Last week, we looked at some electrification startups, placing them in one of three buckets — plugging along, on the bubble or down for a dirt nap. This week, we’ll look at the state of autonomous trucking startups seeking to remove human drivers: Who is leading, who is on the bubble, who is emerging and who has left the stage?

Leading the way

Aurora Innovation

The Pittsburgh-based startup stands out for a number of reasons. It has OEM partnerships with Paccar Inc. and Volvo Group. It has $951 million in cash on its balance sheet, including $828 million raised in July. Aurora originally received about $1.2 billion in proceeds from a special purpose acquisition company merger in November 2021.

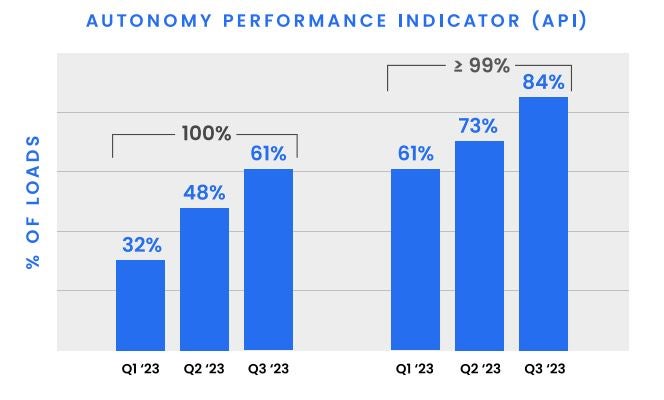

Aurora transparently shares its progress, even if some of the measures described seem a bit in the weeds. Its latest self-assessment shows 84% readiness for commercializing driverless freight on Interstate 45 between Dallas and Houston by the end of 2024.

Its timeline for what it calls Aurora Driver Ready has slipped to the end of Q1 2024 from this quarter, according to its shareholder letter released Wednesday. But the delay is not enough to jeopardize its launch plans.

Aurora uses an Autonomy Performance Indicator quarterly that measures miles driven that:

• Did not require support, such as from a local vehicle operator or other on-site support.

• Required remote input from the Aurora Services Platform.

• Support was received but later determined that it was unneeded.

Gatik

As the only significant player in short-haul autonomous trucking, privately held Gatik continues to grow its hub-and-spoke driverless operations.

Using Class 7 Isuzu box trucks, Gatik is weaning shippers from using Class 8 day cab semi-trailers on shorter runs.

The Mountain View, California-based company practically owns autonomy in Northwest Arkansas. It started driver-monitored deliveries for Walmart in 2019 before going driverless in 2021. It signed a three-year supply agreement with Tyson Foods, a Walmart neighbor, in September that could expand to as many as 40 markets.

Gatik runs autonomous deliveries for Loblaw Companies in Canada and has a deal to do likewise with grocery giant Kroger in Dallas.

Kodiak Robotics

Kodiak is in the leader group despite a lack of public information about its finances. Because it eschewed taking SPAC money during the frenzy of 2020 and 2021, just how much money the Mountain View, California-based company has to scale its business is unknown.

Kodiak has not announced a capital raise since its $125 million B Series led by Pilot Co. in November 2021. But it scored the first autonomous system order of any heft, a June order of 800 autonomous systems by startup freight broker Loadsmith. Deliveries begin in the second half of 2025.

Top carriers including C.R. England, Tyson Foods and Forward Air test or have tested the Kodiak Driver system.

CEO and co-founder Don Burnette won’t offer a specific target for driverless operations. Kodiak lacks a direct OEM relationship. It has some hardware technology like its Sensor Pods that could potentially be licensed. And, while not exactly a capital infusion, Kodiak won a $49.9 million contract with the U.S. Army in December to apply its Kodiak Driver to military uses.

Torc Robotics

The independent subsidiary of Daimler Truck has made significant progress toward commercialization. After declining to define a specific date for driver-out operations from the time Torc became part of Daimler in 2019, the company in July said it would begin commercialization in 2027.

Unlike those with short financial runways, the Blacksburg, Virginia-based company can take its time because market leader Daimler ultimately pays the bills.

Operating in the U.S. out of a former car dealership in Albuquerque, New Mexico, Torc benefits from integrating its software and hardware onto a purpose-built Freightliner Cascadia chassis. It has its pick of interested Cascadia customers for testing and down the road for commercial integrations.

I’ll get an in-person update on Torc’s progress in a couple of weeks.

On the bubble

TuSimple Holdings

Not so long ago, TuSimple arguably led the pack in pursuing commercialization of autonomous trucking. It has since deemphasized its U.S. presence through head count reductions and asset sales. A “strategic review” of its U.S. business could lead TuSimple to exit the market — if it finds a buyer for its patent-rich and cash-healthy operations.

TuSimple was the first to demonstrate a driverless trucking pilot in December 2021, an 80-mile nighttime run in Arizona. It has since demonstrated driver-out capabilities in China and Japan.

