This week’s FreightWaves Supply Chain Pricing Power Index: 35 (Shippers)

Last week’s FreightWaves Supply Chain Pricing Power Index: 35 (Shippers)

Three-month FreightWaves Supply Chain Pricing Power Index Outlook: 35 (Shippers)

The FreightWaves Supply Chain Pricing Power Index uses the analytics and data in FreightWaves SONAR to analyze the market and estimate the negotiating power for rates between shippers and carriers.

This week’s Pricing Power Index is based on the following indicators:

Volumes shake off sluggish start in August

The sluggish start to August appears to be just a bump in the road. Volumes have started to recover as the halfway point of the month has now passed. If tender volumes are able to maintain the momentum found over the past week through Labor Day, it sets up a much stronger fourth quarter than last year. One of the key concerns remains the consumer: Despite a strong retail sales report, retail earnings have shown some level of weakness year over year, with the exception of Walmart.

To learn more about FreightWaves SONAR, click here.

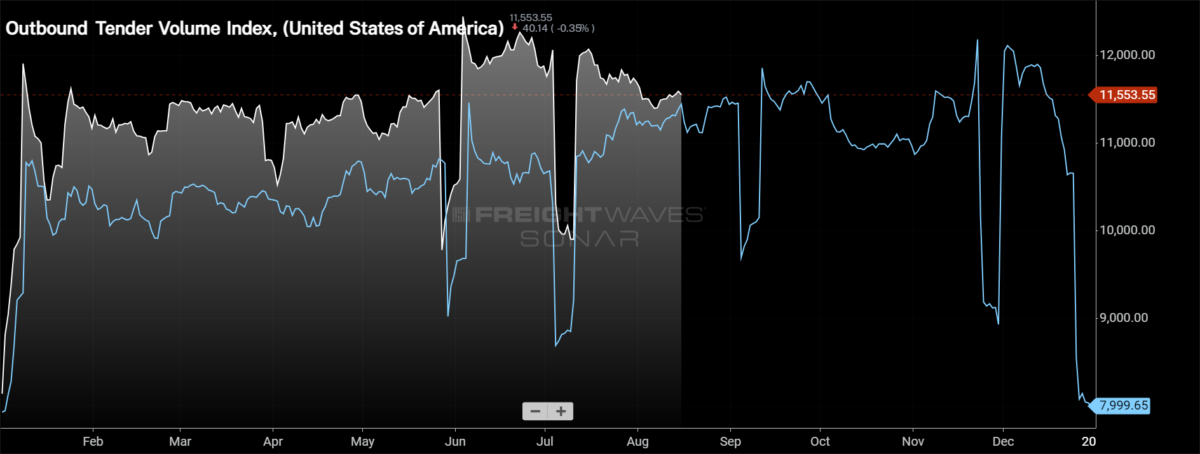

The Outbound Tender Volume Index, a measure of national freight demand that tracks shippers’ requests for trucking capacity, is 0.55% higher week over week, as the market recovers from the sluggish start. The gap with year-ago levels did widen with the weekly growth, now 3.86% higher year over year.

To learn more about FreightWaves SONAR, click here.

Contract Load Accepted Volume (CLAV) is an index that measures accepted load volumes moving under contracted agreements. In short, it is similar to OTVI but without the rejected tenders. Looking at accepted tender volumes, we see an increase of 0.63% w/w, a slight increase from last week’s reading and 3.37% higher year over year.

July’s retail sales figures surprised to the upside, coming in at up 1% m/m compared to the expectations of a 0.3% increase. Total retail sales were 2.7% higher year over year in July, boosted by electronic and appliance store sales that were up 1.6% m/m and 5.2% y/y.

Bank of America’s credit card spending report for the week ending Aug. 10 showed that total card spending was down 1% y/y. Many of the categories that have pulled the spending lower in this report remained negative on a y/y basis. Online retail did see a reversal over the past week, rising 1.6% y/y.

To learn more about FreightWaves SONAR, click here.

