This week’s FreightWaves Supply Chain Pricing Power Index: 30 (Shippers)

Last week’s FreightWaves Supply Chain Pricing Power Index: 30 (Shippers)

Three-month FreightWaves Supply Chain Pricing Power Index Outlook: 35 (Shippers)

The FreightWaves Supply Chain Pricing Power Index uses the analytics and data in FreightWaves SONAR to analyze the market and estimate the negotiating power for rates between shippers and carriers.

This week’s Pricing Power Index is based on the following indicators:

Inventory glut remains a stubborn headwind

Astute readers of this column — or faithful listeners of Grace Sharkey’s FreightWaves Radio on Road Dog Trucking — might have noticed that the three-month outlook was quietly bumped up to 35 in last week’s PPI. While this is a significant revision up from 20, its previous level, it does not betray a blanket optimism for the future. In short, market conditions will likely become a bit more favorable before they could get much worse.

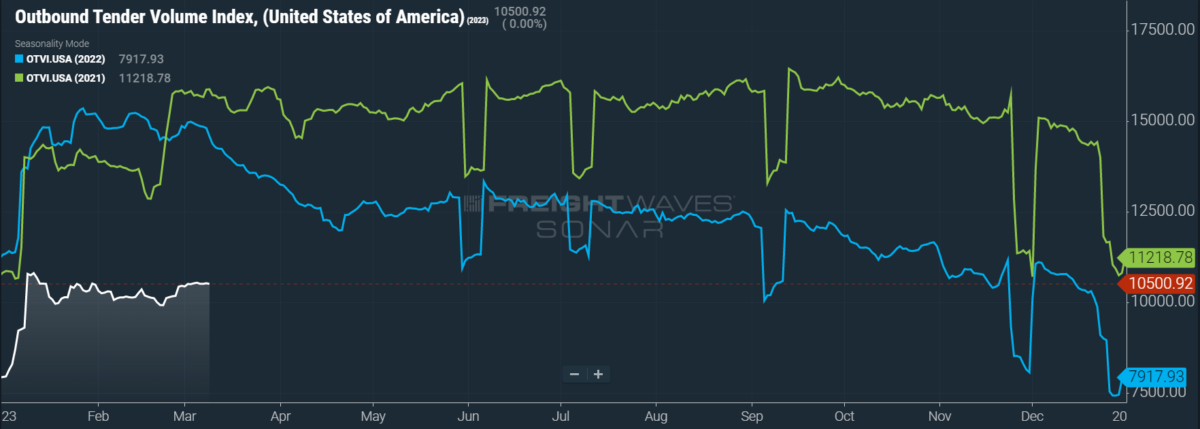

SONAR: OTVI.USA: 2023 (white), 2022 (blue) and 2021 (green)

To learn more about FreightWaves SONAR, click here.

This week, the Outbound Tender Volume Index (OTVI), which measures national freight demand by shippers’ requests for capacity, barely moved. OTVI rose 0.02% on a week-over-week (w/w) basis. On a year-over-year (y/y) basis, OTVI is down 26.93%, yet such y/y comparisons can be colored by significant shifts in tender rejections. OTVI, which includes both accepted and rejected tenders, can be artificially inflated by an uptick in the Outbound Tender Reject Index (OTRI).

