With overnight delivery, same-day and even two- to one-hour delivery becoming the norm, consumers are more demanding than ever. Extreme focus on delivering the right product at the right place and at the right time is mandatory for the ongoing success of consumer-centric businesses. Supply chain analytics, metrics and KPIs are imperative to enabling organizations to operate smarter, better and faster.

Comprehensive supply chain analytics help organizations utilize historical enterprise data to feed predictive models that support better decision-making; identify hidden inefficiencies and save money; and get a more holistic view of total organizational profitability. Expected to reach $7.1 billion in revenues by 2023 (up from $3.6 billion in 2018), the global supply chain analytics market is well-positioned to help companies extract real value from the reams of data that are being produced daily.

“Supply chains are a rich place to look for competitive advantage, partly because of their complexity, and partly because of the significant role they play in a company’s cost structure,” according to a recent Deloitte report. “And with the power of new analytics, companies can now fine-tune their supply chains in ways that simply weren’t possible in the past.”

Surveying Supply Chain and Logistics Leaders

To help shipping managers address their biggest supply chain challenges, Transplace partnered with Peerless Research Group (PRG) on behalf of Logistics Management to conduct an industry-first survey. We surveyed 125 top logistics and supply chain directors to learn more about their operations, their top challenges, and their insights for the future. The majority of respondents are manufacturers with domestic transportation networks, but that also operate globally.

Key findings from the On-Time In-Full Performance Survey include:

