Targa Resources Corp. (NYSE: TRGP) missed Wall Street’s fourth quarter consensus revenue expectations of $2.74 billion. The company’s revenue decreased nearly 3.9 percent year-over-year (Y/Y) from over $2.7 billion to nearly $2.6 billion. According to Seeking Alpha, Targa missed the revenue consensus by $140 million, or about 5 percent.

However, full-year revenue in 2018 increased nearly 19 percent Y/Y from over $8.8 billion to nearly $10.5 billion. Targa’s fourth quarter earnings call expressed a positive outlook for its midstream industry growth due to the construction of new oil/gas infrastructure in the Midwest including the Grand Prix NGL (natural gas liquids) pipeline which will connect the majority of the company’s natural gas production sites to its natural gas processing facilities.

Targa Resources, based in Houston, is an oil/gas pipeline operator. It’s one of the largest midstream energy companies in North America, operating in Kansas, Louisiana, Mississippi, New Mexico, North Dakota, Oklahoma and Texas.

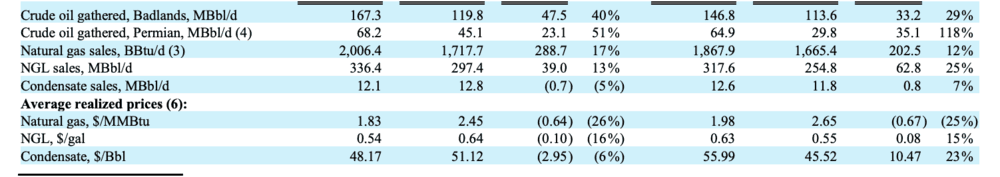

Net income for the quarter decreased nearly 138 percent Y/Y, or $389.5 million, from $283.1 million to a loss of $106.4 million. Full-year net income decreased 97 percent Y/Y from $54 million to $1.6 million. Targa’s earnings release said decreased quarterly net income is due to lower commodity prices for oil/gas. Natural gas prices for the quarter decreased by 25 percent Y/Y, or 62 cents, from an average of $2.45 per million British thermal unit (BTU) to $1.83 per million BTU.

Another reason for Targa’s decrease in quarterly net income was goodwill impairment costs (the price of an asset in excess of its identifiable value). Targa had goodwill impairment costs of $210 million in 2018, which constituted the final payment for the 2015 acquisitions of Atlas Energy L.P. and Atlas Pipeline Partners L.P.