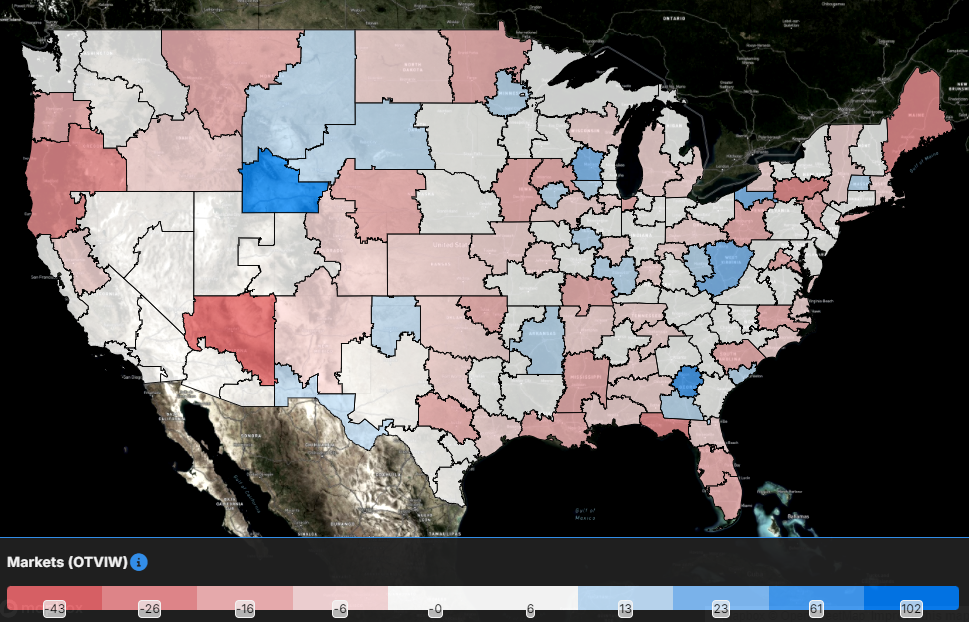

With the half-percent increase in tender volumes on a national level, 75 of the 135 freight markets within SONAR reported higher volumes w/w.

Despite being shaded in white in the map above, the Southern California market of Ontario continues to see volume growth. Ontario tender volumes increased by over 2% in the past week. The growth was once again driven by shorter lengths of haul, but the increase in volumes will eventually flow into the rest of the country. The question at the moment is, when is that going to occur?

Elsewhere, tender volumes in both Dallas and Atlanta increased over the past week as the largest markets in the country continue to flex their muscles. Volumes out of the Dallas market increased by 1.14% w/w while volumes out of Atlanta increased by 3.35%.

To learn more about FreightWaves SONAR, click here.

By mode: The dry van market outperformed the overall market as volumes are still elevated compared to where they have been for much of the year. Over the past week, the Van Outbound Tender Volume Index increased by 1.49% , the largest weekly increase in volumes excluding holiday-impacted weeks since the middle of June. Dry van volumes are running 3.41% higher than they were at this time last year.

The reefer market continues to shine as volume growth during the middle of August has been impressive. The Reefer Outbound Tender Volume Index increased by 3.05% over the past week as the reefer market continues to show signs of life. Reefer volumes are up 1.12% year over year.

