Remember floating storage? It’s back. Or at least, back in the spotlight. Market chatter has refocused on the view that falling oil demand equals higher tanker storage equals fewer ships available for spot deals equals higher spot rates.

Spot rates are definitely rising, albeit off an extremely low base. On Monday, Clarksons Platou Securities put spot rates for very large crude carriers (VLCCs; tankers that carry 2 million barrels of crude oil) at $27,900 per day, up 124% week-on-week.

VLCC rates have essentially gone from very bad back to just plain bad. From below “opex” levels, where owners took in less than they were paying out for crew and other expenses, to “cash breakeven,” where owners scrape by and cover debt and operating costs.

Crude-tanker stocks — which are performing very poorly in 2020 — are rebounding off very depressed levels. The stock price of of DHT (NYSE: DHT) is up 12% over the past week. Teekay Tankers (NYSE: TNK) is up 11%. International Seaways (NYSE: INSW) rose 10% and Euronav (NYSE: EURN) 9%. Frontline (NYSE: FRO) and Nordic American Tankers (NYSE: NAT) gained 7%.

This time it’s different

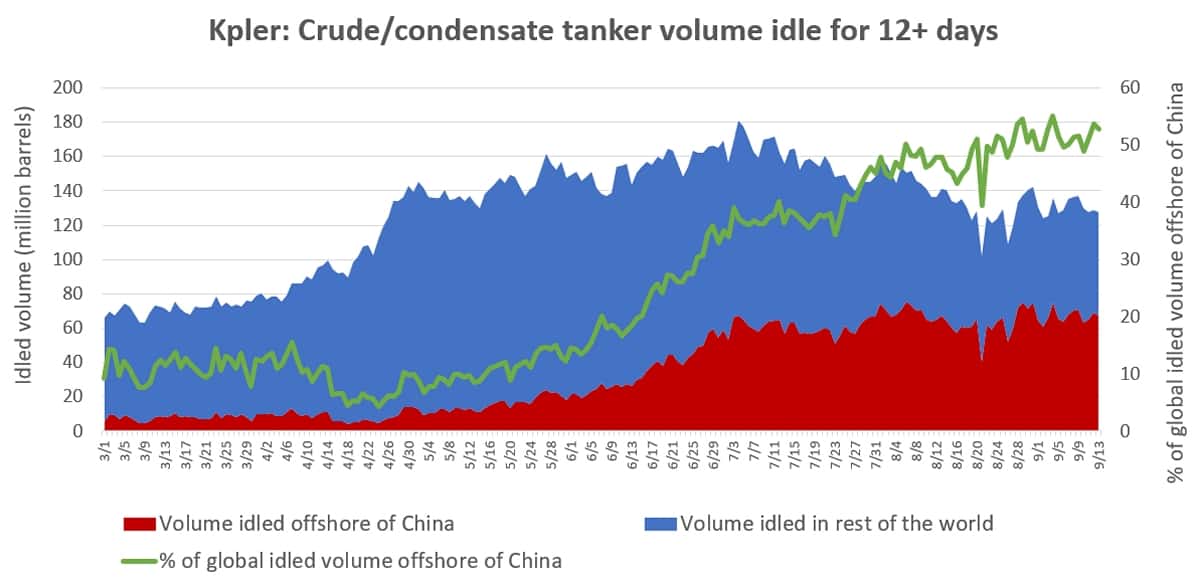

If the market returns to floating storage, version 2.0 will be different, because most of the crude oil loaded on tankers during floating storage 1.0 is still on the water. Much of it is now sitting offshore of Asian terminals.

New data provided to FreightWaves by Kpler shows that the volume of crude lingering offshore of China (aboard ships idle 12 or more days) is still 67 million barrels. This is not far below the high of 75 million barrels. China volumes now represent 53% of the global total. Total idled crude at sea is still 127 million barrels. This is down 30% from the July 4 peak but still very high.

“Be careful what you wish for,” warned Evercore ISI analyst Jon Chappell on Monday. “The only beneficiaries of a short-term super-spike associated with floating storage would be owners looking to issue equity or promote their stock on American TV and investors that didn’t sell fast enough in April.

“Soft demand and prolonged floating storage only prolong the destocking event that is likely to weigh on ton-mile demand for the foreseeable future,” said Chappell.

A “ripping off of the Band-Aid” — in which oil demand is healthier and floating storage is destocked quickly — is “a more investible event,” he maintained.

Contango is back

Crude oil pricing is back in contango. Contango is a pricing dynamic in which the futures price is higher than the spot price (the opposite is known as backwardation).

According to Stifel analyst Ben Nolan, the current six-month contango is about $2 per barrel and has been as high as $4.

Chappell estimated that the current three-month contango would support a three-month VLCC time-charter rate of $24,000 per day. “The economics only work at rates that are below breakeven for most operators,” he pointed out. “If accepted, [it] would be about as bearish an indicator as possible given the timing — i.e., winter is coming.”

Evercore ISI energy analyst Doug Terreson believes OPEC+ will be quicker to cut production in light of softer demand, and that oil prices will “flirt with” backwardation by year-end.

Floating storage or hedging?

Last week, Reuters reported that Trafigura chartered up to five VLCCs and that Vitol, Litasco and Glencore also took tankers. Argus reported two six-month charters by Shell. The analyst team at Fearnleys cited talk that Trafigura chartered over 10 VLCCs. Jefferies estimated that charterers booked around 20 ships in total last week.

The classic contango trader move is to buy oil low, charter tankers, then sell oil high, net of charter costs. But that may not be what drove last week’s chartering flurry.

Frode Mørkedal, analyst at Clarksons Platou Securities, pointed out that charterers booked 16 VLCC spot fixtures out of West Africa last week, the highest weekly count this year. This, in turn, pushed some charterers to look at Arabian Gulf VLCC spot fixtures earlier than anticipated.

This caused rates to rise, making floating storage less economical. “As of now the price differentials are likely too tight for profitable floating storage. Especially with the latest bump in rates,” said Mørkedal.

According to Jefferies analyst Randy Giveans, “The current contango implies VLCC rates of $25,000-$30,000 per day and December cargoes are being priced at over $40,000 per day.” He believes charterers are using period deals to hedge against “a potential rate spike in the fourth quarter.”

According to Chappell, “Many widely read financial news sources would have you believe that the next super-contango-fueled floating storage boost is imminent, while burying the fact that most of the recent uptick in short-term charters are only economic, given the collapse in tanker rates from the spring.”

And if floating storage does rebound?

Today’s contango might not be enough to incentivize a major new wave of floating storage. But it’s not impossible for the contango to widen significantly. “Stranger things have happened,” noted Nolan.

“The downside is that inventory buildup eventually turns into inventory drawdowns. So, a contango storage trade is simply borrowing from the future,” Nolan noted.

At the beginning of this month, the analyst team at Fearnleys laid out two scenarios for the VLCC market. In one, oil demand returns, floating storage destocks, transport volumes rise and rates increase into 2021.

In the other, oil demand underperforms and there’s another round of floating storage. “A short period of elevated rates would then be followed by a longer period of weaker rates,” warned Fearnleys, adding, “In terms of an equity story, we would obviously prefer some more short-term pain [i.e., Scenario one].”

As Chappell put it, “If [recent tanker stock] increases were the result of floating-storage headlines, much of the gains may prove to be short-lived.” Click for more FreightWaves/American Shipper articles by Greg Miller

MORE ON TANKERS: Supertanker spot rates are crashing down to ‘opex’ levels: see story here. How are tanker owners coping with the floating-storage hangover? See story here.Tanker rate puzzle gets even harder to solve: see story here.