FreightWaves features Market Voices – a forum for voices with unique knowledge of numerous transportation/logistics/supply chain sectors, as well as other critical expertise.

On August 4, the University College of London’s Center for Blockchain Technologies (UBL CBT) published Distributed Ledger Technology in the Supply Chain,“a market report looking at the adoption of Distributed Ledger Technology (DLT) in physical supply chains.” The CBT added that the report “is the first comprehensive outlook on the state of DLT in the global physical supply chain sector.”

In this article, I synthesize three themes that the authors of this report identify as affecting the broad adoption of distributed ledger technology in global supply chain networks.

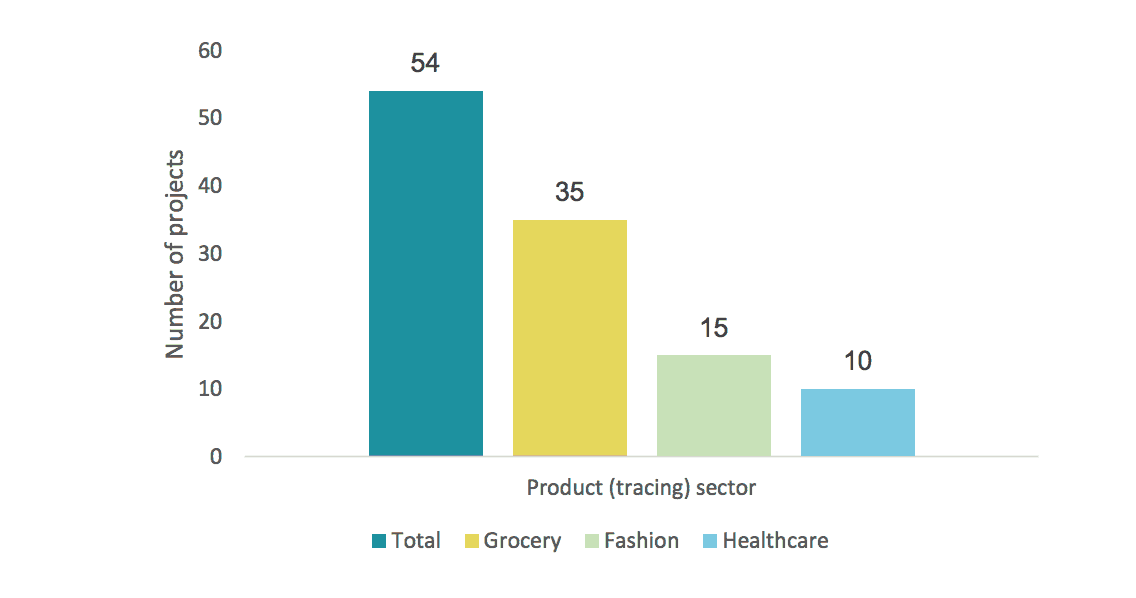

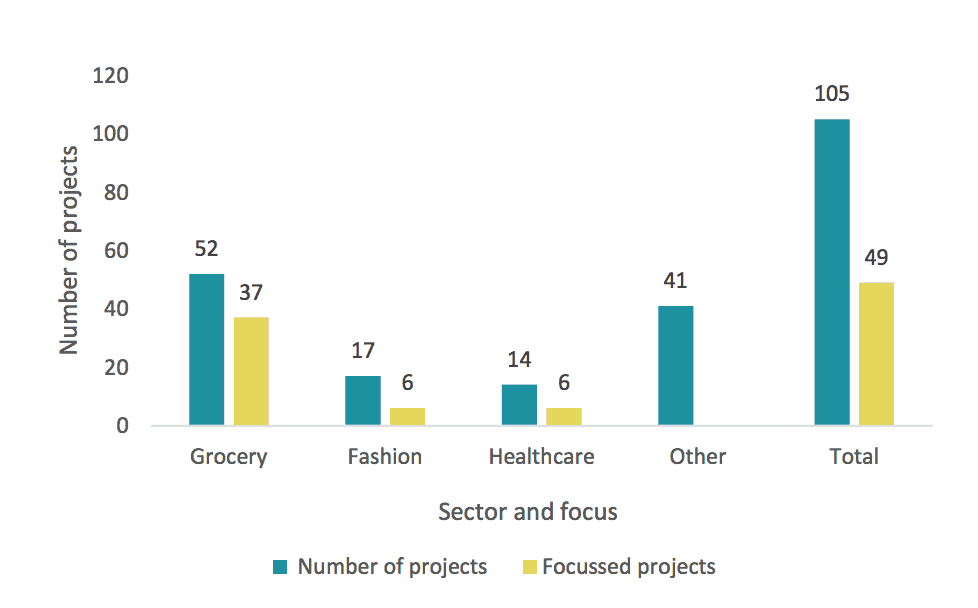

The report assessed 105 DLT projects.

Track and trace is the most common use-case across industries

The globalization of supply chains presents an advantage – goods can be sourced at lowest cost from any part of the world. However, that advantage comes with an attendant disadvantage – individual consumers, business customers and regulators all require information about products that have been sourced from far-flung parts of the world.