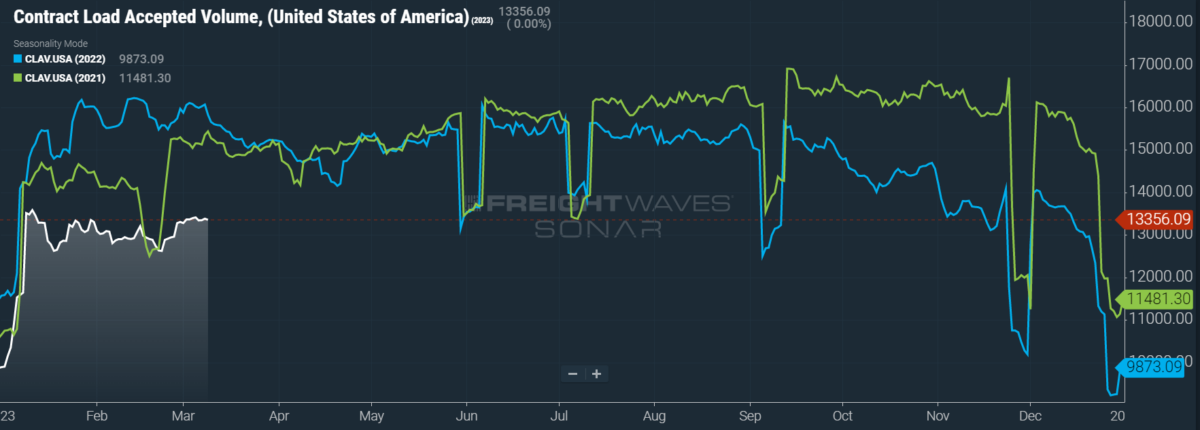

SONAR: CLAV.USA: 2023 (white), 2022 (blue) and 2021 (green)

To learn more about FreightWaves SONAR, click here.

Contract Load Accepted Volumes (CLAV) is an index that measures accepted load volumes moving under contracted agreements. In short, it is similar to OTVI but without the rejected tenders. Looking at accepted tender volumes, we see a slight rise of 0.06% w/w as well as a fall of 15.6% y/y. This y/y difference confirms that actual cracks in freight demand — and not merely OTRI’s y/y decline — are driving OTVI lower.

Freight markets, as stated repeatedly over the past few columns, are relatively stable at present, with accepted volumes comfortably above 2019 levels. This news is likely cold comfort to carriers that are under pressure to downsize or, at worst, declare bankruptcy. Nevertheless, freight demand is abiding by seasonality once again and, with both the produce and summer shopping seasons right around the corner, volumes should tick up over the coming months. Although certain pandemic-era tax incentives have been pared down or eliminated entirely, meaning that tax refunds in 2023 could be lower than expected, the upcoming tax refund season is yet another tailwind to consumer activity.

Hence, the PPI’s three-month outlook was bumped up to 35.

This revision does not, however, mean that freight markets have hit their absolute floor during this cycle and will recover unambiguously. As this column has covered, student loan repayments are set to begin in late August unless the Supreme Court releases its decision on the Biden administration’s forgiveness plan before June 30, in which case they will begin 60 days after the decision. I believe that many consumers with outstanding student debt are not fully prepared to resume payments on top of other inflation-affected necessities. Student loan repayments are also set to resume at a horrible time for freight markets, since many budgets will shrink just as the back-to-school and holiday shopping seasons begin.

Similarly worrying is the rise in auto loan delinquencies, which have hit their highest rate since 2010 per Moody’s Analytics data. Loans 60 or more days past due have reached their highest peak in a data set that reaches back to 2006, according to Cox Automotive.

There are other concerns beyond the consumer. In January 2022, when volatility was rampant throughout freight markets, the New York Federal Reserve released the Global Supply Chain Pressure Index (GSCPI) to measure the magnitude of supply chain disruptions on a historical basis. Capturing data from February, the most recent reading of the GSCPI was negative, hitting its lowest point since August 2019. New York Fed economists pinned this decline on both supply- and demand-side inflationary pressures, while the release itself stated that “the GSCPI’s recent movements suggest that global supply chain conditions have returned to normal.”

This view is an optimistic one, to put it lightly. Per data from the Census Bureau, wholesale inventory-to-sales ratios remain stubbornly high, with apparel, home improvement products and furniture notably languishing in warehouses and ocean containers. Survey data from the Logistics Managers’ Index (LMI) affirms a broader trend of persistently high inventory levels, as the LMI’s Inventory Levels index held relatively stable in February at 62.4, indicating expansion. On the other hand, the Warehousing Capacity index jumped 10.2 points to expansionary territory for the first time in 30 months, reading 56.6. Unlike trucking capacity, warehousing capacity is very difficult to scale quickly, given the realities of surveying and construction. This latest rise should provide some downward pressure to warehousing prices, which spiraled during the first pandemic wave of durable goods demand from consumers.

