The highlights from Tuesday’s SONAR reports. For more information on SONAR — the fastest freight-forecasting platform in the industry — or to request a demo, click here. Also, be sure to check out the latest SONAR update, TRAC — the freshest spot rate data in the industry.

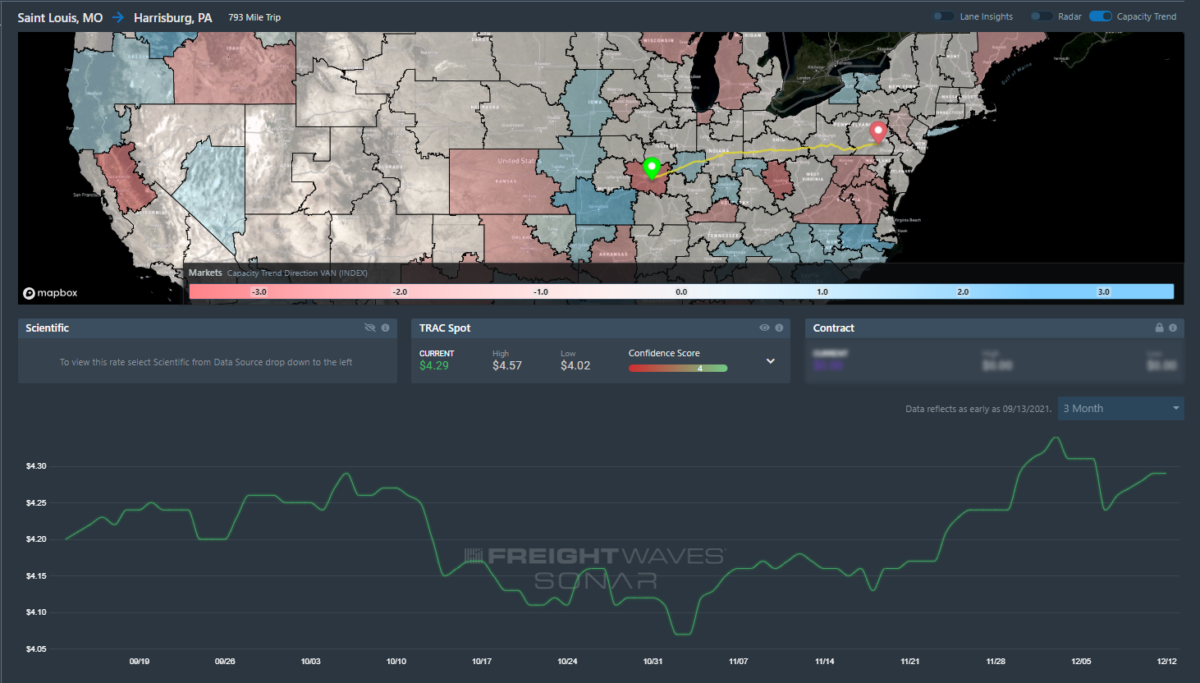

Lane to watch: St. Louis to Harrisburg (Pa.)

Overview: St. Louis rejection rates move back over 20%.

Highlights:

- St. Louis’ outbound rejection rate has increased over two percentage points in less than a week, moving from near 18% to 20.5%.

- Spot rates from St. Louis to Harrisbrug are maintaining near-peak levels after a brief dip, hovering around $4.30 per mile according to FreightWaves TRAC rates.

- Harrisburg’s outbound rejection rate has hovered around 20.3% over the past few days and appears to be stabilizing over the past two months.

What does this mean for you?

Brokers: Increase the priority for finding coverage out of St. Louis. Give loads moving into the Northeast the most attention, paying special attention to anything moving less than $4 per mile. Spot rates may have hit a ceiling for the moment, but carriers may push that limit toward the end of the week.

Carriers: Expect increasing spot market activity in this lane. Most spot loads are moving for more than $4 per mile, but the Northeast is still a heavy inbound and short-haul region. It will become more difficult to find a load out of the region closer to the holiday.

Shippers: Watch for compliance slippage in this lane this week. If your contract rates are over $4 per mile you should have better than 80% compliance at a minimum. Carrier availability will start to shrink later in the week, however. Be prepared to pay a premium for any urgent freight at that point.

