This week’s FreightWaves Supply Chain Pricing Power Index: 35 (Shippers)

Last week’s FreightWaves Supply Chain Pricing Power Index: 35 (Shippers)

Three-month FreightWaves Supply Chain Pricing Power Index Outlook: 35 (Shippers)

The FreightWaves Supply Chain Pricing Power Index uses the analytics and data in FreightWaves SONAR to analyze the market and estimate the negotiating power for rates between shippers and carriers.

This week’s Pricing Power Index is based on the following indicators:

Volumes continue to retreat from summer highs

Freight volumes have gotten off to a sluggish start in August, but that is to be expected as tender volumes tend to fall during the first half of the month. Import levels, especially on the West Coast, remain well above where they were a year ago, which has translated into strong volume growth in the shortest lengths of haul. Eventually that freight will enter the broader market, setting up for a stronger fourth quarter, especially on a year-over-year perspective.

To learn more about FreightWaves SONAR, click here.

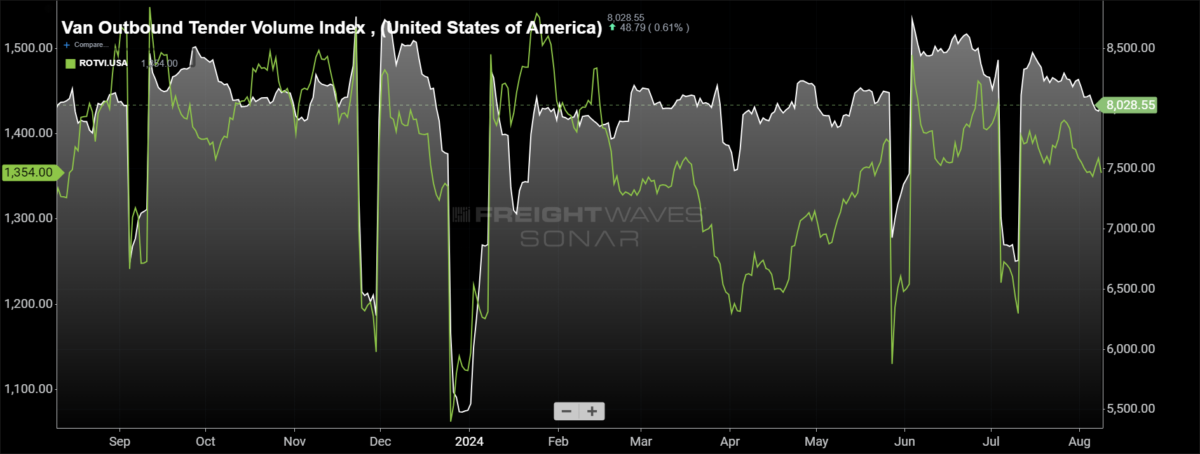

The Outbound Tender Volume Index, a measure of national freight demand that tracks shippers’ requests for trucking capacity, is 1.24% lower week over week, highlighting the sluggish start to the month. The next week is important as it sets the stage for the Labor Day holiday. Volumes in each of the past three years have built from the middle of August through the holiday. Tender volumes are 1.87% higher than they were this time last year, but again the growth is being driven by loads moving under 100 miles, which are up nearly 25% y/y.

To learn more about FreightWaves SONAR, click here.

