Digital intermediaries like Uber Freight, Convoy and Transfix have entered the freight brokerage market to enhance its efficiency and create cost savings for shippers while opening new lanes of cargo for carriers to scale and grow their business.

A new software-as-a-service player has entered the FreightTech community looking to add a marketplace option that democratizes the intermediary experience for shippers and carriers.

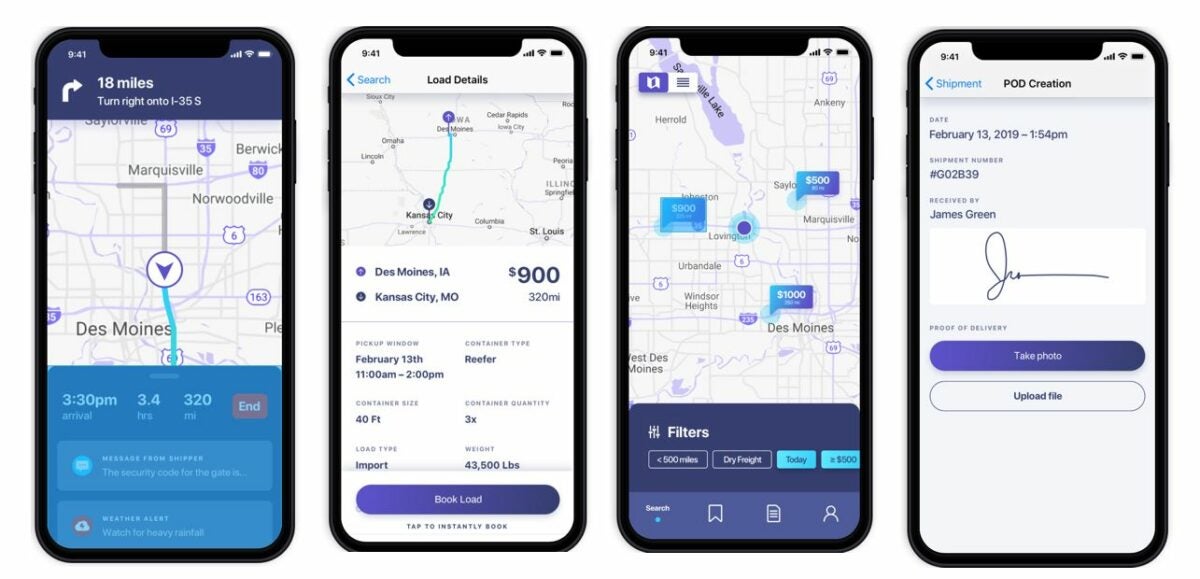

Opening in September as a private beta test for both parties, digital freight platform Toggle looks to solve logistical challenges with real-time data, AI and blockchain technology by directly connecting the two groups and eliminating the business model of freight brokerages.

“This will allow shippers to have access to all carriers in our platform with direct access to their location so they can independently manage their operations,” said Jeremy Spillman, founder and CEO of Toggle, in an interview with FreightWaves.

“For carriers, it will give them a complete, customizable solution to manage their business, and build relationships with shippers directly.”

On the surface, it sounds very similar to the business operations of a digital freight brokerage. What Spillman says differentiates Toggle from these companies is the direct connection Toggle is creating between the two parties that freight brokerages normally separate completely.

In a freight brokerage, carriers are often assigned or asked to bid on specific loads based on standards set by brokers. The same is true for shippers, who are rarely given the opportunity to choose their carrier and instead are given a blanket price by the brokerage with a margin that fluctuates based on the broker’s carrier relationships within given markets.

Having a business as the intermediary often adds to everyday logistical problems for shippers, with unclear transit delays, erratic pricing models and issues arising from brokers changing their systems. Carriers find issues with brokerages as well from unexplained payment delays to barriers on preferred freight and inability to contact shippers and receivers for proper route planning.

“A lot of tracking is done through manual labor,” said Spillman as he explained the work brokers are currently doing to justify their margins — work that can be eliminated with applicable blockchain technology. With Toggle’s carrier network using its tools to manage their business coupled with integrations into electronic logging devices and easily accessible historical carrier data, shippers can get true real-time location updates or contact the carrier directly to communicate effectively.

Spillman also described how his platform will enable shippers to build smart contracts, creating direct relationships with carriers that are seen as taboo within a digital freight brokerage business.

As contract law continues to evolve within blockchain technology, Toggle will become a true decentralized autonomous organization to facilitate these contracts legally.

“Iowa is now at the leading edge of the inclusion of blockchain in contract law here,” said Spillman, as his team recently fought to have these contracts recognized under law in Toggle’s operating state.

This distinct intermediary concept has enabled Toggle to raise $1.6 million from undisclosed investors in an angel round last week to prepare for its private beta testing next month between shippers of various industries and new carriers looking to help with capacity constraints.

After proper beta testing, Toggle aims to provide its service through a hybrid model of subscription and transparent transactional fees.

“There are a lot of issues within supply chains,” said Spillman. “We just want to make it as easy as possible for drivers to enter the market, grow their business and do what they love to do: drive.”

You may also like:

Relay Payments plans to raise $60M for lumper remittance platform

TextLocate smooths driver and load tracking

SEDNA raises $34M, brings ‘speed, simplicity’ to supply chain communications