On the surface, all is well in trucking as a sustained period of high demand outpaces supply, driving rates ever higher. Both less-than-truckload and truckload carriers have more freight than they can handle in what is widely being described as a “carriers’ market.”

But the boom time environment is causing more than just headaches for many carriers. Finding drivers and dockworkers, port congestion, bad weather, rail service issues, and getting equipment stuck at warehouses are some of the obstacles carriers are facing as they try to meet inflated demand and replenish still depleted inventories.

This hot freight market may not be as desirable as it appears from afar, according to Curtis Garrett, VP of pricing and carrier relations at Recon Logistics. Recon is a third-party logistics and transportation management system provider. Garrett’s role in pricing and analytics provides a great view into the operations at many LTL networks across the country.

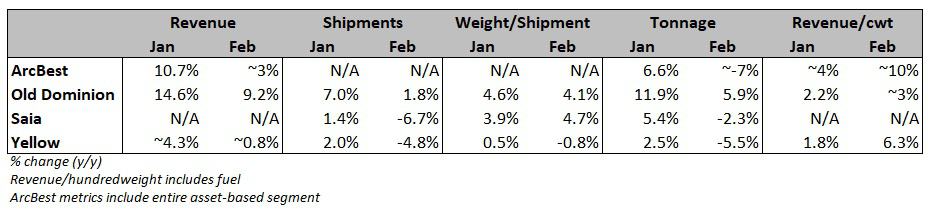

While many of the traditional LTL metrics like tonnage and revenue per hundredweight are rising, excluding the recent winter storms, there is some noise in the numbers as carriers navigate chaotic conditions.

Costs on the rise

Most carriers have seen meaningful margin improvement, posting operating ratios several hundred basis points better year-over-year during the back half of 2020. In an interview with FreightWaves, Garrett said in recent months customer acquisition costs, largely due to a robust freight market, have never been cheaper, but driver acquisition costs have never been higher.

Several expense lines will grow in 2021. Driver recruitment and hiring is the top priority and many carriers are still in need of additional dockworkers. Health and wellness visits, which plummeted during the outbreak, need to be caught up and sales forces will begin to travel and entertain again.

Add in general cost inflation, including annual wage increases of roughly 3% per annum, and the added expenses associated with operating at peak levels every day and you get a scenario in which yield increases don’t flow to the bottom line as easily as the 30%-plus consensus earnings estimates suggest.

“That’s the mistake that the finance world makes I think when they look at LTL like they do manufacturing. You don’t have the same fixed costs with the same economies of scale that come into play,” Garrett said. He noted there are many variables in transportation, which can be tough to model even in high-fixed-cost networks like LTL.

As demand has surged, most carriers have been forced to rely on purchased transportation more heavily to service linehaul needs and those costs have gapped even higher in recent weeks.

“They’re going to new methods and new more expensive methods just to keep servicing their customers. Those costs are rising as quick or quicker than their revenue,” Garrett said.

Higher weight per shipment may be misleading

Garrett doesn’t believe increased weights per shipment, which tend to accompany better margins in a paid-by-the-pound business, are helping all that much. Normally, higher weights are associated with a freight mix that is more industrial in nature. But that wasn’t the case for much of 2020 as manufacturing was disrupted by COVID-related shutdowns.

Also, difficulty procuring trucks in a tight TL market is driving an influx of nontraditional freight into the LTL market.

“It doesn’t seem to have changed as drastically as you would think because there’s more spilling in from both ends. It’s more smaller, lighter e-commerce shipments with limited access and residential, business-to-consumer delivery-type requirements, but then at the same time it’s also a lot more volume north of 10,000-pound shipments, eight to 12 pallets spilling from truckload and the volume world.”

Weights have been comping higher for some of the large, publicly traded carriers in recent months but the change may not be ideal as TL spillover is offsetting e-commerce.

“For every 50 shipments that are coming in on the 12,000-to-15,000-pound per shipment weight, you probably have 1,000 small, e-commerce-type shipments at 50 to 300 pounds that are counteracting that,” Garrett said. “LTL has become the catchall. The average parcel shipment is going up in weight and size as people are buying everything online. And then you have the truckload capacity issues. So everything is just kind of being thrown into the LTL bucket.”

Only looking at the pure average tends to hide what is actually happening within the mix and the classes of freight. He believes adding a metric like revenue per cubic foot as well as breaking out results by service type is the correct way to view the space.

“It’s almost becoming irrelevant to measure LTL by these same metrics that have been used for a couple of decades now,” Garrett added.

Bid activity definitely favoring the carrier

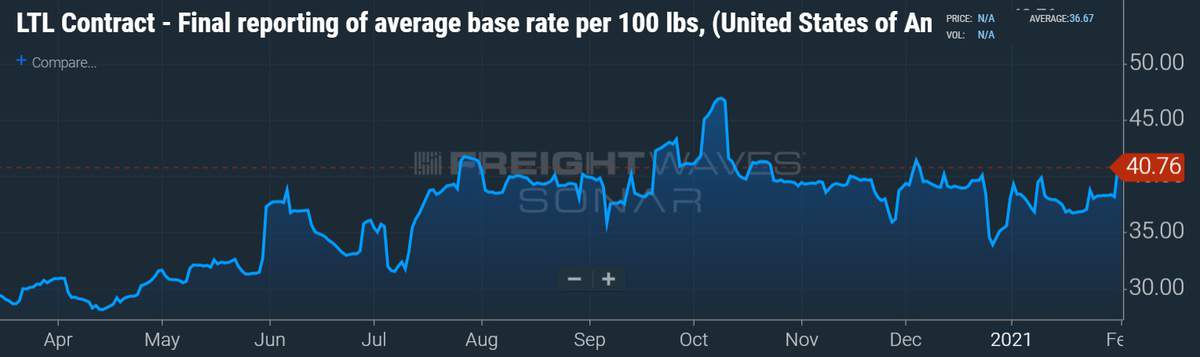

From April to June last year, shippers were able to get “really competitive LTL pricing” as volumes tanked due to widespread COVID-related shutdowns that knocked some parts of the economy offline. Carriers went into preservation mode, furloughing workers and building liquidity. The tide has turned since with rates seeing a steady progression higher. The recent stretch of bad winter weather has only tightened capacity further.