Supply Chain Pain Points

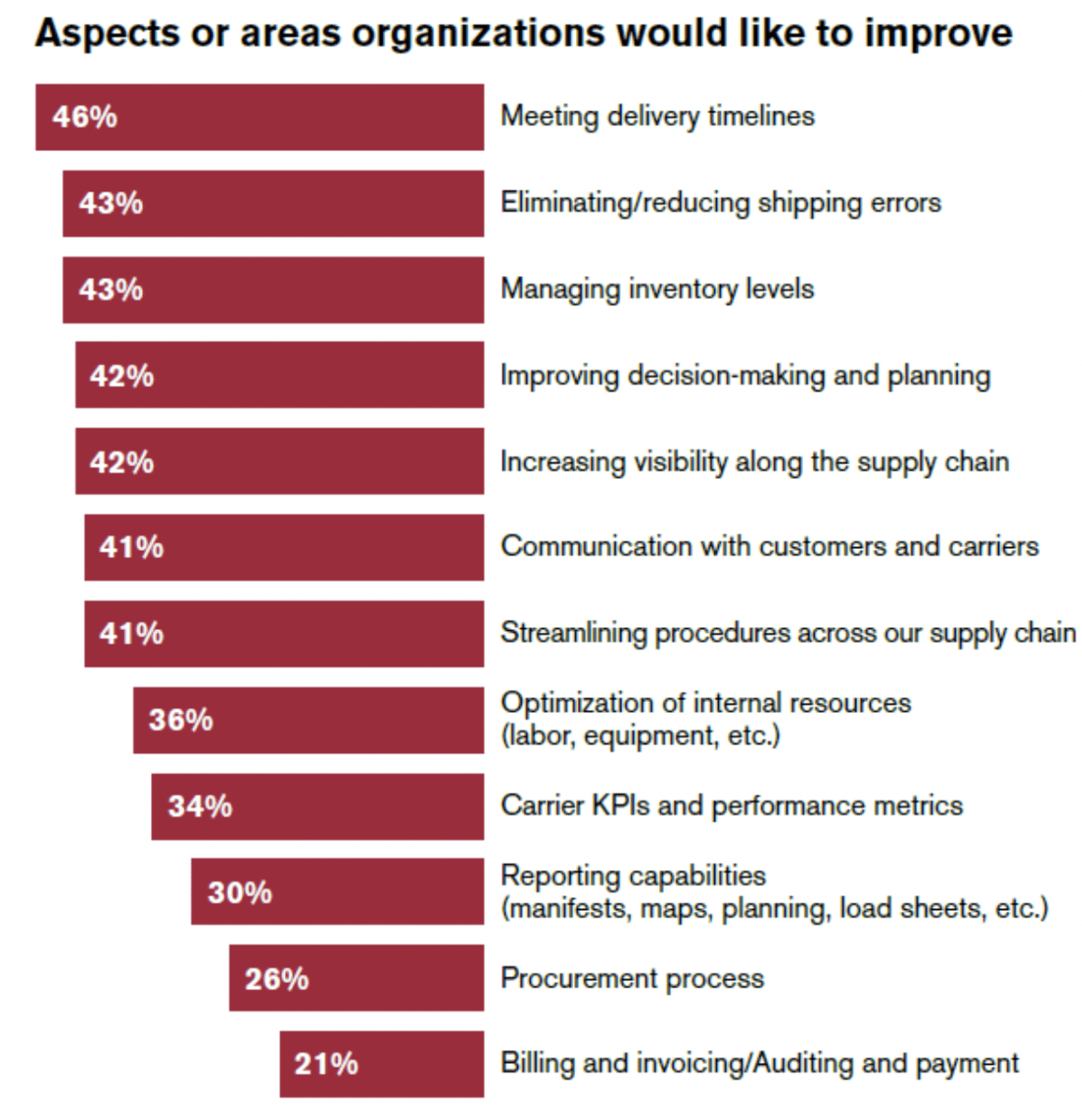

Supply chain managers need help across most areas of their operations – from hitting delivery timelines to reducing shipping errors to better inventory management. According to respondents, meeting delivery timelines is the biggest pain point (46%), followed by reducing or completely eliminating shipping errors (43%), and inventory management (43%). They’re also focused on improving decision-making and planning; better supply chain visibility; and improved communication with their customers and carriers.

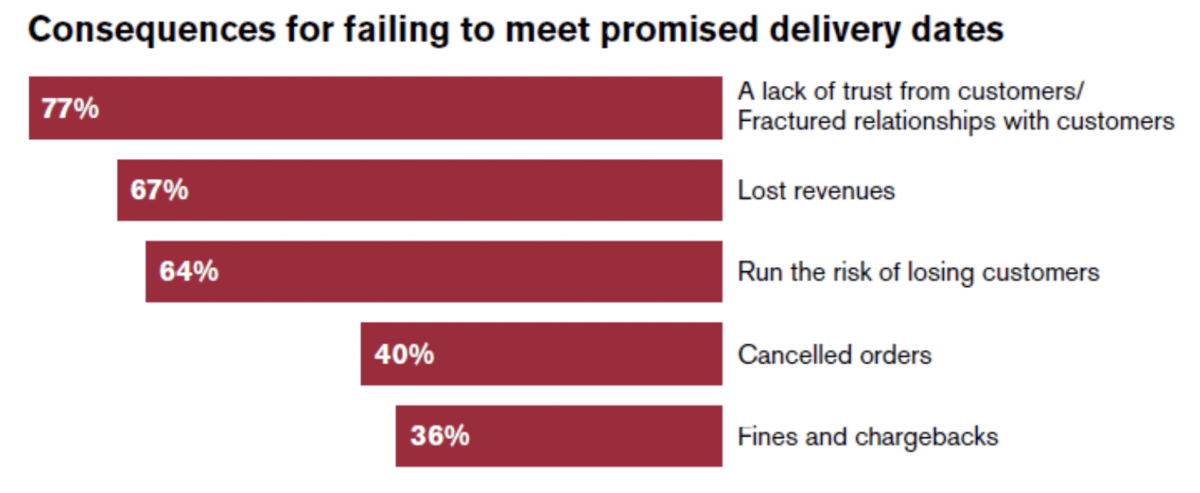

Meeting promised delivery dates is an ongoing challenge for more companies, and the failure to do so can result in damaging outcomes. Among the leading consequences for failing to meet delivery dates include lack of trust or fractured relationships with customers, according to 77% of survey respondents. The inability to meet delivery dates can further result in lost revenues (67%), the risk of losing customers (64%), cancelled orders (40%), and fines or chargebacks (36%). Even though missing delivery deadlines can be out of a carrier’s control, the outcome of such an event can be wide ranging.