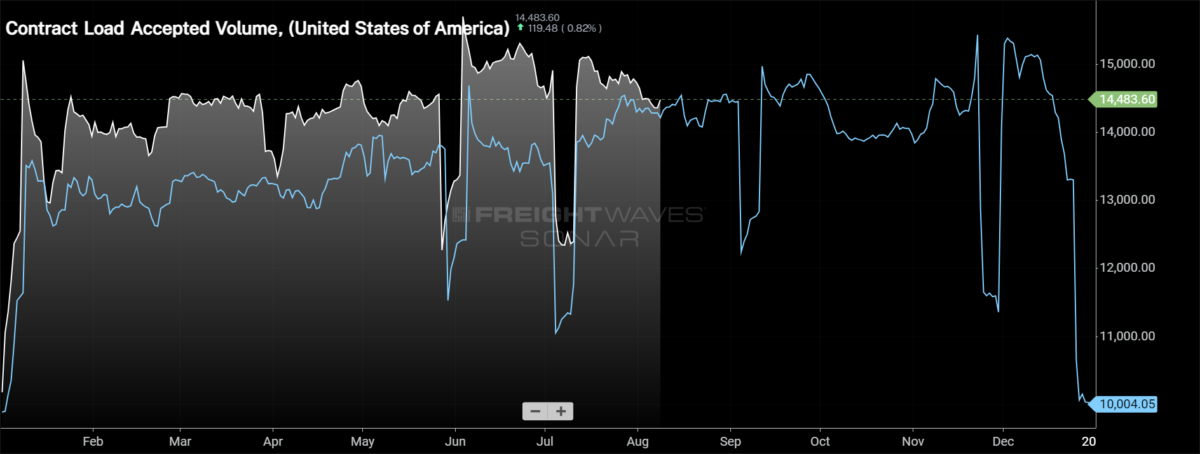

Contract Load Accepted Volume (CLAV) is an index that measures accepted load volumes moving under contracted agreements. In short, it is similar to OTVI but without the rejected tenders. Looking at accepted tender volumes, we see a decrease of 1.15% w/w, a slight deterioration from last week’s reading, when CLAV was down 0.47% w/w. At present, CLAV is 0.78% higher than it was a year ago.

Interest rate cuts are on the horizon at the Federal Open Market Committee’s Sept. 17-18 meeting, which could be a needed boost to the industrial side of the economy.

Consumer spending has taken a hit to start the month as well. According to Bank of America’s card spending report, total card spending fell by 1.7% year over year for the week ending Aug. 3. Overall spending continues to be pulled lower by furniture, home improvement and entertainment spending.

To learn more about FreightWaves SONAR, click here.

Despite the weekly decline in overall tender volumes, half of the freight market actually experienced increases in tender volumes. Of the 135 freight markets within SONAR, 68 had higher volumes week over week.

Atlanta finally saw a slight uptick in tender volumes over the past week, rising 3.55%. Volumes in the market are still lower year over year, down 2.13% y/y. The growth in the past week in the Atlanta market stems from the reefer market as volumes increased by 12.67% w/w.

Elsewhere, many of the largest markets saw volumes decline w/w. Ontario, California, volumes have fallen by over 7% in the past week, but tender volumes for shipments moving less than 100 miles have increased by 1.55% w/w, indicating that volumes flowing into Southern California ports are being moved into warehouses rather than across the country.

To learn more about FreightWaves SONAR, click here.

By mode: The dry van market has faced a more difficult challenge to start August as van tender volumes have trended lower since early June. The Van Outbound Tender Volume Index fell by 1.8% over the past week, to the lowest level, excluding the Memorial Day and Fourth of July holidays, since May 13. With the decline w/w, van volumes have turned negative on a y/y basis, down 0.05% y/y.

After closing out July with a little positive momentum, the reefer market has largely seen that wiped out to start August. Over the past week, the Reefer Outbound Tender Volume Index has fallen by 0.92%. Unlike the dry van market, the reefer market continues to hold on to annual gains, currently 1.35% higher year over year.