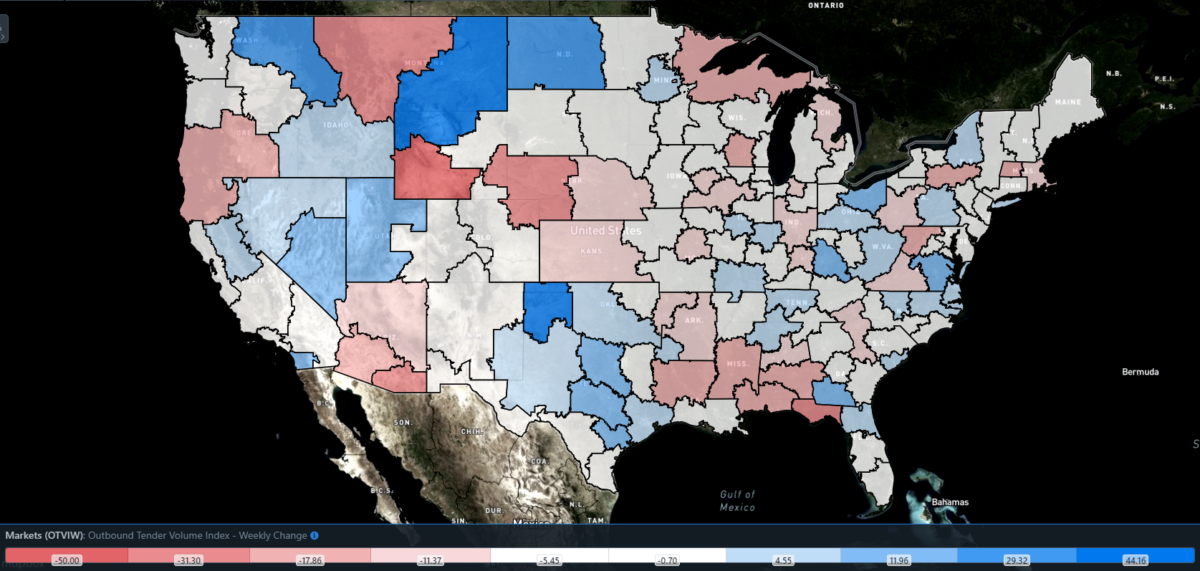

SONAR: Outbound Tender Volume Index – Weekly Change (OTVIW).

To learn more about FreightWaves SONAR, click here.

Of the 135 total markets, 67 reported weekly increases in tender volume, with larger markets responsible for growth.

If you’re a trucker, Detroit was the place to be this week. Not only has the market risen to one of the hottest freight markets over the past year, and not only has it seen a resurgence in demand from industrial shippers, but seasonal laws are also boosting the number of loads in the market. Since mid-February, the Michigan Department of Transportation (MDOT) has placed weight restrictions on loads moving through the majority of the state, including Detroit and its neighboring market of Grand Rapids.

During the spring thaw, roadbeds soften as melting snow and ice are trapped beneath the pavement, making roads more vulnerable to pothole damage. MDOT has effected a 25% load weight reduction for trucks moving on concrete pavements and a 35% reduction for those moving on asphalt. Of course, if load sizes are reduced, the number of loads should rise in concert. Accordingly, Detroit’s local OTVI is up a healthy 3.71% w/w but was up 36.4% w/w on Wednesday.

By mode: Van and reefer volumes were equally unimpressive this week, with no major movements seen in either the Van Outbound Tender Volume Index (VOTVI) or the Reefer Outbound Tender Volume Index (ROTVI). Potatoes and apples continue to drive reefer volumes in Idaho and Washington markets, but the true produce season has yet to commence, leaving ROTVI with anemic growth of 0.23% w/w. Even still, ROTVI saw a major boost last week from severe winter storms across the country, so any further w/w growth is impressive in its own right.

Dry van activity continues to atrophy without significant consumer activity but will likely pick up later in the spring. At present, however, VOTVI is up only 0.32% w/w.

