Citing “waning demand and price dives,” Bank of America downgraded multiple transportation stocks on Friday. The ratings changes come as recent data points and commentary show trucking fundamentals have loosened following a year-and-a-half run of high freight demand accompanied by a lack of supply.

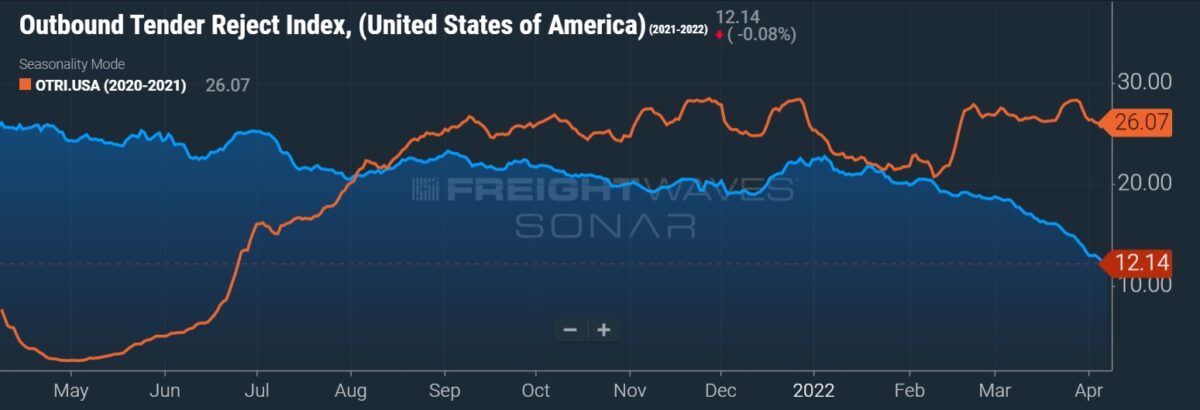

Tender rejections, a proxy for truck capacity tightness, remained very high entering the year but began declining notably in March, bucking normal seasonal trends. High-single-digit price inflation has consumers rethinking purchasing plans, which has resulted in demand cooling from record highs established last year. At the same time, truck capacity is coming back into the market.

There is also concern that heavy buying by retailers and suppliers, in efforts to mitigate supply chain congestion and properly stock e-commerce fulfillment platforms, will turn into an overhang that will need to be worked off if consumer demand remains tepid.

“Given deteriorating demand outlooks and rapidly falling freight rates, we downgrade ratings on 9 of the 28 stocks in our coverage universe,” Bank of America (NYSE: BAC) analyst Ken Hoexter told clients.

He said a proprietary indicator gauging shippers’ expectations around freight demand “fell sharply” in the latest update. The dataset hit the fourth-lowest reading since August 2020. The indicator has been either flat or down in 16 of the past 23 surveys.

“A large number of respondents commented that pricing is declining rapidly, capacity is available, and these shifts could signal a downturn in the economy and lower demand,” Hoexter said.

Survey responses gauging a shipper’s ability to find trucks and the rates they expect to pay for them are deteriorating as well. The firm’s truck capacity indicator registered its highest reading since June 2020 with the rate indicator plummeting to its lowest level since July 2020.

Spot rates, which started the year at record highs, have pulled back 11% since. But those rates include fuel surcharges, which have been propped up by higher diesel fuel costs (up more than 40% over the same period). Hoexter said spot prices excluding fuel are down 37% since the end of 2021, dropping 27% in the past month alone.

Concerns over falling spot rates have investors selling truckload stocks. The nation’s largest fleets have logged share price declines between 10% and 15% since the end of March compared to the S&P 500, which is only off 2%. A high correlation between spot rates and contract rates (the bulk of the revenue book for most public TL carriers) has investors jettisoning the names on the expectations of future rate softness and associated margin degradation.

Hoexter estimates spot rates lead contractual rates by seven to eight months in most cycles.

However, he said recent channel checks show the 2022 bid season “has so far progressed better than expected” and that earnings from public carriers may be better protected than in past cycles given growth in dedicated services, which tend to have less volatile rate and margin profiles.

He modestly lowered 2022 earnings estimates for the TL and intermodal providers he follows, taking them down by 6% on average in 2023.

“While some portion of the rate drop allows full fuel surcharge coverage or is due to seasonality after the holidays, recession fears are rising given an inverted yield curve, rising inflation, higher fuel costs, rising inventories, and increasingly available capacity.”

He’s calling for a “mid-single digit to mid-teen decline in rates next year.”

Hoexter lowered his rating on Schneider (NYSE: SNDR) from “buy” to “underperform” and for Werner Enterprises (NASDAQ: WERN) from “neutral” to “underperform.”

He also moved to the sidelines on less-than-truckload providers ArcBest (NASDAQ: ARCB), Saia (NASDAQ: SAIA) and TFI International (NYSE: TFII), issuing “neutral” recommendations. Less-than-truckload earnings estimates were left mostly unchanged.

Ratings were also lowered to “neutral” for UPS (NYSE: UPS) and railroads Canadian Pacific (NYSE: CP) and Union Pacific (NYSE: UNP).

Click for more FreightWaves articles by Todd Maiden.

- Warehouses will be a tough find through 2023

- Old Dominion adding space to meet ‘heightened’ demand

- XPO breakup advances, intermodal unit sold to STG Logistics