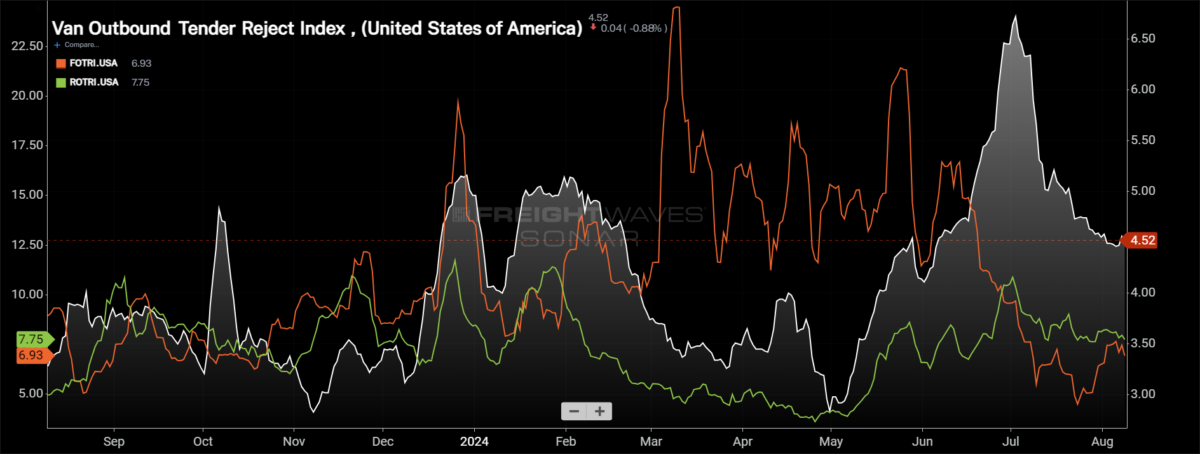

Rejection rates seeing slight decline week over week

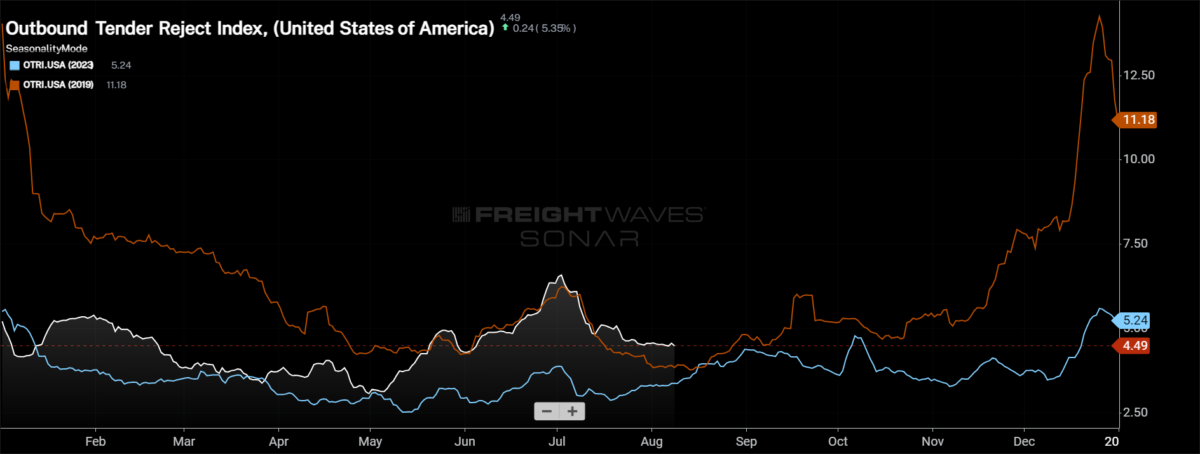

Capacity is continuing to exit the market as rejection rates have moved higher over the past year. Rejection rates have continued to flatten out in August, with very little change during the first week of the month. The next two weeks are going to highlight how fragile the freight market is. If rejection rates find a peak higher than the Fourth of July around the Labor Day holiday, it will be an important signal for how the capacity situation will play out in the fourth quarter.

To learn more about FreightWaves SONAR, click here.

Over the past week, the Outbound Tender Reject Index (OTRI), which measures relative capacity in the market, was fairly stable, falling by just 9 basis points to 4.49%. Tender rejection rates were moving higher at this point last year, but even so, the OTRI is up 111 bps y/y. Rejection rates are 64 bps higher than they were this time in 2019, widening the gap in recent weeks.

To learn more about FreightWaves SONAR, click here.

