With little indication of a freight market turnaround showing up in any data set, two FreightWaves executives who also wear the hat of market experts faced a question during their most recent “State of Freight” webinar.

“What should a small carrier do to survive?” FreightWaves CEO Craig Fuller and SONAR market expert Zach Strickland were asked Tuesday during the monthly webinar.

Their answer and their discussion of four other topics are below.

Staying alive

“The smallest carriers are the most vulnerable,” Fuller said. “They have the least relationships with the shippers, the highest cost of fuel and operating expenses.”

He said a key to surviving those conditions is to “keep the wheels running.” Instead of shooting for high rates in less-traveled lanes that have the potential for a significant payoff, it’s wise to focus activity on an area like Atlanta that gives a driver “more optionality,” Fuller said.

“High-dollar can cost you,” he added. “It’s high maintenance at the same time.”

Is the market dull?

“Capacity and the market itself has been very boring over the last little bit,” Fuller said. “I don’t want to understate it.” Volatility has been largely absent from the market.

There are “a lot of truckers bored, sitting around not hauling freight,” he said. “Boring can be a good thing” if a market is stable and healthy, but that is not currently the case, Fuller said, leading to an observation that during the height of the pandemic, there was a feeling that capacity was “super tight.”

But it wasn’t, Fuller said, and that leads to takeaway No. 3:

Capacity is still excessive

Fuller noted that the drop-off in truck production due to supply chain issues at OEMs was a factor in the view that capacity was tight for much of 2022, but that it was overstated as a cause. “A lot of people got caught up in the lack of new production because it created an artificial restriction to capacity expansion,” he said. But the true capacity constraint comes from drivers, because as he said, “OEMs can produce trucks.” Additionally, trucking fleets held on to existing vehicles longer to help provide capacity.

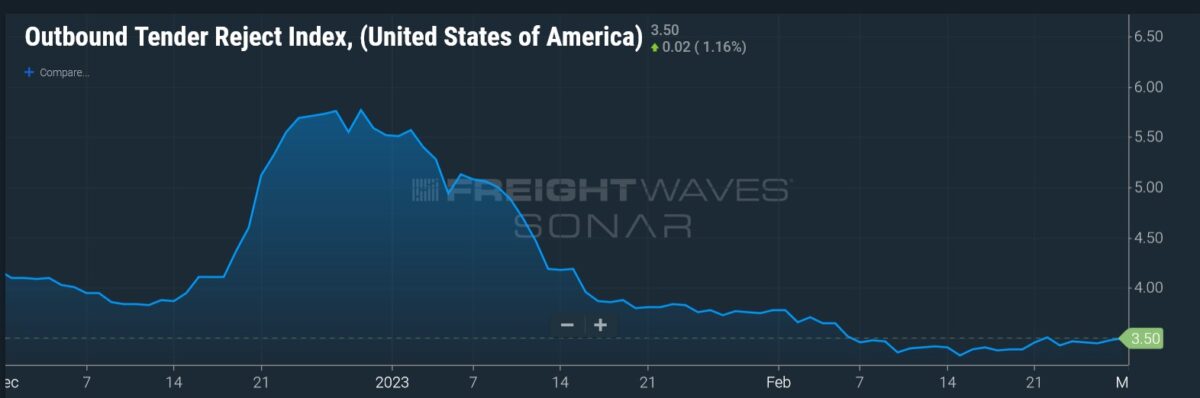

But all the data that measures capacity was pointing to, and continues to point to, plenty of capacity that came into the market through 2022 and has not exited during the tougher times. “When we see a market where volumes have flatlined, that would normally indicate we have a stable market,” Fuller said, noting data in the Outbound Tender Volume Index (OTVI) of SONAR. But the current levels in the Outbound Tender Reject Index (OTRI), languishing at less than 4% since mid-January, reflect the fact that capacity is still excessive in the market. Volumes as measured by the OTVI shot up in early January and have held at a relatively stable level since then, yet there was no reaction in the OTRI to that early January spike in volumes, a surge that has not retreated.

“The only way we’re going to lose that capacity is if it burns out because people leave the industry, or the volumes start to pick up,” Fuller said.

Rates aren’t going to budge with overcapacity in the market

Strickland gave a brief description of the OTRI, noting that it is a percentage of freight tenders that are rejected. He said typically the OTRI was 4% to 10% pre-pandemic — it only dates back to 2018 — and that anything above that range would be inflationary for rates and anything below it would be deflationary.