Watch: Shipper Update

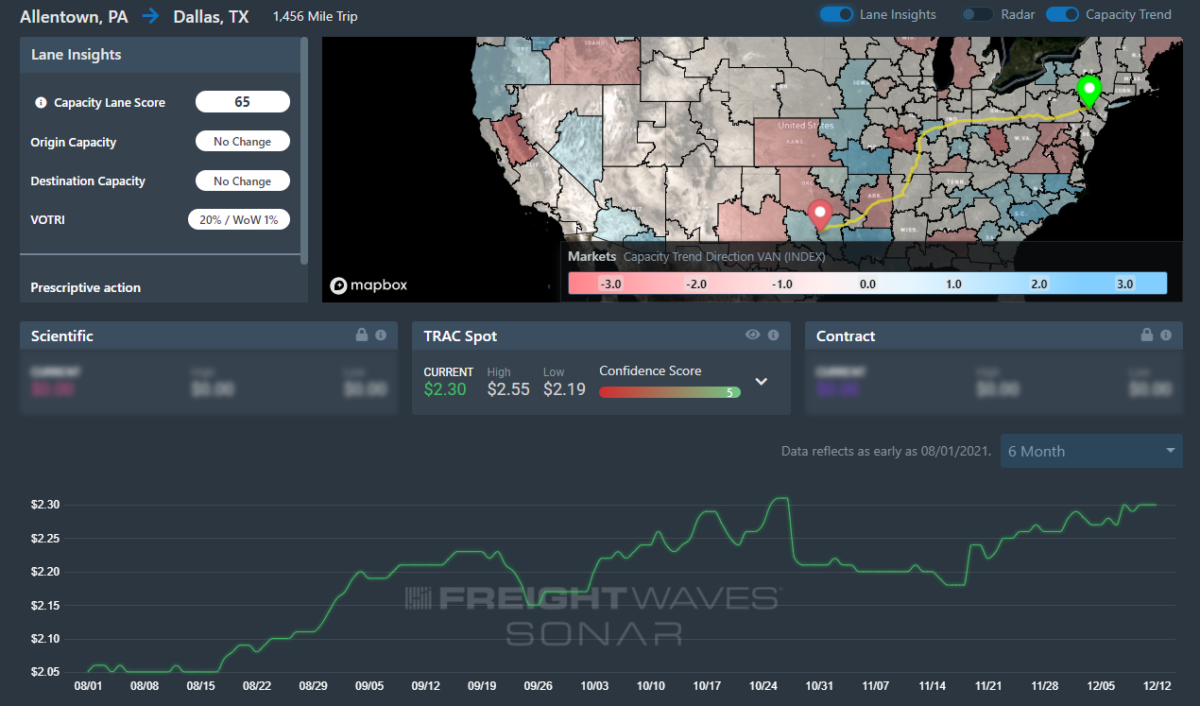

Lane to watch: Allentown (Pa.) to Dallas

Overview: An accelerating volume imbalance in Allentown makes covering loads headed to Dallas more difficult.

Highlights:

- The Allentown Headhaul Index is up 25% w/w, signaling that capacity will tighten in the coming days as the imbalance of outbound and inbound freight grows.

- Spot rates on this lane have increased by 5% over the past month. They are currently sitting at $2.30/mi according to FreightWaves TRAC spot rates.

- Volumes out Allentown increased by 3.6% w/w, while rejections are up just 14 basis points (bps), signaling that there is more freight moving out of the market.

What does this mean for you?

Brokers: Capacity has yet to tighten relative to the change in load balance in the Allentown market. Securing capacity out of Allentown will become more difficult in the coming days; adjust prices accordingly.

Carriers: Spot rates along this lane continue to hover at the highest they have been in the last six months. With the accelerating load volume imbalance, expect more freight to fall through into the spot market. Take advantage of getting out of the Allentown market ahead of the holidays, when securing an outbound load will be more difficult.

Shippers: Securing the necessary capacity will be increasingly difficult throughout the week. Lead times are already above 3 days, but with the load imbalance, expect to push tenders out even further in advance to secure the necessary capacity. Don’t be surprised if rates continue to climb this week.

