Digital freight platform Transfix announced fourth-quarter growth in key financial metrics Tuesday. Full-year 2021 provided the company with many milestones, including record financial results.

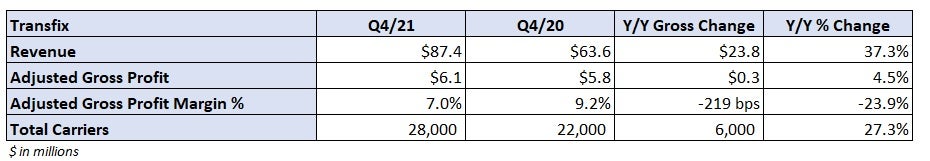

Total revenue increased 37% year-over-year in the quarter to $87 million. The result pushed the top line 60% higher for full-year 2021 to $296 million. Adjusted gross profit in the quarter increased 5% to $6.1 million. The adjusted gross profit margin was down 220 basis points to 7% as third-party truck capacity remained historically tight.

The company said it exceeded all of its projected key financial metrics during the year.

Net shipper retention increased to 148%, 900 bps higher year-over-year. Total carriers on the platform increased by approximately 6,000, to 28,000. Average loads among the company’s top-500 carriers increased 24% to 135.

Even amid the growth in total carriers on the brokerage platform, the company maintained a 93% carrier repeat rate.

“2021 was another incredible year for Transfix,” President and CEO Lily Shen stated in a press release. “We exceeded all of our financial projections and invested meaningfully in the future, including strengthening our leadership team, hiring in key areas, opening an operations office in Atlanta, launching new products, and enhancing our existing products.”

During the year, Transfix opened a second office in Atlanta and expanded its C-suite. The company added Christian Lee from WeWork as CFO and 20-year transportation industry veteran Sophie Dabbs as chief commercial officer. General counsel and the chief marketing officer positions were filled as well.

The company also completed several initiatives aimed at expanding and enhancing the platform.

Transfix built out its drop capacity and managed backhaul offerings, and launched Transfix TMS for shippers. In addition, the company inked a deal with TriumphPay (NASDAQ: TBK) to get drivers paid in as quick as two days.

“We also drove deeper relationships with our shippers and carriers, advanced our sustainability platform, and were recognized for our innovation and employee culture,” Shen continued. “We could not be more excited about the future and the opportunities for growth as we continue to see the benefits of these investments.”

Most notably, Transfix announced in September that it would go public through a special purpose acquisition company transaction with G Squared (NYSE: GSQD). The deal places a $1.1 billion enterprise value on Transfix and is expected to close in the second quarter. Transfix will be listed on the New York Stock Exchange under the ticker symbol TF.

“There is a tremendous opportunity to carry this momentum into 2022 as we continue to identify new ways to build a smarter freight ecosystem through unmatched innovation, expanding our partner network, and providing a unique combination of best-in-class technology and industry execution,” Shen concluded.

Click for more FreightWaves articles by Todd Maiden.

- Radiant Logistics chats value creation on earnings call

- Cass: Omicron hits January volumes; costs, rates still way up

- Universal Logistics sees bridge blockade as ‘blip’ to strong 2022

.

But how much did they lose? Gross profit is not a good metric. Net profit (loss) is. Not putting it in an article is about their sales and profitability prior to a public listing seems like journalistic elementary school stuff.

Jullia

𝐅𝐢𝐧𝐝 𝐔𝐒𝐀 𝐎𝐧𝐥𝐢𝐧𝐞 𝐉𝐨𝐛𝐬 (💵𝟖𝟎𝟎𝟎£-💵𝟗𝟓𝟎𝟎𝟎£ 𝐖𝐞𝐞𝐤𝐥𝐲) 𝐬𝐚𝐟𝐞 𝐚𝐧𝐝 𝐬𝐞𝐜𝐮𝐫𝐞!! 𝐄𝐚𝐬𝐲 𝐀𝐜𝐜𝐞𝐬 𝐓𝐨 𝐈𝐧𝐟𝐨𝐫𝐦𝐚𝐭𝐢𝐨𝐧. 𝐒𝐢𝐦𝐩𝐥𝐞 𝐢𝐧 𝐮𝐬𝐞. 𝐀𝐥𝐥 𝐭𝐡𝐞 𝐀𝐧𝐬𝐰𝐞𝐫𝐬. 𝐌𝐮𝐥𝐭𝐢𝐩𝐥𝐞 𝐬𝐨𝐮𝐫𝐜𝐞𝐬 𝐜𝐨𝐦𝐛𝐢𝐧𝐞𝐝. 𝐅𝐚𝐬𝐭 𝐚𝐧𝐝 𝐭𝐫𝐮𝐬𝐭𝐞𝐝. 𝐃𝐢𝐬𝐜𝐨𝐯𝐞𝐫 𝐬𝐮𝐬 𝐧𝐨𝐰! 𝐄𝐚𝐬𝐲 & 𝐅𝐚𝐬𝐭, 𝟗𝟗% 𝐌𝐚𝐭𝐜𝐡.. 𝐨𝐩𝐞𝐧 𝐭𝐡𝐢𝐬 𝐬𝐢𝐭𝐞 .…………>>𝐡𝐭𝐭𝐩𝐬://𝐰𝐰𝐰.𝐟𝐮𝐥𝐣𝐨𝐛𝐳.𝐜𝐨𝐦