Transportation as a Service is just one way the industry will change in the years ahead

TaaS. It seems like another in a long line of acronyms that have infiltrated the transportation industry with technologies promising to disrupt the world as we know it. But what is TaaS, and why will this be an acronym that might deliver on its promise?

Written out, TaaS is Transportation as a Service. It describes a “shift away from personally owned modes of transportation and towards mobility solutions that are consumed as a service. … The key concept behind [TaaS] is to offer both the travelers and goods mobility solutions based on the travel needs,” according to a description of it on Wikipedia.

TaaS can more immediately be observed in the consumer market, where autonomous cars and ride-sharing services such as Uber and Lyft are changing the way people move about.

“I believe the auto industry will change more in the next five to 10 years than it has in the last 50, and this gives us the opportunity to make cars more capable, more sustainable and more exciting than ever before,” Mary Barra, GM CEO, noted earlier this year at the World Economic Forum.

“Transportation services have attracted many new entrants as the industry replaces low-margin asset revenue with high-margin service revenue,” wrote Paul Asel, managing partner of Nokia Growth Partner, in a guest post on CB Insights. “Ride-hailing companies have garnered the most attention, with funding totaling over $23B between 2015-2016, according to CB Insights. If you include the recent $5.5B and $100M raises by Didi and Ola, that number approaches $29B. Other TaaS companies offering on-demand delivery services, car sharing, bike sharing, and public transport services have also raised over $8B globally.”

Recent investments in TaaS companies

But while TaaS still appears to be most disruptive to consumer mobility, there is a growing belief that it will transform supply chains. According to data from Markets and Markets, the smart transportation market, of which TaaS is a part, is expected to grow from $72.05 billion in 2016 to $220.76 billion by 2021, at a compound annual growth rate of 25.1%.

“New special-purpose delivery vehicles, such as delivery robots (Starship Technologies) and drones, are already being tested as last-mile delivery options. According to CB Insights, private market investment into logistics tech is hitting record highs as investors and startup entrepreneurs probe for opportunities across the transportation industry,” Asel wrote. “The transportation sector is undergoing several epochal changes simultaneously: autonomous driving, electric vehicles and connected cars. Each will significantly impact the auto sector. Together, these changes offer an opportunity to reimagine the transportation sector and shift to Transportation as a Service.”

Tony Seba, an expert on industry and market disruption, tackled the subject of TaaS and its impact on the transportation markets at the recent Nor-Shipping Conference 2017.

“A disruption is when technologies and business model innovations make it possible for entrepreneurs to make new products that both create new markets and also destroy or radically transform existing industries,” he told the audience.

To illustrate his point, he showed two pictures of New York City streets. The first, in 1900, showed dozens of horses transporting residents to their destinations with a single automobile mixed in. The second came from 1913 and showed the exact opposite – dozens of cars with a single horse trying not to get hit by speeding – at least for that time – cars.

“Thirteen years, that’s all it took,” Seba says. “This is what’s called a technology disruption. At the time, the technology product was the internal combustion engine, the car. And disruptions are happening more and more quickly and more and more deeply.”

Seba went on to note that oftentimes the “experts” in industries are the last to know that disruption is occurring until it is too late.

“In 1985, the then-largest telecom company on earth, AT&T, hired McKinsey and they asked them one question, ‘this cell phone thing, the mobile thing, what’s going to be the market in the year 2000, so give me a 15 year forecast,” Seba explains to reinforce his point. “McKinsey went off and did whatever it is that they do, and here is the answer [they came back with]: 900,000. In the year 2000, there will be 900,000 mobile phones in the U.S. The actual number was 109 million. This is not a small mistake people. Of course, AT&T got disrupted, and they also missed out on the largest multi-trillion-dollar new opportunity of the 21st century. If you just look at the top five internet companies today, that’s two-plus trillion dollars in market valuation they missed out on. And as I said, it’s usually the market insiders, the mainstream analysts, who miss the disruptive technologies. You hear smart people say, no, it’s not going to happen, not this quickly.”

To Seba, though, it is obvious the world is in one of these disruptive times.

“It’s 2017 and we’re here,” he says. “We’re in this world of horses and somebody is standing here and telling you that within a few years this whole horse thing is going to go away for solid economic reasons, and this is starting to happen right now. These disruptions of transportation are not in the future, they are happening right now and we are on the cusp of one of the deepest, fastest disruptions of transportation in history.”

This disruption is due to the growth of electric vehicles and TaaS, Seba says.

“Today, we pay a lot of money to own and maintain our cars. In America, it’s $10,000 a family to own a car, 10,000 miles, 10,000 dollars a year more or less, but we only use it for a small percent of the time – 96% of the time our cars are parked, which is such a waste of money,” he explains. “Let’s converge electric, self-driving and shared transportation and what do we get? What we get is the efficiency of the vehicles goes up from 4 to 40%, maybe more. The car, the truck, the bus, instead of 10,000 miles a year, can go 100,000 miles a year, maybe 200,000 miles a year. When that happens, this is what the numbers say, and this is pure economics; no subsidies, just pure economics. Assume autonomous vehicles will be approved in 2021, essentially that day, the cost per mile of Transport as a Service will be 10 times cheaper than the cost of car ownership. Every time there has been a 10X difference in cost, there has been a disruption. Every single time in history.

