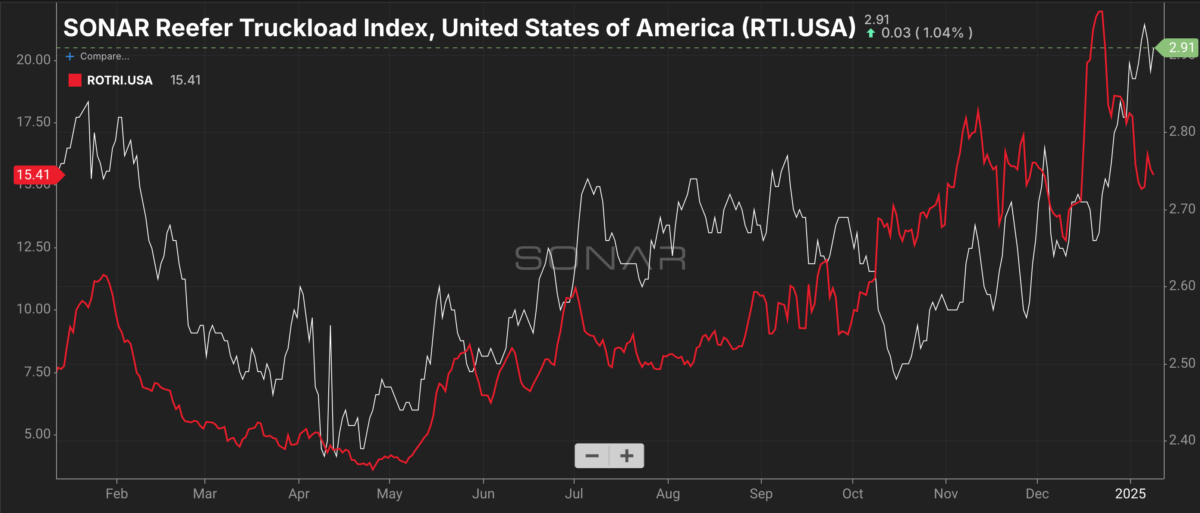

Peak retail season may be over, but reefer national average spot rates are breaking above $2.91 per mile.

The refrigerated trucking market continues to demonstrate robust strength into January, buoyed in part by the challenges posed by severe winter weather systems like Winter Storm Cora. Spot rate and tender rejection data reveal a sustained demand for temperature-controlled transportation, underscoring the critical role of reefer trucks in maintaining the integrity of perishable goods during harsh climatic conditions.

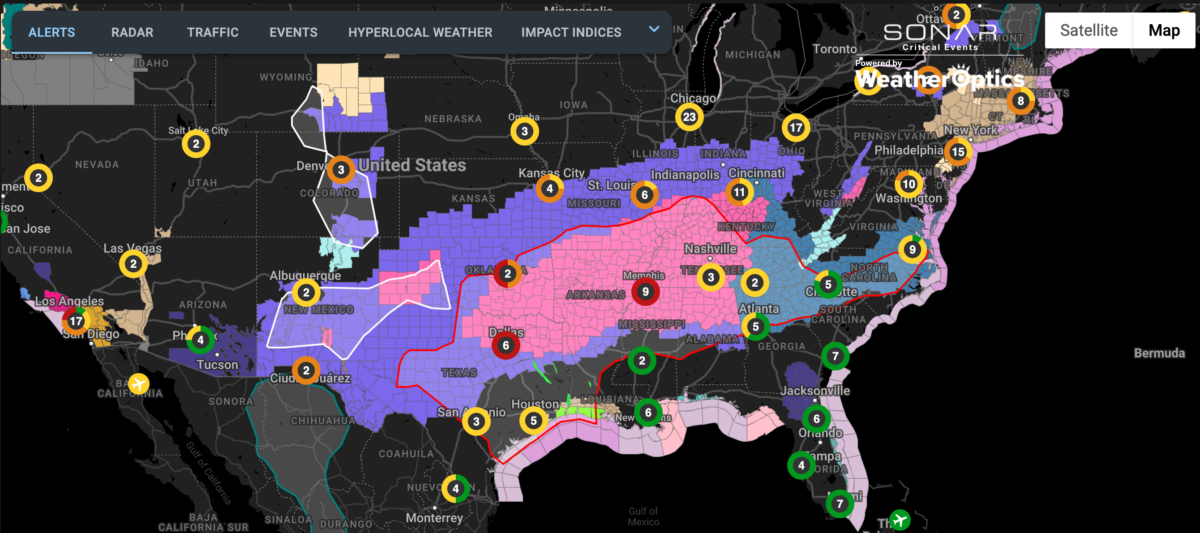

The impact of severe winter weather on the reefer market is particularly pronounced in regions susceptible to freezing temperatures and heavy snowfall. Cora, forecast to affect a broad swath of the southern United States, from Texas and Oklahoma to Virginia and North Carolina, exemplifies the type of extreme weather events that drive up the demand for reefer trucks. These trucks, equipped with insulated trailers and temperature-control units, are essential for safeguarding perishable goods against freezing, thereby ensuring uninterrupted supply chains.

