Listed tanker owners are raking in profits and doling out hefty dividends. The tanker orderbook, despite a flurry of recent contracts, is virtually barren through 2025. Yet tanker share prices have been drifting lower since early March. They dropped again on Wednesday.

Tanker stocks have a “boy who cried wolf” reputation thanks to all the false starts and head fakes in the years since the global financial crisis. As a result, many investors will inevitably sell too early or stay on the sidelines too long if and when the real wolf — a sustainable tanker upcycle — finally arrives (some say it already has).

Evercore ISI, Jefferies and Stifel published new tanker industry outlooks, rate forecasts and stock picks this week. Omar Nokta of Jefferies and Ben Nolan of Stifel have “buy” ratings on every tanker stock they cover. Jon Chappell of Evercore has an “outperform” rating on all but one.

FreightWaves calculated that the average crude-tanker rate forecasts of these analysts for 2023 are 65% above the cash breakeven rate assessed by Clarksons for 10-year-old vessels. The average of the analysts’ crude-tanker rate forecasts for 2024 are 45% above the current breakeven.

The three analysts’ average product-tanker rate forecasts for this year are 58% above the Clarksons’ 10-year-old vessel breakeven rate. Their 2024 forecast averages top that bar by 40%.

“Tankers are cash machines. Everything else is a trade,” said Nolan.

Tanker stocks down double digits since March

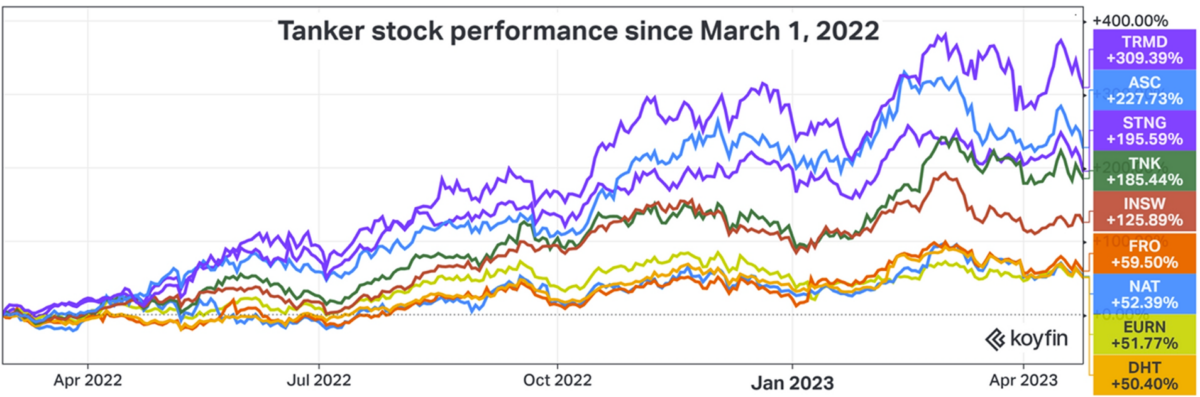

Tanker shares started their upswing back in March 2022, following several years of historically weak earnings.

Product-tanker owners are at the top end of the spectrum of gainers. Torm (NASDAQ: TRMD) is up 309% from March 1, 2022, through Wednesday’s close. Ardmore Shipping (NYSE: ASC) is up 228% and Scorpio Tankers (NYSE: STNG) 196%.

Crude-tanker owners are at the lower end of gains since March 1, 2022, albeit still impressive. DHT (NYSE: DHT) is up 50% through Wednesday’s close. Euronav (NYSE: EURN) — which has been weighed down by a three-way battle for control — and Nordic American Tankers (NYSE: NAT) are up 52%.

The tide turned against tanker stocks this March, mirroring a previous decline in late December and early January. Tanker shares briefly rallied in mid-April but have fallen back again since then. Crude- and product-tanker shares are down 11%-22% from March 1 through Wednesday’s close.

Causes for concern on tankers

One reason tanker stocks are down: Spot rates are down.

According to Clarksons, spot rates in the crude-tanker sector for older VLCCs were down 49% month on month as of Thursday. Suezmaxes rates were down 37% and Aframax rates 45%. On the product-tanker side, spot rates for older LR2s were down 10% month on month. Rates for MRs were down 28%.

These large rate rate declines have occurred at the same time Russian sanctions are increasing average voyage distance for both crude and product tankers. Tanker demand is measured in ton-miles (volume multiplied by distance), so Russian sanctions should support rates.

Another blow to tanker sentiment: the April 2 decision by OPEC+ to cut over 1 million barrels per day in production starting next month.

The question is whether OPEC+ is cutting its production to artificially prop up oil prices, or for its stated reason — concern about demand.