Death by a thousand cuts

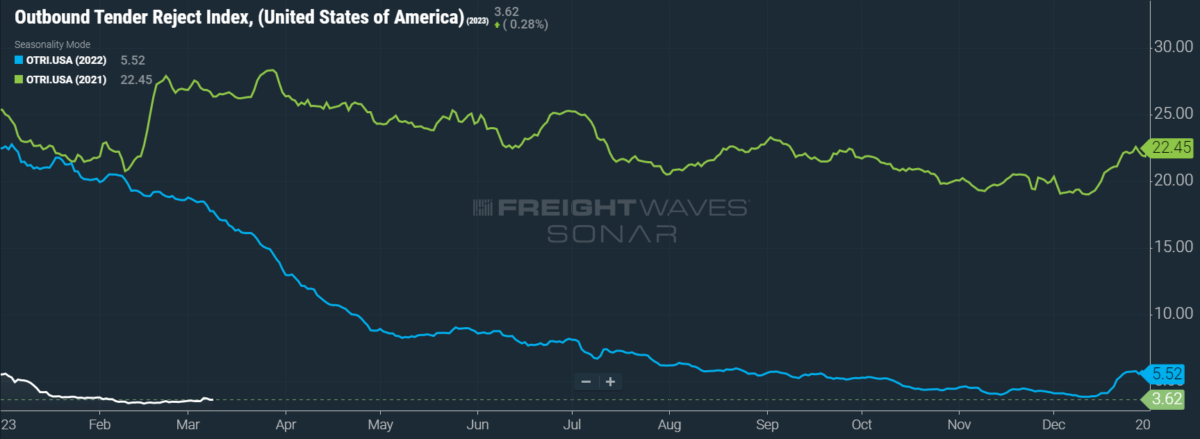

As expected, last week’s late-winter storms had some effect on tender rejection rates. OTRI, which is calculated as a seven-day moving average, ticked up to 3.74% early in the week. Sadly, this movement was both inconsequential — returning OTRI only to the levels of early February — and insubstantial, since these gains are evaporating.

SONAR: OTRI.USA: 2023 (white), 2022 (blue) and 2021 (green)

To learn more about FreightWaves SONAR, click here.

Over the past week, OTRI, which measures relative capacity in the market, rose to 3.62%, a change of 7 basis points (bps) from the week prior. OTRI is now 1,412 bps below year-ago levels.

Earlier this week, a North Carolinian trucking company shuttered its operations after 11 years in the industry. FreightWorks — not to be confused with FreightWaves, which posted outstanding growth last quarter — operated 186 power units with roughly 140 drivers. In a frank video message to employees, Joyce Siqueira, vice president of operations at FreightWorks, clarified that the company suffered a fatal blow when its core group of contract customers demanded “massive rate and volume concessions.” The company’s fleet size placed it among the largest carriers in an industry in which fewer than 3% of fleets operate with 20 or more power units. This news is solemn, both for the employees displaced and for the grim reminder that even larger carriers are not insulated from adverse market conditions.

Such layoffs were apparently common in February, according to the Bureau of Labor Statistics’ latest jobs report. Last month, the transportation and warehousing sector lost 21,500 positions, with the heaviest losses coming from the truck transportation (minus 8,500 jobs) and the warehousing and storage (minus 5,500) subsectors. This data set is important because the other primary source for measuring driver employment comes from the Federal Motor Carrier Safety Administration. FMCSA data is highly reactive to new authorities granted, meaning that new entrants to the market can be measured quite easily, but is slow to react to carriers exiting the marketplace. This slowness is simply due to the fact that carriers can choose to let their insurance expire and sit on their authority without revoking it. In fact, when a smaller carrier is closing operations and/or declaring bankruptcy, revoking one’s authority is hardly a top priority.