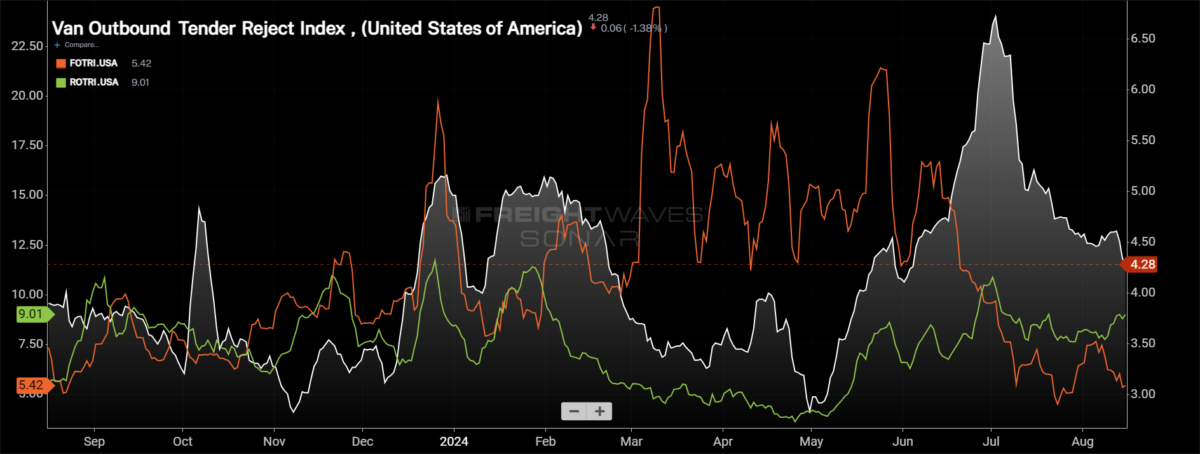

Rejection rates continue to inch lower

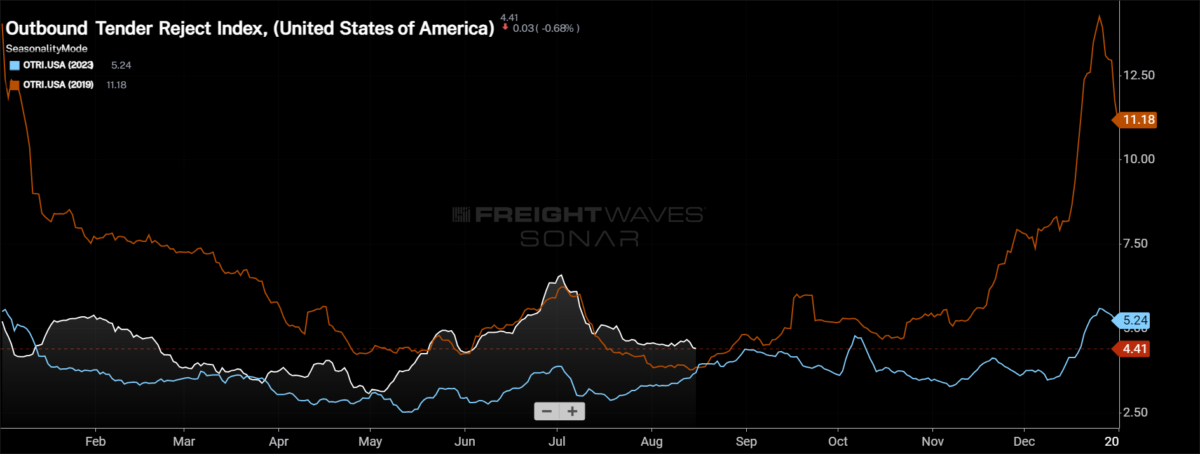

While capacity continues to exit the market, tender rejection rates have really started to stall the declines around the 4.5% mark. Tender rejection rates are continuing to track above 2019 levels. If those rates are able to move above the Fourth of July holiday highs in the coming weeks, specifically around the Labor Day holiday, it will signal that the capacity situation in the fourth quarter could be far more challenging than it has been in the past two years.

To learn more about FreightWaves SONAR, click here.

Over the past week, the Outbound Tender Reject Index (OTRI), which measures relative capacity in the market, was fairly stable, falling by just 8 basis points to 4.41%. Tender rejection rates were moving higher at this point last year, but even so, the OTRI is up 45 bps y/y. Rejection rates are 55 bps higher than they were at this time in 2019.

To learn more about FreightWaves SONAR, click here.