Geographically, areas such as Yuma, Arizona, known as the “Winter Lettuce Capital of the World,” play a significant role in the reefer market. Truckload volumes in Yuma were 15% higher compared to the same period in 2023, with reefer rates ending 2024 almost 1% higher at an average of $2.40 per mile. High-volume regional lanes like Yuma to Los Angeles are averaging $3.73 per mile, nearly 50 cents per mile higher than last year. These elevated rates reflect the increased demand and the critical nature of refrigerated transport in ensuring the timely delivery of leafy greens consumed nationwide during winter months.

Cora’s approach is expected to exacerbate the demand for reefer trucks in affected regions. The storm’s path covers key agricultural areas, including portions of Texas, Oklahoma, Arkansas, Tennessee and the Carolinas, where the transportation of perishable commodities is vital. In Buffalo, New York, for instance, the reefer outbound tender rejection rate has surged to 36%, significantly above the national average of 15.4%. This spike indicates a tightening of reefer truck capacity as shippers prioritize temperature-controlled freight to mitigate the risks associated with the impending winter weather.

The shortage of reefer trucks in these regions is underscored by the national trends in tender rejection rates. Since early October, the Reefer Outbound Tender Reject Index (ROTRI) has averaged above 14%, a substantial increase from the historic lows of 5.3% in 2023. This rise in rejection rates suggests that demand for refrigerated capacity is outstripping supply, particularly in areas impacted by severe weather. As Winter Storm Cora intensifies, the need for reliable reefer transportation becomes even more critical, further straining available resources.

(The Reefer Truckload Index is a national average of refrigerated truckload spot rates in U.S. dollars per mile; the Reefer Outbound Tender Reject Index is the percentage of refrigerated truckload tenders rejected by carriers. Chart: SONAR. To learn more about SONAR, click here.)

Reefer capacity constraints are not limited to peak winter periods. As 2024 came to a close, reefer truck shortages were reported in Idaho’s Twin Falls, Burley and Upper Valley regions, as well as Washington’s Columbia River Basin, according to the U.S. Department of Agriculture’s Refrigerated Truck Dashboard. These shortages reflect broader overcapacity concerns in the industry, where approximately 7,000 carrier authorities have been lost each month. Despite these challenges, carriers like RST Inc. in Caldwell, Idaho, have not seen significant rate increases, suggesting that the market may be approaching a bottom cycle, although the impact of ongoing winter weather could alter this trajectory.

Winter weather also affects the operational efficiency of refrigerated trucks. The necessity for insulated trailers and precise temperature-control systems means that reefer trucks are in higher demand during periods of extreme cold. This demand surge is particularly evident in regions experiencing heavy snowfall and freezing temperatures, where maintaining the cold chain is crucial for preventing spoilage and ensuring the safety of transported goods.

(SONAR’s Critical Events dashboard. Map: SONAR)

Outperformance in the restaurant industry is also driving demand for temperature-controlled logistics higher.

In November, the Restaurant Performance Index (RPI) saw a modest increase of 0.8%, reaching a value of 101.2. This uptick was largely attributed to improved business outlooks among restaurant operators, who reported a net increase in same-store sales for the second time since December 2023. The Expectations Index, which measures a six-month outlook, also rose to 102 — its second consecutive month above 100 — indicating growing optimism about sales growth and economic conditions. This positive sentiment translates into steady demand for refrigerated trucking services as restaurants anticipate higher consumption rates.

In addition to increased demand, winter weather conditions contribute to higher operational costs for reefer trucking companies. The need for specialized equipment and the challenges of navigating treacherous roads and adverse weather conditions require carriers to invest more in their fleets and operations. These factors collectively drive up reefer rates and contribute to the sustained strength of the refrigerated trucking market.

Looking ahead, the winter outlook remains a critical factor for the reefer market. With Cora poised to impact a significant portion of the United States, the demand for temperature-controlled transportation is expected to remain strong. Reefer trailers will not only be essential for cooling but also for protecting goods from freezing temperatures, underscoring the indispensable role of reefer trucks in the supply chain during winter months.

The regional disparities in reefer truck availability highlight the uneven impact of weather conditions on the market. While regions like Buffalo and Idaho’s Upper Valley experience heightened demand and capacity constraints, other areas may see more balanced conditions. However, the overarching trend points to a reefer market that is not only resilient but also adapting to the increasing challenges posed by severe winter weather.

The refrigerated trucking market’s continued strength in January testifies to the critical importance of temperature-controlled transportation in maintaining the flow of perishable goods through challenging winter weather. Severe events like Winter Storm Cora amplify the demand for reefer trucks, leading to higher spot rates and increased tender rejection rates.