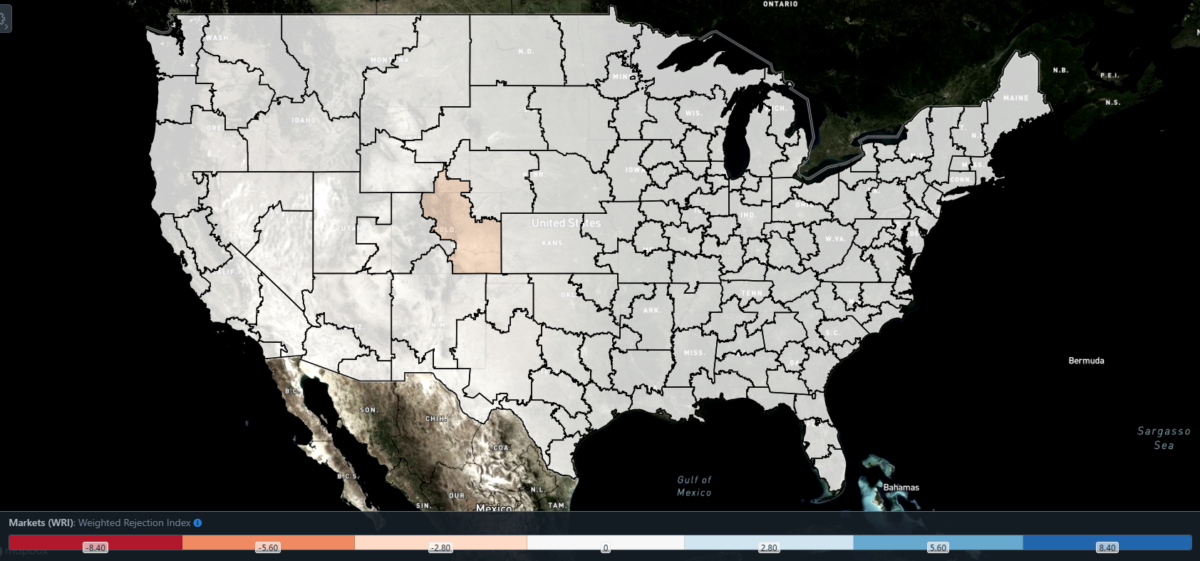

SONAR: WRI (color)

To learn more about FreightWaves SONAR, click here.

The map above shows the Weighted Rejection Index (WRI), the product of the Outbound Tender Reject Index — Weekly Change and Outbound Tender Market Share, as a way to prioritize rejection rate changes. As capacity is generally finding freight this week, no regions posted blue markets, which are usually the ones to focus on.

Of the 135 markets, 66 reported higher rejection rates over the past week, though 42 of those saw increases of only 100 or fewer bps.

As mentioned earlier, Idaho potatoes are still a major source of reefer freight demand for the time being. This seasonal activity has led the market of Twin Falls, Idaho, to have one of the highest reefer rejection rates in the country, with its local Reefer Outbound Tender Reject Index (ROTRI) sitting at 10.96% after a staggering gain of 845 bps w/w. Evidently, this growth in reefer rejection rates has had a knock-on effect for the market’s overall OTRI, which rose 308 bps w/w to 5.62%.

To learn more about FreightWaves SONAR, click here.

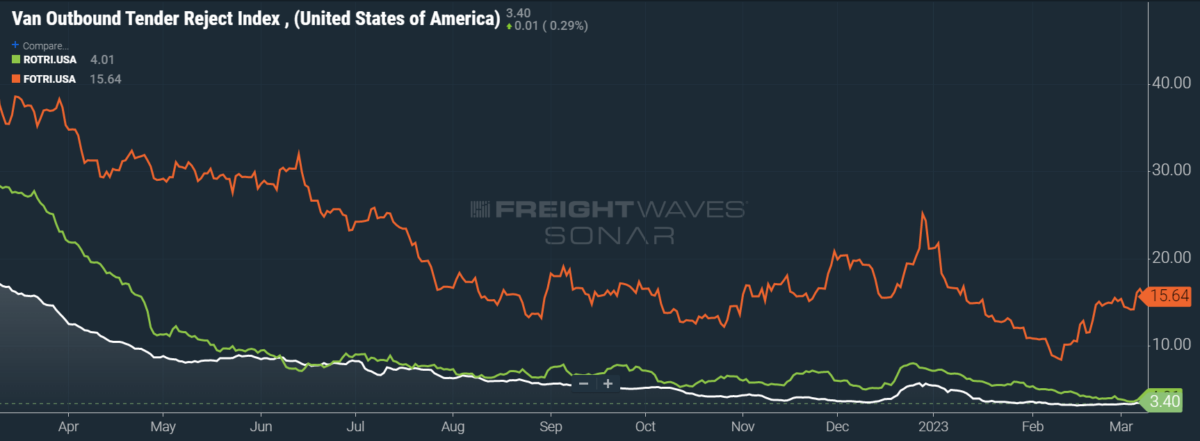

By mode: All modes benefited from a bump in rejection rates early this week, when capacity was disrupted by heavy winter storms. But flatbed rejections arguably saw the most important growth since, last week, the Flatbed Outbound Tender Reject Index (FOTRI) was losing its grip on gains made since early February, when FOTRI was 8.43%. This unexpected bump pushed FOTRI up 115 bps w/w to 15.64%, despite weak signals from the manufacturing and construction sectors.

