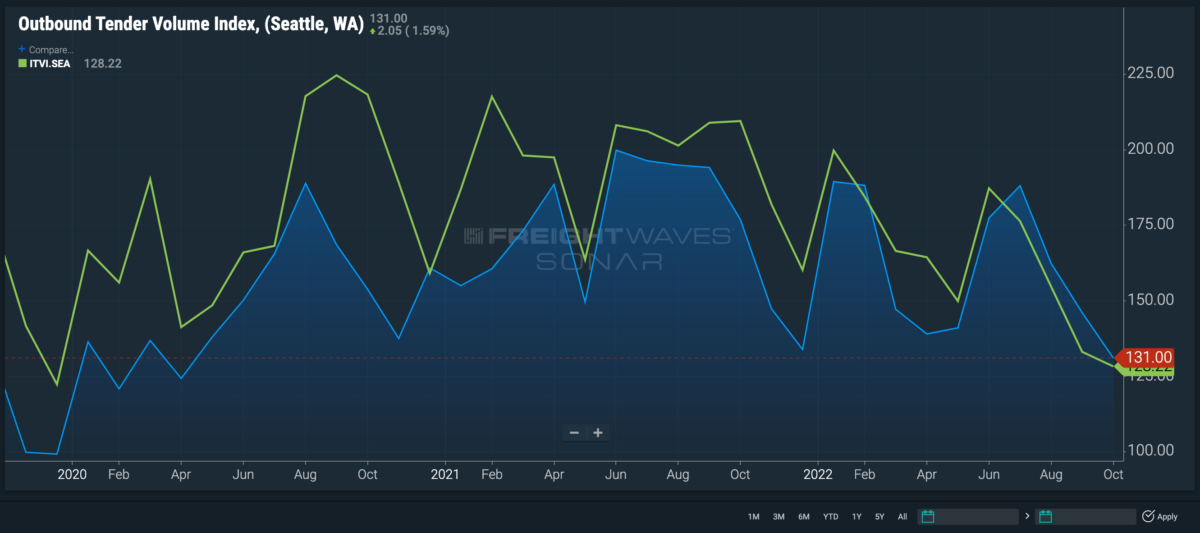

Outbound volumes from Seattle are showing signs of life after hitting a two-year low last week.

Demand in Seattle started dropping mid-August but finally bottomed out early last week after falling 35%. Last Wednesday, however, volumes began to tick upward. The Outbound Tender Volume Index in Seattle is up 12.5 points, or 10.5%, since Wednesday to an even 131.

Seattle has historically been a strong backhaul market, but outbound volumes have exceeded inbound freight levels on and off since June and currently still do — albeit only by 2.1%. The Northwest is not an ideal market for carriers to enter — unless they’re pulling a reefer container — and the decrease in outbound volume brought inbound tender rejections in September to a six-month high of 6.5%.

Now that outbound volume is beginning to pick up, carriers are essentially hitting auto-accept, as the Outbound Tender Reject Index in Seattle remained flatlined at 1% while volume began to increase, and dipped even lower this week.