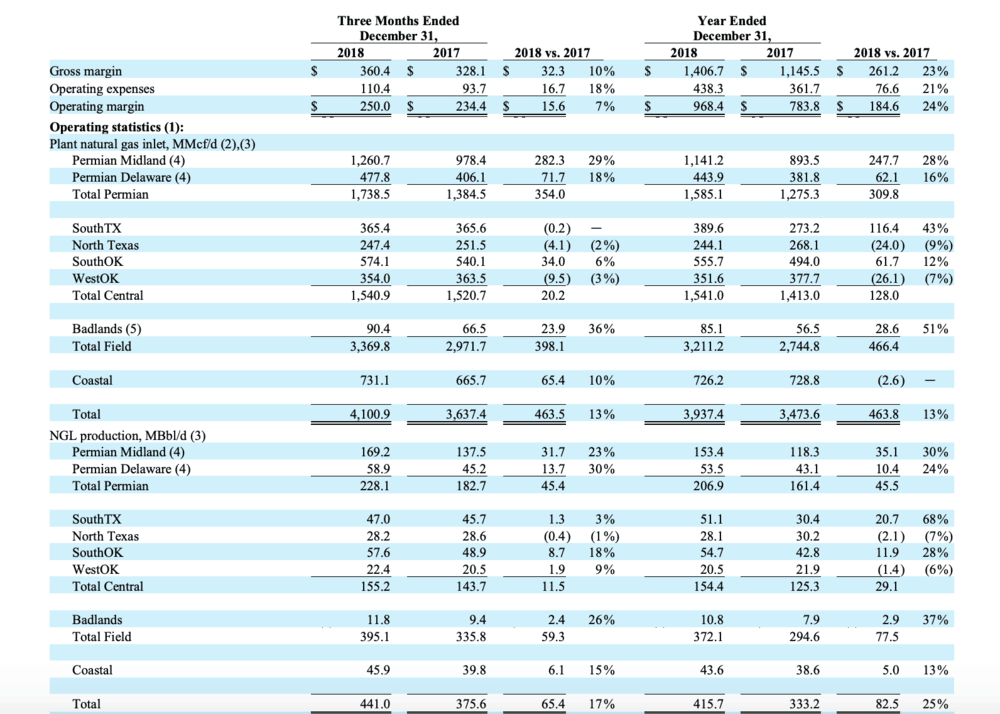

Operating expenses for the quarter increased 14 percent Y/Y, or $23.1 million, from $160.2 million to $183.3 million. The operating margin for the quarter increased by 8 percent Y/Y, or $31.5 million, from $374.4 million to $405.9 million.

Targa’s business segments were divided between gathering and processing (G&P) of oil/gas (which was 60 percent of operating margin) and downstream distribution of oil/gas (40 percent of operating margin). The quarterly operating margin for the G&P segment increased 7 percent Y/Y, or $15.6 million, from $234.4 million to $250 million. The quarterly operating margin for the downstream segment decreased 2 percent Y/Y, or $2.8 million, from $153.5 million to $150.7 million.

Quarterly operating margin increased in the G&P segment due to increased Badlands (North Dakota) and Permian (Texas) production volumes, according to the quarterly earnings release. The operating margin decreased in the downstream segment due to lower natural gas and condensate prices.

Quarterly earnings before interest, taxes, depreciation and amortization (EBITDA) increased over 14 percent Y/Y, or $47.4 million, from $328.4 million to $375.8 million.

“The strength of our execution and performance during 2018 drove record adjusted EBITDA, providing Targa with positive momentum for 2019 and beyond,” said Joe Bob Perkins, chief executive officer at Targa Resources. “Key projects are coming online for us in 2019, including additional gathering and processing facilities, another fractionator in Mont Belvieu, Texas, and our Grand Prix NGL pipeline, which will connect much of our G&P NGL supply to Mont Belvieu. These projects are all expected to be highly utilized as we continue to support the needs of our customers, and will drive increasing, largely fee-based, cash flow growth for Targa. We remain focused on execution to enhance our already attractive long-term outlook.”

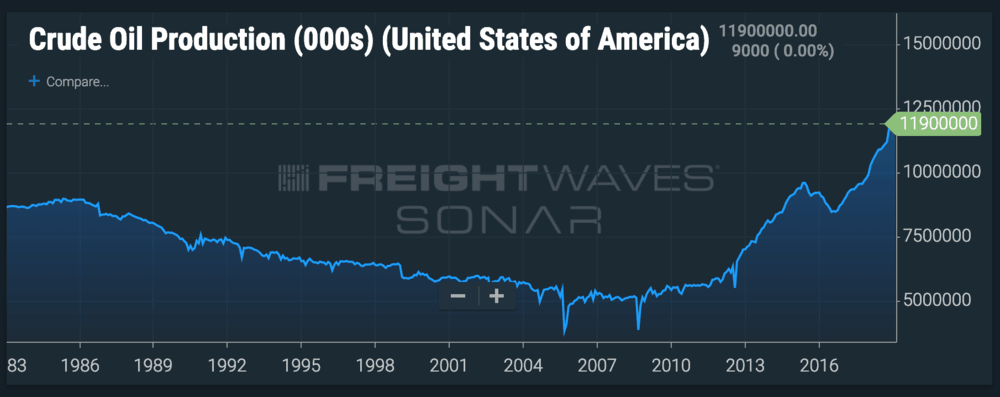

According to SONAR, the United States produced a record 11.9 million barrels of crude oil daily in February 2019, an increase of nearly 16 percent Y/Y from nearly 10.3 million barrels.

Targa Resources announced on February 19 that it will sell a 45 percent stake of its North Dakota operations – known as Badlands – to the Blackstone Group (NYSE: BX). The transaction is valued at $1.6 billion, which will be used to pay down debt and fund Targa Resources’ capital program. The company’s total consolidated debt as of December 31, 2018 was $6.66 billion while total consolidated liquidity was over $1.9 billion.

In the fourth quarter Targa issued over 2.4 million shares of common stock, which resulted in net proceeds of $111.5 million for the company.