Given the size of the global food retail market, the complexity of food supply chains around the world, and the need to monitor and minimize outbreaks of food-borne illnesses, it is not surprising that retail food supply chains account for the majority of track and trace DLT in supply chain projects.

The report highlights IBM Food TrustTM, an ecosystem of food industry participants who share information with one another to create a more transparent and secure global food supply chain. This project already counts some of the world’s biggest food companies as members.

One promising early application of DLT is the digitization of manual, paper-based processes in supply chain logistics

One area in which we may see rapid adoption of DLT is in the digitization of manual, paper-based processes and record-keeping related to supply chain logistics. This is particularly relevant for the record-keeping required by the regulatory bodies involved in the import and export of goods around the world. Some port authorities are experimenting with blockchain-based bills of lading. One of the startup projects that the report highlights is CargoX, whose chief operating officer was a presenter at The New York Supply Chain Meetup’s one-year anniversary event in November 2018. Projects like CargoX have application across several industries.

On the other hand, as the authors state, “However, since supply chains typically involve many and varied participants it is also among the most complex use cases to implement. As with all blockchain deployments, benefits are only realized at scale once critical mass is obtained. Consequently, whilst a raft of proof of concepts have been completed over the past three years, rollout at scale is still a work in progress. This is challenging because it requires a collective approach with industry-level engagement.”

I have written that the cultural obstacles to DLT and blockchain adoption in supply chain logistics may be more difficult to overcome than the technical difficulties. This is because private, permissioned implementations of DLT in supply chain need to be interoperable with one another. This requires intra- and inter-industry collaboration. It requires collaboration between once sworn competitors. It requires collaboration between startups and established companies.

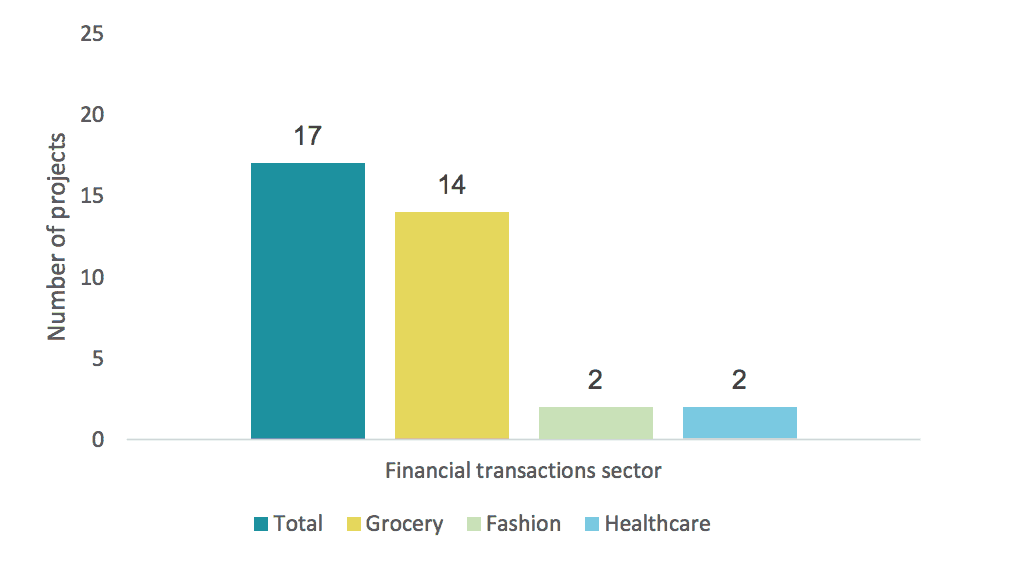

DLT in financial applications may take longer to gain widespread adoption than one would expect

In my opinion, applications of DLT in supply chain finance or trade finance are possibly the most exciting and most significant in terms of their potential economic impact. However, I believe they may be the last to gain broad adoption amongst enterprises. Applications in supply chain management and supply chain logistics will need to become more mature and widespread before applications in supply chain finance gain wider adoption. The authors of this report explain why this may be the case.

Applications in this area include: payments enabled by smart contracts; selling directly to individual consumers; and alternative methods of obtaining and deploying working capital. The chart below shows how the projects studied for this report are distributed.

The authors point out two reasons financial transaction applications of DLT in supply chain could take longer to gain adoption than the others. First, distributed ledger technologies and cryptocurrencies are still poorly understood. The lack of understanding of the technology creates negative perceptions. This creates barriers to adoption in financial transactions. Second, financial transactions must adhere to a high degree of regulation and legal scrutiny. It takes time for a regulatory framework that accommodates new payment methods to be developed. As I wrote above, supply chain finance applications of DLT will become more prevalent once supply chain management and supply chain logistics applications become more prevalent.

Conclusion: DLT in supply chain is here to stay, even if it takes time

The authors conclude by stating that DLT is set to transform physical supply chains, even though there is still much work to be done before decentralized systems become a reality for real-world applications at scale. They end the report with three observations. First, data quality remains a concern in DLT in supply chain applications. Second, input and output connections between DLT supply chain applications and physical supply chains must be built and defined. Lastly, “the new co-opetition model of consortia is not an easy one to implement. It requires a new way of working for companies and also is potentially challenging from a regulation and antitrust perspective. New collaborative forums can play an important role here to bring stakeholders together and drive industry level adoption.”