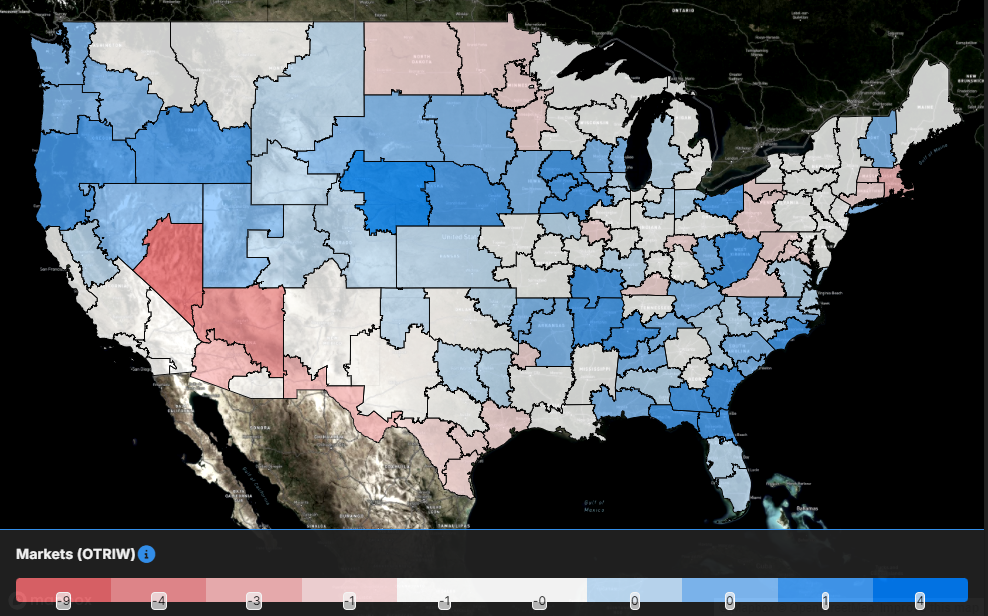

The map above shows the Outbound Tender Reject Index — Weekly Change for the 135 markets across the country. Markets shaded in blue are those where tender rejection rates have increased over the past week, while those in red have seen rejection rates decline. The bolder the color, the more significant the change.

Of the 135 markets, 69 reported higher rejection rates over the past week, an increase from 53 in last week’s report.

The Southeast dominated the rejection rate increases over the past week as rejection rates in Savannah, Georgia, and Jacksonville, Florida, both increased over 200 basis points week over week.

The Northeast remains well supplied as tender rejection rates in the region were largely lower w/w. Harrisburg, Pennsylvania, the largest freight market in the region, saw rejection rates decline by 63 basis points w/w.

To learn more about FreightWaves SONAR, click here.

By mode: Dry van rejection rates have been trending lower since the Fourth of July and continued to trend lower this week. The Van Outbound Tender Reject Index fell by 24 bps over the past week to 4.28%, the lowest level since June 4. Van rejection rates are continuing to track slightly above where they were at this time last year, currently up 39 bps y/y.

The reefer market is still shining through as rejection rates have continued to move higher throughout August. The Reefer Outbound Tender Reject Index increased by 126 basis points over the past week to 9.01%, the highest level since July 5. Reefer rejection rates are currently 329 bps higher than they were at this time last year as they continue to shake off the lull from earlier in the year.

The flatbed market still faces pressure as the industrial sector of the economy continues to lag the consumer side of the economy. The Flatbed Outbound Tender Reject Index fell by 151 basis points over the past week to 5.42% as it approaches the lowest level of the year. Flatbed rejections are 135 basis points lower than they were at this time last year, highlighting the lack of activity in the space.

