The Energy Information Administration’s (EIA) new short-term energy forecast confirms strong demand for 2025 but notes that the balance of supply and demand will shift toward oversupply in the back half of the year and 2026.

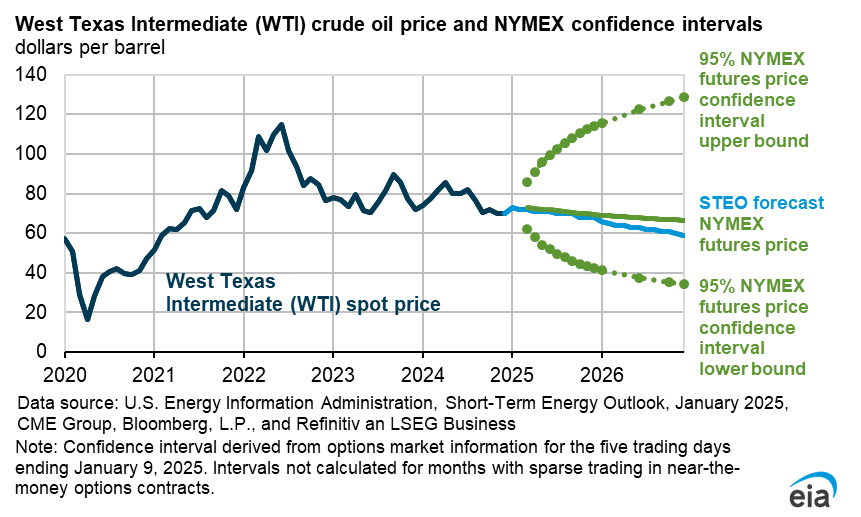

“We expect downward oil price pressures over much of the next two years, as we expect that global oil production will grow more than global oil demand,” the EIA wrote.” We forecast that the Brent crude oil price will average $74 per barrel (b) in 2025, 8% less than in 2024, and then continue to fall another 11% to $66/b in 2026.”

Since the pandemic, the global oil market has navigated a complex landscape shaped by various economic, geopolitical and production-related factors. In 2025, the outlook remains fairly neutral, with projections indicating downward pressure amid relative stability in oil prices despite potential challenges on the horizon.

One of the primary demand-side factors influencing the oil market has been China’s sustained economic growth. As the world’s second-largest economy, China’s thirst for oil plays a pivotal role in shaping global oil consumption patterns. The ongoing expansion of China’s industrial sector and its transportation infrastructure have significantly bolstered global oil demand, contributing to the stabilization of oil prices. In 2025, China’s economic trajectory is expected to continue exerting a positive influence on oil demand, pushing global consumption to an estimated 104 million barrels per day (mb/d).

(Chart: EIA)

Geopolitical events, often a source of volatility in the oil markets, are also a key consideration for the 2025 forecast. While the potential for disturbances exists, current projections suggest that these events will not substantially disrupt the overall stability of oil prices. Factors such as international sanctions, particularly those targeting major oil producers like Russia, Iran and Venezuela, have already impacted the market by restricting the flow of crude oil. For instance, U.S. sanctions targeting over 160 tankers associated with these countries have curtailed Iranian crude exports by nearly one-third in 2024. Despite these measures, the global oil market has demonstrated resilience, maintaining a balance between supply and demand that mitigates the impact of such disruptions.

In terms of production, the International Energy Agency (IEA) outlines a robust outlook for both OPEC+ and non-OPEC countries. OPEC+ nations are projected to significantly ramp up their crude oil production, with Saudi Arabia, a leading member, increasing its output from 8.98 mb/d to 12.11 mb/d. Other key players, including Kuwait, Nigeria and the United Arab Emirates, are also expected to boost production levels, collectively contributing to a potential total OPEC+ output of up to 40.67 mb/d. On the non-OPEC side, production is anticipated to grow by 1.5 mb/d in 2025, in line with the previous year, bringing the total non-OPEC production to approximately 15.16 mb/d.

Brent crude futures, a major benchmark for global oil prices, saw a notable increase in mid-January, reaching a four-month high of $81 per barrel (bbl), an $8/bbl rise from the preceding month. Similarly, West Texas Intermediate (WTI) prices have remained robust, reflecting the overall stability projected for the oil market in 2025.

Demand projections reinforce the narrative of a stable oil market. The Organization for Economic Cooperation and Development raised its oil demand estimate for the fourth quarter of 2024 by 250,000 barrels per day (kb/d), signaling a strong rebound in consumption patterns. For the entirety of 2024, global oil demand growth is estimated to be up by 90 kb/d, bringing the total to 940 kb/d. This upward adjustment is a testament to the recovering global economy and the continuous demand from emerging markets, particularly China. The question is whether it will be enough: The IEA expects that gradual oversupply will bring prices down in 2026 and 2027.

The anticipated stability and slight degradation in oil prices has far-reaching implications for U.S. production and industrial activity. $74 per barrel is plenty to yield positive margins in the Pemian Basin. Steady oil prices provide a conducive environment for sustained investment in domestic oil production. U.S. oil producers can plan with greater certainty, leading to potential increases in exploration and drilling activities. This, in turn, supports job creation and economic growth within the energy sector. Additionally, stable oil prices help maintain predictable input costs for industries reliant on petroleum products, fostering an environment of consistent industrial activity and economic stability.

Despite the relatively sanguine outlook, certain challenges could pose risks to the projected stability of the oil market. Geopolitical tensions, while not expected to cause significant disruptions, remain a variable that could influence market dynamics. The effectiveness of U.S. sanctions and their long-term impact on oil exports from targeted nations will be crucial in determining the extent of their influence on global supply. Moreover, any unforeseen economic slowdowns or shifts in energy policies, particularly those aimed at transitioning toward renewable energy sources, could alter demand projections and price stability.

The EIA forecasts the global oil market in 2025 to maintain a steady state, underpinned by robust production capacities and sustained demand driven by China’s economic growth. While geopolitical events and sanctions present potential challenges, the market’s inherent resilience and balanced supply-demand dynamics are expected to uphold price stability. This projected stability not only benefits global economies by ensuring predictable energy costs but also supports industrial activities and domestic production growth, particularly in major oil-consuming nations like the United States.

As the world continues to navigate the complexities of energy demands and geopolitical tensions, the resilience of the oil market will be a critical factor in shaping economic outcomes. The interplay between production increases from OPEC+ and non-OPEC countries, coupled with sustained demand growth, particularly from burgeoning economies, sets the stage for a relatively stable oil landscape in 2025. Stakeholders across the spectrum, from producers to consumers, can look toward a softening yet stable market environment, provided that external disruptions remain managed and global economic growth persists as anticipated.