Fulfilling Orders On-Time and In-Full

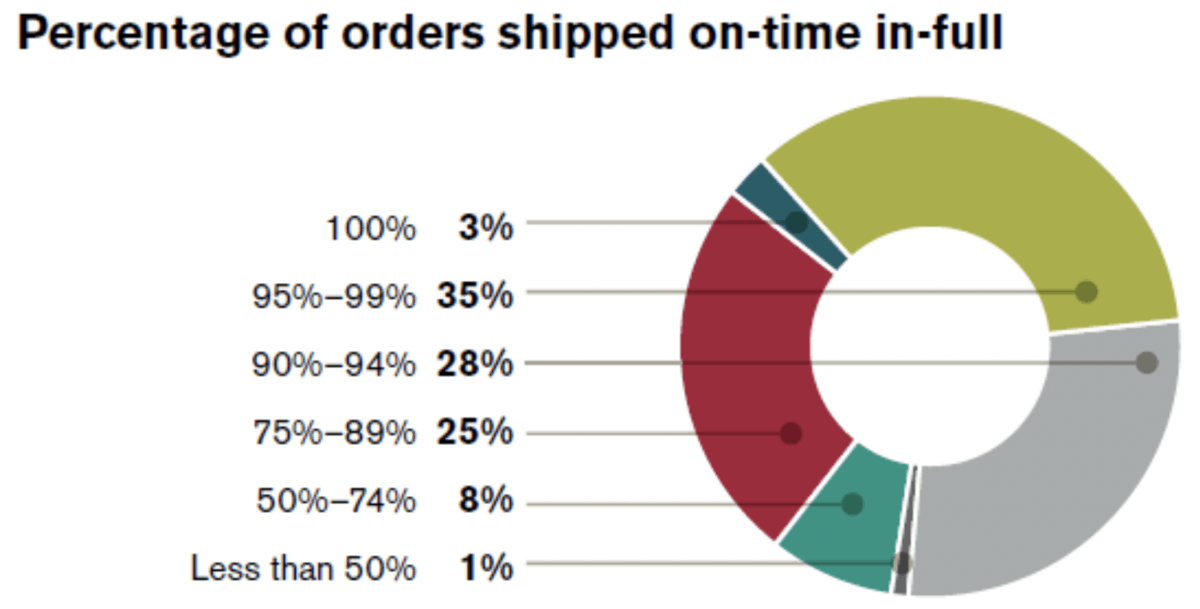

According to the survey, more than one-third of companies are shipping on-time and in-full

(OTIF) between 95%-99% of the time, while 28% are meeting this KPI on 90%-94% of their orders. Just 3% of companies are hitting this metric 100% of the time.

