In an extraordinary video, the head of the largest brokers trade association defended his industry from the online and on-the-highway criticisms from carriers facing increasingly weak freight rates.

Bob Voltmann, president and CEO of the Transportation Intermediaries Association (TIA), took to YouTube with a roughly three-and-a-half-minute video in which he ripped views of the market that “some snake oil salesman would have you believe.”

“There’s a lot being said about truck rates and brokers today,” Voltmann said. “Brokers don’t set prices. The market does.”

The video comes as some small protests by truckers on highways have called for higher trucking rates. In some of those protests, like the one depicted in the picture accompanying this story, brokers have been portrayed as the villain in the plunge in trucking rates. Online, the vilification of brokers in various Facebook groups geared mostly toward drivers has been ramping up considerably.

Voltmann noted that the U.S. has shut down huge portions of its economy as a result of the pandemic. “And since mid-March, rates have plummeted,” he said. “Nobody is getting pre-virus rates.” It is the belief that some people are getting those higher rates that led to his statement about unidentified “snake oil salesmen.”

Much of the online chatter does involve some drivers saying, in essence, just park your trucks and wait for the rates to come back. Voltmann addresses this concept while talking about how rates are set in a market he describes as “huge, fractured and incredibly transparent.”

“Shippers, like all buyers, want to get the lowest price possible,” Voltmann says in the video.

“They know there is not enough freight to fill all the trucks. Shippers and brokers offer rates to probe the market. Shippers do it to brokers, and brokers do it to carriers.”

If the market doesn’t go through what economists call “clearing” at the numbers in the “probe,” higher numbers will be discussed. “If carriers don’t accept the rate, shippers and brokers will offer higher rates until the load is accepted,” Voltmann said. “That’s the free market economy that allows owner-operators and small carriers to operate.”

In a phone interview with FreightWaves, Voltmann conceded that the video “isn’t the type of thing I normally do. But these are not ordinary times.”

As a result of low rates, Voltmann said smaller carriers, like independent owner-operators or small firms, “are lashing out at my members. I thought this was something that was needed to put out there.” He described his arguments in the video as “economics 101.”

Voltmann also said TIA had been receiving phone calls from their members “looking for positive news or industry things they could point to.”

“Rates are down, margins are down across the board,” he said. “No one in America is fat, dumb and happy right now.”

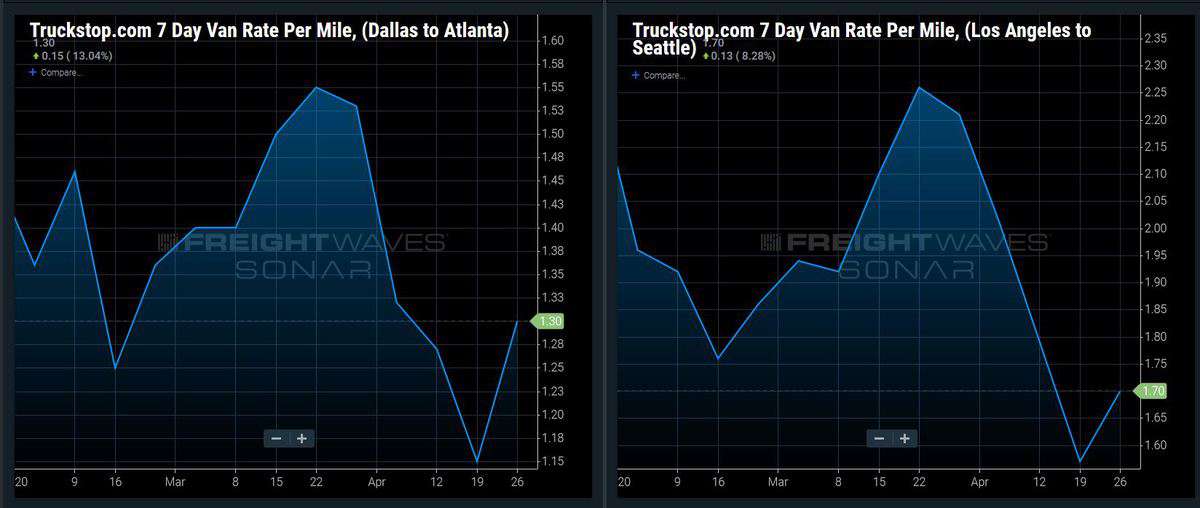

The irony of the video is that it comes as there are some signs that the market may be turning. According to the weekly data on rates published by SONAR and supplied by Truckstop.com, rates have taken an upturn.

For example, the Dallas to Atlanta lane posted a per-mile rate of $1.55 on March 22. It dropped to $1.15 on April 19 but a week later, in the most recent update, it was $1.30.

Similarly, the Los Angeles to Seattle late was $2.26 per mile on March 22, dropped to $1.57 per mile on April 19 and rose to $1.70 in the most recent update.

Voltmann cited the TIA 3PL market report. He said in the latest edition of that internally generated report, which comes out quarterly, brokers reported their average margin was 16%. “That means that if the shippers pay $1,000 for a load, the brokers keep $160 or 16% to cover their costs in manning a sales force to get the load and find the carrier, and their investment in technology to manage the shipper’s load and their profit,” Voltmann said.

In the economics of that transaction laid out by the TIA chief, the carrier gets $840, “84 percent of the gross margin to cover their costs of equipment, maintenance and profit.”

“The motor carrier gives up that $160 so they don’t have to have their own sales force and their own investment in technology to manage the shipper’s load,” Voltmann said.

And in a statement sure to spark some friction with carriers who are already angry, Voltmann said there exists a “yin and a yang between the brokers and the carriers. Neither can survive without the other.”

A recent post on the popular Rate Per Mile Masters group on Facebook lays out where the two sides of the debate are coming from. A broker posted a question: “If you feel that you are getting ripped off by the broker then why not go to the shipper and let them know how much their broker is paying you? Ask them if they think the broker is making a fair profit off of them.”

And while there was plenty of grumbling in response to that, but in some cases sort of an agreement, the question was raised about why in a technology age, brokers are even needed — a question that comes up about all middlemen as technology advances. “My question has always been, WHY [his emphasis] do we “need” a middleman eating up double digit amounts of what would have been a fair rate?” one commenter wrote. “In the age of internet, all shippers should be able to post their own loads and pay a carrier directly.”

The full video can be seen here.