JP Hampstead here, co-host of the Bring It Home podcast with Craig Fuller. Welcome to the second edition of the Bring It Home newsletter, which continues the conversations from our podcast about reindustrialization and reshoring in North America and the American manufacturing renaissance.

Be sure to check out the second episode of the podcast, “The Shale Revolution,” with Digital Wildcatters founder and CEO Collin McLelland (@fracslap on X), which was released last Thursday. Collin has a deep background in oil and gas that he draws on to describe the evolution of the energy sector and how the U.S. reached the position of one of the largest energy producers in the world.

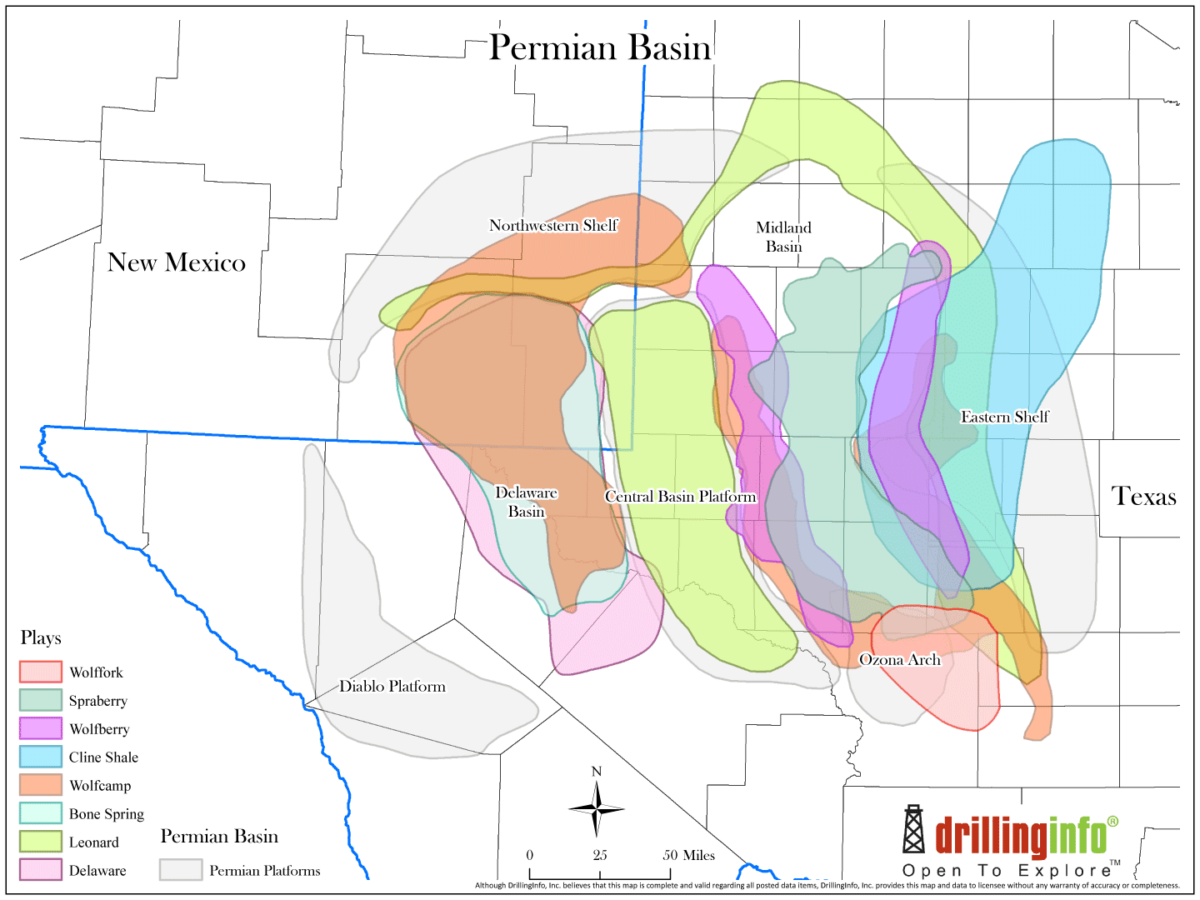

Collin grew up in Midland, Texas, in the heart of the Permian Basin, an ancient shale formation that straddles West Texas and part of Oklahoma. He became a roughneck, performing manual labor as part of an oil rig crew, before moving up in the industry and eventually founding Digital Wildcatters. First, Digital Wildcatters was a professional network and a media company covering the energy industry, but now DW has brought its first software product to market, an AI solution that combs through an oil and gas company’s internal data to help its engineers answer questions.

As Collin tells the story, it was the combination of two primary techniques in oil production that contributed to the shale revolution: first, hydraulic fracturing, which uses large amounts of fluid under pressure to shatter shale formations and release hydrocarbons, including oil and natural gas. Fracking (some oil and gas experts insist that it’s spelled “frac’ing”) has been done since the 1950s, but it wasn’t that profitable because a vertical line going down through a layer of shale doesn’t actually touch that much of the formation. It wasn’t until drillers learned how to reach the shale vertically, then turn 90 degrees and snake their way through the shale horizontally, touching as much of the rock as they could, that fracking became an important part of oil production.