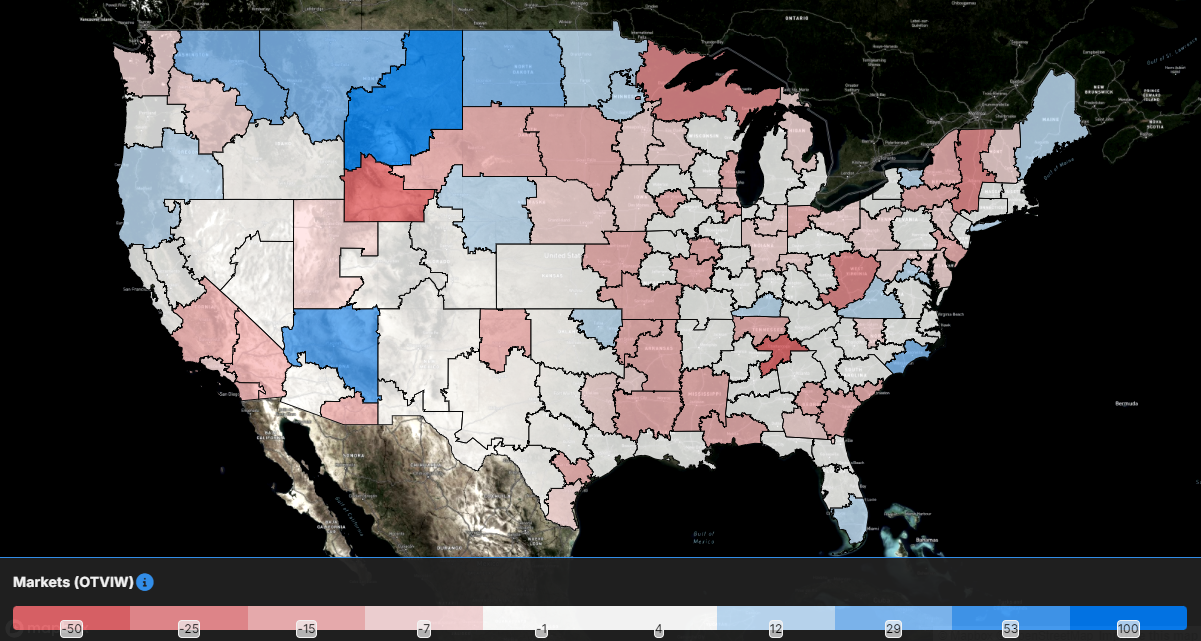

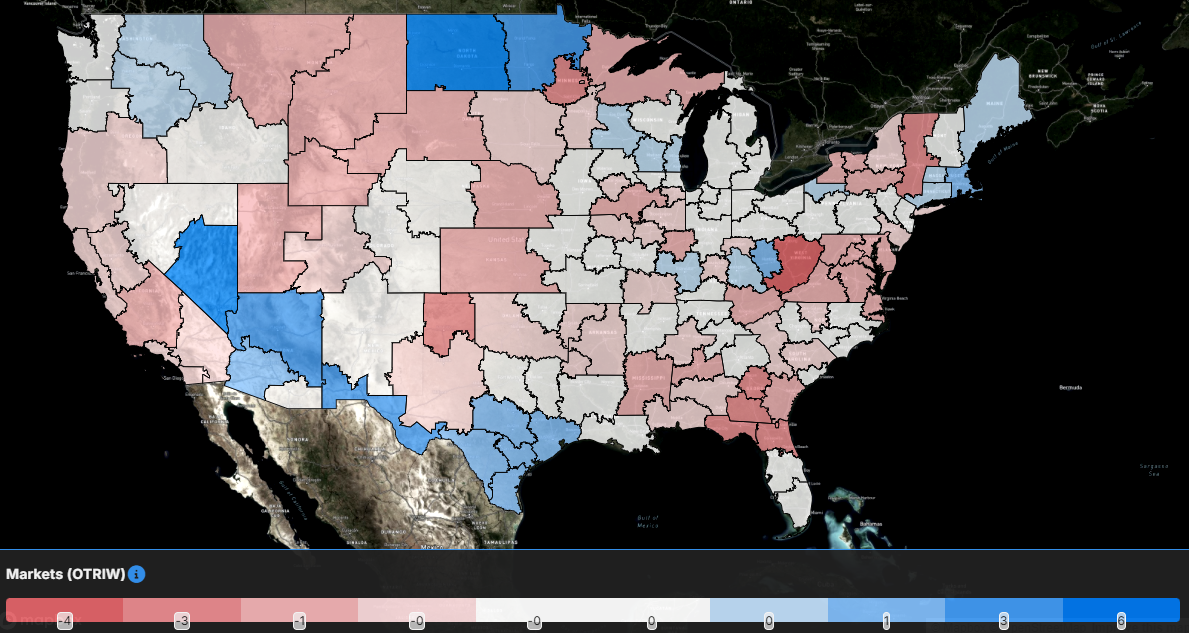

The map above shows the Outbound Tender Reject Index — Weekly Change for the 135 markets across the country. Markets shaded in blue are those where tender rejection rates have increased over the past week, while those in red have seen rejection rates decline. The bolder the color, the more significant the change.

Of the 135 markets, 53 reported higher rejection rates over the past week, falling from the 67 that reported increases last week.

Many of the largest markets in the country saw rejection rates decline over the past week, including the Southern California markets of Ontario and Los Angeles. Rejection rates in those markets fell by 97 bps and 96 bps, respectively, despite a relatively strong increase in reefer rejection rates.

The Houston market remains volatile as tender rejection rates in the market jumped by 249 bps w/w, one of the strongest increases across the country.

To learn more about FreightWaves SONAR, click here.

By mode: The dry van market saw tender rejection rates drop to start the week before bouncing back to close out the week. Even with the slight bounce back, the Van Outbound Tender Reject Index is down 6 bps w/w. Van rejection rates are 117 basis points higher than they were this time last year, a gap that has been above 100 bps y/y since early May.

