With all the e-commerce activity in the supply chain, the assumption would be that this is now a smoothly running logistics operation. According to a new survey from Zebra Technologies Corporation, that assumption would be wrong.

The Future of Fulfillment Vision Study found that only 39% of supply chain respondents are operating at an omnichannel level (the ability to integrate various forms of customer shopping methods into their operations) and while 72% utilize barcodes for inventory management, 55% are still using pen-and-paper manual processes to manage their logistics.

The good news? According to Jim Hilton, manufacturing and transportation and logistics global principal, Zebra Technologies, changes are happening and happening fast.

“Driven by the always-connected, tech-savvy shopper, retailers, manufacturers and logistics companies are collaborating and swapping roles in uncharted ways to meet shoppers’ omnichannel product fulfillment and delivery expectations,” he said. “Zebra’s Future of Fulfillment Vision Study found that 89% of survey respondents agreed that e-commerce is driving the need for faster delivery.”

The global survey of more than 2,700 professionals in transportation and logistics, retail and manufacturing firms on their plans, implementation levels, experiences and attitudes toward omnichannel logistics, found that 78% of logistics companies expect to provide same-day delivery by 2023 and 40% anticipate delivery within a two-hour window by 2028. Crowdsourced delivery or a network of drivers that choose to make specific deliveries will likely be the preferred methods to accomplishing such quick last-mile delivery. Eighty-seven percent of respondents cited these methods as the likely solutions.

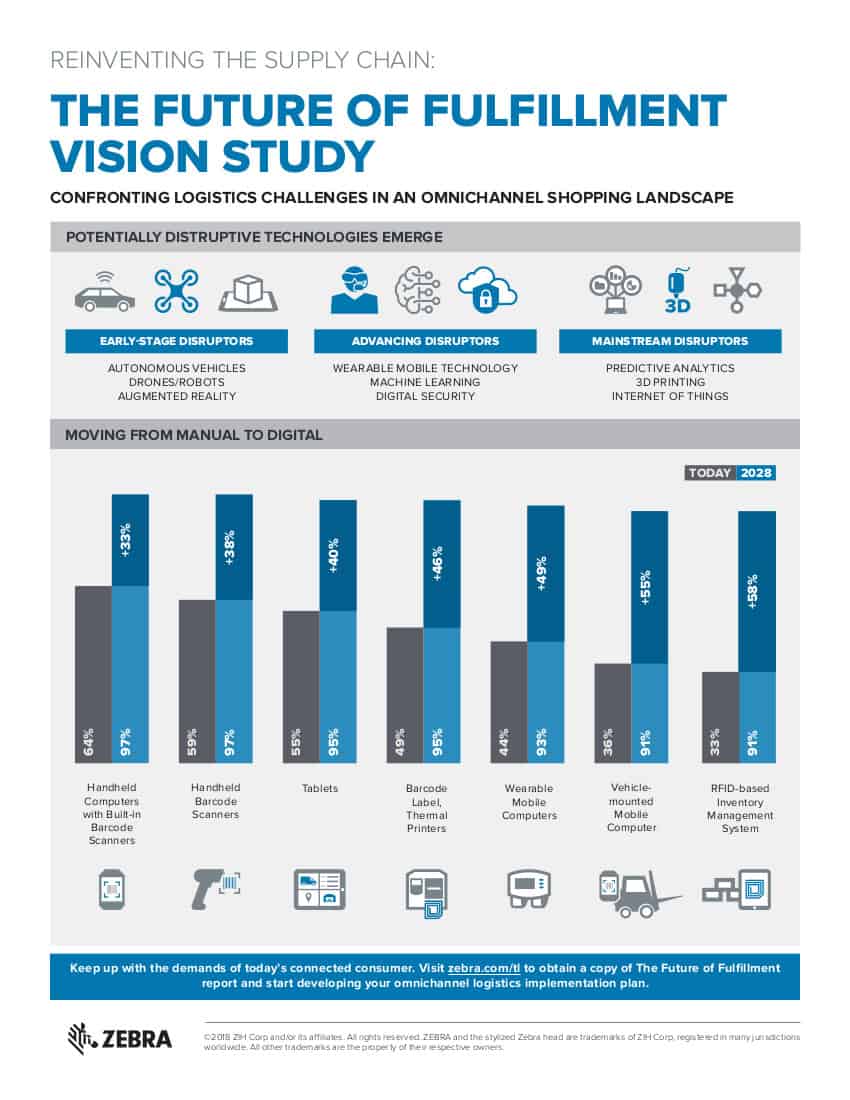

That doesn’t mean organizations are currenty sitting still. “Companies are turning to digital technology and analytics to bring heightened automation, merchandise visibility and business intelligence to the supply chain to compete in the on-demand consumer economy,” Hilton noted.

The survey also found that backlogged orders was the primary challenge for most retailers with 33% saying meeting order demand is a primary concern followed by inventory allocation and freight costs. Approximately three-quarters of retailers (76%) currently use store inventory to fill online orders with 86% planning to institute buy online/pick up in store programs next year. Some retailers are retrofitting stores to double as online fulfillment centers and 70% of surveyed executives believe this trend will grow.

Managing free shipping programs has also been a problem for many, as have returns, which 87% say they struggle with. As a result, 44% expect to outsource returns management.

Many of these challenges will significantly improve over the next five years as more adoption of technology will provide improve real-time management of warehouse inventory, the survey found.

Survey respondents expect their transportation partners to deploy a variety of technologies to help manage the e-commerce delivery space. These include drones, mentioned by 39% of respondents, driverless/autonomous vehicles (38%), wearable and mobile technology (37%) and robotics (37%).

In North America, manufacturers, logistics companies and merchants, report that inventory accuracy is at 74% but needs to improve to 83% to successfully handle growing omnichannel logistics operations. In Europe and the Middle East, respondents are more likely to fill e-commerce orders direct from stores, with more than 80% saying they do that now and 29% expect that percentage to rise to more than 90% in the next five years.

Most interesting is that 40% of respondents from Latin America report they plan to discontinue free shipping programs and 55% expect to end free return shipping.