Other modes did not perform as admirably. ROTRI fell to an all-time low of 3.63% over the weekend — lower even than the darkest days of the pandemic in April 2020, when ROTRI was 3.82%. The index did manage to claw back some of those losses, with ROTRI rising 20 bps w/w to 4.01%. The Van Outbound Tender Reject Index (VOTRI), meanwhile, saw insignificant growth of 5 bps w/w to 3.4%.

Trucking industry has a soft spot (market)

Spot rates have been predictably unpredictable. In last week’s column, I signaled that spot rates “appear to be leveling out” with the caveat that they “retain the possibility to fall even further.” While such an escape clause might seem cheap (and it is, to some extent), I wrote it knowing that spot rates have continually found new opportunities to be debased even when one might think that they’ve hit a floor.

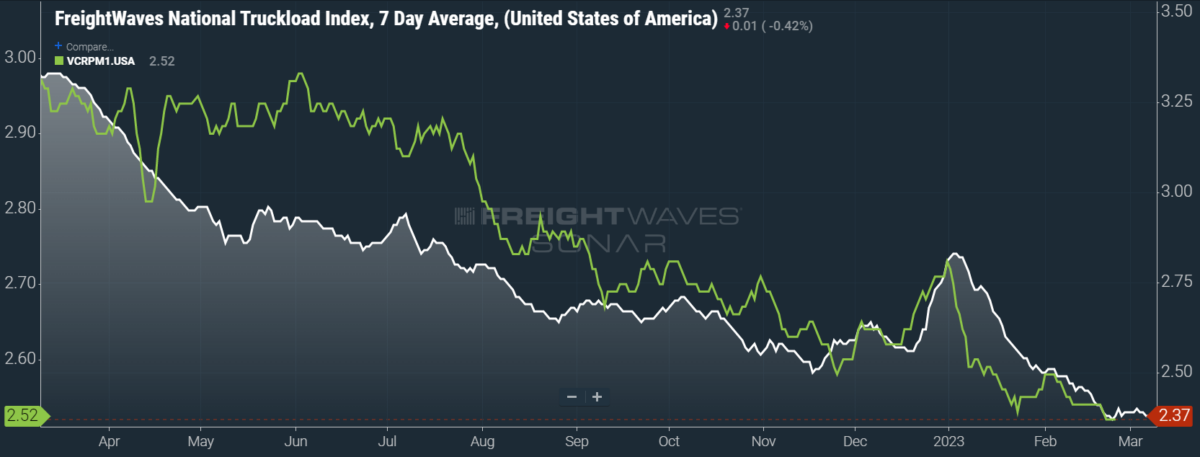

SONAR: National Truckload Index, 7-day average (white; right axis) and dry van contract rate (green; left axis).

To learn more about FreightWaves SONAR, click here.

This week, the National Truckload Index (NTI) — which includes fuel surcharges and other accessorials — fell 2 cents per mile to $2.37. Unfortunately, this loss cannot be pinned on falling diesel prices, as the linehaul variant of the NTI (NTIL) — which excludes fuel surcharges and other accessorials — likewise fell 2 cents per mile w/w to $1.69. Eventually, consistently low spot rates will force a massive wave of smaller carriers out of the market, balancing the current overabundance of capacity and driving up rates once again. But, aforementioned closures notwithstanding, no such exodus has been reflected in OTRI or other SONAR data.

Contract rates, which exclude fuel surcharges and other accessorials like the NTIL, also fell 2 cents per mile w/w yet remain far more stable than spot rates, given the average length of shippers’ bid cycles. Contract rates, which are reported on a two-week delay, presently sit at a national average of $2.52 per mile. It is possible that we will see contract rates rise notably once data from early March comes in, but we should nevertheless expect contract rates to decline in the second quarter.

To learn more about FreightWaves SONAR, click here.

