Trailer manufacturers continued to swat away most orders in May, holding backlogs steady while battling supply chain disruptions that jumped from one part to another.

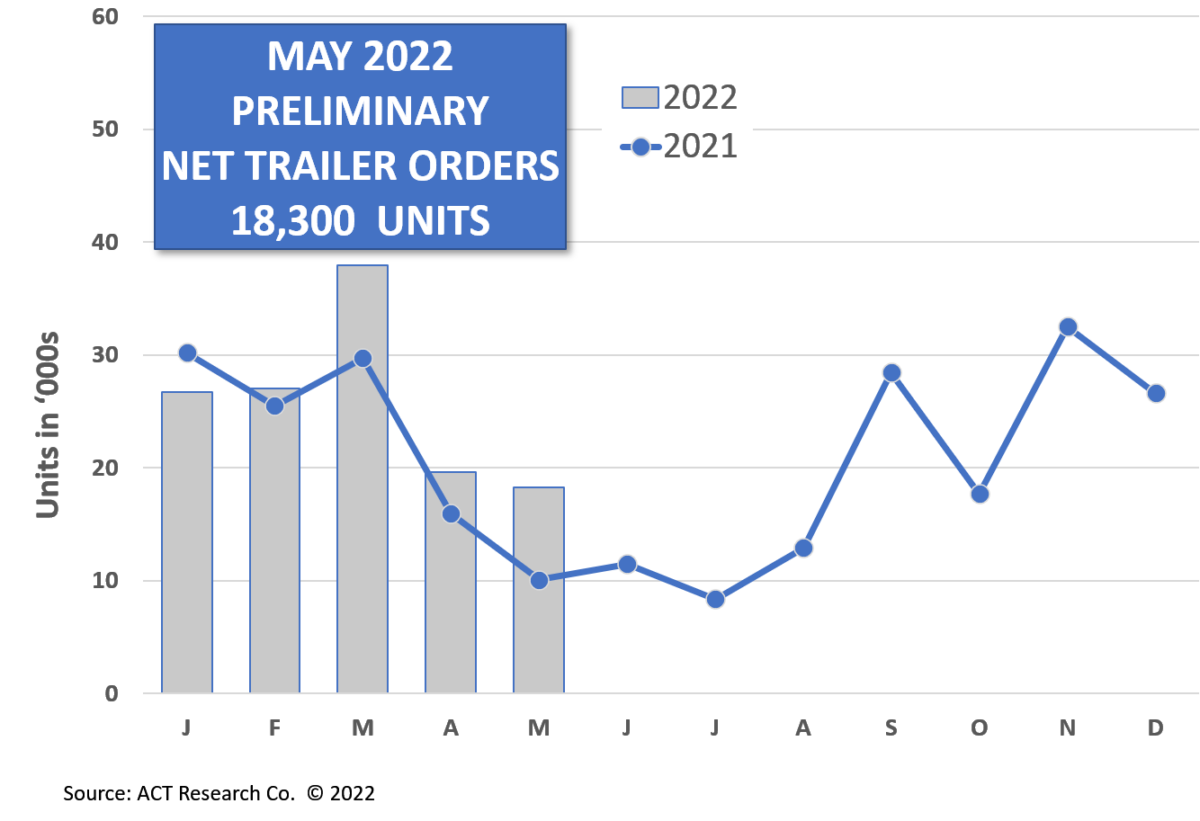

Preliminary reports show that net trailer orders in May were 18,300 units. That was down about 7% from April but up 111% from the same month last year, according to ACT Research.

FTR Transportation Intelligence reported that trailer orders on a rolling basis for the past 12 months totaled 250,000. Trailer orders typically decline in May on a seasonal basis.

“We continue to believe there is reluctance to push the order board horizon into next year as OEMs continue to closely control order acceptance,” said Jennifer McNealy, ACT director of commercial vehicle research and publications.

Tight ordering environment for trailer manufacturers

Two trailer manufacturers confirmed to FreightWaves that the ordering environment is tight.

“We’ve not really seen any cancellations,” said Chris Hammond, executive vice president of sales at Great Dane. “If there is a small cancellation, the spot is quickly filled with another order.”

Said David Giesen, vice president of sales at Stoughton Trailers: “We still have customers requesting more equipment than we can build. There is significant pent-up demand, especially in dry vans.”

Visibility into supply chains should improve later this year, but it is not happening so far.

“As we get closer to Q4, OEMs will begin to gain necessary visibility into the future impacts brought by supply chain disruptions and overcome suppliers’ caution to commit to 2023 pricing and lead times,” said Charles Roth, FTR analyst-commercial vehicles.

Hammond said Great Dane will not open 2023 order books for several more weeks “as we manage the supply chain to determine capacity changes.”

Is the supply chain stabilizing for trailer manufacturers?

FTR said it has seen modest improvements on the supply side. That suggests stable production.

“Under these conditions, OEMs are still proving that they can overcome headwinds and keep production at consistent levels, while also carefully and strategically managing their backlog,” Roth said.

A shortfall follows every improvement in the availability of one part, Giesen and Hammond said.

“The supply chain is still quite strained. Each week brings new challenges with shortages and action plans to adjust to not having what is needed,” Giesen said.

Added Hammond: “We will see improvement in one area only to see another area of the supply chain falter.”

Related articles:

Trailer orders whacked by geopolitics in April

Knight-Swift: Trucking downturn would favor carriers with large trailer pools

New trailer orders rebound in March but supply chain still broken

Stephen Webster

In Canada we are about 20,000 reefer trailer short and about 33,000 dry box to maintain same service with e logs coming in. I am concerned about a repeat of 2008 if too many people coming into trucking and too many new tractors come in to service. We need safe parking overtime hourly pay medical care and a min freight and wage rates or we will have more homeless people from the trucking industry.