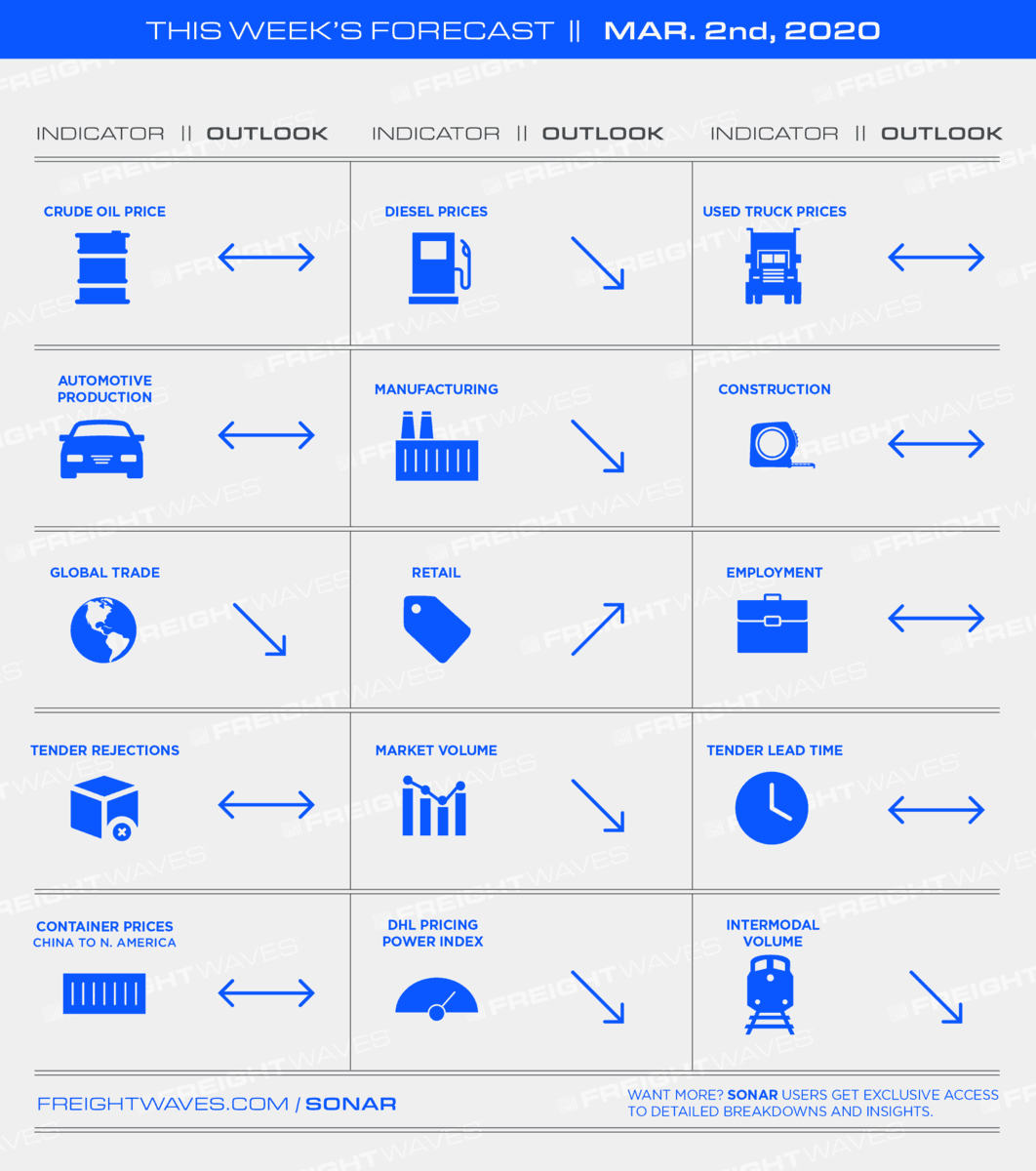

Manufacturing outlook:

The coming week will be telling for the industrial segment. The Institute for Supply Management updated the Purchasing Managers’ Index (ISM.PMI). It breached the 50-expansion threshold in for two consecutive months. There may be some talks of a turnaround for the manufacturing segment. However, the numerous headwinds in the current macro-economy suggest that we aren’t at the tail end of industrial (IPROG.USA) decline yet. The lack of activity means fewer goods being hauled via flatbed, loosening capacity and lowering rejection rates (FOTRI.USA).

Diesel fuel price outlook

EIA statistics show total U.S. distillate production at the highest level ever for the second week of February despite significant concern over demand. Inventory reports were bearish. One other factor looming in the market: OPEC meets March 5-6. All models show it needs to cut further to balance markets, but it is getting no support from its non-OPEC allies led by Russia. The market will probably start to focus on that soon and there’s nothing bullish there either.

Intermodal rates and volume

U.S. rail carload traffic excluding coal, grain and petroleum might be the most telling. They posted a 6% y/y decline during the past four weeks. In the week ahead, we will be watching railroad operating metrics. Canadian National suggested that it will take a number of weeks to return to pre-blockage levels of fluidity. In addition, we will closely watch international intermodal volumes out of the West Coast (ORAIL40L.LAX) for impacts related to lower imports from China.

Truckload capacity

The big unknown as we start March is both the duration of mandatory factory shutdowns in China and the magnitude of U.S. import decreases spilling over to shippers and carriers. Last week CNBC reported production shipments from Asia are down 10% m/m to the West Coast and 13% m/m to Northern Europe, which points to a crash in coastal freight volumes in the coming weeks. For shippers, this will create increased capacity in both intermodal and truckload markets and substantial pricing opportunities to reduce transportation costs, but this comes with a word of caution this week. Once the coronavirus runs its course, the recovery will be v-shaped and capacity will be hard to find as spot rates increase in all modes – look after your dedicated capacity by keeping them busy over the coming weeks and make sure your surge capacity is committed when the tide turns.