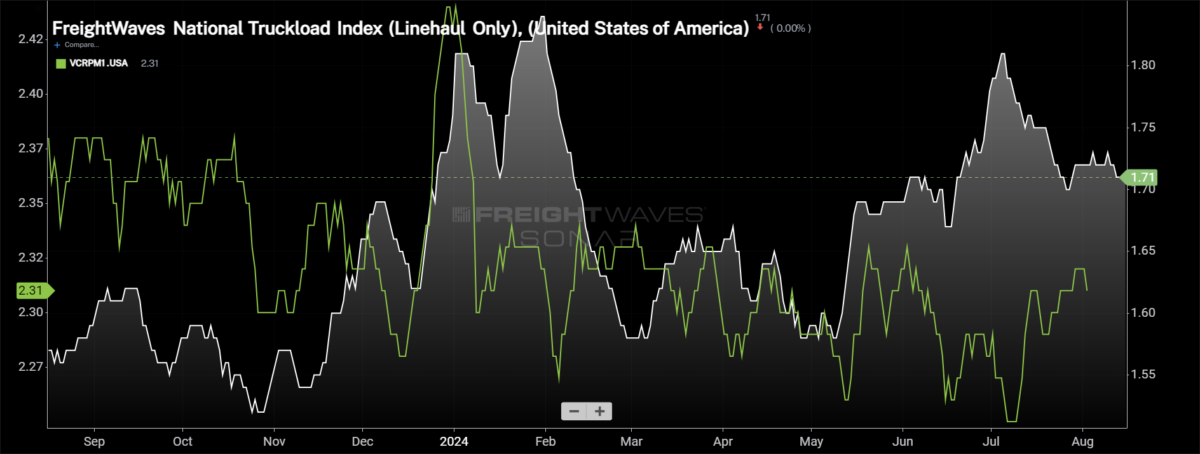

Spot rates stable, contract rates seemingly range-bound

With there being limited change in rejection rates since the beginning of the month, spot rates have been fairly stable throughout August. At the same time, contract rates have moved back into the range where they have spent most of the year. With spot rates remaining stable around Memorial Day levels, if rejection rates move meaningfully higher into the Labor Day holiday, it could create a Fourth of July-like boost to spot rates.

To learn more about FreightWaves SONAR, click here.

This week, the National Truckload Index — which includes fuel surcharge and various accessorials — fell by 2 cents per mile from the week prior at $2.29 per mile. Compared to this time last year, the NTI is up 6 cents per mile (2.7%). The linehaul variant of the NTI (NTIL) — which excludes fuel surcharges and other accessorials — was down 1 cent per mile this week at $1.71. The NTIL is 14 cents per mile higher than it was at this time last year, a positive sign for carriers that have been able to withstand the market challenges of the past two years.

Initially reported dry van contract rates continue to be in a fairly tight range, remaining unchanged over the past week at $2.31. Throughout 2024, contract rates have been in the tight range, an indication that the extreme cost savings are in the rearview mirror and service is now coming to the forefront. Initially reported contract rates are down 5 cents per mile from this time last year, about a 2% decline.

To learn more about FreightWaves SONAR, click here.

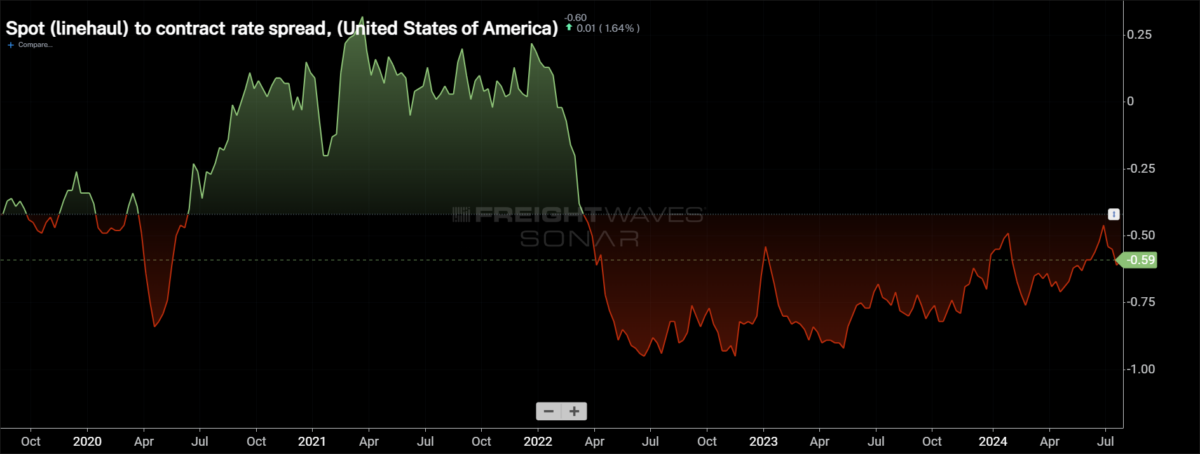

The chart above shows the spread between the NTIL and dry van contract rates is trending back to pre-pandemic levels. The spread has widened again as contract rates have moved higher in recent weeks. If the spot rates move higher into the Labor Day holiday, it will create a spread that is comparable to that of the final months of 2019.

To learn more about FreightWaves TRAC, click here.

The FreightWaves Trusted Rate Assessment Consortium spot rate from Los Angeles to Dallas fell by 4 cents per mile over the past week to $2.28 per mile.

To learn more about FreightWaves TRAC, click here.

From Chicago to Atlanta, the TRAC rate experienced a slight upward move to start August. It rose by 3 cents per mile to $2.43, the highest level since March 18. The spot rate on this lane is still 32 cents per mile below the contract rate.