“In 2021, the day autonomous vehicles are approved, it won’t make any sense to buy a car,” he adds. “Essentially it won’t make any sense to buy a car because you can get the same service 10 times cheaper. And TAAS will be 4 times cheaper than running a car you already own.”

And due to autonomous technologies, that same disruption trend will occur in the transportation markets, including trucking and maritime.

“There are 33 companies to our knowledge that are already investing billions of dollars in autonomous technologies,” Seba says. “So this is not something on the fringe, this is something that is becoming very much mainstream. Folks have woken up to self-driving. And Tesla says that by the end of this year, essentially every car that they produce will be ‘fully autonomous,’ which is to say Level 3, which is one step from fully autonomous.”

The result, Seba says, is that consumers and businesses such as trucking companies and ocean cargo carriers will make the economically prudent choice.

“The right economic choice is using TaaS,” he says. “Basically we’ve gone from ownership to on-demand services in many industries in the last few decades. And technology happens in S curves. One of the mistakes that mainstream analysts make is assuming the future will be linear. Technology disruptions don’t work like that. It’s an S curve; once you hit that tipping point, it happens very quickly.”

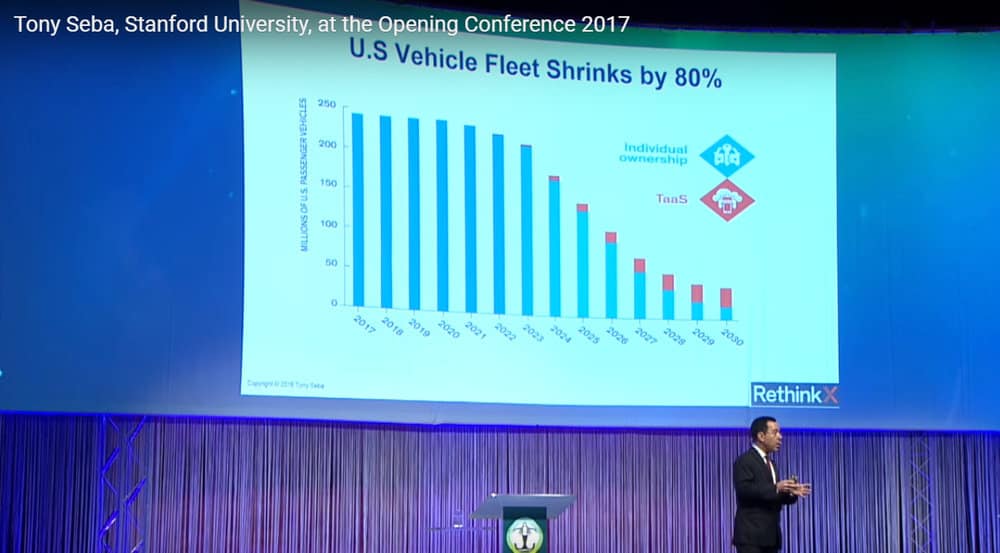

Seba says that by 2030, 95% of all passed miles will be driven by electric and autonomous vehicles. “Which means this, we will need 80% fewer cars on the road to go the same number of miles,” he says. “Eighty percent fewer cars as a fleet because we are going to use them 10 times more efficiently.”

The same premise holds true for trucking, although the shipping industry will take a double hit from this disruption in some case.

“What that means also, for shipping, is our annual demand for new cars will go down by 70% as soon as 2021,” he adds. “So if you are in the car shipping business, this is what you’re looking at. Oil [demand] will peak in 2020, and go down to 100 million barrels per day and go down to 70 by 2030 – a 30% drop. Do you ship oil? You should be looking at this; good luck.”

Seba also tackled the cost equation, using LIDAR technology – a key technology in the autonomous movement – as an example.

“LIDAR in 2012, according to Google, was $70,000. Within a couple of years it was $10,000 and within another couple of years $1,000,” he says. “There is a Silicon Valley company today that announced a $250 LIDAR, solid state, which means it doesn’t move, and it lasts a much longer time. So LIDAR, one of the essential technology of self-driving, has gone from 70 grand to $250 in only a few years.”

Seba also listed other technologies he is watching that are poised to disrupt nearly every business. They are:

- Sensors/Internet of Things

- Artificial intelligence/machine learning

- Robotics

- Solar PV

- Energy storage

- 3D printing

- 3D visualization

- Mobile internet & cloud

- Big data/open data

- Unmanned aerial vehicles/nano satellites

- Blockchain/emoney/efinance

“Business model innovation is every bit disruptive at technology innovation,” he adds. “If you look at a company like Uber, Uber is a business model disruption. They essentially took advantage of the cloud and smartphone infrastructure to disintermediate and become a broker and that business model was not possible before the cloud, of course, and the smartphone.”

Related:

Is a blockchain revolution about to hit the supply chain?

Big Data: Are you a disrupter?

Logistics innovation begins in the Kenco lab

The growing number of digital freight matching services would also fall into this category, as would a company such as Nikola Motors, which is creating an all-inclusive hydrogen-electric truck where buyers would get everything – from maintenance, to freight matching services, to fuel and the truck itself, in a single payment from a single provider.

He then added a word of caution to those who still don’t believe in the power of disruption.

“For those of you who think that disruptions in transportation can’t possible happen within a decade, Uber did not even exist in 2008 and today their bookings were higher than the whole U.S. taxi industry. So disruptions do happen very quickly when they tip; it may take a while for them to reach that tipping point, but when they tip, they will happen very quickly,” Seba says.