Garrett estimates that bid activity slowed down a little bit in early 2021. Shippers that were working with 3PLs to put their freight in front of carriers for bid this year waited to do so in the first few weeks of the year hoping the capacity dynamic would change. They then saw the market turn further away from them as winter storms caused broad service outages for several days at a time.

“Nobody wants to send a bid into a carrier in the middle of February when they’re embargoing lanes left and right and can’t even keep up just because of the weather situation,” Garrett said.

He said annual increases and renewals are still happening on time with contractual business seeing mid-to-high-single-digit rate increases. Also, carriers are using the current environment to be more selective in their freight choices and partner with shippers that have the loads they want to haul.

“LTL carriers are in a hurry to position themselves and knock out the higher cost shippers,” Garrett added. Carriers are getting decent rate increases on the freight they want and pricing themselves out of the market on the customers they want to walk. “There’s a trend right now for sure — less room to negotiate and definitely higher increases.

“The carriers that really try to chase the price metric and try to match what their competitors in the market are pricing at are actually the ones that get it wrong.” He believes trying to raise average revenue per shipment with a broad brush, or “policy pricing,” will get more revenue from some shippers but the approach usually results in lost freight. The carriers that look at all of their activity-based costs on an account-specific level are the ones that get it right, according to Garrett.

Recent GRIs are more than meets the eye

Practically every LTL carrier implemented a general rate increase (GRI) earlier this year, most ranging from 4.6% to 6%. The rate increases are to published rates, or noncontractual freight, which can account for 25% of total freight in an LTL network.

Garrett was quick to point out that the recent round of GRIs can really add up to more than just the percentage increase. First off, the GRI is not a rate increase on every single lane in the country, it’s an average of all of the rate changes for all of the lanes.

“Some lanes may see 20% or more and others might get more competitive,” Garrett said. It’s a way for carriers to reshuffle the deck and address higher costs in certain regions, which means the net impact for carriers can be “massive compared to that single-digit percentage that you hear about.” He views the cost-based approach to pricing lanes as a driver for margins compared to just layering in additional revenue on a piece of business.

Garrett pointed out that carriers don’t want to implement GRIs way above the market and higher than the competition, which is why the range among the group is always in a tight band annually. He noted that the portion of business on current tariffs that would see the GRI impact is usually very profitable already compared with larger, national accounts.

New entrants and investment in the space

The quick turns and short cycle of LTL freight is generating significant interest from investors, 3PLs and transportation companies already adjacent to the mode.

In TL, the truck, driver and load are lined up and confirmed ahead of the shipment, which will tie up that capacity for a full day. In LTL, the infrastructure – terminals, equipment, technology, etc. – is in place, operating continuously and quickly turning loads.

“If your nets are always in the water, you’re going to catch fish,” Garrett said.

While the recent freight cycle has been unique with trailers getting stuck at warehouses that are grappling with labor headwinds, LTL pickup and delivery capacity is being constantly renewed as loads are moved much faster. The linehaul portion of the LTL equation still remains a sticking point but available capacity in the mode is pliable in comparison to TL.

“In normal times, every morning you’ve got a full fleet of empty P&D trailers to go get more freight,” Garrett added. “One thing that carriers really need to improve on the P&D side right now is shipment visibility, customer service and accurate delivery estimates. The chaotic industry environment is understandable, however better communication from carriers around shipment exceptions and updated ETAs is needed.”

As the LTL industry continues to become a freight catchall it will continue to attract more nontraditional LTL providers, which he believes will see success. “If they have the capital to get the terminals in place, hire drivers and buy equipment, it’s almost a sure thing. They’re going to get the business if they cast their nets out there.”

Gold

We provide competitive mortgage loans, business loans and personal loans to facilitate the purchase of both investment buy to let properties and those for residential owner occupation, in addition to a refinancing or re-mortgage of an existing US property.

Type of Loans available:

1. Mortgage Loans

2. Business Loans

3. Personal Loans

4. Home Loans

5. Car Loans

Apply for a loan today by contacting us via email:

goldmortgage1@gmail.com

http://www.goldmortgage.weebly.com

+1 914 598 9562

Gold Mortgage.

Funding and expanding businesses around the world.

Richard Piontek

Solid information that is aligned with what we are seeing in our Managed and Brokerage lines of business. All things considered and not minimizing the structural issues facing asset LTL carrier’s, I can also see opportunity coming out of the chaos. The new “capacity insecure” freight being jettisoned by carriers will find a home with creative 3PL’s in the mix. No such thing as bad freight, just freight not priced correctly.

Tcs53

Wrong, there absolutely is such a thing as bad freight. Anything that’s floor loaded is bad freight. If the freight company has to physically hand load or hand unload that freight is garbage. There is no way you can price it to be profitable.