New venture capitalists have entered the supply chain technology space. Larger checks and higher valuations from Tiger Global and Softbank are changing the landscape, but mature startups and incumbents are also scaling their M&A capabilities.

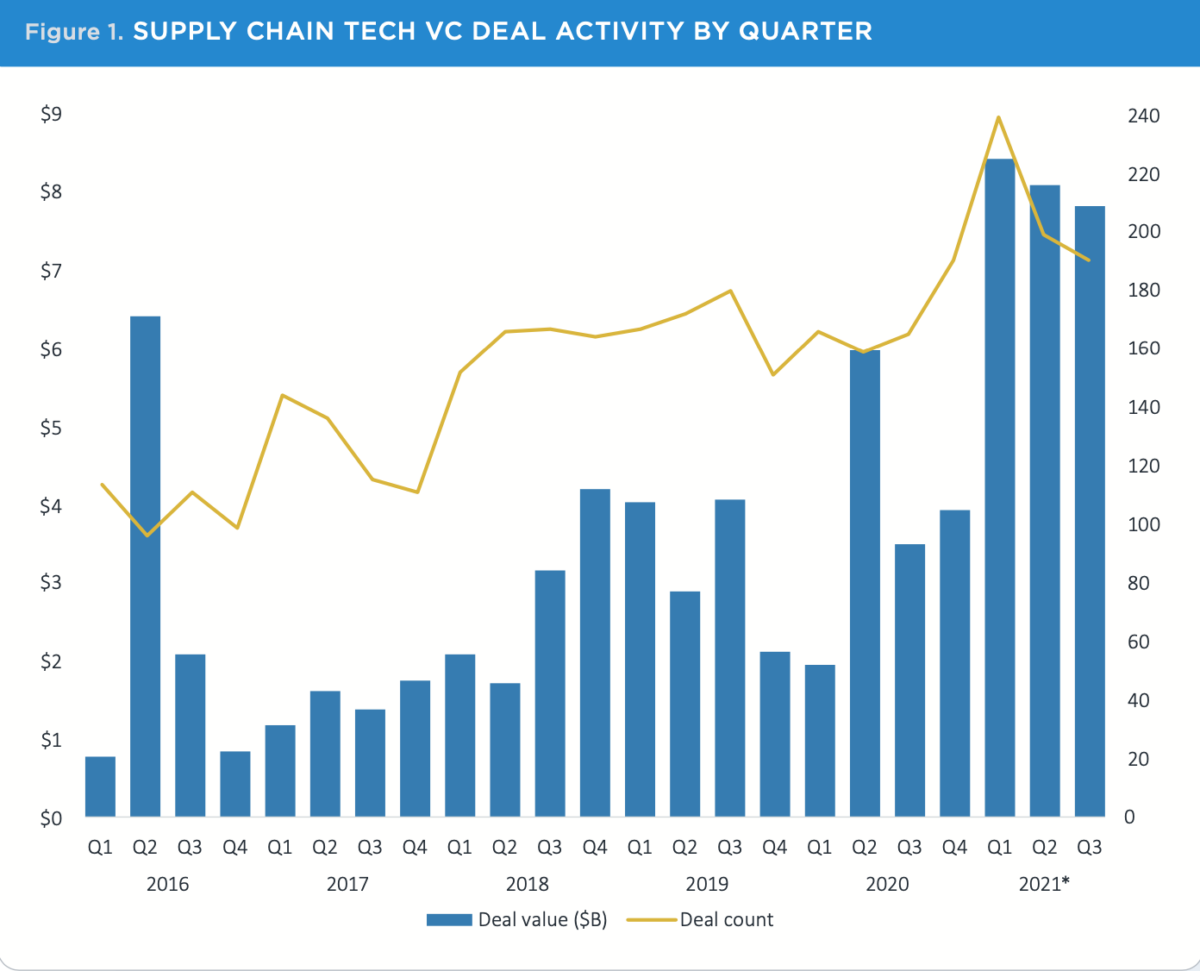

Venture capital investment in supply chain technology startups remained robust in the third quarter of 2021, coming in at $7.8 billion for the United States and Europe. That number represents a cooling from the segment’s most recent peak in the first quarter of 2021 but is still up more than 100% year-over-year.