TuSimple’s Asian operations — once on the block — now get most of the attention, possibly because co-founder and controlling shareholder Mo Chen has businesses in China. Two rounds of layoffs in December and May affected about 55% of the U.S. workforce.

TuSimple shut down a costly autonomous freight-hauling business with safety drivers. An operations base in Tucson, Arizona, was put up for sale.

The breakup in December 2022 with Traton Group-owned Navistar International after 2 1⁄2 years left TuSimple without an OEM partner. CEO Cheng Lu dismissed the criticality of a specific tie-up since Tier 1 suppliers lead efforts in redundancy of steering, braking and power.

Since its $1.1 billion initial public offering in April 2021, TuSimple has held onto much of its cash. It reported $834 million in cash and short-term investments as of June 30.

Plus

Another private player, Plus focuses most of its U.S. efforts on autonomous features that fall short of a full Level 4 system. But the high-autonomy system runs in the background of PlusDrive-enabled trucks.

Plus had a big presence in China, including a joint venture with the state-owned First Auto Works. According to a Reuters report in October, Plus agreed to hand off its China operations to Full Truck Alliance, a key stakeholder. Plus executives declined to discuss details.

More recently, Plus has talked up an alliance with Australia’s Transurban, a leading toll road operator. Plus tested its Level 4 system in June and announced a collaboration in August.

A Plus SPAC merger collapsed in November 2021 amid rising U.S.-China tensions. CEO David Liu demurred when asked on Truck Tech whether Plus is considering going public. He said the company’s cash position is strong but declined to give details.

Waymo Via

Alphabet Inc.-backed Waymo suspended but did not cancel its autonomous trucking efforts in July. While focusing on the Waymo robotaxi and ride-hailing operations, the company could resume trucking efforts if its parent company, born of the original Google Self-Driving Car Project, allows.

For now, Waymo Via continues working with partner Daimler Truck on the redundant chassis that Torc also uses. The original plan had Waymo selling its Waymo Driver system while Torc would offer a homemade version — much the way Daimler sells its Detroit-branded engines alongside offerings from Cummins Inc.

It could still happen. But not right away.

Emerging players

Waabi

The Canadian startup in September signed a 10-year deal to haul loads for Uber Freight.

On Thursday Waabi announced a partnership with the MIT Center for Transportation & Logistics. It is the first autonomous player to join the center’s research-focused Supply Chain Exchange. That fits with founder Raquel Urtasun’s academic background. She was a professor at the University of Toronto before starting Waabi in 2021.

Waabi focuses on using generative AI to train its autonomous system.

Stack AV

The newest name in the autonomous trucking space has the founders of shuttered Argo AI as its founders and money from Japan’s Softbank behind it. Precisely what Stack plans is still unclear, but most industry observers say it must be taken seriously.

The down and out

Embark Trucks

San Francisco-based Embark created a plug-and-play autonomous system capable of operating on major OEM Class 8 trucks. But the startup ran out of money to scale despite significant interest and the influential former U.S. Transportation Secretary Elaine Chao on its board.

Embark had significant accomplishments: testing autonomous trucks in snowy conditions; demonstrating interaction with law enforcement; and even delivering a test unit to carrier giant Knight-Swift. But the end came suddenly in March when $314 million raised in a November 2021 SPAC merger ran out.

Embark Technology sold itself in May to Applied Intuition in an all-cash $71 million merger.

Locomation

Spell-checkers always correct Locomation to Locomotion. The Pittsburgh startup envisioned using Level 4 autonomy to advance truck platooning.

By swapping the drivers at the end of an 11-hour allowable shift, Locomation could safely operate two trucks for up to 22 hours per day while remaining in compliance with hours-of-service regulations. Locomation planned to eventually remove the drivers from the trucks.

Nothing has been heard of Locomation since February when co-founder and CEO Çetin Meriçli denied it was shutting down amid the layoff of an undetermined number of its 122 employees. The company raised $105 million from the time of its founding in 2018, including $15 million in October 2022, according to PitchBook.

That’s it for this week. Click here to get Truck Tech via email on Fridays. And catch the latest in major events and hear from the top players on Truck Tech at 3 p.m. Wednesdays on the FreightWaves YouTube channel.

Thanks for reading. I’m always interested in your feedback and story ideas. Email me at aadler@freightwaves.com.

Editor’s note: Corrects Torc commercialization target to 2027 from indefinite.

Don’t miss five top-name keynotes planned to anchor F3: Future of Freight Festival:

Brad Jacobs, managing partner of Jacobs Private Equity, LLC and executive chairman of XPO, Inc.

Alex Epstein, the founder & president of the Center for Industrial Progress and author of “Fossil Future: Why Global Human Flourishing Requires More Oil, Coal, and Natural Gas — Not Less”

Chris Voss, former international FBI hostage negotiator & Wall Street Journal bestselling author of “Never Split the Difference: Negotiating As If Your Life Depended On It”

Leland Miller, co-founder & CEO of China Beige Book International

Dr. Michio Kaku, a theoretical physicist, professor, & futurist with five New York Times bestsellers, who is one of the most influential physicists in the world