Nashville, Tennessee

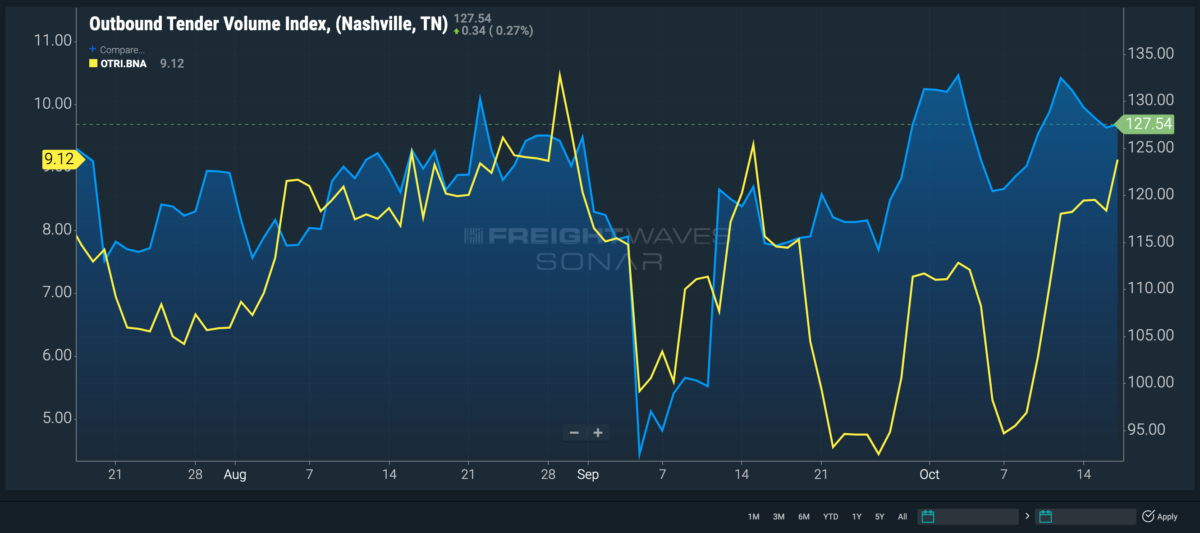

Outbound volumes from Nashville recovered and plateaued, but rejection rates are continuing to rise.

This month’s outbound volumes are proving to be as inconsistent as good country music coming out of Music City. In the first week of October, outbound demand dropped by 9.3%, made a swift recovery the week after gaining back 10% and now is down 3.7% in the past six days.

Inbound freight levels are down as well in the past week. The Inbound Tender Volume Index fell more than 12 points, or 8.5%, since Oct. 11. The disparity between inbound and outbound freight volumes is down to only 1.1%, creating a stalemate in Nashville’s Headhaul Index at -1.4.

Despite the recent decrease in both directional flows of volume, rejection rates continue to climb. The Outbound Tender Reject Index is up 435 basis points since Oct. 7 to 9.1%. The rise in rejections indicates that carriers are searching the spot market for better opportunities, or rejecting contracted freight altogether and bobtailing to another market.

NTI as a point of reference

The National Truckload Index is a daily look at how spot rates in specific lanes hold up in comparison to the national average, giving carriers and brokers an idea of which lanes to gravitate toward or avoid.

Diesel prices

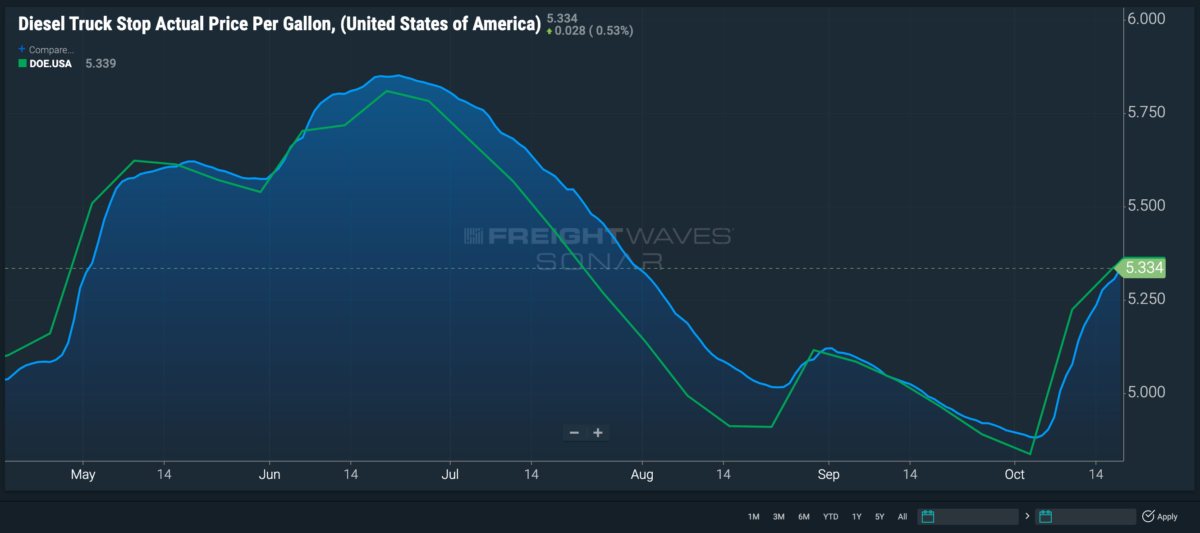

It created a major sense of false hope when retail diesel prices dropped below $5 per gallon last month.