Pitchbook’s recently published report “Supply Chain Tech Q3 2021 VC Update” makes it clear that the segment’s growth is increasingly fueled by strong late-stage activity. The quarter saw nine $1 billion-plus exits, including public listings by Deliveroo ($9.3 billion), Berkshire Grey ($2.7 billion) and Xos Trucks ($2 billion). The list of the most prolific supply chain tech VC investors since 2019 has now been topped by two firms, Alumni Ventures and Tiger Global, both of whose deals have been concentrated in late-stage rounds.

At the same time that more capital is flowing to bigger companies, earlier-stage categories like drone logistics, augmented reality tech for warehousing, and ultrafast delivery are being populated with waves of new entrants.

The $7.8 billion of venture capital invested in the third quarter was spread across 190 deals. Notable deals included Netradyne’s $150 million Series C led by Softbank, Stord’s $90 million Series D from Kleiner Perkins at a $1.1 billion post-money valuation, and Interos’ $100 million Series D led by NightDragon, which made Interos a unicorn.

But the last-mile delivery category led the way with the largest investments in supply chain technology in the third quarter. goPuff raised a $1 billion Series H led by Hedosophia; Gorillas raised a $950 million Series C led by Delivery Hero; Bolt raised a $709 million round led by Sequoia, and Picnic raised a $707 million Series D led by the Bill and Melinda Gates Foundation. GoPuff and Gorillas are part of the emerging “ultrafast delivery” niche — Gorillas offers grocery delivery in as little as 10 minutes in 60 cities across nine countries.

Beyond the big headline deals, though, there are other indications that supply chain tech is maturing. Alumni Ventures has closed 30 deals in the space since 2019, 12 of them late-stage rounds. Tiger Global Management has led 25 investments, 19 of them late-stage deals. 8VC has also done 25 deals, but they’re more evenly distributed across the company life cycle: six angel/seed deals, 11 early-stage deals and eight late-stage deals. Meanwhile, Softbank is the fourth-most prolific supply chain tech investor, with 23 deals since 2019, 22 of which were considered late-stage.

On the other end of the spectrum, Schematic Ventures has made 18 supply chain tech investments since 2019, concentrated at the seed stage, a deal count matched by Maersk Growth’s investments, coming mostly in early-stage rounds.

Valuations are up, but supply chain tech has seen the most valuation growth in late-stage rounds, where median valuations have grown from $85 million in 2020 to $120 million as of Sept. 30, 2021. Valuations can be driven by a host of factors, but in a niche venture capital category it’s fundamentally a reflection of supply and demand for equity in specific kinds of companies. Rapidly rising late-stage valuations indicate upward price pressure driven by new capital coming into the space and seeking a home at a finite number of appropriate targets.

Significant year-over-year growth in round sizes, from seed to late-stage, also supports the thesis that an influx of capital relative to the number of startups is likely primarily responsible for the rapid rise in valuations. Compared to 2020, median seed rounds in supply chain tech in 2021 through September grew 27.7%, to $2.3 million, early-stage rounds grew 69%, to $10 million, and late-stage rounds grew 94%, to $24.9 million. The most rapid round size growth occurred in late-stage deals, further illustrating the fact that the segment is being increasingly fueled by new investors writing larger checks.

Strategic mergers and acquisitions activity has also been driving exits. Descartes and project44 made three acquisitions each in the third quarter, and J.B. Hunt and Coupa made two each. The fact that supply chain tech startups have built unique technology and scaled their businesses to the point where they’re investable by public companies is yet another indication of the increasing maturity of the segment. That some supply chain technology providers like project44 and Coupa have built M&A into an internal capability also demonstrates the ambition and sophistication of leading firms in the space.

Patricia Castile

[ JOIN US ] I get paid more than $30 to $87 per hour for working online. I heard about this job 3 months ago and after joining this I have earned easily $10k from this without having online working skills . Simply give it a shot on the accompanying site…

copy and open this site .…………>> http://Www.NETCASH1.Com