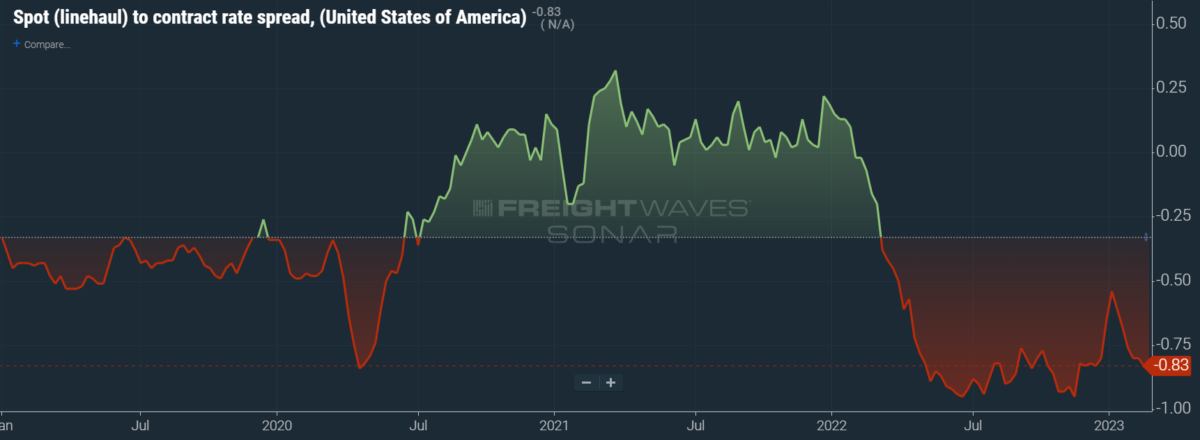

The chart above shows the spread between the NTIL and dry van contract rates, revealing the index has fallen to all-time lows in the data set, which dates to early 2019. Throughout that year, contract rates exceeded spot rates, leading to a record number of bankruptcies in the space. Once COVID-19 spread, spot rates reacted quickly, rising to record highs on a seemingly weekly basis, while contract rates slowly crept higher throughout 2021.

Despite this spread narrowing significantly over the first few weeks of the year, tightening by 20 cents per mile in January, it has continued to widen again. Since linehaul spot rates remain 83 cents below contract rates, there is still plenty of room for contract rates to decline over the coming months.

To learn more about FreightWaves TRAC, click here.

The FreightWaves TRAC spot rate from Los Angeles to Dallas, arguably one of the densest freight lanes in the country, was on an unstoppable decline since January but has finally leveled out. Over the past week, the TRAC rate held firm at $2.01, still a far cry from its year-to-date high of $2.39. The daily NTI (NTID), which sits at $2.38, is greatly outpacing rates from Los Angeles to Dallas.

To learn more about FreightWaves TRAC, click here.

On the East Coast, especially out of Atlanta, rates declined slightly and are similarly outpaced by the NTID. The FreightWaves TRAC rate from Atlanta to Philadelphia fell 1 cent per mile this week to reach $2.35. Except for Q4’s holiday run, rates along this lane have been dropping stepwise since July 2022, when the TRAC rate was $3.48 per mile.

For more information on the FreightWaves Passport, please contact Michael Rudolph at mrudolph@freightwaves.com or Tony Mulvey at tmulvey@freightwaves.com.

Thagearjammer25/8

Produce season is most likely a wrap this year. Fields are wrecked in California. Yuma and Mexico? Drive slow homie! Drop eld in puddle! 📝

Proud Family Logistics LLC

We can talk about shipper negotiations being in their favor all day, but the real blunder is carriers don’t see but a fraction of that. Give us Broker Transparency Carriers are dying out here.

ThaGearJammer258

Only thing we need is that market insight on we’re to position ourselves to maximize roi. As things get more fun; these are the types of articles that help you make good decisions. Appreciate your hard work. From my perspective. The maintenance and tires (mt index) are slacking pair that with the all time high driver fatigue and crabbiness index (fc) and that signals increased pressure from a low rate environment. We’ve also noticed more long term truck parking at truck stops. Suggesting guys are setting the tough times out. Gotta be in it to win it! Only 3% of trucking companies with 20 or more trucks. Interesting

Colin Postance

Do you know how many carriers have cancelled authority this year and how many trucks are of the road

I don’t understand how anyone can run for $1.00 to $2.00 a mile its impossible

I run my own trucks and also do mobile repair and shop repairs

trucks come in weekly with major issues due to lack of maintenance and never leave due to Lack of $$$$$$$$

Thanks Colin