Watch: Carrier Update

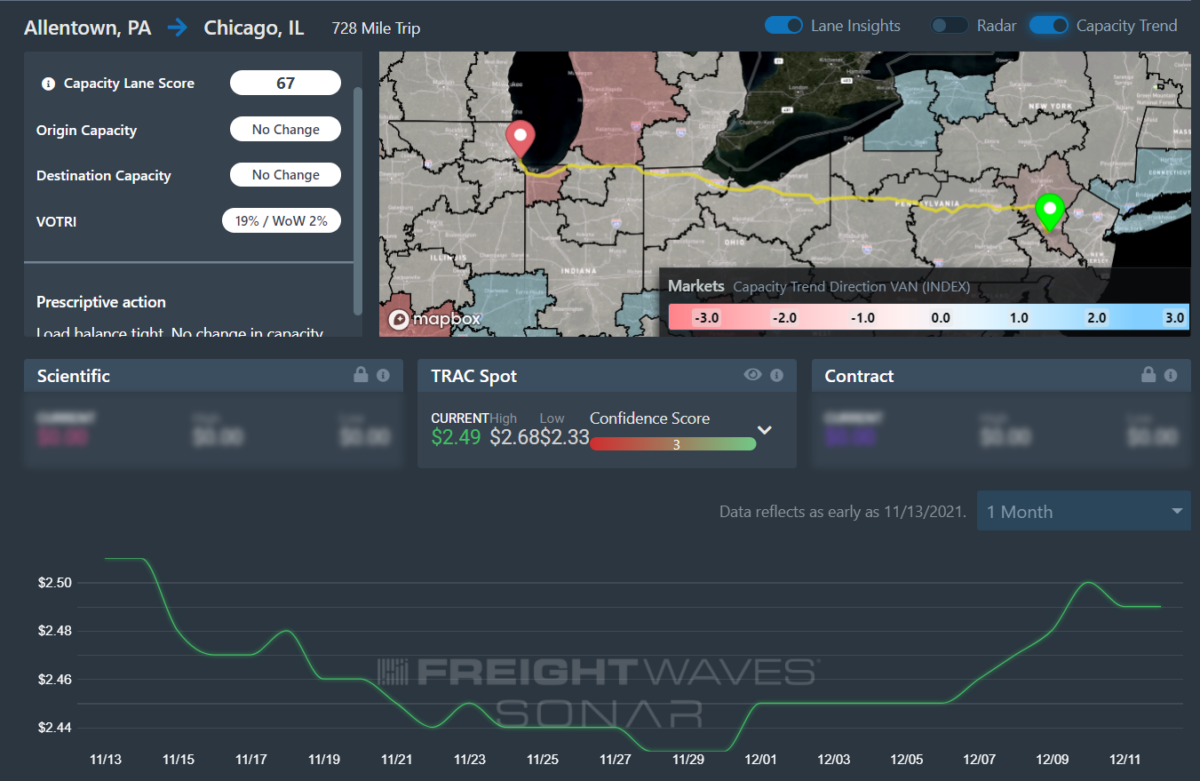

Lane to watch: Allentown (Pa.) to Chicago

Overview: Capacity should loosen after outbound volumes drop 2.7% w/w.

Highlights:

- Allentown outbound tender volumes are up 3% w/w, signaling that demand for outbound capacity has increased slightly w/w.

- The Headhaul Index in Allentown is up 25% w/w, signaling that capacity is likely to tighten due to a growing imbalance between inbound and outbound volumes.

- Allentown outbound tender rejections are relatively flat w/w, but due to the growing imbalance in volumes, rejections are expected to rise in the days ahead.

What does this mean for you?

Brokers: Allentown outbound capacity has considerable room to tighten further, and rejections are likely to increase through the remainder of 2021. Be sure to keep an eye on outbound tender rejections because that will be one of the best proxies for a significant tightening in the market. Rejections are relatively flat w/w, but be sure to take note of the growing imbalance in volumes and its potential impact on capacity via the Headhaul Index, which is already up 25% w/w.

Carriers: Allentown pricing power is shifting even further in your favor as the large surge of over 25% in the Headhaul Index is likely to cause a significant tightening of capacity in the days ahead. With spot rates already about to breach their highest point in a month, spot rates are likely to hit a new monthly high in the coming days.

Shippers: Your shipper cohorts in Allentown are averaging 3.1 days in tender lead times, but it is highly recommended to push those out closer to 4 days if possible to prepare for tightening conditions. With spot rates expected to move higher in the coming days, pushing your lead times further out will help alleviate some of the upward pressure being put on these spot rates.

Yolande

●▬▬▬▬ ✹ 𝐒𝐭𝐚𝐲 𝐀𝐭 𝐇𝐨𝐦𝐞&𝐖𝐨𝐫𝐤 𝐀𝐭 𝐇𝐨𝐦𝐞 ✹ ▬▬▬▬●

[ JOIN US] I get paid more than 💵$90 to 💵$120 per hour for working online. I heard about this job 3 months ago and after joining this I have earned easily 💵$10k from this without having online working skills . Simply give it a shot on the accompanying site…

Here is I started.……GOOD LUCK…>> http://Www.NETCASH1.Com

Frances

A few months ago . I was like a Beggar asking everyone for money and shelter, but a really nice man introduced me to the best on-line work . This work needs no special skills . Now I am able to earn $406/day and $12k/month easy and non-stoppable money . It helps lots financially .Everybody must try this by just using the info on this page.

▬▬▬▬► http://Www.PAYCASH1.com