Reefer rejection rates have declined slightly to start the month, but there are areas of the country where the market is experiencing capacity constraints. The Reefer Outbound Tender Reject Index fell by 48 bps w/w on a national level to 7.75%, but in the Southern California market of Ontario, reefer rejection rates jumped 580 bps w/w. Reefer rejection rates are 276 basis points higher than they were this time last year.

Flatbed tender rejection rates remain under pressure as the industrial side of the economy faces challenges until interest rate cuts are announced. Even once announced, it will take some time for the dry powder that has been on the sidelines to enter the market. The result: the Flatbed Outbound Tender Reject Index increased by 36 basis points over the past week to 6.93%, but rejections are down 214 bps y/y, the only equipment type with lower rejection rates.

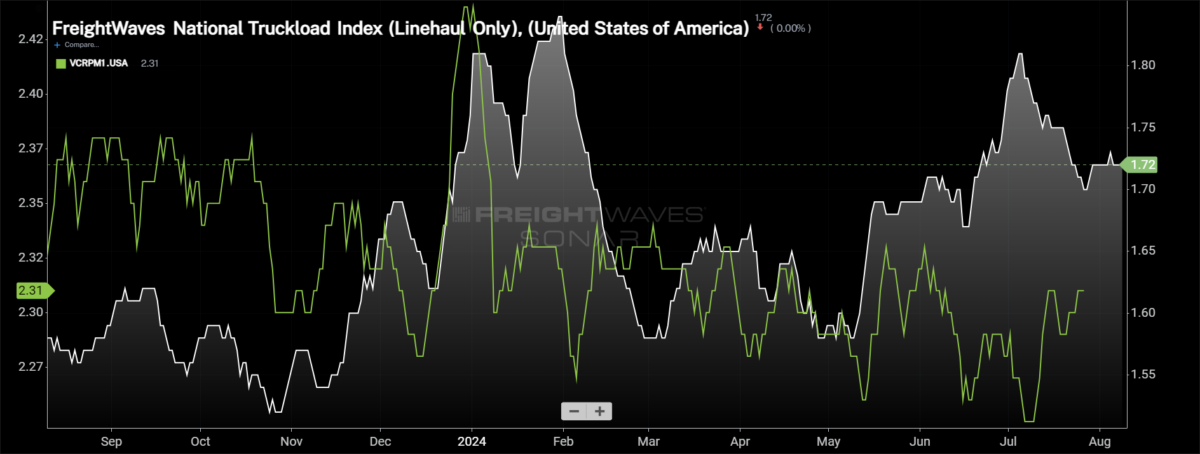

Spot rates stable to start August

Spot rates continue to hold stable in August, a positive sign for the market as the gains from the Fourth of July weren’t immediately given back. As with volumes and rejection rates, eyes are now on the momentum established heading into Labor Day as a barometer for how the fourth quarter will play out.

To learn more about FreightWaves SONAR, click here.

This week, the National Truckload Index — which includes fuel surcharge and various accessorials — was unchanged from the week prior at $2.31 per mile. Compared to this time last year, the NTI is up 7 cents per mile (or 3.1%). The linehaul variant of the NTI (NTIL) — which excludes fuel surcharges and other accessorials — was also unchanged this week at $1.72 per mile. The NTIL is 13 cents per mile higher than it was this time last year, a positive sign for carriers that have been able to withstand the market challenges of the past two years.

Initially reported dry van contract rates continue to be in a fairly tight range, increasing 2 cents per mile over the past week to $2.31. Throughout 2024, contract rates have been in the tight range, an indication that the extreme cost savings is in the rearview mirror and service is now coming to the forefront. Initially reported contract rates are down 5 cents per mile from this time last year, about a 2% decline.

To learn more about FreightWaves SONAR, click here.

