Management from Knight-Swift Transportation sees weak demand carrying through the first quarter with hopes of normal sequential improvement by spring. The company announced worse-than-expected fourth-quarter results on Thursday as slightly favorable trends to start the period turned sour in the closing weeks.

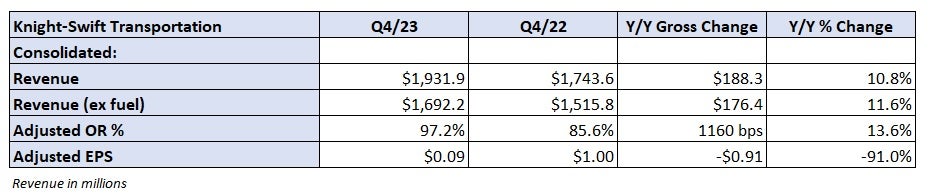

Knight-Swift (NYSE: KNX) reported a headline net loss of 7 cents per share for the 2023 fourth quarter. Excluding acquisition expenses, legal fees and impairments related to the sale of equipment, adjusted earnings per share were just 9 cents compared to the consensus estimate of 44 cents and the year-ago result of $1.

“The full truckload market capacity oversupply, coupled with customers’ efforts to reduce inventory levels have contributed to a difficult operating environment,” said President and CEO Dave Jackson.

The period included a $71.7 million operating loss in its third-party insurance offering, which was a 30-cent drag on the number. Knight-Swift said it has initiated a process to exit that business as it continues to see unfavorable claims developments among the pool of small carriers to which it brokers insurance. Through the downturn, the unit has also struggled to collect premiums from some operators.

All outstanding liability policies will be canceled and the unit will be unwound during the first quarter. Knight-Swift will still have some claims exposure but significantly less than the magnitude experienced in recent quarters.

Analysts lowered fourth-quarter numbers heading into the tape given a falloff in activity industrywide in the last two weeks of December.

Using a normal tax rate, higher net interest expense (due to acquisitions) was an 8-cent headwind compared to the prior year while lower gains on equipment sales were a 1-cent headwind.

The company only provided first-half 2024 guidance compared to a full-year outlook, which it normally provides in its fourth-quarter report each year. Knight-Swift is calling for adjusted earnings per share of 90 cents to 98 cents in the period (39 cents in the first quarter at the midpoint of that range and 55 cents at the midpoint of the second quarter range).

Management said inclement weather led to double-digit-percentage revenue declines in the first two weeks of the year, which was partly the reason for the shortened outlook.

The new guide assumes continued softness in the truckload business in the first quarter with some seasonality in the second. Contract rates are expected to remain stable sequentially. Less-than-truckload demand is expected to stay strong with improving yields.

The 94-cent first-half guide (at the midpoint) is less than half of the $2.08 consensus estimate at the time of the print. Most analysts are expecting at least some degree of acceleration in TL fundamentals in the back half of the year.

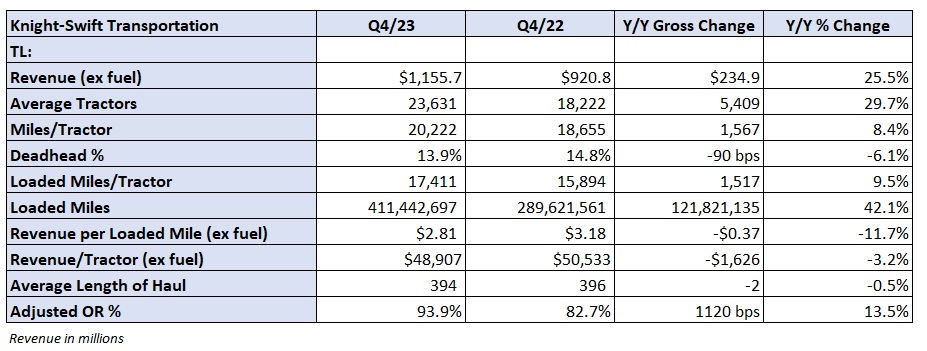

The TL segment reported a 26% y/y increase in revenue (excluding fuel surcharges) to $1.16 billion as average tractors in service increased 30% and revenue per tractor was off 3%. The y/y comparison included the acquisition of U.S. Xpress, which closed on July 1.

Revenue per loaded mile (excluding fuel) was down 12% y/y, which pushed margins lower. A 93.9% adjusted operating ratio was 1,120 basis points worse y/y. U.S. Xpress produced operating income on an adjusted basis in the period after multiple quarters of losses. The fleet, however, was a 250-bp drag on the overall segment.

Jackson said only a “minority” of its customers are trying to push pricing lower currently. It noted that a continuation of elevated costs has left it with little ground left to concede.

“We are not in a position to lower our rates through bids right now,” Jackson said.