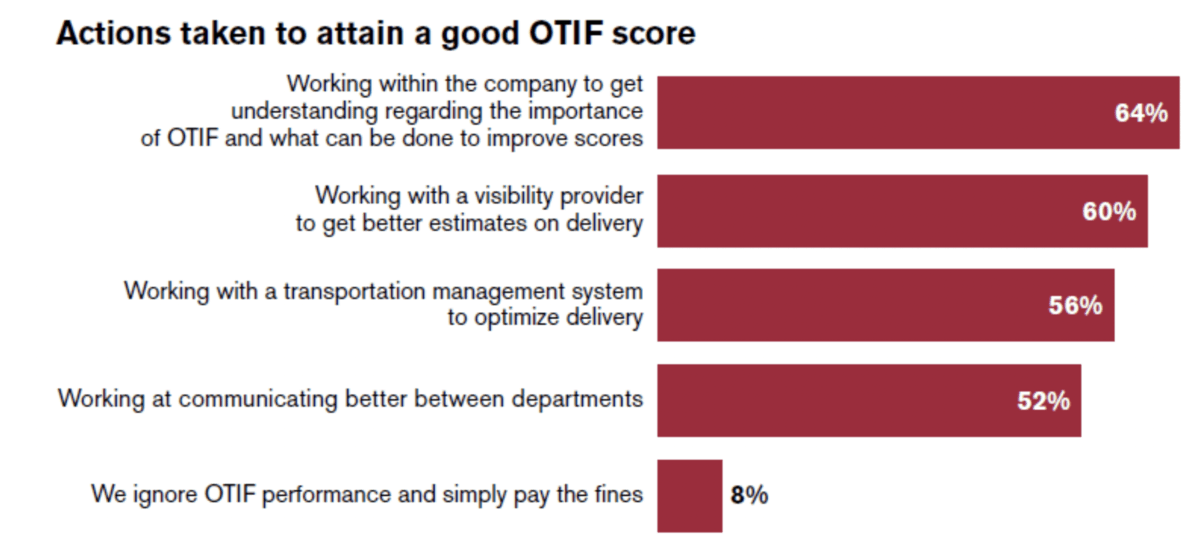

To attain a favorable OTIF score with their customers, 64% of companies are working to better understand the importance of this score—a possible indicator that more education could be needed on this metric. The survey found that 60% are working with a visibility provider to get better delivery time estimates.

Fifty-six percent of respondents are using a transportation management system (TMS) to optimize delivery, and 52% are trying to improve communication between their various departments. Finally, 8% of companies are ignoring OTIF and simply paying the fines associated with non-compliance.

“We have not yet perceived the value in our business,” one professional pointed out. Another said, “OTIF has not been a determining factor in gauging performance levels. It is however becoming more important and as such we need to start reviewing it as a gauge factor in performance ratings.” Others say they’re putting OTIF on their organizational agendas for 2020.

Of those companies that are using OTIF programs, 58% say the program has prompted changes in their operations, while 42% say it hasn’t.

When asked what changes they’ve made because of their OTIF program results, survey respondents say they’re now paying more attention to inventory planning, stocking strategies, cross-functional agreements and setting values accordingly—all of which are important steps in today’s fast-paced distribution environment. Other companies are making multiple changes in supplier scheduling, production balancing across factories, shipping, transit need matching, delay in transit, delivery management, receiving, and inbound delivery processes. “We’re trying to get better planning in advance to improve shipping in full and having the right transportation assets in place,” another respondent reveals.

