The reshoring of semiconductor manufacturing to the United States is rapidly gaining momentum due to several critical factors. At the forefront is the recognition of the increasing complexity and vulnerability of global supply chains and geopolitical tension with China.

This is J.P. Hampstead, co-host of the Bring It Home podcast with Craig Fuller. Welcome to the sixth edition of our newsletter, which explores the chipmakers’ return to American shores.

The semiconductor industry, vital for countless technologies, has been predominantly outsourced to Asia, particularly Taiwan and South Korea. The recent global chip shortage underscored the risks of this reliance, revealing how disruptions in these supply chains could cripple industries from automotive to consumer electronics.

Geopolitical tensions, especially with China, have further propelled this movement. The U.S. has implemented export controls and investment restrictions on semiconductor technology to protect its economic and security interests, recognizing semiconductors as not just commercial products but strategic assets crucial for national defense and technological dominance. The strategic necessity of domestic production has become clear as chips are integral to everything from military applications to the infrastructure of the digital economy.

(Photo: Dell blog)

Additionally, the U.S. maintains a leading edge in high-tech innovation but has lost ground in manufacturing capabilities. To sustain and advance its position in the global tech arena, the U.S. needs to control the production of advanced semiconductors, particularly those critical for emerging technologies like AI, 5G and quantum computing.

In response to these imperatives, the U.S. government passed the CHIPS and Science Act, catalyzing significant investments in domestic manufacturing. Here are some notable examples:

- Micron Technology received nearly $6.2 billion in subsidies to expand its operations in Idaho and New York, aiming to increase U.S. semiconductor production capacity.

- Taiwan Semiconductor Manufacturing Co. (TMSC) announced investments totaling $65 billion for constructing three new fabrication plants in Arizona, showcasing a commitment to diversify production beyond Taiwan.

- Intel has been investing heavily in Ohio with plans for a $20 billion facility near Columbus, emphasizing the manufacturing of leading-edge logic chips necessary for future tech advancements.

These initiatives are not only about bringing manufacturing back to the U.S. but also about fostering an ecosystem that includes research, design and skilled labor development.

Two industries most directly impacted by this resurgence are automotive and tech.

Modern vehicles, especially electric and autonomous vehicles, rely heavily on semiconductors for functions ranging from basic engine control to advanced driver-assistance systems (ADAS) and infotainment. The automotive industry has been severely affected by chip shortages, prompting a push for domestic production to ensure supply chain resilience and meet the increasing demand for chips in each car.

Semiconductors are the backbone of the digital transformation in tech. From servers supporting cloud computing and AI workloads to the chips powering smartphones and data centers, the demand for high-performance and energy-efficient chips is soaring. AI applications, in particular, require specialized chips like GPUs and TPUs, which are pivotal for training and deploying AI models at scale.

At the end of the day, the resurgence of semiconductor manufacturing in the U.S. is more than an economic strategy; it’s a multifaceted approach to national security, technological leadership and economic competitiveness. By reshoring this critical industry, the U.S. aims to secure its supply chains, leverage its innovation capabilities and meet the burgeoning demand from sectors that are shaping the future of technology and mobility. This move is pivotal in ensuring that the U.S. remains at the forefront of the global technological revolution.

Quotable

“We are in the early innings of a multi-year race to enable artificial general intelligence. Micron will be one of the biggest beneficiaries in the semiconductor industry of the multi-year growth opportunity driven by AI.”

– Sanjay Mehrotra, CEO of Micron Technology

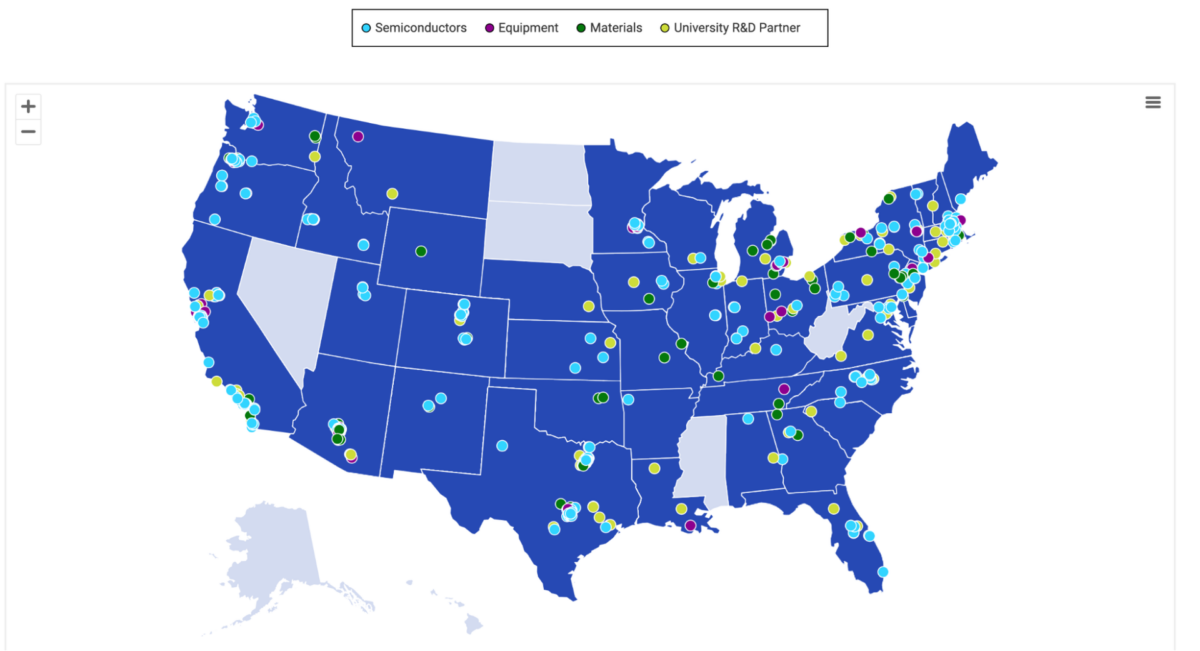

Infographic

Map of “The U.S. Semiconductor Ecosystem” via the Semiconductor Industry Association.

News from around the web

US finalizes $6.1 bln Micron chip-making subsidy

The U.S. Department of Commerce has finalized a subsidy of more than $6.1 billion for memory chip maker Micron Technology to support the construction of several domestic semiconductor facilities, according to a White House statement on Tuesday. The investment, unchanged from the amount originally announced in April, marks one of the largest government awards to chip companies under the CHIPS and Science Act. It will fund factory projects in New York and Idaho and is expected to create at least 20,000 jobs by the end of the decade.

GlobalWafers awarded $406m under CHIPS Act

Taiwanese silicon wafer maker GlobalWafers has finalized its CHIPS Act funding award with the Department of Commerce. The company will receive $406 million in direct funding, which will support the construction of two fabs in Sherman, Texas, and St. Peters, Missouri, for the production of 300mm wafers and silicon-on-insulator wafers.

More jobs, more manufacturing coming to California

On Friday, the Biden-Harris administration announced that the Department of Commerce and Bosch have signed a nonbinding preliminary memorandum of terms to provide up to $225 million in proposed direct funding under the CHIPS and Science Act.

Along with the state match from a CalCompetes Tax Credit award last year, this proposed funding will support Bosch’s planned investment of $1.9 billion to transform its manufacturing facility in Roseville, California, for the production of silicon carbide (SiC) power semiconductors. This will significantly increase the company’s production capacity and support the expansion of Bosch’s largest SiC device factory globally, while creating up to 1,000 construction jobs and up to 700 manufacturing, engineering, and research and development jobs in California.