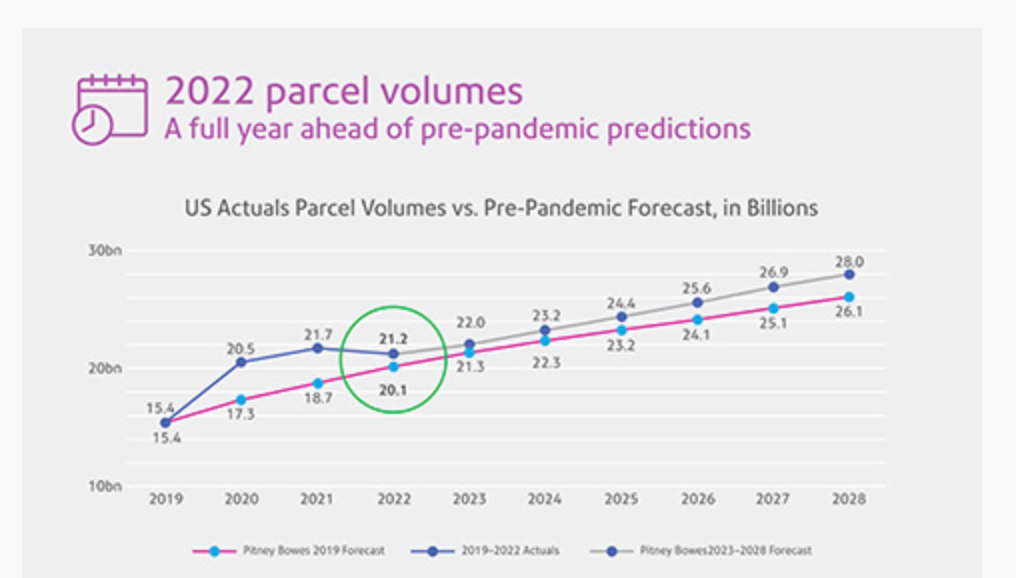

U.S. parcel shipping activity is expected to grow 5% per year over the next five years, continuing what is expected to be an increase over pre-pandemic volume projections despite a slowdown in 2022, according to an annual parcel shipping index published Tuesday by global shipping and mailing company Pitney Bowes Inc.

By 2028, annual U.S. parcel volume is expected to hit 28 billion, according to the report.

America shipped, received and returned 21.2 billion parcels last year, 1.1 billion shipments more than had been projected by pre-pandemic forecasts, according to Pitney Bowes (NYSE: PBI)

The 2022 levels were not expected to be attained until ’23, putting volumes a year ahead of pre-pandemic estimates, Pitney Bowes said.

The report, along with a study published recently by the e-commerce unit of Deutsche Post DHL, validate the argument that consumers remain unlikely to fully return to pre-pandemic behaviors. The Pitney Bowes report also indicates a slowdown from the 10.8% annual growth rate from 2016 through 2022.

According to the Pitney Bowes index, 58 million parcels were shipped across the U.S. each day during 2022, equivalent to 674 shipped every second. Per-capita volumes fell slightly to 64 from 65 with an average of 162 pieces shipped per American household, according to the data.

Carrier revenues hit $198 billion, an all-time record for the index and a 6.5% increase from $186 billion in 2021. This reflects solid pricing power, as well as the impact of inflation and higher fuel surcharges, experts said.

All four major delivery carriers reported down or unchanged year-over-year volume growth. The Postal Service shipped 6.7 billion parcels in 2022, down from 7 billion in ’21. UPS Inc. (NYSE: UPS) shipped 5.2 billion parcels, down slightly from 5.3 billion. FedEx Corp. (NYSE: FDX) shipped 4.1 billion parcels, down from 4.3 billion. Amazon Logistics (NASDAQ: AMZN), which ships almost exclusively for its in-house retail and third-party fulfillment network, kept volumes steady at 4.8 billion.

UPS generated the highest revenue and market share totals last year, reporting $73 billion in carrier revenue and 37% in market share. FedEx was next with $65 billion in revenue and 33% market share. The Postal Service came in third with $31 billion and 16% share, followed by fourth-place Amazon Logistics ($24 billion,12% share).

UPS generated a 5.5% increase in revenue, while FedEx came in at 5% and the Postal Service’s gains were flat.

The category marked “others,” which includes regional delivery carriers and a plethora of newbies that have entered the market since 2020, posted the fastest growth, albeit off a tiny base. Revenue for those carriers rose to $4 billion, up 29%. Volume climbed 25% year over year, according to the index.

The report focused exclusively on U.S. shipping activity. A similar report on international activity will be published later this year.