Prices started the fourth quarter of the year at less than $4.90 per gallon but quickly began to swing upward on Oct. 4. Since then, retail prices have risen more than 30 cents to $5.334 per gallon.

The DOE price — as calculated by the Energy Information Administration of the Department of Energy — is up to $5.339. This calculation is what most carriers use to determine the fuel surcharge attached to rates, so shippers can expect to start seeing the fuel surcharges increase — if they haven’t already.

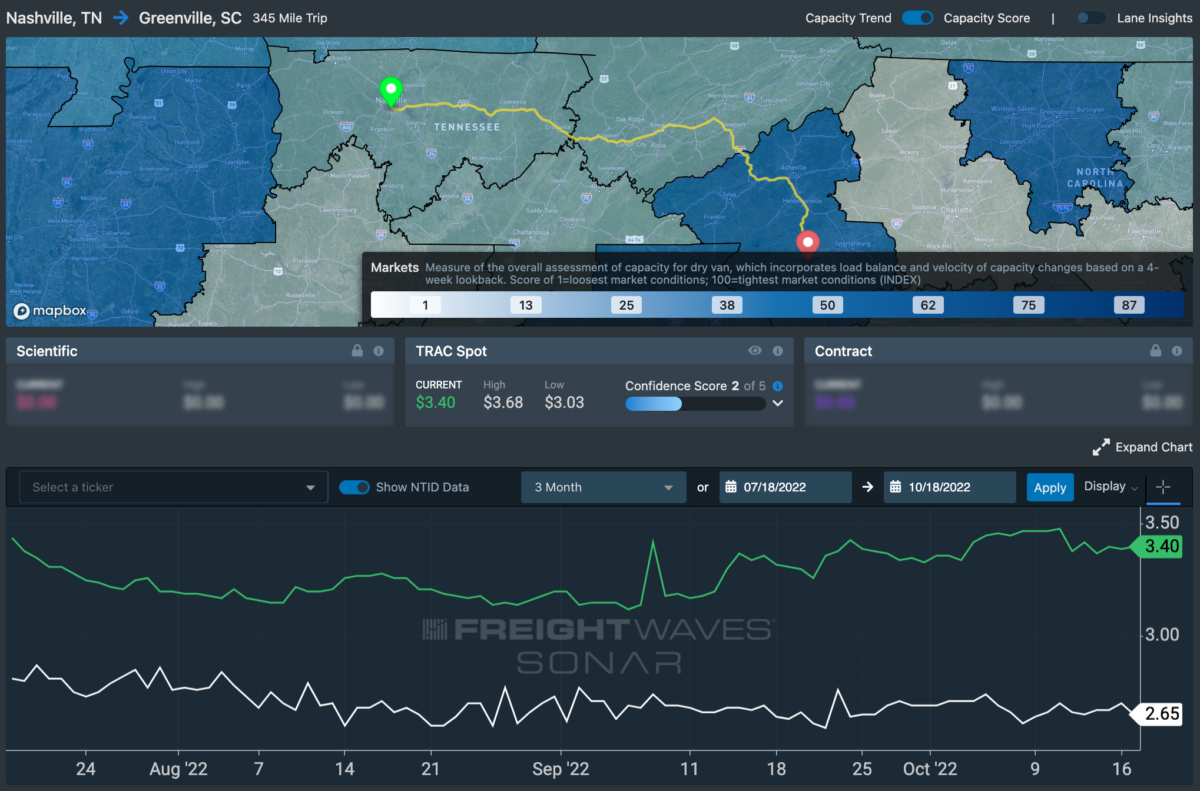

Lane to watch: Nashville to Greenville, South Carolina

Spot market rates from Nashville to Greenville are up 4 cents since the start of the month to $3.40 a mile — 75 cents above the national average — and as rejection rates rise out of Nashville these rates will only continue to increase.

The Greenville market recovered from a volume drop in late September, and volumes are 14.5% higher than they were on Oct. 10. Inbound capacity levels are currently trending downward, so keep eyes open for anything entering the market. There should be plenty of loads to choose from on the way out.