Measuring the Benefits

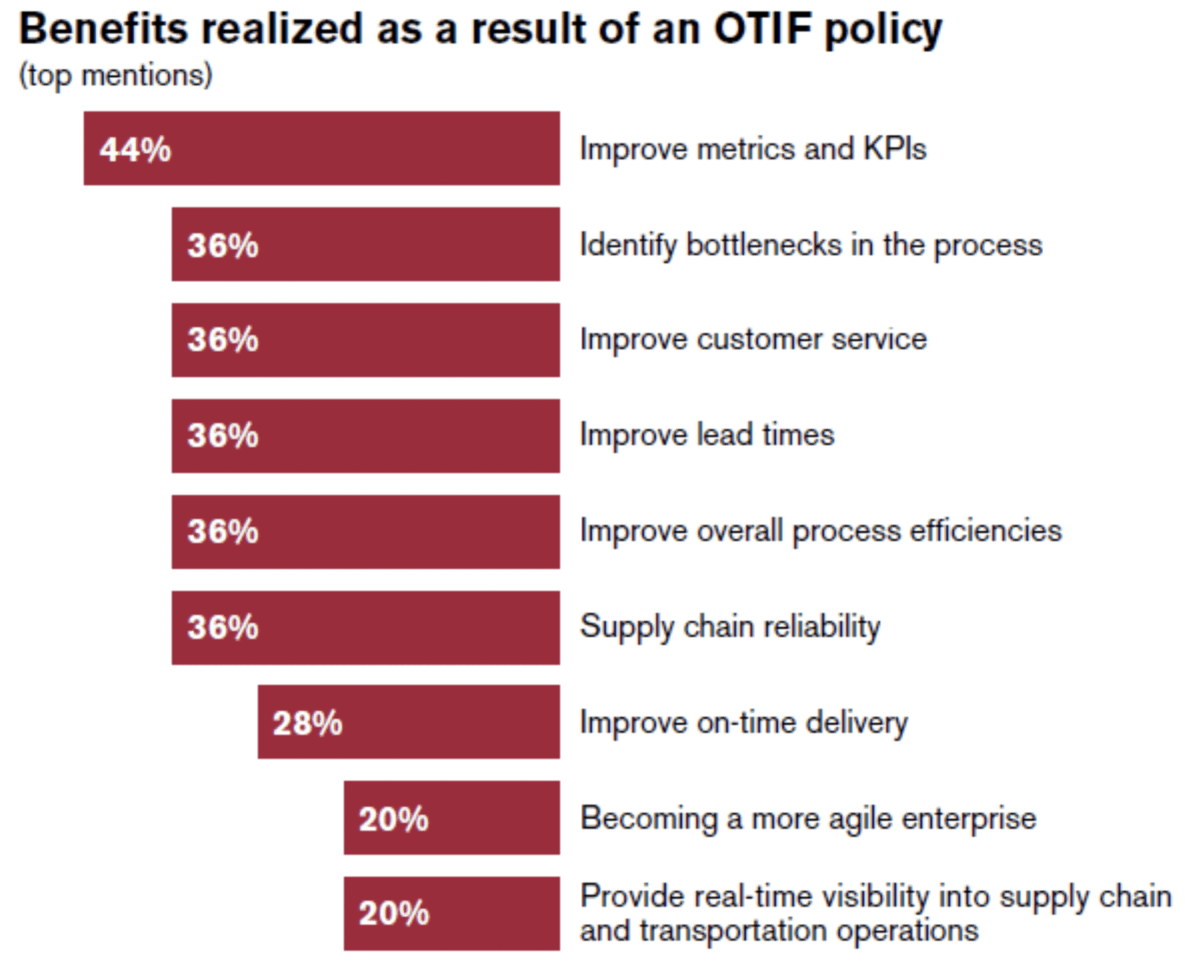

Supply chain professionals agree than an OTIF policy produces benefits with the most popular being improved metrics and KPIs (44%). Other benefits include being able to identify bottlenecks and improve customer service, lead times, overall efficiencies, and supply chain reliability.

KPIs and Measuring Performance

Used to measure operational areas and determine efficiency and productivity, KPIs can help companies pinpoint and quickly address areas of concern within the supply chain. According to the survey, these measures are used by about 44% of companies.

Of those managers who are using KPIs, those measures are focused on reducing transportation costs (63%), meeting customer service metrics (61%), saving money (54%), and improving workflow processes (48%).

When asked how their organizations can improve their on-time and in-full delivery promises to customers, respondents pointed to better communication from client to purchasing through sales or client services; better data collection and analysis (which will lead to better direction for projects and process improvements); and improved tracking of late/lost orders with direct feedback to company distribution centers. “[We need a] system that gives full circle information on actual lead times,” another survey participant explained, “rather than the order entry personnel taking an educated guess at the lead times.”

Conclusions

As supply chains speed up, fulfillment windows shrink, and customer delivery expectations evolve, the need for comprehensive supply chain metrics, KPIs, and analytics will only expand. Many companies are already utilizing these measures to make good supply chain decisions and hit their on-time delivery performance goals, and even more will follow. With 56% of online consumers ages 18-34 years expecting same-day delivery, and 49% of shippers stating that same-day delivery makes consumers more likely to shop online, the push to meet 100% OTIF demands is on.

If they’re not already doing so, companies will need to measure every aspect of the customer experience—the shipment and delivery of products included. Instead of simply “reacting” to problems when a customer calls about a late order, smart companies are putting systems and solutions in place to better measure and improve on-time performance across their supply chains. They’re also using the right KPIs to measure their goals, hold their partners accountable, and meet their customers’ high expectations.

To access the full research brief for the On-Time In-Full Performance Survey, click here. Connect with a Transplace expert to learn about the Transplace Transportation Management System at transplace.com/transplace-contact.

Sources:

(1) https://www.weforum.org/agenda/2019/04/how-much-data-is-generated-each-day-cf4bddf29f/