During the height of the pandemic, Strickland said, the OTRI was consistently above 20%.

Fuller said that although the history of the OTRI is only about five years, it’s been long enough to establish a fact about rates: “You’re not going to see a firming of rates until the OTRI starts to tighten.”

And how would it tighten? “You have to have some available dispatch capacity leave the market,” Fuller said. “You either have that or an increase in demand or volume, which we’re not seeing.”

The volatility in rates may be historic

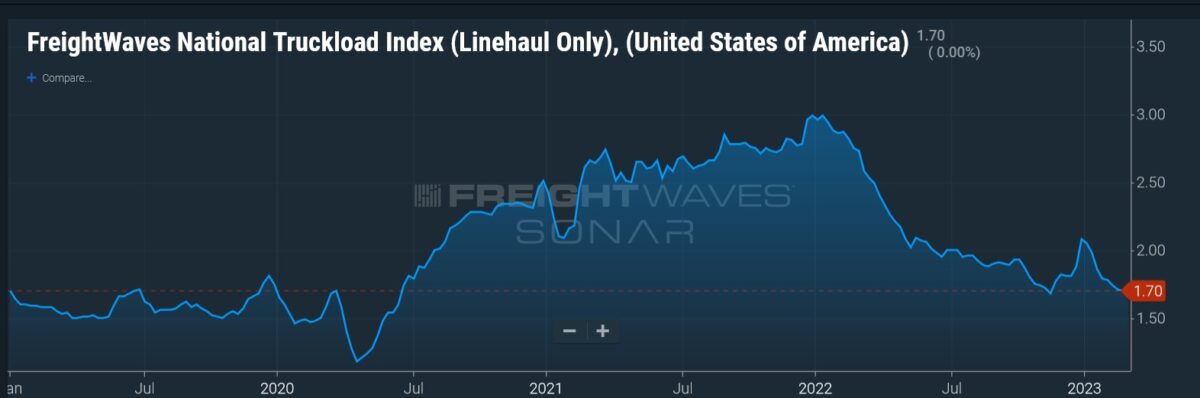

Historical information on spot truckload rates is tough to come by. Fuller said rates collapsed rapidly in 2008 as the financial crisis unfolded, but data on that is not extensive.

Truckload rates as measured by the National Truckload Index (Linehaul Only) in SONAR, or NTIL, have been plummeting, last week reaching $1.70 per mile after starting the year at $2.10. Longer term, NTIL was $2.09 in January 2021 before peaking at just under $3 before Christmas 2021. (The companion index to NTIL is NTI, which includes fuel costs.)

The recent decline in rates led Strickland to wonder if they had ever declined that quickly, to which Fuller responded that it was possible. But he then said it was also the case that the earlier increases recorded in 2021 might have been a record as well.

Those sorts of movements mark what Fuller said has been a series of markets that have “round-tripped,” coming back where they started, and that includes some cost inputs such as acquiring driver capacity. “The risk is that companies that sort of thought the market would be stable, they are now paying the price, and if they think they are going to hold out for a better second half, they may be making the mistake again,” he said.

That’s because, he added, “there is no indication we are going to see a surge in demand, and rates will continue to be under pressure.”

The next webinar will be on March 16 at 2 p.m.

More articles by John Kingston

CARB clear on lack of changes in California Clean Fleets rule

Ascend, ATBS to share data coming off TMS for tax, other services

OOIDA survey points 2 ways on independent truckers’ digital brokerage use

John Q Indentured

For over a year, trucking companies have been told over capitalism in trucking.

Higher cost trucks.

Electronic device add on needed to operate.

Higher cost insurance.

Higher cost maintenance.

The answer is keep taking it up the rear.

Fuel surcharge would have aided trucking rate.

But we all know the shipping rate from the dock is in the price. The shipping doesn’t change up and down week to week.

Example load cost and paid $ 78,000 to ship is already in the paid price. Ship price $5000

Brokerage puts on those tap dancing shoes and

Lies and talks about its a lane. Low balls it for $3000. Pocketing the rest $2000.00.

Brokerage gags the shipper and trucking company to not speak to each other.

Since the Brokerage is conning the industry and allowed to do so.

Talk about double brokered loads.

Load with funds taken off from two or three brokers.

If trucker strike, they are punished.

Canada trucker go fund me account canceled by Canadian president.

Hope is not a effective plan.

Rest in Peace

James Woods — super trucker and friend