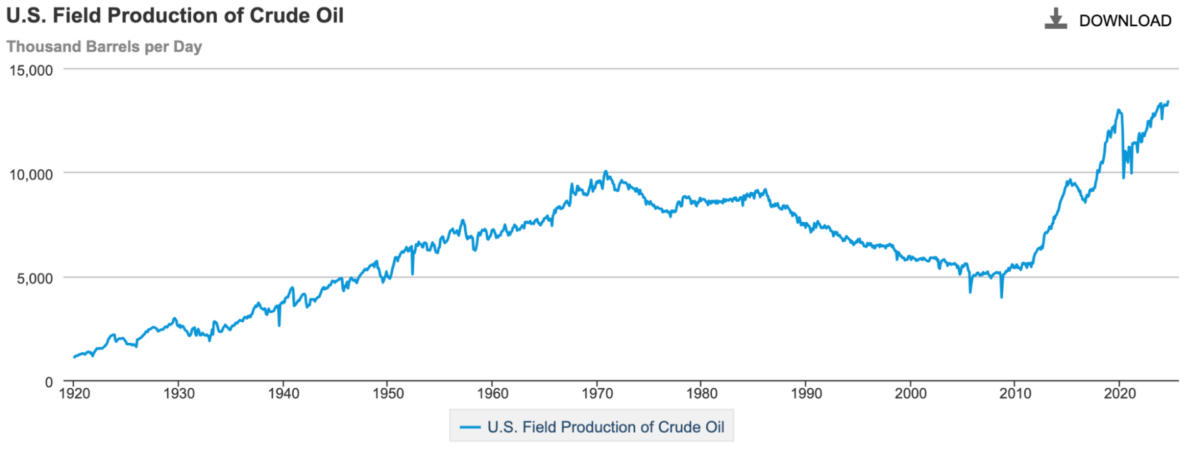

Now the U.S. leads the world in oil production and is finally a net exporter of petroleum — though Collin will be the first to tell you that “energy independence” is a mirage, and that no matter how much oil we produce, it will be priced in a global market.

More important for the reindustrialization of the United States than “energy independence” per se is abundant, inexpensive energy that we produce ourselves. Because fracking produces an abundance of natural gas along with its oil, it’s helping the U.S. transition from coal-fired power plants to natural gas. It’s also a boon to our petrochemicals industry.

Quotable

“We are moving policy over time to a more neutral setting. But the path for getting there is not preset. In considering additional adjustments to the target range for the federal funds rate, we will carefully assess incoming data, the evolving outlook and the balance of risks. The economy is not sending any signals that we need to be in a hurry to lower rates. The strength we are currently seeing in the economy gives us the ability to approach our decisions carefully.”

— Jerome Powell, chair of the Federal Reserve, in remarks made on Nov. 14

Infographic

News from around the web

Gov. Beshear announces $712m investment, 1,500 new jobs for Shelbyville Battery Manufacturing

The project will establish a state-of-the-art, 6-gigawatt-hour battery cell, module and packaging manufacturing facility in a 1 million-square-foot building on Logistics Drive in Shelbyville, Kentucky. These self-contained energy storage systems will be packaged into modular, containerized utility-scale batteries. Shelbyville Battery Manufacturing will support e-Storage’s rapidly growing U.S. energy storage business and deliver American-made energy storage solutions to customers throughout the United States.

Manufacturing Was Set to Rebound. Then Trump Happened.

A new uncertainty is clouding the horizon as companies contemplate the impacts of tariffs that President-elect Donald Trump has promised to apply liberally on friends and foes alike and of policy changes that could slash support for electric vehicles, computer-chip plants and battery production, among other things.

Even moves by the incoming administration that support business, such as making the 2017 tax cuts permanent, can pause decision-making. Companies will think twice about spending heavily on capital goods now if there’s a chance that bonus depreciation, which is set to drop to 40% on Jan. 1, could be reintroduced at 100%.

Army races to widen the bottlenecks of artillery shell production

The Pentagon is investing billions of dollars to increase the capacity of 155mm munition production as it races to replenish stock sent to support Ukraine’s fight against the Russian invasion, which began in early 2022, and to ensure the U.S. has what it might need should conflict erupt across multiple theaters at once. The Army planned to spend $3.1 billion in FY24 supplemental funding alone to ramp up production.

The service has set a target of producing 100,000 artillery shells per month, but Army officials have shared that it has fallen slightly behind schedule. Even so, the Army is now producing 40,000 shells a month, Army Secretary Christine Wormuth said at the Defense News Conference last month, adding that the plan is to reach 55,000 shells a month by the end of the year.