According to Allied Shipbroking, “Whether this is just a temporary blip or a persistent problem is widely dependent on the reasoning behind this decision. If OPEC+’s concerns [on demand] prove right, this might actually have prolonged effects on the market, with demand for crude oil losing ground on the back of global economic weakness, keeping earnings restrained.”

Henry Curra, global head of research at brokerage Braemar, wrote on Monday, “What worries owners now is that after an $8-per-barrel rally to $88 per barrel on the back of OPEC’s announced cut, Brent is already back to $83 per barrel.” (As of Wednesday, it had fallen even further, all the way down to $77.69 per barrel.)

“The fear is that this could be an indication of lower demand,” Curra said.

Curra cited other negatives, as well. “China’s crude oil imports have thus far failed to respond meaningfully to the lifting of COVID restrictions or the addition of new refining capacity,” he said.

Curra also pointed out that “weaker refining margins present a tougher operating environment for tankers. The huge profitability of refineries last year gave refiners and traders plenty of flexibility to pay up [on] freight.” With slimmer margins, charterers will “refocus on cutting their freight bill.”

Orderbook historically slim – but now growing

One of tanker stocks’ biggest selling points is the sector’s minuscule orderbook.

As of the beginning of this week, crude-tanker tonnage on order was just 2.6% of the on-the-water fleet, according to Clarksons. The VLCC orderbook was a mere 1.5%. The product-tanker orderbook-to-fleet ratio was 7.3%.

The problem for sentiment is that tanker newbuilding orders are now streaming in.

“Ordering over the past few weeks was dominated by tanker newbuilding contracts, perhaps a symptom of the growing recognition of the relatively minimal deliveries expected over the next few years,” said Allied.

Brokerage Compass Maritime reported that the Angelicoussis family’s Maran Tankers recently ordered four Suezmaxes with four options, Capital Maritime ordered four Suezmaxes with four options, John Fredriksen’s Seatankers ordered two Suezmaxes, Euronav ordered two Suezmaxes and exercised options for two more, and Evalend ordered two Suezmaxes. Tradewinds reported Wednesday that Greece’s Procopiou family ordered 10 LR2 product tankers with two options.

‘Shipowners seem closely related to lemmings’

Brokerage BRS reported Thursday that firm orders for 61 tankers totaling 5.7 million DWT were placed from January through mid-April, not including the “flurry of orders over the past two weeks.” This new capacity will not arrive until 2025-27, but it sours sentiment nonetheless.

“Given that new ordering is invariably the downfall of virtually every shipping market, prognosticators like yours truly have been keeping a wary eye on incremental activity,” said Nolan.

“At least with respect to supply there is no problem yet. However, shipowners seem closely related to lemmings and when the leaders start moving in one direction, others are typically quick to follow,” he said.

According to Chappell, “Though figures remain low and the orderbook has not changed much, if this development builds momentum, the clock on the supply-induced cycle end may begin.”

‘Cycles are rarely straight lines’

The argument in favor of tanker stocks rising further is that the supply side is effectively set in stone for the next two years and demand will ultimately outstrip vessel capacity as China rebounds and Russian sanctions keep voyage distances high, leading to outsized returns.

“We do expect to see confidence fall further before it improves, but freight markets themselves remain well supported,” said Curra. “Chinese imports should finally pick up in the second half and the large trade-sapping OECD stock draw of recent months will soon run out of track.”

Chappell maintained that the recent pullback of tanker stocks gives investors “another bite at the apple.”

Dropping spot rates are now being affected by seasonality “as is almost always the case in April,” he said.

“Volatility, though par for the course in the shipping sector, keeps some investors away, despite attractive fundamentals and valuation.”

Chappell estimated that net tanker fleet growth will only be 1.6% this year and will drop to essentially nothing (0.3%) next year.

“Cycles are rarely straight lines — even the supercycle of 2003-08 had periods when rates declined. Seasonal pullbacks in rates, timed with … macro fears, are to be expected. But despite some of the changes at the margin, the supply-demand balance for the industry remains very much in favor of owners through at least 2024.

“Valuations are not as ‘cheap’ as in January [when stocks last pulled back], but the majority of the group still trades at discounts to NAV [net asset value], with half of our coverage expected to provide double-digit dividend yields in 2023,” said Chappell. “Until there is a structural change to the fleet utilization outlook we remain bullish on tankers and we’d continue to use periods of panic-selling to accumulate positions.”

Click for more articles by Greg Miller

Related articles:

- Price cap on Russian crude could soon face its biggest test

- European tanker owners make a fortune off Russian oil trade

- OPEC+ throws tanker shipping a curveball, shaking confidence

- China-Russia vs. US-EU: How global shipping is slowly splitting in two

- In search of shipping’s next supercycle: Are tankers next?

- Tanker shipping consolidation saga watched ‘like it’s Netflix’

- How push to decarbonize shipping slowed tanker building to a trickle