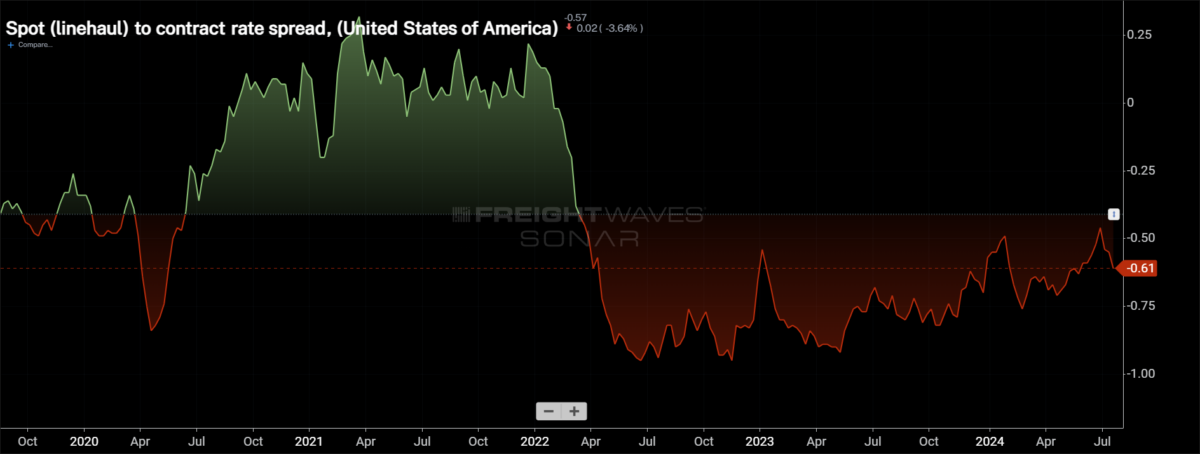

The chart above shows the spread between the NTIL and dry van contract rates is trending back to pre-pandemic levels. The spread has widened once again as contract rates have moved higher in recent weeks. If the spot rates move higher into the Labor Day holiday, it will create a spread that is comparable to how it was in the final months of 2019.

To learn more about FreightWaves TRAC, click here.

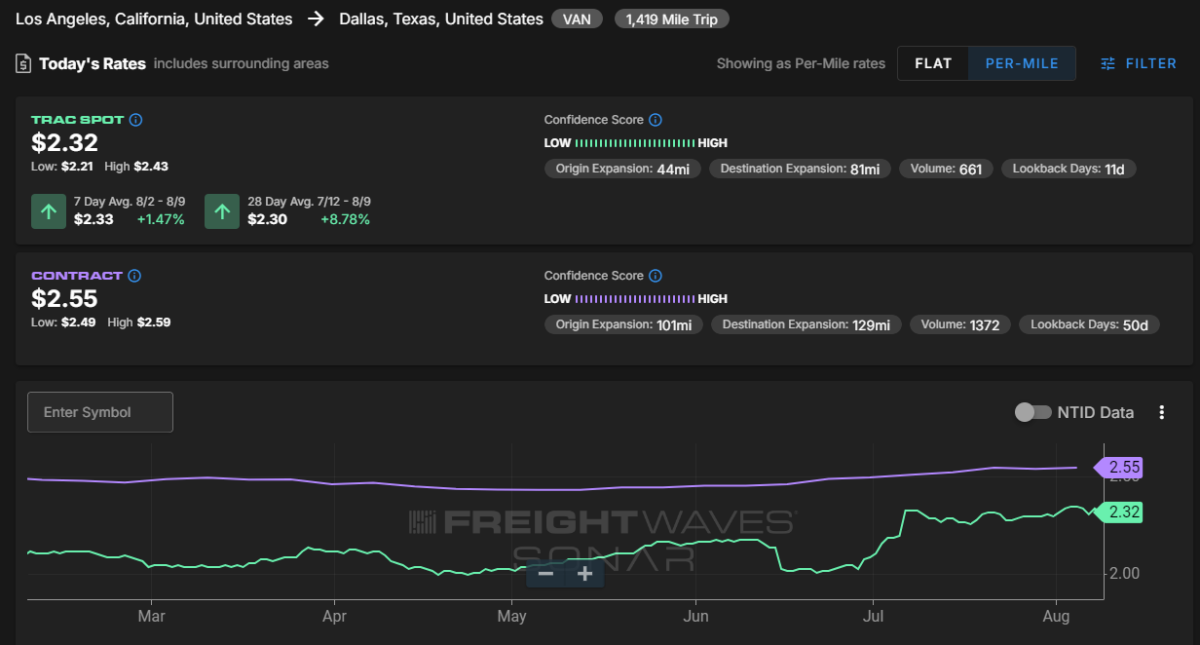

The FreightWaves Trusted Rate Assessment Consortium spot rate from Los Angeles to Dallas was unchanged this week at $2.32 per mile.

To learn more about FreightWaves TRAC, click here.

From Chicago to Atlanta, the TRAC rate experienced a slight upward move to start August. The TRAC rate from Chicago to Atlanta rose by 1 cent per mile to $2.40 per mile, the highest level since April 18. The spot rate on this lane is still 33 cents per mile below the contract rate.