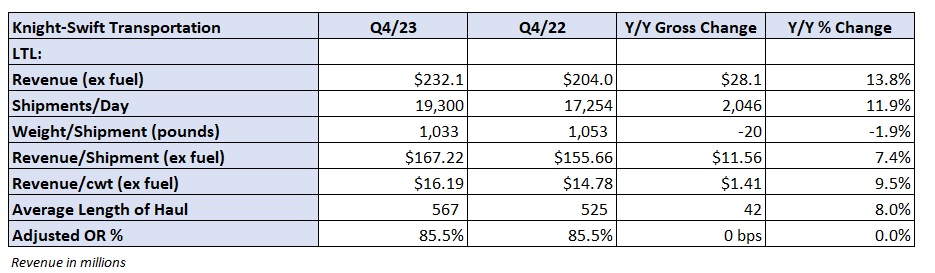

The LTL segment recorded a 14% y/y increase in revenue (excluding fuel) to $232 million. Shipments were up 12% y/y and revenue per shipment increased 2% (up 7% excluding fuel). Revenue per hundredweight was up 10% excluding fuel.

Knight-Swift added 14 LTL terminals to its network in 2023. The company said it will add a total of 25 terminals in 2024, some of which were formerly occupied by Yellow Corp. It said it takes 60 to 90 days from open until the new service centers begin to record breakeven results.

The LTL unit recorded an 85.5% adjusted OR in the period, which was flat y/y.

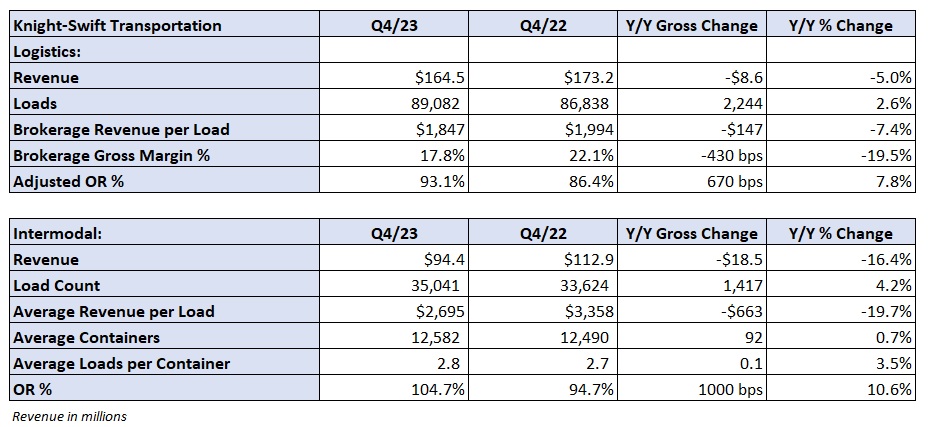

The logistics unit recorded a 5% y/y decline in revenue even with the addition of U.S. Xpress. Revenue per load was off 7% and the segment recorded a 93.1% adjusted OR, which was 670 bps worse y/y.

The intermodal segment lost money for a third straight quarter. Revenue was down 16% y/y as revenue per load fell 20%, which was just partially offset by a 4% increase in volumes. A 104.7% OR was 1,000 bps worse y/y.

- More FreightWaves articles by Todd Maiden:

- Late-December swoon has analysts cutting Q4 estimates again

- Forward Air-Omni merger dustup heads to trial Friday

- Truckload linehaul rates stabilizing, Cass report shows

James Bauman dba Kirplopus MC 895097

Todd (author), regarding upcoming Q1 reports for many carriers: I expect many to post losses; due to state of US economy. Inflation is ramping up; likely a byproduct of covert QE by Fed. Fed can hide the QE in footnotes; but can’t hide the inflation as a byproduct of QE….. with increasing inflation; the freight dynamics not likely to improve significantly. Anyway, I expect many net losses in upcoming Q1 reports. Would you plz , yourself and other FW writers, please note a company’s cash reserves in proportion to losses? If a legacy carrier posts a net $30M loss, it would be nice to see what percentage this loss is; compared to cash on hand. I think there will be some more $30M losses; but nice to know if this $30M is relatively small (or large) compared to cash on hand; compared to size of company, etc.

Brett Sant

The Swift fleet has the lowest DOT recordable Crash rate of all its large peers (and by a considerable margin in many cases), and since the merger with Knight its crash rate has been reduced by 50%. Folks who continue to denigrate Swift’ safety and training, do not know the facts. The data is publicly available.

Melissa Simon

As the largest carrier, Knight-Swift will be most visible as far as accidents go but the ratio is lower than most if you look at percentages. Eric you obviously have little experience beyond driving, if you have that even, and have joined the naysayers without being properly informed. I have not ever worked for either company but have been in the business over 30 years, so I’m able to see the full picture, not just the limited windshield view of a driver who couldn’t ever comprehend all of the intricacies of operations, safety, accounting, recruiting, etc. Try all of those thongs and then comment about Knight-Swift’s safety record.

Barry Knight

Really dumb observations. They entered the insurance market and lost ( read the article)

Billey Dies

No need to bash them as a company Eric , the same could be said about CR England,CRST, JB Hunt ,Prime ,ect you get the picture . There are videos on YouTube of every carrier out , you just pic them because they’re the largest carrier out here . From what I e seen they’ve made a lot changes for the better.

ERIC CHAPMAN

We all know Swift is a punchline for a very bad joke in the industry. Some how they are able to hide or buy there safety record to stay in business. As the rest of us have to deal with consequences of that.

Meaning all the new safety features that can’t keep swift out of the ditch. But will be mandated for the rest of us . Plus higher and higher insurance premiums.