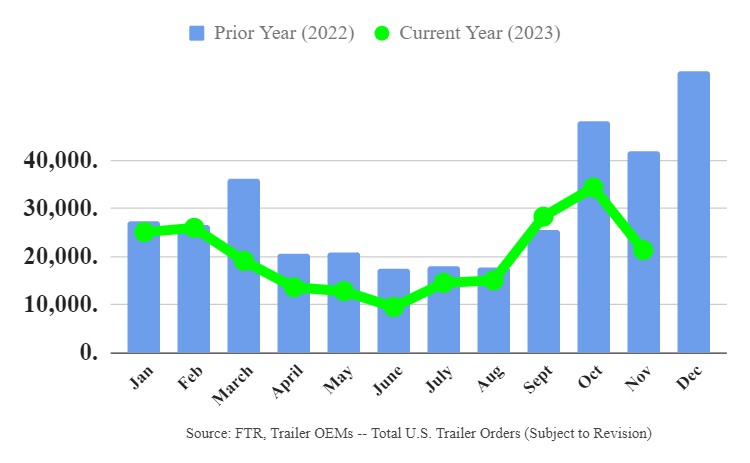

Trailer orders tanked in November, falling 38% from October accompanied by the lowest production rate since last year.

But the retrenchment to 21,362 units still left November orders 7% above the average for 2023. Orders in November 2022 were 45% higher than last month.

Manufacturers produced 23,770 trailers in November, down 12% from October and 9% year over year. A drop in production after October is normal, and the average monthly build is still healthy at more than 27,200 units, FTR Transportation Intelligence reported.

“With orders coming in under production levels, backlogs in November fell slightly, shedding almost 2,500 units to end at just over 140,000 units,” FTR Chairman Eric Starks said in a news release. The backlog-to-build ratio increased to 5.9 months, the length of time a typical order placed today would take to be completed.

Trailer orders ‘in line with historical average’

“This ratio is in line with the historical average prior to 2020 and suggests the industry is moving towards a pre-pandemic level of stability,” Starks said.

OEM Wabash said during a third-quarter earnings call Oct. 25 that its first-to-final-mile portfolio would offset softer near-term demand for dry vans. Easing of customer demand for goods following a surge during the pandemic has led to low spot rates, excess capacity and drivers surrendering Department of Transportation authorities sought when spot rates hit record highs.

The number of trailers ordered over the past 12 months decreased to just above 276,700 units, FTR said.

ATA truck tonnage index falls an unadjusted 5.1%

Separately, the American Trucking Associations reported Tuesday that its advanced seasonally adjusted For-Hire Truck Tonnage Index decreased 1% in November after increasing 0.8% in October. Without seasonal adjustment, the predominantly contract-freight index fell 5.1% in November compared to October.

“We continued to see a choppy 2023 for truck tonnage into November,” ATA Chief Economist Bob Costello said. “It seems like every time freight improves, it takes a step back the following month. While year-over-year comparisons are improving, unfortunately, the freight market remains in a recession.

“Looking ahead, with retail inventories falling, we should see less of a headwind for retail freight, but I’m also not expecting a surge in freight levels in the coming months,” Costello said.

Related articles:

Specialty trailer orders show strength as vans and reefers lag

Wabash Q3 profits rise as revenue falls

Stephen Webster

This is very bad when trailer orders dropped this much because we need more trailers and trailer parking with elogs anything below 25 000 is too low .